Summary

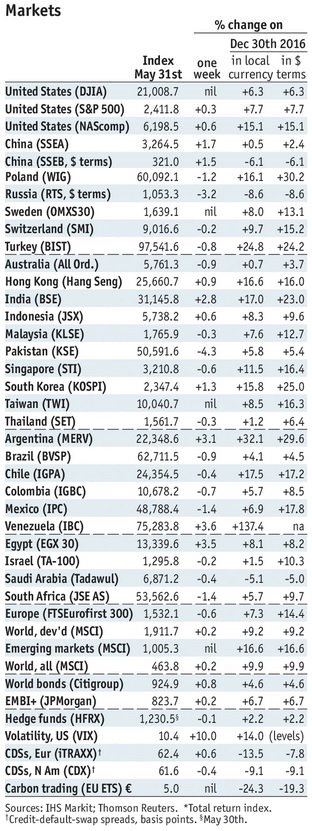

Stock MarketsIn the EM equity space as measured by MSCI, Egypt (+4.7%), Hong Kong (+2.2%), and Hungary (+1.9%) have outperformed this week, while Russia (-3.2%), South Africa (-3.2%), and Brazil (-2.5%) have underperformed. To put this in better context, MSCI EM fell -0.3% this week while MSCI DM rose 0.9%. In the EM local currency bond space, Argentina (10-year yield -43 bp), Turkey (-25 bp), and South Africa (-14 bp) have outperformed this week, while Indonesia (10-year yield +2 bp), Romania (+2 bp), and the Philippines (+1 bp) have underperformed. To put this in better context, the 10-year UST yield fell 8 bp to 2.16%. In the EM FX space, TRY (+1.8% vs. USD), ILS (+0.9% vs. USD), and CNH (+0.7% vs. USD) have outperformed this week, while MXN (-0.3% vs. USD), MYR (-0.3% vs. USD), and RUB (-0.2% vs. USD) have underperformed. |

Stock Markets Emerging Markets, May 31 Source: economist.com - Click to enlarge |

IndonesiaThe Indonesian cabinet is discussing revisions to the 2017 state budget. President Jokowi reportedly asked government departments to review their spending plans. Finance Minister Indrawati said revenues from higher oil prices will be eroded by a decline in tax revenue of about IDR15 trln ($1.1 bln). Indrawati added that “We estimate about IDR16 trln can be saved from goods expenditure.” The Thai central bank plans to reform some FX rules. Details will be provided Monday at an official briefing. There is speculation that the changes will involve regulations on fund inflows/outflows that are designed to prevent excessive currency gains. Note USD/THB is making new cycle lows, whilst foreign investment inflows remain very strong. South AfricaSouth African President Zuma survived the no confidence vote within his own ANC. Attention now turns to parliament, where the opposition has submitted a no confidence motion of its own. We have long felt that markets were too optimistic about Zuma’s ouster, and so some re-pricing of assets is in order. BrazilBrazil’s central bank signaled a slower pace of easing ahead after it cut 100 bp again. The bank implied this was due to uncertainty regarding fiscal reforms. A slower pace of easing shouldn’t be that surprising for anyone given heightened political risk. Right now, our base case is for a 75 bp cut at the July 26 meeting. Moody’s cut the outlook on Brazil’s Ba2 rating from stable to negative. Agency official noted that “The risk of prolonged political uncertainty can’t be ruled out. There’s now a risk that the reforms could be stalled.” Our own model has Brazil at BB+/Ba1/BB+, but an upward revision to the “Politics” factor pushes it down to BB/Ba2/BB. Further deterioration in the fundamentals seems likely, which would likely push it down another notch to BB-/Ba3/BB-. |

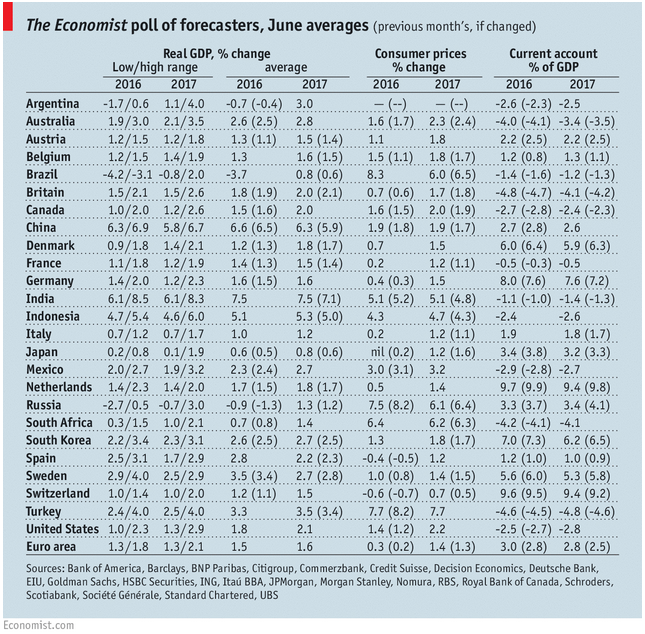

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2017 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent,win-thin