Tag Archive: Daily News

Dollar Consolidates Its Gains Ahead of Jobs Report

Senate Democrats are setting the table for passage of President Biden’s proposed $1.9 trln relief bill; there were glimmers of possible bipartisanship in some of the votes; US January jobs data is the highlight; Canada also reports January jobs data; Colombia reports January CPI.

Read More »

Read More »

Dollar Remains Firm Despite Dovish Fed Hold

The FOMC delivered a dovish hold, as we expected; we get our first look at Q4 GDP; Fed manufacturing surveys for January will continue to roll out; weekly jobless claims data will be closely watched.

Read More »

Read More »

Dollar Trading Sideways as FOMC Meeting Begins

The FOMC begins its two-day meeting today with a decision out tomorrow afternoon; Senate Minority Leader McConnell has finally agreed to a power-sharing deal based on the 2001 model; President Biden signaled willingness to negotiate his stimulus proposal in order to get a bipartisan deal; Fed manufacturing surveys for January will continue to roll out; Brazil reports mid-January IPCA inflation

Read More »

Read More »

Dollar Flat as Markets Await Fresh Drivers

Discussions on President Biden’s proposed $1.9 trln fiscal package are getting off to a rocky start; Fed manufacturing surveys for January will continue to roll out. ECB Governing Council member Olli Rehn viewed yield curve control for the region as “not sensible”;

Read More »

Read More »

Dollar Weakness Continues Ahead of ECB Decision

Joe Biden became the 46th President of the US; three Democratic Senators were also sworn in; weekly jobless claims data will be the highlight of an otherwise quiet week; Fed manufacturing surveys for January will continue to roll out; Brazil kept rates on hold at 2.0%, as expected ECB is expected to keep policy unchanged; Norges Bank kept rates steady at 0%, as expected;

Read More »

Read More »

Dollar Continues to Soften Ahead of Inauguration

President-elect Biden will be inaugurated and becomes the 46th President of the United States at noon; he will hit the ground running by announcing a raft of executive orders upon taking office; Janet Yellen’s confirmation hearing was revealing; Canada and Brazil are expected to keep rates unchanged.

Read More »

Read More »

Dollar Regains Some Traction as Markets Search for Direction

House Democrats will move ahead with impeachment proceedings today; December CPI data will be the US highlight; heavy UST supply this week wraps up with a $24 bln sale of 30-year bonds; December monthly budget statement will be of interest the Fed releases its Beige Book report; several Fed officials pushed back against notions of tapering anytime soon

Read More »

Read More »

Dollar Runs Out of Steam as Sterling Leads the Way

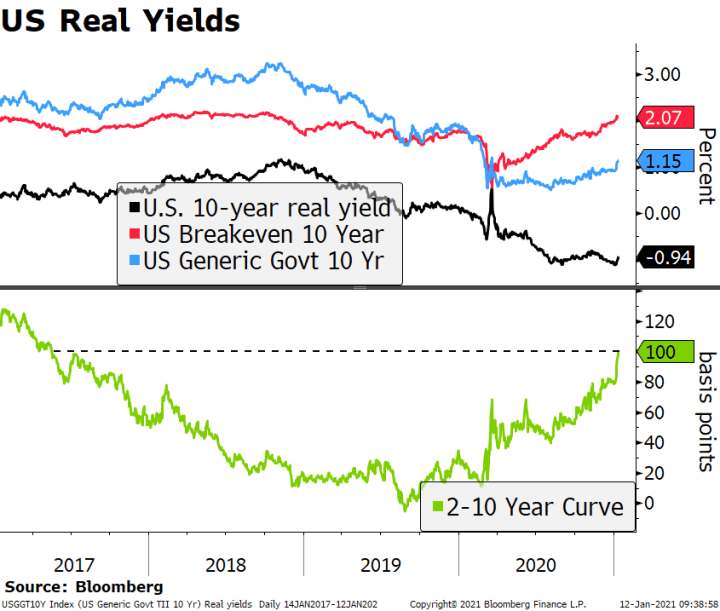

The US curve continues to steepen; real US yields have become less negative; UST supply will remain an issue as $38 bln of 10-year notes will be sold today; Brazil reports December IPCA inflation.

Read More »

Read More »

Dollar Continues to Soften Ahead of FOMC Decision

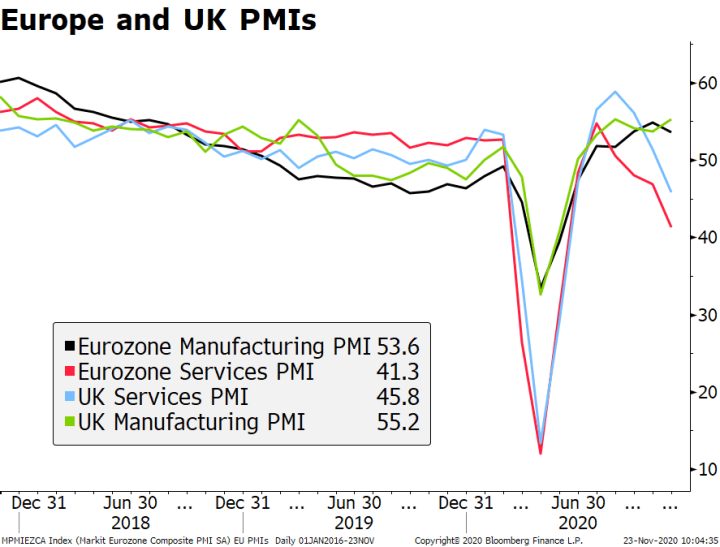

Optimism on a stimulus deal remains high; the FOMC decision will be key; the dollar tends to weaken on recent FOMC decision days November retail sales will be the US data highlight; Markit reports preliminary December PMI readings; Canada reports November CPI

Read More »

Read More »

Dollar Rally Running Out of Steam Ahead of ECB Decision

Stimulus talks drag on; US November CPI will be today’s data highlight; US Treasury wraps up a big week of auctions today with $24 bln of 30-year bonds on offer. The November budget statement will hold some interest; weekly jobless claims will be closely watched;

Read More »

Read More »

Jittery Markets Keep the Dollar Afloat (For Now)

US fiscal negotiations are taking longer than expected; US Treasury auctions $56 bln of 3-year notes; we believe the Fed is watching the yield curve closely; Brazil reports November IPCA inflation; Chile kept rates on hold at 0.50% and tweaked its asset purchase program.

Read More »

Read More »

Dollar Stabilizes but Weakness to Resume

There are new efforts to pass another round of stimulus sooner rather than later; we warn against getting too optimistic; US bond yields rose in anticipation of stimulus; Fed Chair Powell and Treasury Secretary Mnuchin gave somewhat conflicting outlooks for the US.

Read More »

Read More »

Dollar Plumbs New Depths With No Relief In Sight

Stimulus talks continue but the goalposts have indeed been moved; the good news is that a package before year-end is looking more likely; optimism regarding stimulus continues to buoy US yields. ISM services PMI is expected at 55.8 vs. 56.6 in October; weekly jobless claims data will be reported; Fed Beige Book report was suitably downbeat.

Read More »

Read More »

Dollar Consolidates Ahead of Thanksgiving Holiday

The divergence in developed markets yield curves continues; the dollar is consolidating ahead of the US holiday. FOMC minutes will be released; weekly jobless claims data will be released a day early; October personal income and spending will be reported; Banco de Mexico releases its quarterly inflation report.

Read More »

Read More »

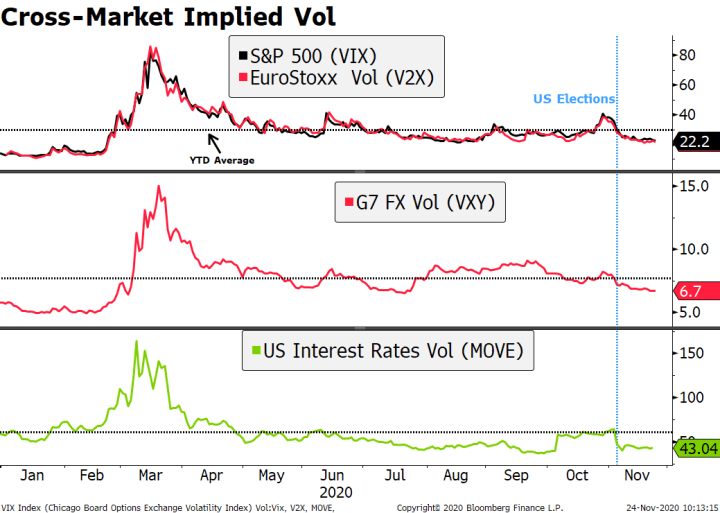

Dollar Weakness Resumes as Short-Covering Fades

Sentiment is being buoyed by two incrementally positive stories; cross-markets implied volatility measures continue to trend lower; dollar weakness has resumed. President-elect Biden will reportedly officially name his first cabinet picks today; Fed manufacturing surveys for November will continue to roll out; Brazil and Mexico both reports mid-November inflation readings.

Read More »

Read More »

Dollar Weakness Resumes as Markets Start Another Week in Risk-On Mode

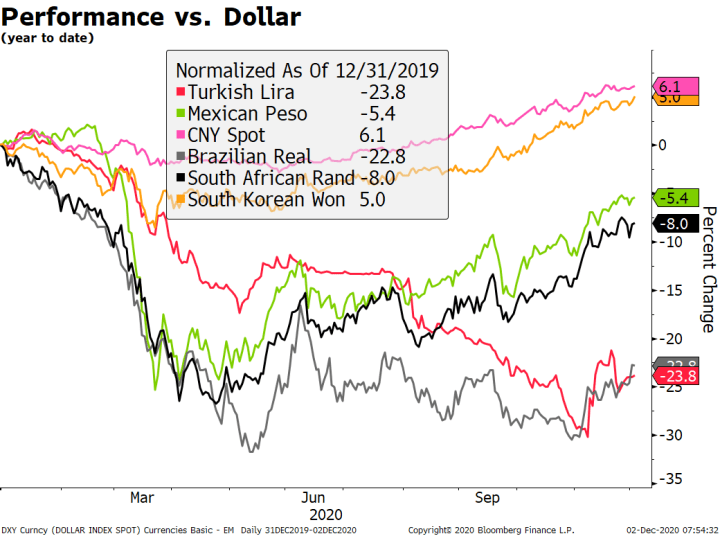

Covid vaccine results from AstraZeneca and Oxford University brought another wave of optimism; dollar weakness has resumed; that said, we will refrain from making any longer-term calls for the demise of the dollar. Reports suggest President-elect Biden is pushing House Democrats to reduce the size of their fiscal package demands to unlock negotiations; Republicans have an interest in compromising.

Read More »

Read More »

Dollar Bounce Likely to Fade

The negative virus news stream is taking a toll on market sentiment; the dollar is benefiting from the risk-off price action but is likely to fade. Weekly jobless claims data will be of interest; Fed manufacturing surveys for November will continue to roll out; Judy Shelton’s Fed confirmation is looking less and less likely.

Read More »

Read More »

Dollar Weakness Continues Ahead of US Retail Sales Data

The dollar continues to soften. October retail sales will be the US data highlight; Fed manufacturing surveys for November have started to roll out; Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed.

Read More »

Read More »

Dollar Soft as Markets Start the Week in Risk-On Mode

The odds of national-level action in the US against the second wave virus outbreak remains small, even after Biden takes over; the dollar continues to soften. There is growing speculation about former Fed Chair Yellen becoming Biden’s Treasury Secretary; Fed manufacturing surveys for November will start to roll out; Peru’s interim President Merino resigned under pressure from more demonstrations.

Read More »

Read More »

Dollar Softens Ahead of CPI Data

Pressure on the dollar has resumed; October CPI data will be the US highlight; US bond market was closed yesterday but yields have eased a bit today. Weekly jobless claims data will be reported; monthly budget statement for October will hold some interest; Mexico is expected to cut rates 25 bp to 4.0%; Peru is expected to keep rates steady at 0.25%.

Read More »

Read More »