In the Bretton Woods system of the 1950s, the US was the center region with essentially uncontrolled capital and goods markets. Europe and Japan, whose capital had been destroyed by the war, constituted the emerging periphery. The periphery countries chose a development strategy of undervalued currencies, controls on capital flows and trade, reserve accumulation, and the use of the center region as a financial intermediary that lent credibility to their own financial systems. In turn, the US lent long term to the periphery, generally through FDI. Once the capital of these zones had been rebuilt and their institutions restored, the periphery graduated to the center. It had no further need for the fixed rate, controlled development strategy, especially when it perceived that the US, in performing its financial intermediation service, was reaping a large transfer payment. For an insightful and entertaining example of the French and US views see Rueff and Hirsch (1965)1

Then and now the debate focused on the willingness of the periphery to accumulate claims on the center country.Triffin Dilemma

Triffin2, for example, argued that the US could provide reserves for a growing world economy “but only if European governments and central banks were willing to abandon to the political, monetary, and banking authorities of the United States their sovereignty over the management and use of reserves

source Dooley, Folkerts-Landau, Garber3

With the Vietnam war the current account deficit and public deficit of the U.S. exploded. From 1967 on, Germany and Japan had strong current account surpluses again; global imbalances became bigger. Until 1969, higher U.S. interest rates managed to attract foreign capital and neutralise the deficits, but finally led the United States to a recession, while Europe did not experience one. The Fed lowered interest rates and exercised “financial repression”. Funds escaped from the United States: the balance of payments deficit of 1970 and January to April 1971 was 16 billion dollars.

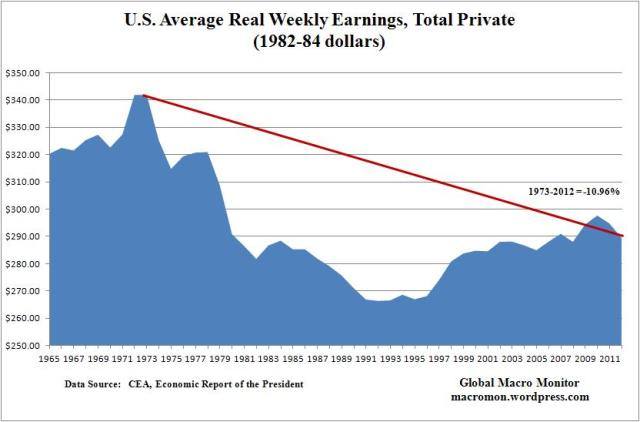

In purchasing power terms (PPP), the against gold undervalued US dollar helped to increase US real income until 1972, but then inflation eroded purchasing power.

<— Back to overview of financial cycles

- Rueff, Jacques and Fred Hirsch, “The Role and Rule of Gold: An Argument,” Princeton Essays in International Finance, no 47 (June, 1965), Princeton University International Finance Section. [↩]

- Triffin, Robert, “The Evolution of the International System: Historical Reappraisal and Future Perspective,” Princeton Essays in International Finance, no 47 (June, 1965), Princeton University International Finance Section [↩]

- Michael P. Dooley, David Folkerts-Landau, and Peter Garber, September 2003, An Essay on the Revived Bretton Woods System; NBER Working Paper No. 9971, PDF [↩]