- US fiscal negotiations are taking longer than expected; US Treasury auctions $56 bln of 3-year notes; we believe the Fed is watching the yield curve closely; Brazil reports November IPCA inflation; Chile kept rates on hold at 0.50% and tweaked its asset purchase program

- UK Prime Minister Johnson is going to Brussels for high-level Brexit negotiations with EC President von der Leyen; there are no signs of progress in the EU budget and recovery fund negotiations; Germany reported a firm December ZEW survey

- Japan reported October household spending, real cash earnings, current account, and final Q3 GDP; stimulus efforts continue in Japan

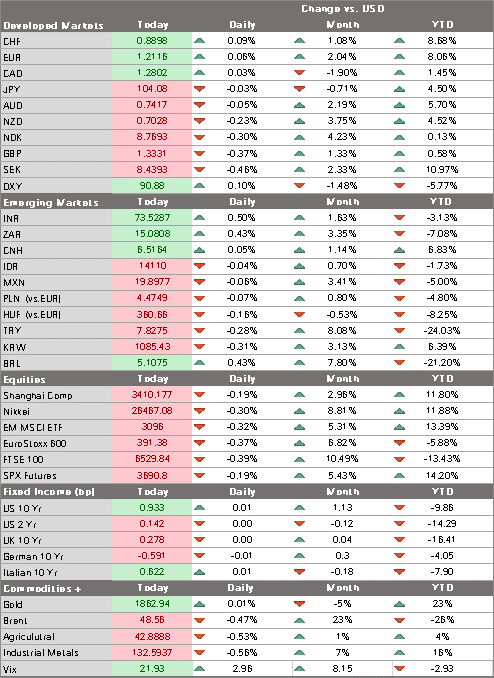

The dollar is stabilizing a bit. Given all the event risk this week, it’s not that surprising that markets on the defensive. Risk-off impulses that are giving the dollar a temporary boost are likely to fade and the underlying fundamentals remain unchanged. Dollar weakness should resume and so we continue to target the February 2018 low near 88.253 for DXY. The euro is holding above $1.21, while sterling has recovered from yesterday’s selloff to move back above $1.33. USD/JPY is trading near 104 but remains heavy and so we look for a clean break below 104 and an eventual test of the November low near 103.20.

AMERICAS

US fiscal negotiations are taking longer than expected. Reports suggest Congress will pass a one-week continuing resolution Wednesday to keep the government running past Friday. During that short extension, Congress will work to complete the omnibus spending bill with the pandemic relief attached. This is proving to much to complete by the Friday deadline.

Pandemic relief talks remains stuck on aid to state and local governments and liability shields for businesses, two areas that have proved vexing all along. Senate Majority Leader McConnell has yet to officially endorse the latest $908 bln compromise. Indeed, reports suggest he continues to balk at a package greater than his $500 bln skinny deal, pushing for targeted (that is, smaller) relief. Yesterday, McConnell said “I’m optimistic we’re going to get somewhere. But I have no report at the moment about how.”

Elsewhere, talks on the omnibus spending bill has also hit some snags. President Trump is still pushing for border wall funding and is fighting efforts to rename military bases that honor Confederate figures. While Congressional leaders say they have the votes to override a veto, continued delays will likely unnerve markets further.

Market appetite for UST issuance will be tested this week, with a near record $118 bln on offer. The US Treasury kicks things off today by auctioning $56 bln of 3-year notes. At the previous 3-year auction, the bid to cover ratio was 2.4 and the high yields was 0.25%, while direct bidders took down 14.3% and indirect bidders took down 38.9% of the total on offer. This sale will be followed by $38 bln of 10-year notes Wednesday and $24 bln of 30-year bonds Thursday.

We believe the Fed is watching the yield curve closely. A break above 1.0% would likely trigger some jawboning, while a break above 1.25% would likely trigger some action. The upcoming December 15-16 may provide some clues to the Fed’s thinking here. The media embargo is not in place and so we will get no Fed speakers until Chair Powell’s post-decision press conference next Wednesday.

| Brazil reports November IPCA inflation. Headline is expected to rise 4.20% y/y vs. 3.92% in October. If so, inflation would be the highest since January and would move into the top half of the 2.5-5.5% target range. COPOM then meets Wednesday and is expected to keep rates steady at 2.0%. However, CDI market is pricing a chance of the first hike at the January 20 meeting, followed by a series of hikes throughout the year. October retail sales will be reported Thursday and are expected to rise 7.0% y/y vs. 7.3% in September.

Chile central bank kept rates on hold at 0.50% and tweaked its asset purchase program. The bank will start reinvesting the coupons it gets from its holdings of bank bonds (about $8 bln purchased) and extended the end of the asset purchase program from January to June. Officials have plenty of room to continue expanding liquidity if necessary though these programs, but rate cuts seem firmly off the table for now and forward guidance suggests steady rates over the bank’s two-year forecast horizon. The Chilean peso continues to recover and remains the outperformer in the region, the only currency with a year-to-date positive return (+1.0%). |

Performance vs. Dollar, 2020 |

| ASIA

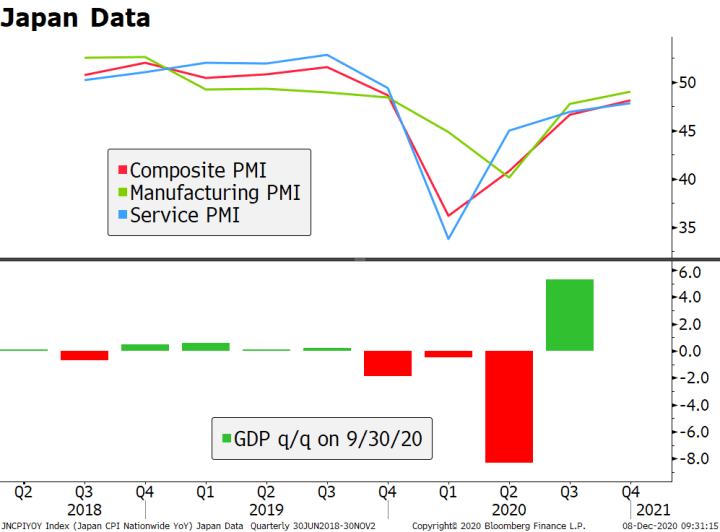

Japan reported October household spending, real cash earnings, current account, and final Q3 GDP. Spending rose 1.9% y/y vs. 2.8% expected and -10.2% in September, while earnings fell -0.2% y/y vs. -0.4% expected and -1.1% in September. The adjusted current account surplus came in at JPY1.983 trln vs. JPY1.829 trln expected and JPY1.346 trln in September, while final GDP growth was revised higher to 22.9% SAAR vs. 21.4% preliminary. Stronger private consumption and business spending were the main factors behind the upward revision to GDP. |

Japan Data, 2018-2021 |

| Stimulus efforts continue in Japan. Next BOJ meeting is December 17-18 and reports suggest it will extend its emergency programs then. Prime Minister Suga just announced a third round of stimulus worth ¥73.6 trln ($700 bln) and it may not be the last one. As we have stressed before, fiscal policy is in the driver seat in Japan with little to be expected from the BOJ. The latest stimulus will help bridge the country’s economy until private consumption (hopefully) picks up again. But of course, it will only expand Japan’s huge debt/GDP ratio, quickly approaching 270%. There was no notable impact on JGB yields as the package had been well telegraphed. |

EUROPE/MIDDLE EAST/AFRICA

UK Prime Minister Johnson is going to Brussels for high-level Brexit negotiations with EC President von der Leyen. The meeting will probably take place on Wednesday, just before the crucial EU summit Thursday. For what it’s worth, recent comments surrounding the notations have been decidedly negative. In a sign of good will, Jonson indicated he could ditch the internal market bill draft legislation, removing an important (even if self-imposed) obstacle. While we still think some sort of skinny deal will be reached, our conviction has weakened and see the odds at around 50-50 right now. Most investors seem to believe that a no-deal Brexit will have very little impact on global markets, and this complacent attitude r makes us nervous. A hard Brexit is the absolute last thing that the UK and EU need in the middle of a pandemic and we really can’t stress that enough.

Separately, there are no signs of progress in the EU budget and recovery fund negotiations. Polish officials continue to hold the veto line, reiterating their opposition to the rule of law conditions. If the veto remains and the budget isn’t passed, it goes to emergency funding mode where payments are prioritized and disbursements to Poland and Hungary could be put at the end of the line. On the recovery fund, the EU is working on a plan B to try to carve Poland and Hungary out of the fund altogether. Here too, all sides are playing with fire but we fault leaders of these two illiberal democracies for their brinkmanship. These two stand to lose the most, both economically and politically. An eventual compromise should be seen but guess what? Delays to the budget and recovery fund are the last thing the EU, Poland, and Hungary need right now.

Germany reported a firm December ZEW survey. The expectations component unexpectedly jumped to 55.0 vs. 46.0 expected and 39.0 in November, while the current situation fell slightly to -66.5 vs. -66.0 expected and -64.3 in November. Eurozone ZEW expectations also rose to 54.4 from 32.8 in November. What could be driving this? Simply put, it appears that targeted lockdowns have been working and virus infections have been falling across Europe since the mid-November peak. While there is a long hard winter ahead for the world, Europe has shown again that it can bend the curve. We have yet to do that here in the US as our third wave shows no sign of peaking yet.

Full story here Are you the author? Previous post See more for Next postTags: Articles,Daily News,Featured,newsletter