Summary

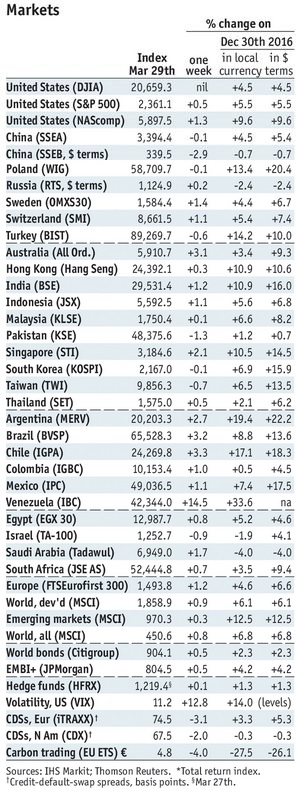

Stock MarketsIn the EM equity space as measured by MSCI, Colombia (+2.0%), Brazil (+2.0%), and Singapore (+1.2%) have outperformed this week, while Egypt (-1.5%), Turkey (-1.3%), and Poland (-1.2%) have underperformed. To put this in better context, MSCI EM fell -0.6% this week while MSCI DM rose 0.6%. In the EM local currency bond space, the Philippines (10-year yield -23 bp), India (-16 bp), and Hungary (-11 bp) have outperformed this week, while Turkey (10-year yield +21 bp), the South Africa (+14 bp), and Malaysia (+7 bp) have underperformed. To put this in better context, the 10-year UST yield was flat at 2.41%. In the EM FX space, RUB (+1.5% vs. USD), PLN (+1.2% vs. EUR), and INR (+0.9% vs. USD) have outperformed this week, while ZAR (-7.9% vs. USD), BRL (-1.4% vs. USD), and TRY (-1.1% vs. USD) have underperformed. |

Stock Markets Emerging Markets, March 29 Source: economist.com - Click to enlarge |

KoreaFormer Korean President Park was arrested. Officials cited concerns that she would destroy evidence in connection with the ongoing bribery investigation. Prosecutors have 19 days to decide whether to indict Park. HungaryHungary’s central bank was more dovish than expected and eased its unconventional policy again. It lowered the cap on the amount that banks can park at its three-month deposit facility to HUF500 bln by end-Q2 from HUF750 bln by end-Q1. The bank also raised its 2017 inflation forecast from 2.4% to 2.6%. South AfricaSouth African President Zuma finally fired Finance Minister Gordhan. While part of a wider cabinet shuffle, the moves are unambiguously negative for the nation’s standing. The ratings agencies have been very patient so far, but we think this will be the trigger for at least one downgrade to sub-investment grade. BrazilBrazil’s meat industry may have seen the worst of the scandal. Some foreign markets are reopening access to Brazilian meat, limiting only imports from the 21 companies identified in the so-called “Carna Fraca” probe. Of the 45 nations that limited Brazilian meat imports, only 13 remains closed. MexicoBanco de Mexico slowed the pace of tightening. It hiked 25 bp, as expected, which is smaller than the usual 50 bp hikes during most of this cycle. The bank left the door open to further hikes, which may be taken in lockstep with the Fed. |

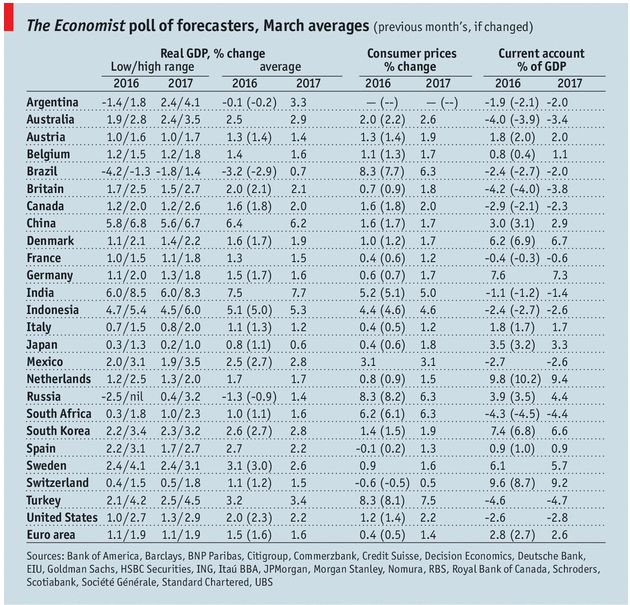

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, March 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent