Tag Archive: Daily News

Dollar and Equities Sink as Trade Pessimism Rises

Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions. FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue. South Africa is expected to cut rates by 25 bp to 6.25%. Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected.

Read More »

Read More »

Dollar Stabilizes as Markets Await Fresh Drivers

Press reports suggest that the mood in Beijing is pessimistic after President Trump pushed back against tariff rollbacks. Fed Chair Powell met with President Trump and Treasury Secretary Mnuchin yesterday. Hungary is expected to keep rates steady; the deadline to form a government in Israel is fast approaching. RBA released dovish minutes from its November policy meeting.

Read More »

Read More »

Dollar Rally Stalls as Fresh Drivers Awaited

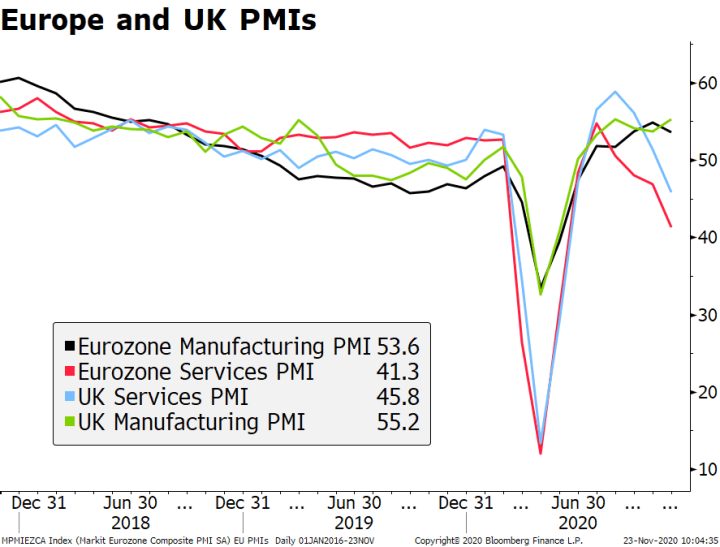

US-China relations continue to improve with news of cooperation in a major fentanyl case. Eurozone final services and composite PMIs surprised on the upside; UK Parliament will be dissolved today. Poland is expected to keep rates steady at 1.5%; Russia October CPI is expected to rise 3.8% y/y. China sold €4 bn in its first euro-denominated bond since 2004; Thailand cut rates 25 bp to 1.25%, as expected.

Read More »

Read More »

Dollar Firm as Two-Day FOMC Meeting Begins

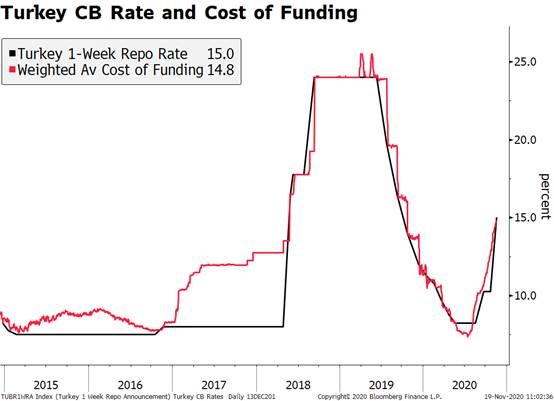

The dollar continues to gain traction as the two-day FOMC begins; US political uncertainty has entered a new phase. Yesterday marked the third time that UK Prime Minister Johnson lost a vote for elections; he will try again today. Weak South Africa data support our call for imminent easing; the threat of sanctions against Turkey are back on the table.

Read More »

Read More »

Dollar Broadly Weaker as Brexit Deal Takes Shape

The dollar remains under pressure due to weak US retail sales and rising optimism on Brexit and the trade war. Brexit negotiations remain tense and we should expect a higher than usual noise-to-signal ratio at this stage. China said its goal is to stop the trade war and remove all tariffs. US has a full data schedule; we remain constructive on the US economic outlook.

Read More »

Read More »

Dollar Resilient as Cracks in Risk-On Appear

Some cracks have appeared in the market’s risk-on sentiment. We continue to believe that recent developments take some pressure off the Fed to cut rates again this month. Our base case for a Brexit delay has been strengthened; UK reported weak labor market data. The situation is Turkey continues to develop negatively for asset prices; trade data out of China once again showed the impact of the trade war and the resulting global slowdown.

Read More »

Read More »

Dollar Remains Soft as Risk-On Sentiment Continues

Markets have seized on the possibility of a partial trade deal as well as some hopes that a hard Brexit will be avoided. The main event for the day will be President Trump’s meeting with Vice Premier Liu He. These market movements (if sustained) will take pressure off of the Fed to cut rates this month. The notion of a “pathway” to a Brexit deal continues to capture investors’ imagination.

Read More »

Read More »

Dollar Soft Despite Heightened Geopolitical Risks

The dollar staged a stunning comeback yesterday as risk-off took hold on rising geopolitical risk; those risks remain high. US-China tensions have risen ahead of trade talks that begin Thursday. The US abruptly announced that it would withdraw its troops from northeast Syria. US reports September PPI; German IP came in better than expected.

Read More »

Read More »

Dollar Firm as US Economy Continues to Outperform

Political uncertainty is likely to persist in the US; the big unknown is whether this will impact the US economy. US core PCE reading will be of particular interest and is expected to rise 1.8% y/y; Quarles (voter) and Harker (non-voter) speak. Dovish BOE comments are weighing on sterling; France reported weak CPI and consumer spending data.

Read More »

Read More »

Dollar Firm Despite Rising US Political Uncertainty

The dollar continues to benefit despite US political uncertainty

President Trump claimed to be getting “closer and closer” to a trade deal with China; we are very skeptical. There is a lot of US data to be reported and a heavy slate of Fed speakers today.

Read More »

Read More »

Dollar Firm as Risk-Off Impulses Return

Markets have moved into risk-off mode from a confluence of events emanating from the US. Speaker of the House Pelosi formally launched a formal impeachment inquiry; DOJ inserted itself into Trump’s fight with New York state. Trump’s speech to the UN General Assembly yesterday was noteworthy for its belligerence.

Read More »

Read More »

Dollar Mixed on Central Bank Thursday

As expected, the Fed cut rates by 25 bp; the dollar firmed after the decision but has since given back some gains. During the North American session, there will be a fair amount of US data. BOE is expected to keep rates steady; UK reported August retail sales. SNB and BOJ kept rates steady, as expected; Norges Bank unexpectedly hiked 25 bp.

Read More »

Read More »

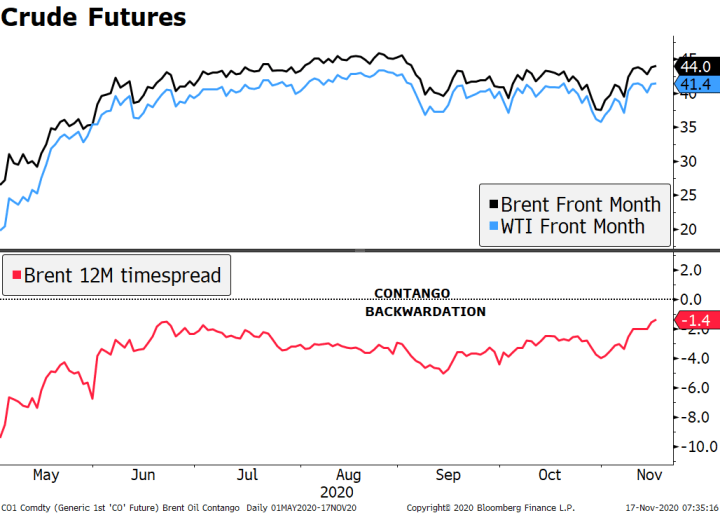

Dollar Mixed, Oil Spikes as Markets Digest Saudi Attack

The weekend bombing of Saudi oil facilities continue to reverberate across global markets. The currencies of the oil producing nations are likely to outperform near-term. US rates continue to adjust ahead of the FOMC. UK Prime Minister Johnson is in Luxembourg today to meet with EC President Juncker. China reported weak August IP and retail sales.

Read More »

Read More »

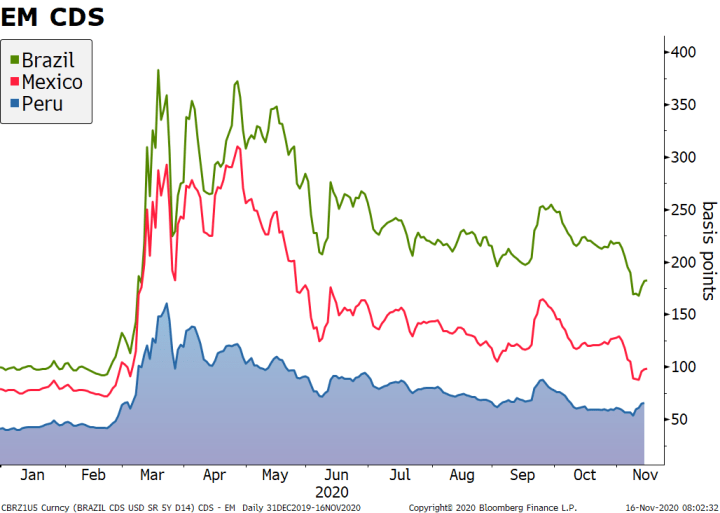

Dollar Soft as Risk Sentiment Stoked Ahead of US Retail Sales

US-China relations appear to be thawing. Trading was volatile after the ECB decision; we are still dollar bulls. EM has benefitted from the shift in the global backdrop this week. The US data highlight is August retail sales. Vietnam cut rates 25 bp to 6.0%; Turkey reported July current account and IP.

Read More »

Read More »

Dollar Firm as Markets Calm

Market sentiment has improved after President Trump said China has asked to restart trade talks. PBOC fixed the yuan basically flat and firmer than what models suggested. The G-7 summit wraps up today with little to show for it. We believe the Chicago Fed National Activity Index remains the best indicator to gauge US recession risks. Germany July IFO business climate came in weaker than expected

Read More »

Read More »

Dollar Firm Ahead of Jackson Hole

FOMC minutes were not as dovish as many had hoped; bond and equity markets are set up for a big reset. Today sees the start of the annual Fed symposium in Jackson Hole; the US reports a slew of data. Markit flash eurozone August PMI readings were reported; ECB publishes the account of its July 25 meeting.

Read More »

Read More »