Tag Archive: Daily News

Risk Appetite Ebbs Ahead of BOE Decision

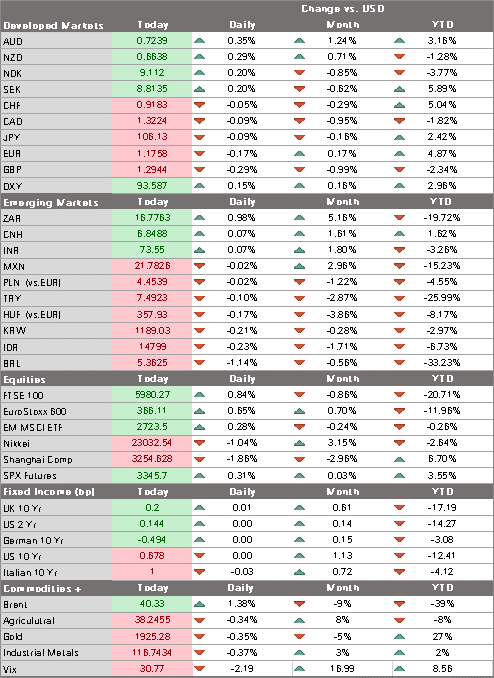

The dollar has gotten some limited traction despite the dovish FOMC decision; the FOMC delivered no surprises. We are seeing some more movement on fiscal stimulus; August retail sales disappointed yesterday.

Read More »

Read More »

Dollar Bounce Ends Ahead of ECB Decision

The dollar rally ran out of steam; US Senate will hold a vote today on its proposed “skinny” bill. US reports August PPI and weekly jobless claims; US will sell $23 bln of 30-year bonds today after a sloppy 10-year auction yesterday

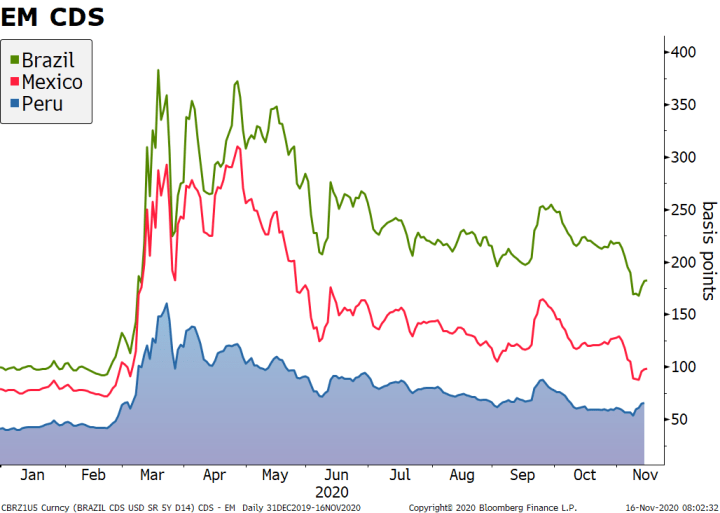

BOC delivered a hawkish hold yesterday; Peru is expected to keep rates steady at 0.25%.

Read More »

Read More »

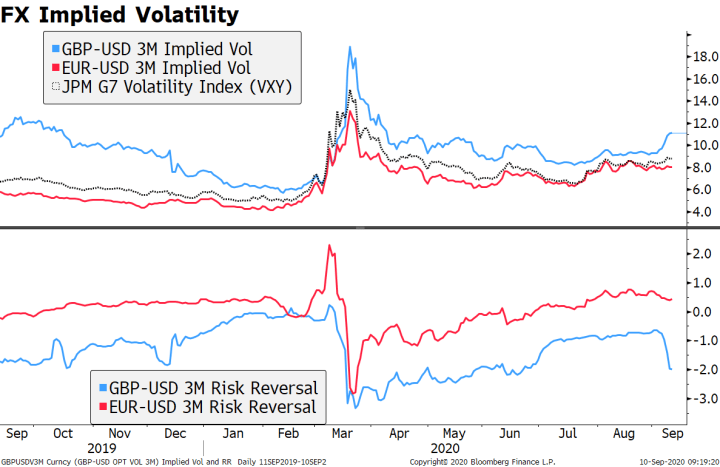

Sterling Pounded by Brexit Developments

The dollar rebound continues; odds of a near-term stimulus bill in the US are falling; ahead of inflation readings later this week, the US holds a 10-year auction today. Bank of Canada is expected to keep policy steady; Mexico reports August CPI; Brazil reports August IPCA inflation.

Read More »

Read More »

Dollar Softens, Equities Rise as Markets Ignore the Negatives

Markets seem to be increasingly desensitized to the usual negative drivers; the dollar is under pressure again. Stimulus talks remain stalled; reports suggest Trump is mulling a capital gains tax cut of some sort. US data highlight today will be July PPI; US Treasury begins its record $112 bln quarterly refunding.

Read More »

Read More »

Dollar Weak Ahead of Likely Dovish Hold from the Fed

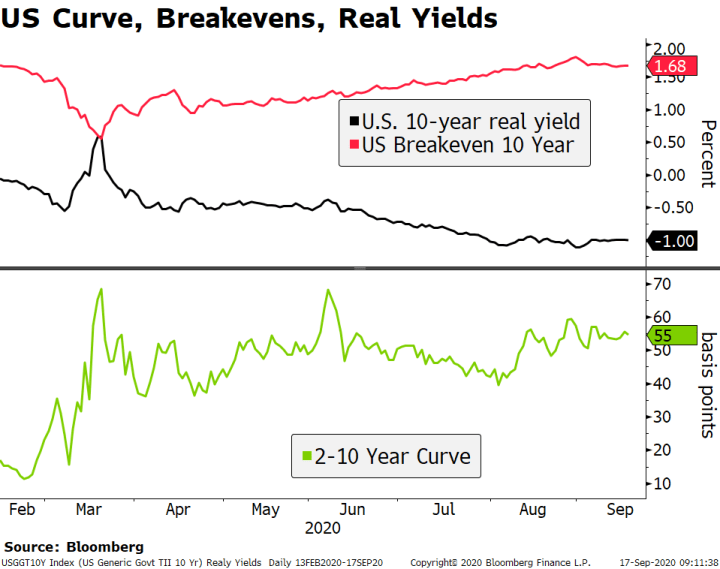

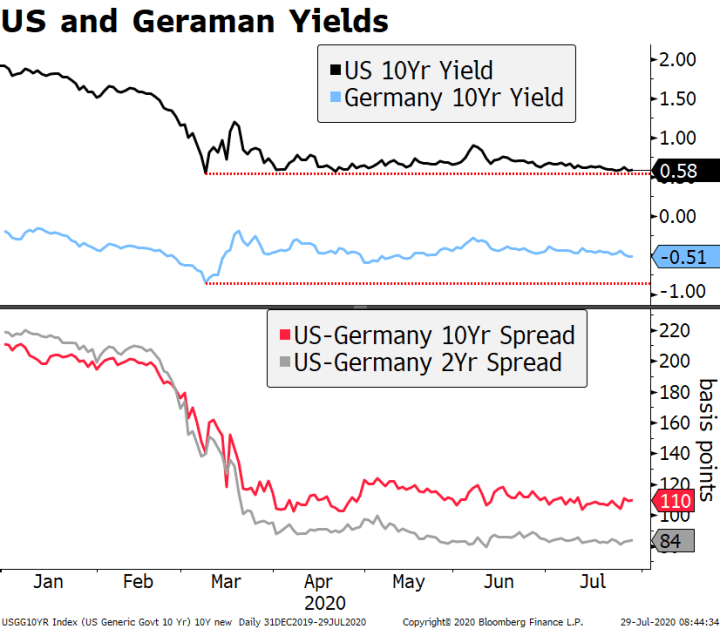

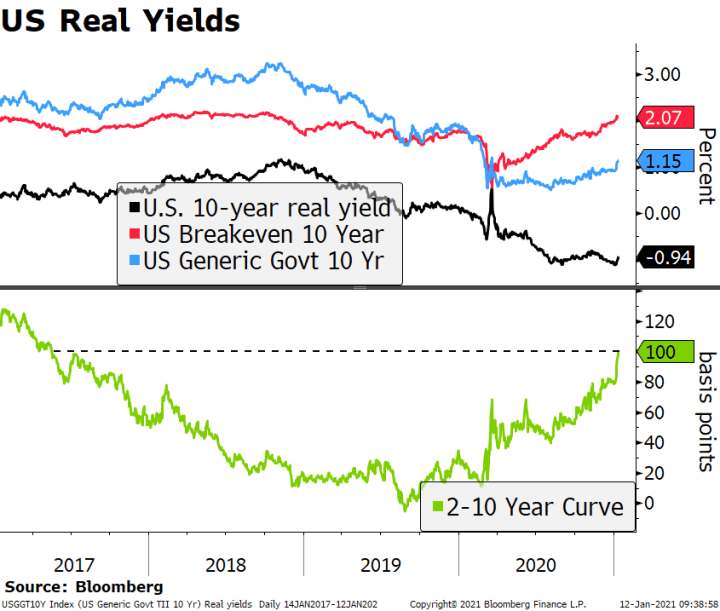

The FOMC decision today is likely to deliver a very dovish tone; the dollar tends to weaken on FOMC decision days. Tensions about the latest US stimulus bill are rising; core bond yields have been remarkably stable over the last several months.

Read More »

Read More »

Dollar Stabilizes but Further Losses Likely

The dollar is stabilizing today but further losses are likely. Senate Republicans have proposed a sharp cut to weekly unemployment benefits; Senator Collins will oppose Judy Shelton’s nomination to the Fed. Regional Fed manufacturing surveys for July will continue to roll out; early July reads for the US economy support our view that Q3 is off to a rocky start.

Read More »

Read More »

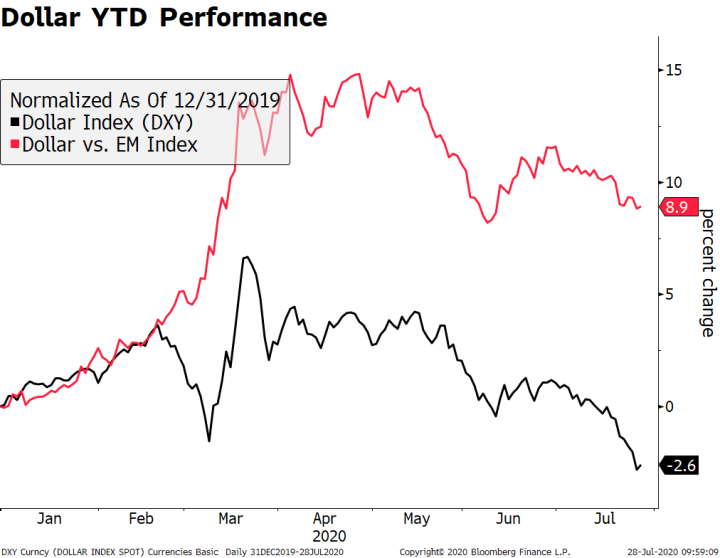

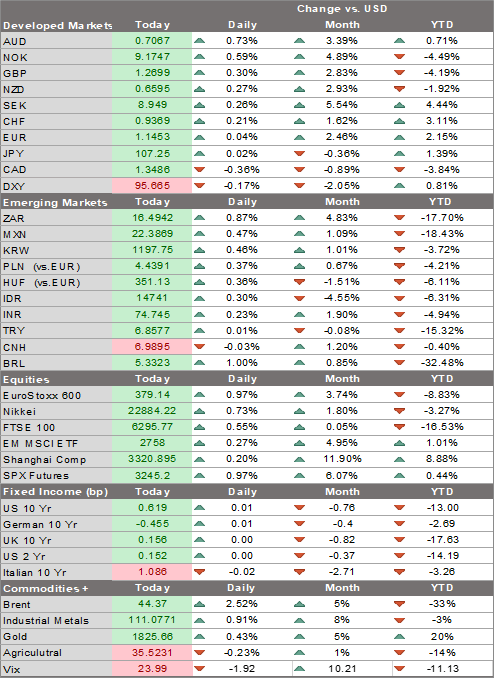

Dollar Remains Under Pressure as European Outlook Shines

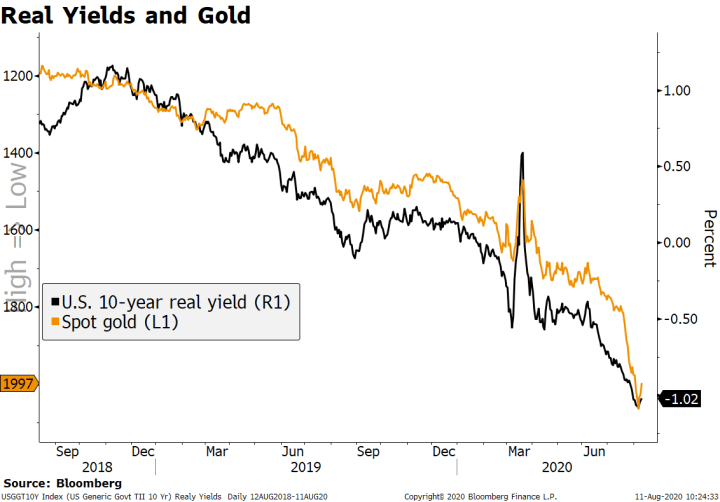

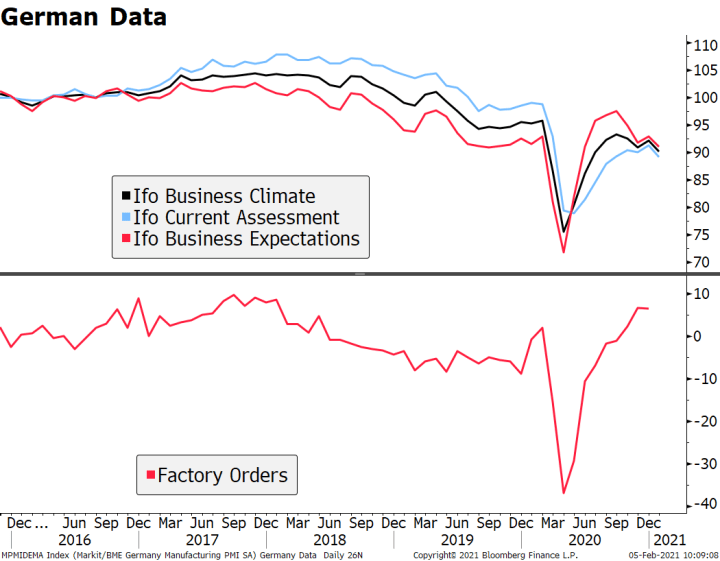

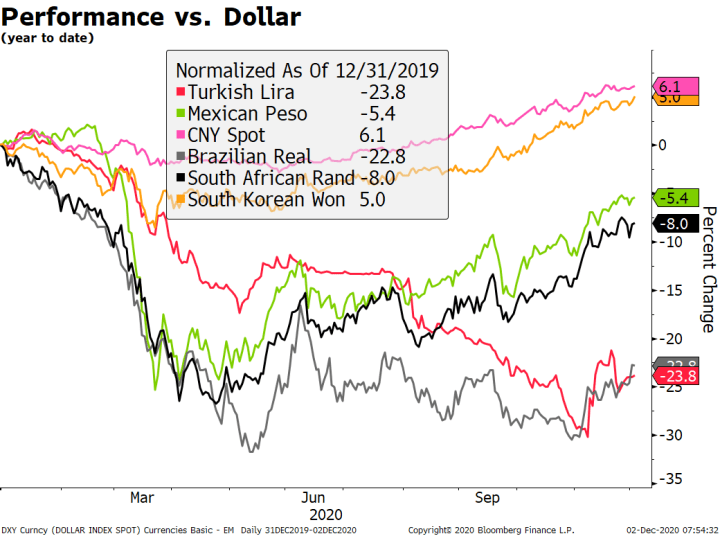

The outlook for risk assets remains uncertain; the dollar continues to make new lows; the uncertain outlook continues to propel gold and silver higher. The next round of stimulus in the US is proving to be difficult; regional Fed manufacturing surveys for July will continue to roll out. German July IFO survey came in better than expected; eurozone June M3 rose 9.2% y/y vs. 8.9% in May.

Read More »

Read More »

Market Sentiment Boosted by Stimulus Outlook

Today, it’s all about the stimulus; the dollar remains under pressure. Mnuchin and Pelosi kick off the first round of talks for the next stimulus package this afternoon; it’s another quiet day in terms of US data; Canada reports May retail sales

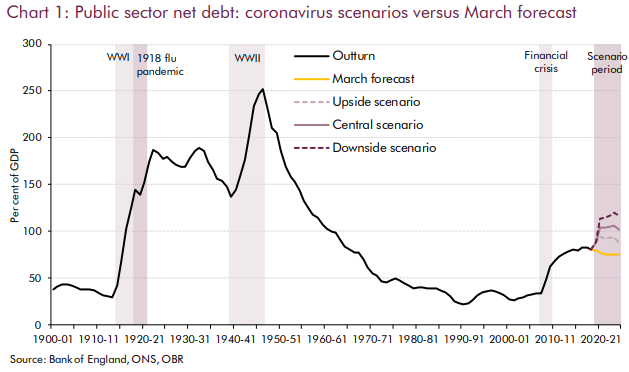

EU finalized its recovery package; UK reported June public sector net borrowing; Hungary is expected to cut rates 15 bp to 0.60%.

Read More »

Read More »

Market Sentiment Dented by Weak Data and Rising US-China Tensions

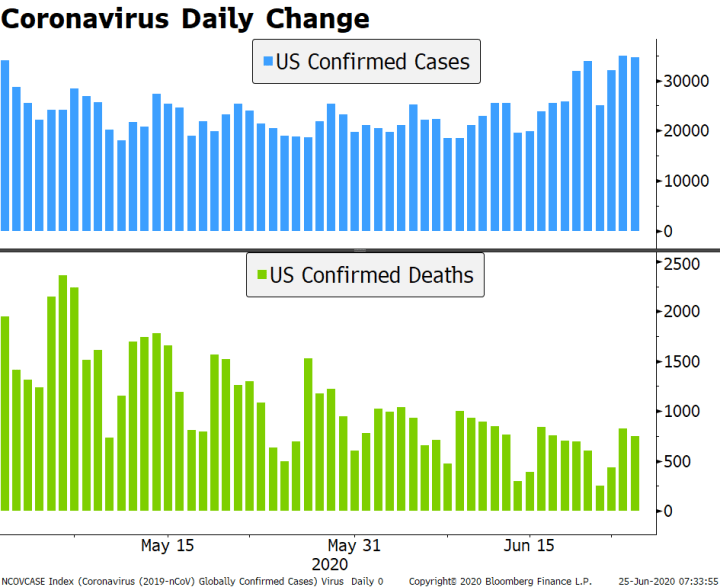

Market sentiment has been dented by more than just rising virus numbers; yet the dollar continues to trade within recent well-worn ranges. California’s decision to reverse partial reopening will likely have a huge economic impact; June CPI may hold a bit more interest in usual; June budget statement is worth a quick mention.

Read More »

Read More »

Dollar Rangebound in Quiet Start to an Eventful Week

Today marks a relatively quiet start to what is likely to be one of the most eventful weeks we’ve seen in a while; the dollar remains within recent well-worn ranges. The US continues to ratchet up trade tensions; the only US data report today is the June budget statement.

Read More »

Read More »

Dollar Bid as Market Sentiment Yet to Recover

The US has started the formal process of withdrawing from the WHO; the dollar continues to benefit from risk-off sentiment but remains stuck in recent ranges. The White House is asking Congress to pass another $1 trln stimulus plan by early August; President Trump hosts Mexican President AMLO for a two-day visit.

Read More »

Read More »

Dollar Soft Ahead of Jobs Report

Re-shutdowns continue to spread across the US; the dollar has come under pressure again. Jobs data is the highlight ahead of the long holiday weekend in the US; weekly jobless claims will be reported. FOMC minutes were revelatory; the Fed for now will rely on “outcome-based” forward guidance and asset purchases to achieve its goals; US House passed the latest China sanctions bill.

Read More »

Read More »

Dollar Begins the Week Under Pressure Again

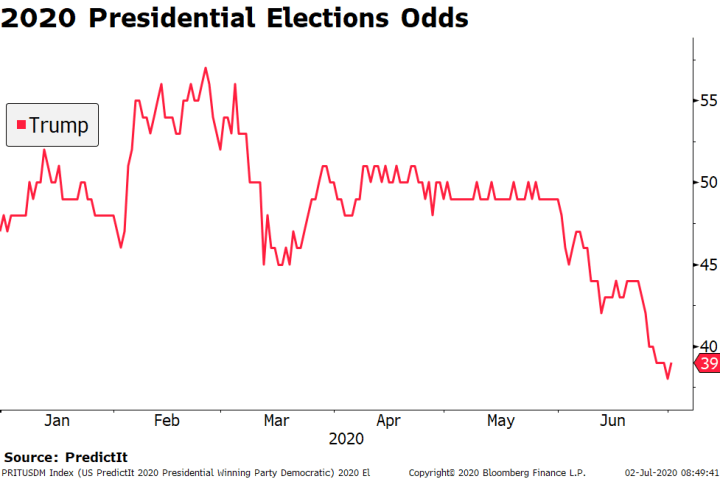

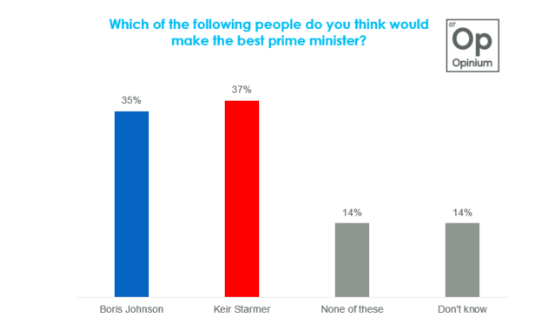

The virus news stream remains negative; pressure on the dollar has resumed. The US economy is taking a step back just as Q3 is about to get under way; there are some minor US data reports today. UK Labour leader Starmer overtook Prime Minister Johnson in the latest opinion poll; Macron’s party did poorly in French local elections.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Persists

Higher infection numbers in the US and other countries continue to fuel risk aversion across global markets; the IMF released more pessimistic global growth forecasts yesterday. The US has rekindled trade provocations against China through Huawei; weekly jobless claims will be reported; regional Fed manufacturing surveys for June will continue to roll out.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Returns

Risk-off sentiment has picked up from reports that the US will impose new tariffs against the EU; there’s also been a messy set of headlines regarding the virus contagion outlook in the US. The IMF will release updated global growth forecasts today; the dollar is benefiting from risk-off sentiment; another round of fiscal stimulus in the US is in the works.

Read More »

Read More »

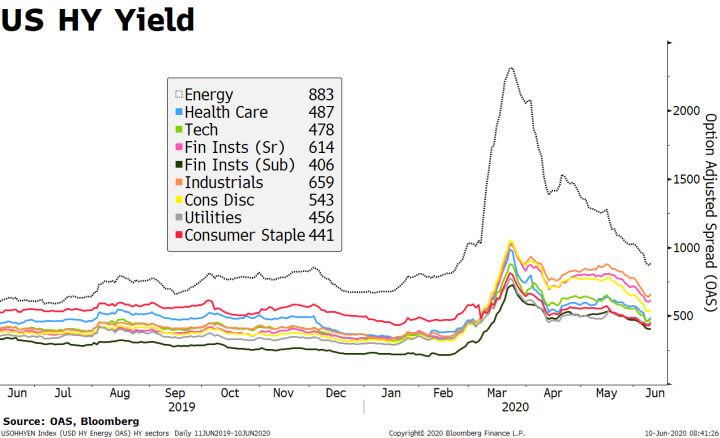

Dollar Suffers as Stimulus Efforts Boost Market Sentiment

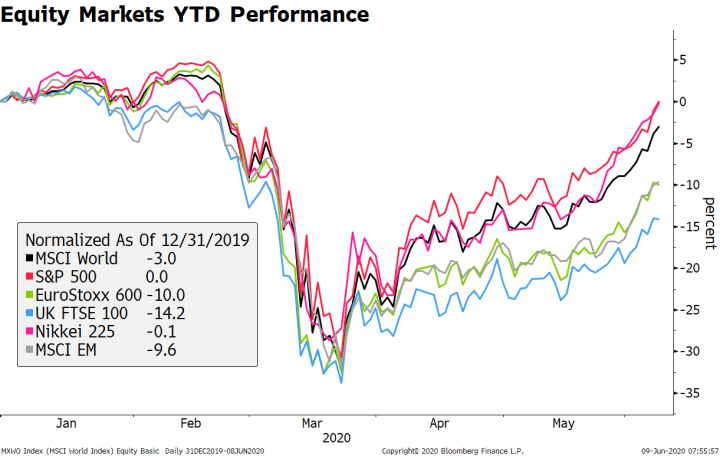

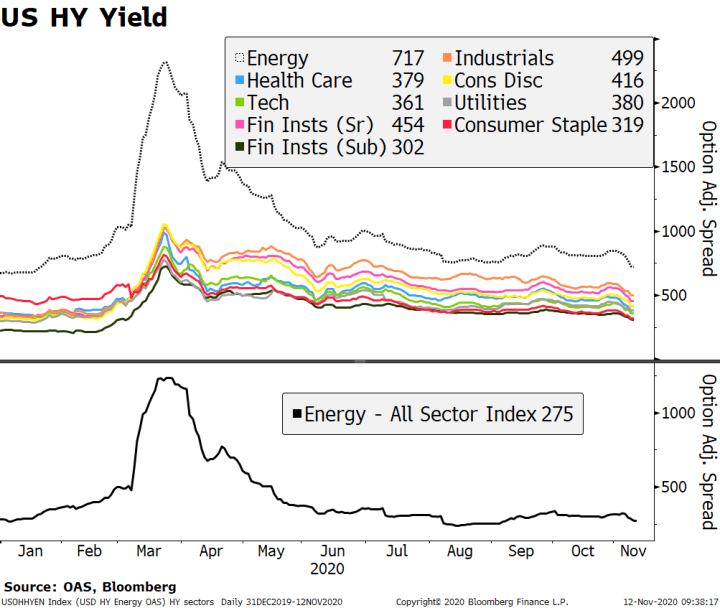

Market sentiment reverse sharply to the positive side due to several factors; as a result, the dollar has suffered. The Fed beefed up its support for the corporate bond market; all eyes are on Fed Chair Powell as he delivers his semi-annual report to the Senate today. The Trump administration is reportedly preparing a large infrastructure bill; May retail sales will be the data highlight.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Intensifies After FOMC Decision

Concerns about still rising infection numbers and a second wave ofCovid-19 have contributed to today’s downdraft in risk assets; for now, the weak dollar trend is hard to fight. Despite delivering no change in policy, the Fed nonetheless sent an unequivocally dovish signal; stocks have not reacted well to the Fed; weekly jobless claims and May PPI will be reported.

Read More »

Read More »

Dollar Firm as Risk-Off Sentiment Takes Hold

Today’s risk off price action appears to have been triggered by profit-taking; the dollar has gotten some traction. The Fed expanded its Main Street Loan Program to include more businesses; the jobs rebound has removed a sense of urgency regarding the next round of fiscal stimulus.

Read More »

Read More »

Dollar Broadly Weaker Ahead of FOMC Decision

The FOMC decision comes out this afternoon and we expect a dovish hold; this would of course be negative for the dollar. Ahead of the decision, May CPI will be reported; the budget statement will be of interest; Brazil reports May IPCA inflation. We are still getting mixed messages about Europe’s flagship €750 bln recovery package; French April IP fell -20.1% m/m.

Read More »

Read More »

Dollar Stabilizes as the New Week Begins

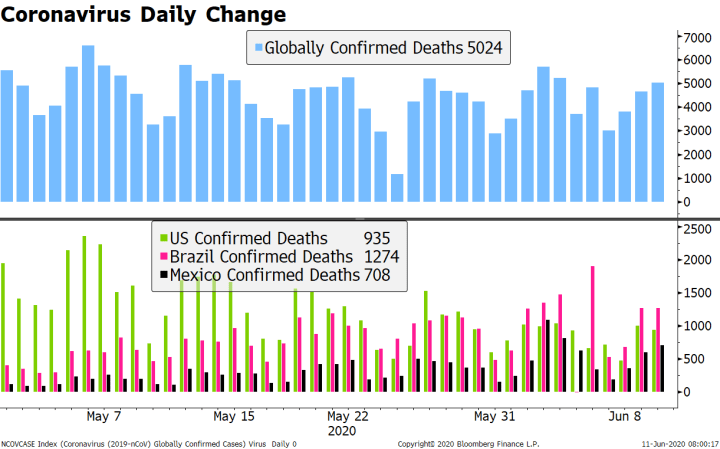

The dollar has stabilized a bit; Friday’s US jobs data could be a game changer. The US bond market selloff continues; for now, the weak dollar trend is hard to fight. The Brazilian government has found a way to make a bad situation worse by trying to control its Covid-19 statistics.

Read More »

Read More »