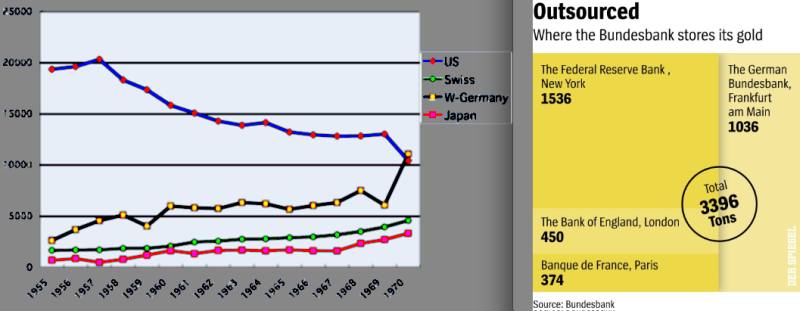

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell. The reason were persistent German, Swiss and Japanese current account surpluses but US and UK deficits. None the less, the gold was and is still stored in the United States or in the UK, but the official owners are abroad.

Gold and FX Reserves

Gold and FX Reserves US, Germany, Switzerland, UK, Japan 1950-1970 vs. German Gold - Click to enlarge

Already in 1965, the former French president De Gaulle knew that the Bretton Woods system would collapse. He understood that gold was worth far more than the 35 US$ agreed in the system.

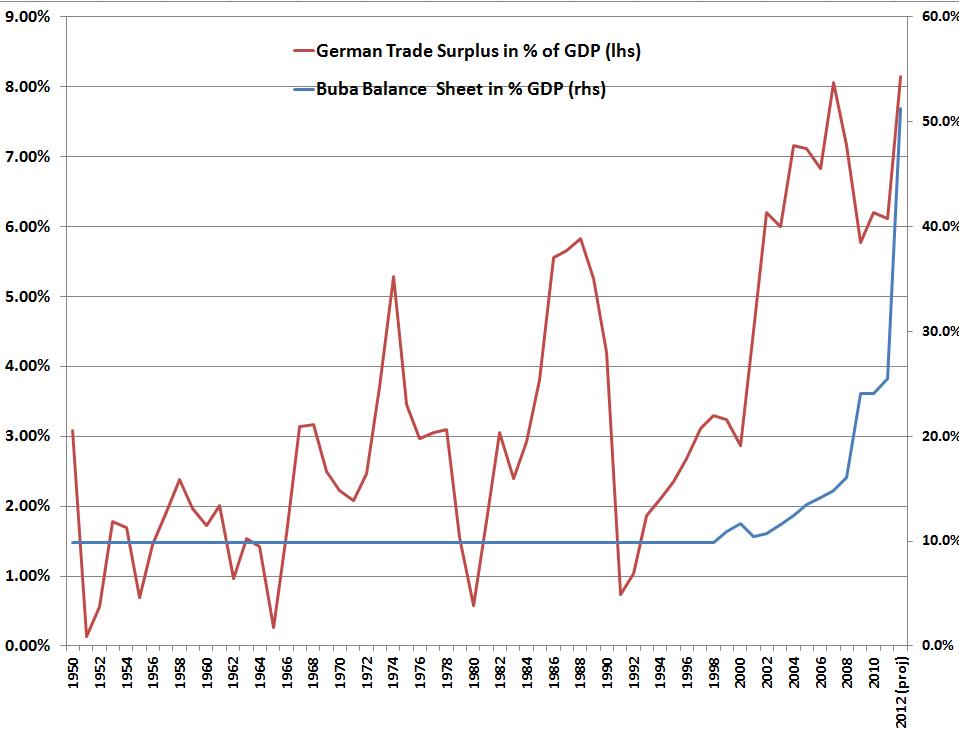

From the introduction of the EMU in the 1990s and even more from the euro introduction in 1999 this changed again: The Bundesbank bought assets from the European periphery and France instead, in the last ten years via the Target2 balances.

While the trade surplus amounts to 8% of GDP, the surpluses are not exported via the capital account, but the current account surplus remains on the Bundesbank balance sheet. In 2012 the BuBa possessed assets for around 50% of German GDP. On the contrary, a capital flight further blew up the Bundesbank balance sheet. Since October 2012, however, the capital flight is reduced, the target2 balance has decreased and the Bundesbank balance sheet has become shorter again.

German Trade Surplus vs. Bundesbank Balance 1950-2012 (till 1994 only rough estimate of Buba balance) , click to expand Sources 1. destatis, 2. crp-intotec, 3. Arbeitsagentur, 4. Querschuesse.de, 5.Deutsche Bundesbank

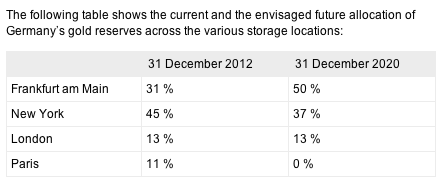

In the future foreign German gold reserves will partially come back to Germany.

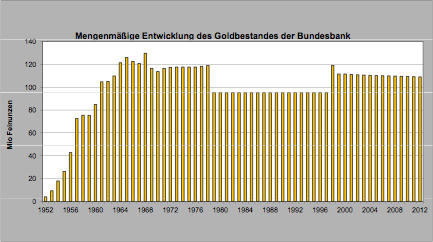

German, Swiss and Japanese gold reserves rose continously in the Bretton Woods system, whereas American and British reserves fell. - Click to enlarge

For the readers who are able to read German, we provide here the full background, the history of the German revalutions during the Bretton Woods system and the 1970s by former Bundesbank president Otmar Emminger (+ in 1986)

The file is also available here.

More on the history of gold in the 20th century here.

See more for