We think that eventually the euro will be abolished and a Northern Euro will be introduced: politicians and their economic advisors might just be waiting for a calm and secure moment, especially when confronted with Northern European inflation that could become a problem in 5 to 7 years.

Recent European austerity has only led to stagflation in Southern Europe: increasing unemployment and higher inflation than in Germany. Many economists call for an end of austerity, but they do not understand that allowing the PIIGS to consume more, means that Germany must pay for it.

Fearing their own economic principles like Robert Mundell’s optimum currency area, leading economists and politicians drive Europe into years and maybe decades of austerity, transfers from the north to the south and economic uncertainty.

This uncertainty, however, is the worst thing for business leaders and the European economy.

In the first part of our essay, we will discuss the results of recent European policy: austerity and global imbalances. In a second part we will present an alternative solution, a strategy for the introduction of a Northern Euro.

Part one: Austerity and weak euro worsens European and global imbalances

We admit that an exit of a weak euro member might trigger irrational behaviors and bank-runs, clearly explained here:

One weekend we will just find that the Greeks have done [the Greek euro exit]. But now suppose Greece does pull this trick. The day after we have a Drachma – deposits are in Drachma. We might print a single 10 drachma note and allow it to settle against the Euro – then over time print more. This should work for Greece.

Now if you are Irish or Italian or Portuguese (or even Spanish) you know the rules. You get to get your Euro out of the PIGS and into the core (Germany) as fast as possible. So max all your credit cards (for cash), draw all your bank deposits and load them in the boot of your car and make the drive to Switzerland or Germany. Somewhere safe. Otherwise you are going to lose half the value the day that the rest of the PIGS do a Greece.

And this bank run – a run including tens of thousands of Italians driving their Fiats – will surely blow apart every Italian bank. And their Euro-skeloritic compatriots will sign the death knell for all their banks too.

Target2 balances and rising German house prices versus falling peripheral ones show that this bank-run scenario already happens today, inside the common euro zone, just a bit more slowly.

Instead of kicking the periphery out of the euro zone and risking a bank run, we should go for a different approach, namely that the Northern countries leave the euro zone.

Austerity and kick-the-can approach

Richard Koo, the economist, who propagated the “balance sheet recession theory” thinks that only fiscal spending will rescue the PIIGS and austerity will do just the opposite. Most recently a group of economists called for the end of US and global austerity.

We are of the strong belief that Germany will not (be able to) pay this big bill for many years and decade. And if it does, it should do it once-off and not in an endless delirium, that eventually costs ten times more than a simple clean and clear cut, with the Northern euro introduction.

The potential official sector loss participation for Greece is only the very first example of the explosion of costs caused by the kick-the-can approach. Fiscal spending and stimulus in the PIIGS is only possible with fiscal and monetary independence, which is not the case inside the euro zone. It also requires a currency that can devalue.

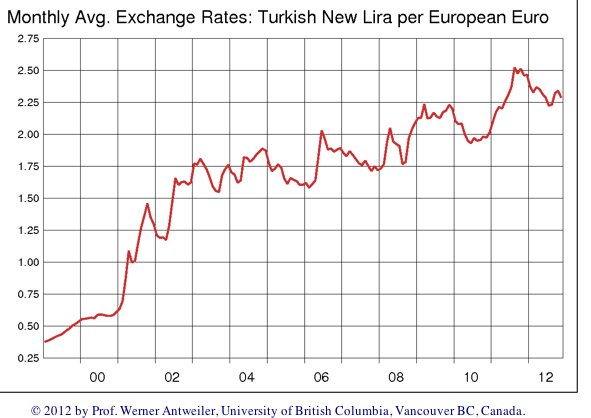

Turkey does a lot better than Greece with its own currency

Turkey, the biggest Greek competitor in holiday destinations, is currently booming, last but not least thanks to a cheap currency. At the time when Greece was to join the euro, Turkey had big issues with hyper-inflation, but overcame the problems with the time.

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation. - Click to enlarge

Southern European states have no chance in the long-term

Italy, Spain, Portugal, Cyprus and Greece did not use their historical chance to improve their economies via long-term factors like technology or better infrastructure between 1999 and 2008, but much of the money flowed into real-estate and consumption. As opposed to the previously, when cheap money was easily available, funding for Italian and other peripheral companies has dried up now. Salaries are downwards sticky, so that the only way out is a strong devaluation of the Euro and higher wages in the Northern and Eastern European countries over many years.

A quick look at economic theory shows that the southern states have no chance to stay in the euro in the long-term. Between 1999 and 2008 they were able to compete with the Northern countries in terms of GDP only thanks to cheap debt, a construction bubble and a consumption run.

Production factor labour

The southern countries have seen a loss of labour-intensive work such as textiles due to globalization since the euro’s introduction.

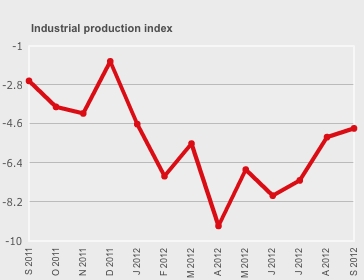

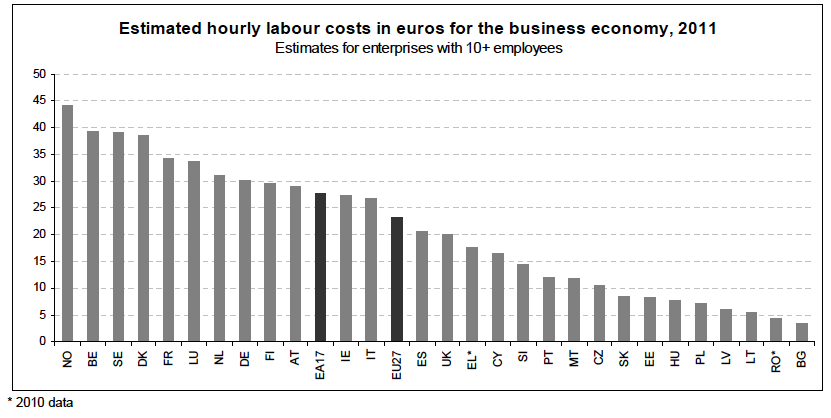

They see labour competition from the former communist countries and the advanced German export model. Italian labour costs are close to Germany’s, but they are four times higher than the ones in Slovakia or Estonia. Slovakian industrial production is rising at more than 10% per year, while those from the periphery have fallen strongly and are still sinking.

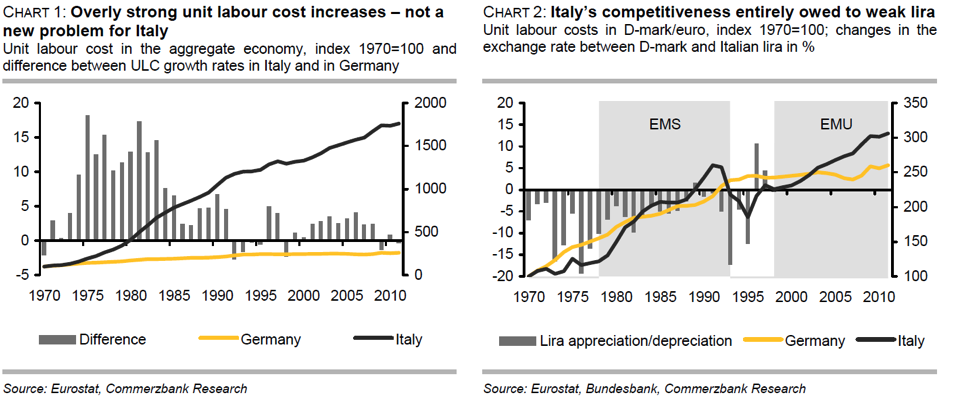

Southern European countries cannot devalue any more to become competitive. Before the euro era, Italian labour was competitive only thanks to an always weaker Lira, as the following graph from Commerzbank shows.

Production factor capital

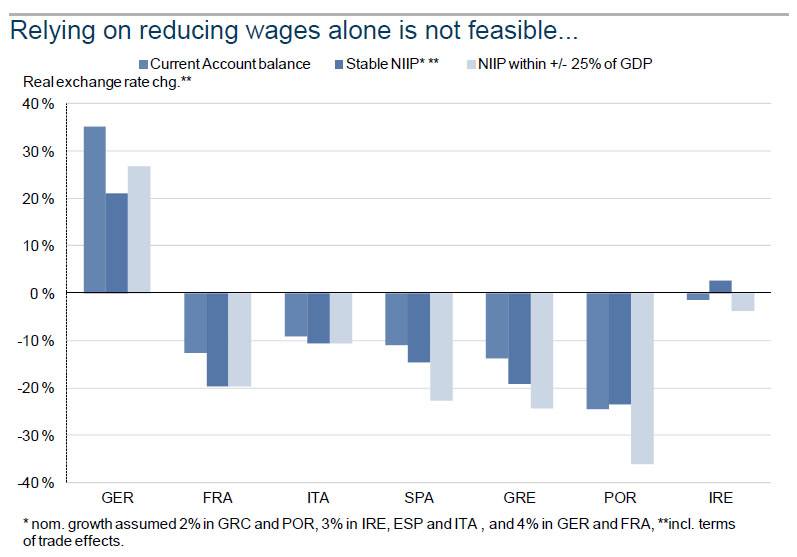

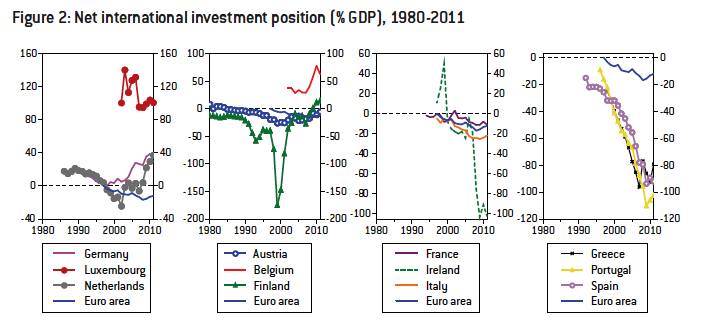

The following graph shows the net international investment position (NIIP) of the euro countries, one indicator of availability of capital. It shows that Greece, Portugal, Spain and Ireland desperately need foreign capital.

The ongoing capital crunch makes everything worse, we see huge capital outflows (see video). Due to missing capital, production costs in the PIGS are rising more quickly than in Germany. This despite falling or slowly rising labour costs. But only a return to really cheap labour and a cheaper currency would attract foreign capital again.

As Goldman’S Huw Pill explains, relying on labour costs reduction is not sufficient: 50% lower Greek and Portuguese and 30% Spanish or French labor costs would be needed.

Source Goldman Sachs via Zerohedge

We view relative wage cuts of this magnitude as unfeasible: it is difficult to imagine France accepting a one-third fall in living standards relative to Germany. Of course, one could rely on Germany to raise wages, so as to redress the competitiveness gap from the other side. But ultimately such an approach would imply Germany accepting much higher rates of inflation, say above 4% pa for a decade or more, assuming the ECB met its target of keeping area-wide inflation close to 2%. We doubt the German public would countenance such an eventuality…. Source Goldman Sachs via Zerohedge

Other factors

- Technology

The periphery is far behind in technology. Their expenditure on R&D is less than half that of the Northern states. Latest Greek data showed 0.6% R&D of GDP, Italy has 1.3%, but France or Germany close to 3% and Finland 4%. More R&D like the Euro Plus Pact wants, is restricted by the lack of capital and the Fiscal Compact, the implementation of European austerity.

- Human capital and worker’s mobility

- Overall competitiveness (taxes, debt, etc.)

The southern states are behind countries like Poland or Estonia.

The euro will destroy the public-sector, but first the welfare state in the periphery

If, on the contrary, the euro remains, then free-market forces will reduce the public-sector share and destroy the southern European and the French welfare states as Robert Mundell said:

”It puts monetary policy out of the reach of politicians,” he said. ”[And] without fiscal policy, the only way nations can keep jobs is by the competitive reduction of rules on business.”

But unfortunately the first thing that is destroyed is the welfare state, but bureaucracy and the public sector remains. Spain has 60000 more public employees than in 2007 and so many labour laws to remove; the way to an efficient economy is still very very long.

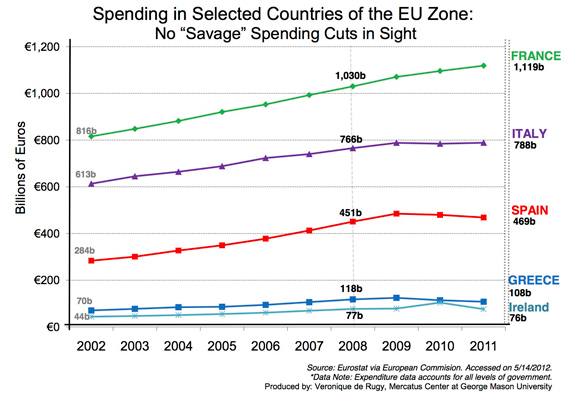

Austerity means welfare state cuts, but less public-sector (source Mercatus Center)

Populist and maybe astute politicians like Silvio Berlusconi have realized that the problem country in euro zone is not Italy, but might be Germany.

A more competitive exchange rate is a help to help yourself

Currently German tax-payers just finance the ever rising unemployment rates in the periphery and send always new “care packages” down to them. Yes “care packages” is the right word – our Italian, Greek, Portuguese and Spanish friends may forgive us. It is like the life aid for Africa in the 1970s. At the end of that decade aid organizations finally discovered that “help to help yourself” is the solution and not just sending food packages to survive. The Africans needed to have also machinery to be able to produce their own food.

We identify with this “help to help yourself” a competitive exchange rate, that is at least 20% weaker than the German currency. We do not see the point to go to an Italian supermarket and to see more German and Austrian dairy products than Italian ones. Dairy products that are carried in trucks over the once so beautiful alps. In the 1990s, however, Parmalat, an Italian dairy products company, dominated the market, at the times of a weak Lira. With the euro introduction and rising Italian salaries the competition was too big. After a series of frauds they went bankrupt.

The strongest and most efficient weapon against such environmental excesses in a free market like the European one, are exchange rates. They are far quicker than adjustments of labour costs, especially when capital is missing.

The euro increases global and European imbalances and prevents German consumers from spending

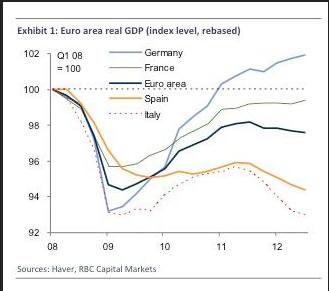

The following graph shows that the Northern Euro is a necessity to eliminate the increasing growth divergences in the euro zone.

Eventually the euro will be abolished, a Northern Euro introduced: politicians and their economic advisors might just be waiting for a calm moment, especially with upcoming German inflation. - Click to enlarge

Leading American Keynesians like Barry Eichengreen want to provoke German inflation of 4% and more, in order to force Germans to consume. They do not understand the German mentality and the historical fear of inflation. They do not understand that Germans are very price-sensitive and spend more when they think that prices are cheap. All Germans still remember the “Geiz ist geil”, “Penny-pinching is cool” of the early 2000s. A weak euro does not help them to consume, they need a strong Northern euro with strong purchasing power. Like they lived in the 1970s when always weaker dollar did not harm the German competitiveness.

Inflation and the pure fear of tax rises to finance the potential German losses on the Greek bailout, the ESM and Target2 will do the contrary: Germans will not increase spending as much as recent salary improvements and a potential cost-push inflation might suggest.

But the cheap euro helps that the German trade surplus with the US, France and Asia is rising more and more, even if a brutal reduction in consumer spending in the PIIGS cut the German trade surplus with these countries. Global trade imbalances become bigger and bigger thanks to the world biggest currency manipulator, Germany.

German trade surplus increasing with US, France, Asia but decreasing with Portugal, Greece, Italy, Spain

Nigel Farage puts it in simple words:

Northern Euro: One-off write-offs instead an endless delirium

In 1982 Paul Volcker stopped the vicious inflationary cycle, reduced uncertainty and stabilized the American and European economies. Only Latin America went for a lost decade due to lower commodity prices, high interest rates and high debt. One reason was that Wall-street did not want to accept a final hair-cut until 1989. Read why Southern Europe will live the same lost decade as Latin America, if nothing changes.

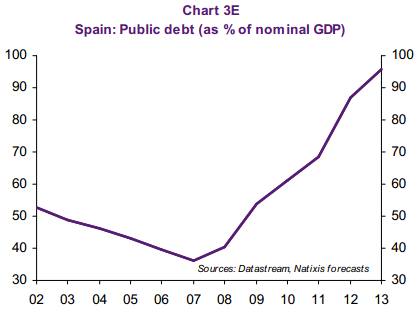

The Greek example has shown that delaying write-offs leads to more and more debt. The same will happen for Spain, Portugal, Cyprus, Slovenia and partially Italy. These countries might be able to reduce debt, but with falling GDP, the debt to GDP ratio will rise.

The Greek example has shown that delaying write-offs leads to more and more debt. The same will happen for Spain, Portugal, Cyprus, Slovenia and partially Italy. These countries might be able to reduce debt, but with falling GDP, the debt to GDP ratio will rise.

With a 20% higher Northern Euro exchange rate, German and other Northern European leaders should accept 20% private and official sector write-offs for assets of the other peripheral countries.

The 20% price advantage will make the peripheral economies competitive again, far more quickly than it will do with gradual (real) wage cuts and negative or slow GDP growth for many years. At the same time, cheaper import prices will help the Northern Europeans to spend more. Admittedly, the Northern Euro creation is a step, that implies big German sacrifices and a once-off uncertainty, but it avoids an uncertainty that lasts for years and decades.

We think that eventually the Northern Euro will be introduced: politicians and their economic advisors might just be waiting for a calm and secure moment, especially when confronted with Northern European inflation that could become a problem in 5 to 7 years, see the retrospective of the Northern Euro introduction from the year 2030.

In a forthcoming second part of this essay, we will present details on the strategy for the Northern Euro introduction that includes currency depreciation-related haircuts on Northern official sectors and banks, a certain amount of capital controls and stabilizing monetary policy and currency purchases, similar to the ones of the Swiss National Bank.

See more for

2 comments

2 pings

Alex Bernard

2012-11-28 at 10:16 (UTC 2) Link to this comment

Dear George,

thank you for the always out of the box insights you share on this page.

As you practically replicate my own views on the Euro crisis I mostly agree with what you write, and dangerously please myself. I am wondering why it is so hard to make these simple arguments understand to practictioners and economists, notwithstanding to common people. At some point, eventually, this view will become mainstream an turn events in Europe.

As I am half-Italian let me say, however, where I disagree. I don’t think Italy will break out of the Eurozone in the next years (I wish it would, but it ain’t). The reason is twofold: first, the institutional setting is deeply flawed and does not transmit the will of people into actual political action; so e.g. the M5S and other anti-euro movements won’t ever be able to control the Parliament, while incumbent parties will do everything to keep power and influence (for instance, changing electoral rules); second, as Italians are still very wealthy both materially and culturally -you know: weather is nice, food is superb!- there is only a small chance people outside the reach of trade unions, political parties and structured organizations will protest against austerity measures. You are right that the flows (income and savings) are small and becoming smaller, but the stock is still huge and leaves ample room for a long and painful adjustment.

Hope to read more interesting posts on your page.

Best,

Alex

DorganG

2012-11-28 at 10:29 (UTC 2) Link to this comment

Hi Alex, thanks for your comment.

Maybe you have already read parts of the second part, which I initially published here inside the first part.

I work in the think tank of a German political party which has currently 5% of votes and might go for this Northern euro solution. I appreciate any feedback especially on the second part, the technical realization of the Northern euro introduction.

Italy: Who Says No to Austerity Must Say Yes to the Northern Euro | Euro Economy

2014-01-07 at 10:32 (UTC 2) Link to this comment

[…] Read more: Italy: Who Says No to Austerity Must Say Yes to the Northern Euro […]

Euro: Who Says No to Austerity Must Say Yes to the Northern Euro | Euro Economy

2014-03-24 at 07:57 (UTC 2) Link to this comment

[…] Read more: Euro: Who Says No to Austerity Must Say Yes to the Northern Euro […]