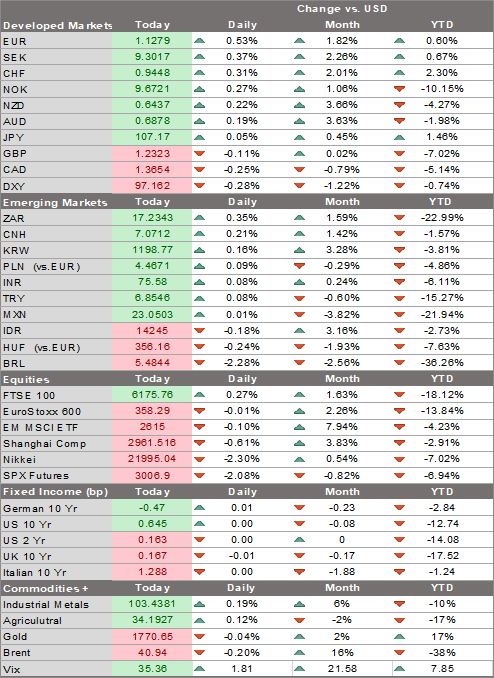

- The virus news stream remains negative; pressure on the dollar has resumed

- The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today

- UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections

- French and German leaders meet to discuss the planned EU pandemic rescue package; UK and EU begin their “intensified timetable” for Brexit negotiations

- Japan reported May retail sales and department store sales; China industrial profits rebounded nicely to 6.0% y/y in May

The virus news stream remains negative.

Deaths surpassed 500,000 worldwide, while confirmed cases exceeded 10 mln. Australia, Tokyo, and Austria are seeing a resurgence of infections, while the state of Texas has become the epicenter for the US. It’s clear that the recovery story worldwide will face headwinds in Q3, and we think markets had simply gotten too bullish. This is a very important week for US data, and we think risk sentiment will remain under pressure ahead of what we think will be a likely downside surprise in the US jobs number Thursday.

Pressure on the dollar has resumed. DXY traded Friday at the highest level since June 22 but has since reversed lower. The euro is trading at the highest level since June 24 and is testing the $1.13 area. Sterling is struggling to stay above $1.23, pushing the EUR/GBP cross to a new cycle near .9150. Break of the .91837 level would set up a test of the March 19 high near .9500. USD/JPY remains stuck in narrow ranges around 107.

AMERICAS

The US economy is taking a step back just as Q3 is about to get under way. The states that are experiencing higher virus numbers are a significant part of the US economy. California accounts for nearly 15% of GDP, followed by Texas at nearly 9%. Florida accounts for 5% of GDP so those three states together account for almost 30% of total US GDP. With many reopenings on hold now, this will be a headwind that carries over into Q3. If these states can quickly bend the curve back down, perhaps the recovery can proceed but for now, we are getting more pessimistic about the US outlook.

There are some minor US data reports today. Dallas Fed survey is expected at -22.0 vs. -49.2 in May. The regional Fed surveys so far have all come in better than expected for June, with the Philly Fed even posting a positive reading of 27.5. Elsewhere, May pending homes sales will be reported (18.0% m/m expected). The Fed’s Daly and Williams speak.

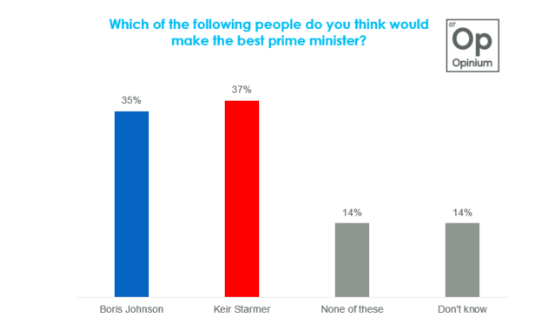

EUROPE/MIDDLE EAST/AFRICAIn the UK, Labour leader Keir Starmer overtook PM Boris Johnson in the latest opinion poll. The survey by Opinium show that 37% favored Starmer against 35% who favored Johnson. It also found that 59% of those surveyed disapproved of the government’s handling of the pandemic, and 54% thought that the country was coming out of the lockdown too fast. Nevertheless, the government is pushing ahead with the reopening. It will also deliver more funding for infrastructure, housing, and hospitals, likely to be announced in a speech tomorrow. On the other side of the Channel, Macron’s party did poorly in French local elections. As all political disputes are at the moment, this one also seemed to have been largely a referendum on the pandemic management. Several other idiosyncratic factors also played a role, of course, including low turnout. Macron’s party did very poorly in Paris (where it had won a decisive victory in the 2017 elections) with only 14%. The incumbent Mayor Hidalgo took nearly 50%. The Green party did very well in several urban centers. The far right nationalist party led by Le Pen took the southern city of Perpignan but didn’t make big headwinds elsewhere. Poland will have a runoff election in a closely contested race for the presidency. Incumbent candidate Duda (Law and Justice Party) took 45% of the vote compared to 29% for opposition candidate Trzaskowski (Civic Platform). A victory by Duda, even with a weaker mandate, would likely signal a continued path towards weakening of Polish institutions and more confrontation with the EU. The turnout was high at 64% from 49% in the last elections. The zloty is outperforming on the day, up slightly against a broad but modest day for EM currencies. Germany reports June CPI. Headline inflation of 0.6% y/y is expected, but state data already reported today suggest potential for an upside surprise. The eurozone-wide measure will be reported Tuesday, where headline inflation of 0.2% y/y is expected. French and German leaders meet today to discuss strategy on getting a deal struck on the EU pandemic rescue package. These two countries have spear-headed the most aggressive approach but have run into resistance from the so-called Frugal Four. Talks come ahead of a planned EU summit July 17-18. EC President von der Leyen stressed last week that time pressure is high as an agreement is needed before the summer holiday. She added that it is important for all EU countries to get behind this plan. The UK and EU begin their “intensified timetable” for Brexit negotiations. Today, chief UK negotiator Davide Frost will meet in person with the EU’s Clara Martinez Alberola, Michel Barnier’s deputy. Five rounds of weekly talks will be held. Given the lack of progress to date, we remain skeptical that such a complicated trade deal can be wrapped up by year-end. As such, we believe markets are underestimating the odds of a hard Brexit. Recent sterling softness could accelerate if the tone of the talks turns negative. |

The best prime minister |

ASIAJapan reported May retail sales and department store sales. Overall sales rose 2.1% m/m vs. 3.0% expected, while the y/y improved slightly to -12.3% from a revised -13.9% (was 13.7%) in April. Department store sales contracted -16.7 %y/y vs. -18.2 expected. The economy has started to turn the corner, but full recovery is unlikely until we move through Q3. For now, the Bank of Japan is in wait and see mode. China industrial profits rebounded nicely to 6.0% y/y in May from -4.3% in April. Also note that the low for the year was -34% in March and that industrial profits are still down nearly 30% y/y this year. While the productive capacity looks to be improving, the problem is on the demand side. It’s hard to see a material improvement in final demand domestically or globally from sectors apart from government spending. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Boris Johnson,Daily News,Featured,newsletter