The period between 1986 and 1991 was characterized by a boom in Europe that moved towards the end of communism with Gorbachev’s “perestroika”. The period was characterized by five major economic factors:

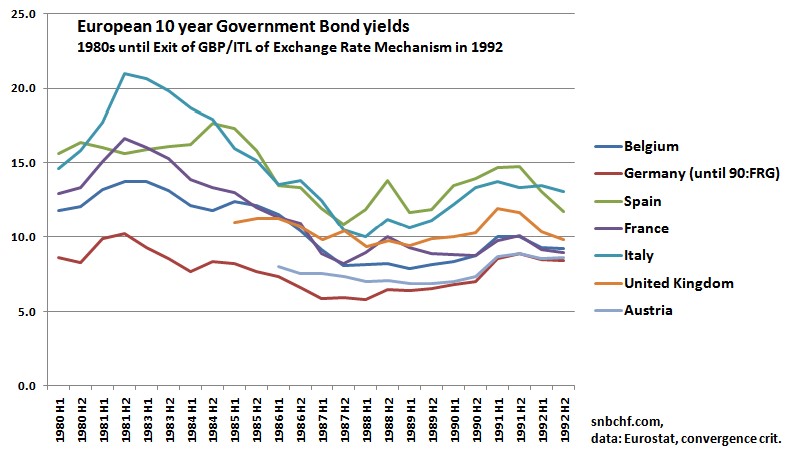

- In the Plaza accord of 1985, central banks decided to devalue the strong dollar. This strengthened the yen and European currencies. Interest rates dropped and made mortgages attractive again.

- After the Black Monday crash of 1987, the global economy quickly recovered. Wages, spending and inflation rose quickly, in particular in Northern European countries.

- During the oil glut, oil price dropped to under 10$ in 1986 from values at 35$ still in 1981.

- The oil glut reduced the income of the Soviet Union and was maybe the major reason for the breakdown of communism.

- The end of communism supported demand for European products, until the Soviet Union economically collapsed in 1991.

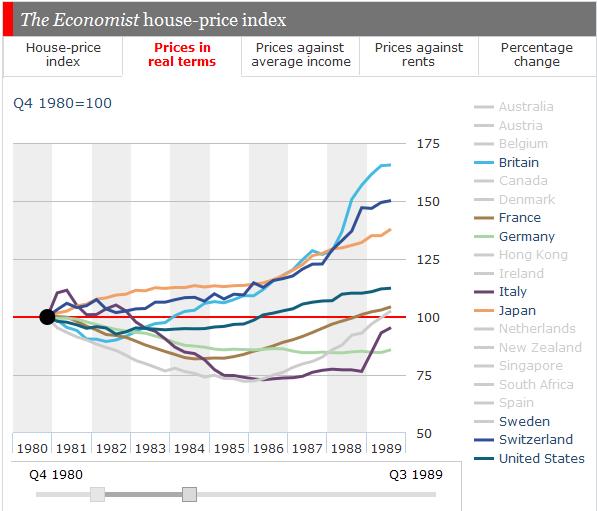

Interest rates in the late 1980s quickly dropped and fuelled the housing market.

European housing boom in the late 1980s

The biggest rise in real home prices in the 1980s happened in the UK (65% against 1980), in Switzerland (50%) and in Japan (42%). Despite its so-called “housing boom” in the late 1980s, real home prices in Sweden did not change much between 1980 and 1989.

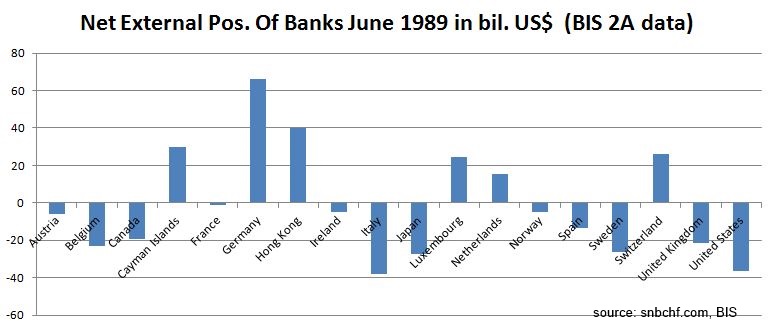

Japan lived an even stronger asset price boom; in 1989 the country was still a debtor among international banks. Borrowing from abroad helped to finance the boom.

In the following cycles, however, the Japanese built up a huge positive external position – see the following financial cycle.

In the following cycles, however, the Japanese built up a huge positive external position – see the following financial cycle.

<– Back to Financial Cycles Overview

See more for