Ladies and Gentlemen

I welcome you all to the ceremony of the Carl Menger Award, given by the Verein für Socialpolitik. I do so in the name of the sponsors of the award, namely the Deutsche Bundesbank, the Oesterreichische Nationalbank and the Swiss National Bank, as well as on behalf of the selection committee. This important award is given in recognition of outstanding research work relating to monetary economics and monetary policy.

The city selected as the venue for this year’s Annual Conference of the Verein für Socialpolitik has a very special appeal to central banks. Basel has hosted the BIS, the bank of central banks, since its creation in 1930. In a way, Basel can be considered as the capital of central banks. I regularly travel to the BIS to meet my peers from all over the world and to discuss matters at the heart of monetary policymaking.

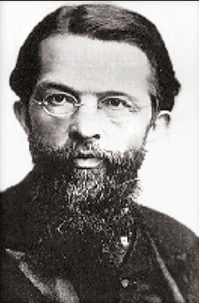

Today I am in Basel not for a BIS meeting but rather for an important celebratory academic occasion. I am very honoured to present the 2022 Carl Menger Award to our friend, Professor Ricardo Reis. Professor Reis is the inaugural holder of the A W Phillips Chair at London School of Economics. The name of his chair says a great deal about today’s award winner. Ricardo is a researcher who has dedicated his career to answering questions of great relevance to central banks and monetary policy, and more often than not, his work has a link to the Phillips curve, still one of the key relationships for central banks.

Contenders for the Carl Menger Award face two constraints: They must teach at a European university, and they must be no older than 45. Considering the number and quality of Ricardo’s contributions to the literature, you might be surprised to learn that he meets the second criterion. But when you see him in person, you could easily believe that he is even younger.

This curiosity is the proof that Ricardo’s career has been exceptional. It began 20 years ago, when he published two ground-breaking papers at the tender age of 24. The focus of the first paper, co-authored with Greg Mankiw in 2002, was sticky information versus sticky prices. In the second paper, written with Mankiw and Justin Wolfers in 2003, Ricardo noted that progress in studying expectations depends on the examination of survey data. Importantly, it is not only the average of the expectations that matters, but also the distribution of disagreement across people, and its evolution over time.

Ricardo’s research has shaped our understanding of expectations as drivers of inflation. Such work could not be more topical today. But have central bankers followed Ricardo’s advice by looking at movements in the distribution of expectations? In a working paper published in June this year, Ricardo analyses how and why several countries are experiencing a sharp increase of inflation. He highlights a range of factors. One of these is the neglect of using expectations data in the way he recommended. While household inflation expectations seemed solidly anchored in 2021, closer inspection reveals that a significant change in expectations was already underway. Expectations, in other words, were not as well-anchored

as had been supposed.

Ricardo has investigated other topics of great importance to central bank policies. Let me mention just three papers. In the first, again co-authored with Mankiw and published in the Journal of the European Economic Association in 2003, the issue was what measure of inflation a central bank should target. The conclusion was the following: In order to achieve maximum stability of economic activity, a central bank should use a price index that gives substantial weight to the level of nominal wages. The question of the correct measure of inflation has grown in importance over the years, partly due to the observed difference between the development of consumer prices and asset prices.

In the second paper, published in the Journal of Economic Perspectives in 2013, Ricardo explored the appropriate design of a central bank, drawing on the relevant literature and historical experience. He discussed twelve dimensions and derived recommendations for optimal central bank design. One recommendation is that society should give central banks a

clear goal focused on price stability in the long run.

In the third paper, published as a chapter in the Oxford Handbook of the Economics of Central Banking in 2019, Ricardo concluded that central banks have a limited scope for lowering the fiscal burden. This message is particularly important in times of sharply rising public deficits and debts.

I would like to personally congratulate Professor Reis on this award as well as on behalf of the members of the expert panel and my colleagues at the Bundesbank and the Oesterreichische Nationalbank. I hope that Ricardo pursues his prolific studies and further expands our knowledge of how central banks can achieve their mandates. I wish him every success, and that his citations curve will go on exhibiting an impressive slope. I am sure central bankers will continue to benefit from his lucid work.

Please join me now in a warm round of applause as I ask Professor Reis to join me on stage.

Carl Menger Award

Every two years, the Verein für Socialpolitik confers the Carl Menger Award for innovative international research in the areas of monetary macroeconomics and monetary policy. The award, named after the Austrian economist and co-founder of the Austrian School, is sponsored jointly by the Deutsche Bundesbank, the Oesterreichische Nationalbank and the Swiss National Bank and is worth EUR 20,000.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter