- The FOMC decision today is likely to deliver a very dovish tone; the dollar tends to weaken on FOMC decision days

- Tensions about the latest US stimulus bill are rising; core bond yields have been remarkably stable over the last several months

- UK unemployment will spike this fall if the government does not extend its wage program; Turkish central bank released its quarterly inflation report

- Fitch moved the outlook on Japan’s A rating from stable to negative; Australia reported Q2 CPI; Hong Kong Q2 GDP came in weak

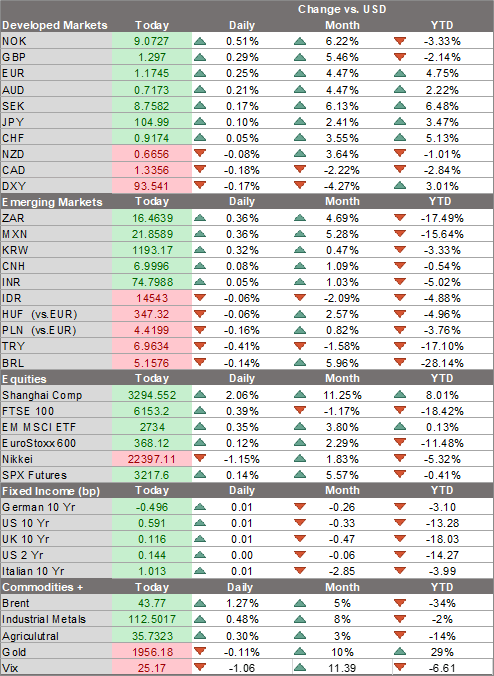

The dollar continues to make new lows. It tends to weaken on FOMC decision days (see below). DXY is trading at new lows for this move near 93.40 at lows not seen in two years.

The next targets are the June 2018 low near 93.193 and then the May 2018 low near 92.243. The euro is having trouble breaking above $1.18 but should eventually break above the September 2018 high near $1.1815. Sterling is mounting a challenge of $1.30, while USD/JPY is trading below 105 for the first time since March 13 and is on track to test the March low near 101.20.

| AMERICAS

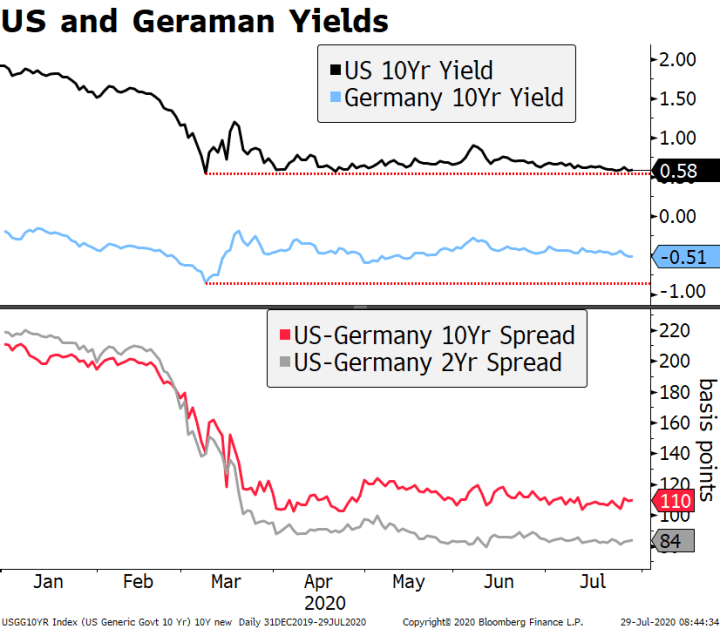

The FOMC decision today is likely to deliver a very dovish tone. New staff forecasts and Dot Plots won’t come until the September 16 meeting and so for now, it’s steady as she goes. However, the Fed will have to acknowledge the worsening outlook for the US since the June 10 meeting. With the virus outlook still evolving, it seems too early to add stimulus now. That said, we think Powell will shift his tone even more dovish. At the last meeting, he said that the Fed “isn’t even thinking about thinking about hiking rates.” He may now say that the Fed is “thinking about thinking about adding more stimulus.” The dollar tends to weaken on FOMC decision days. Indeed, DXY has fallen eight straight times dating back to October 2019 and is following suit today ahead of the decision. Looking at other asset market behavior on FOMC days, the S&P 500 tends to weaken, as does its banking sub-index. US Treasury yields tend to fall. Tensions about the latest US stimulus bill are rising. Markets had assumed that the risk to the deal was mostly to the upside with the Republican’s $1 trln proposal taken as the floor. But discussions seem to be heating up and bogging down and so the range of possible outcomes looks wider now. While we are still confident a deal will eventually materialize, this creates a new downside risk where there was none before, which includes the possibility of a delay of its approval. Core bond yields have been remarkably stable over the last several months. This despite considerably volatility in FX and equity markets and so much uncertainty about the economic outlook and policy trends. The 10-year nominal Treasury yield has been stuck around 0.60% since March (even though breakeven inflation rates have been moving higher, as we have previously noted). In Germany, yields bounced back from their lows of around -0.80% to stabilize around -0.50%. This means the yield differential between the two counties have narrowed, both in the 10- and 2-year tenors. This must be, at least in part, a testament to the effective forward guidance by the Fed and ECB. Even if the details of programs change, the broad trend and reliable bid seems to be unquestionable. One could even be forgiven for imagining that yield curve control had been implemented but they forgot to announce it. There are some US data reports to keep markets busy ahead of the FOMC decision. June advance goods trade (-$75.1 bln expected), wholesale and retail inventories, and pending home sales (14.5% m/m expected) will all be reported today. |

US and Germany Yields |

| EUROPE/MIDDLE EAST/AFRICA

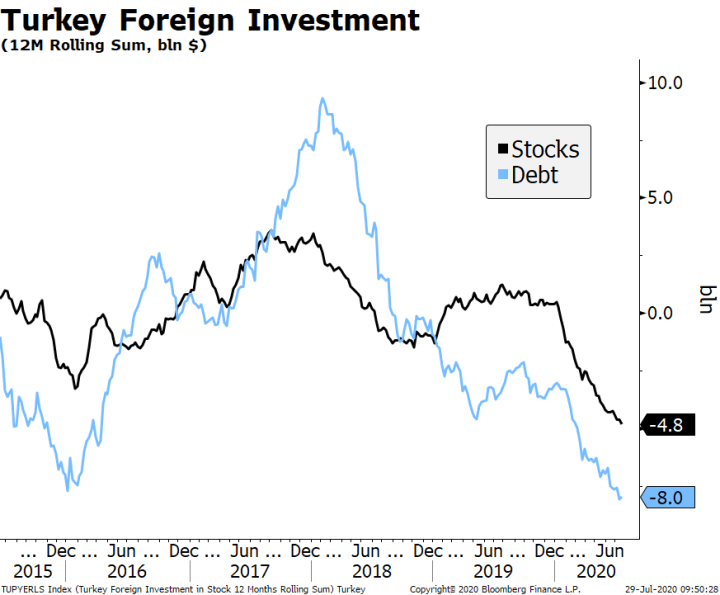

UK unemployment will spike this fall if the government does not extend its wage program. The National Institute of Economic and Social Research warned that unemployment will rise above 3 mln by year-end if the furlough program expires in October. The think tank estimated that keeping the plan running through mid-2021 would cost about GBP10 bln but would prevent unemployment from hitting 10%. Chief Secretary to the Treasury Steve Barclay, Chancellor Sunak’s deputy, reiterated that the plan will end as scheduled, saying Sunak had been “clear” on the matter. The Turkish central bank released its quarterly inflation report. Of note, it raised its forecast for this year to 8.9% from 7.4% previously and for next year to 6.2% from 5.4% previously. This still looks optimistic to us given the June print of 12.62% y/y, higher oil prices, and a weaker currency. Governor Uysal stated that the policy rate of 8.25% “is in line with the inflation outlook,” even though the central bank’s target is 5.0%. The bank has remained on hold for two straight meetings and may do so again at the next one August 20. It’s hard not to be negative on Turkey given the central bank’s credibility problem, a complicated geopolitical situation, and a weak fundamental starting point. State banks reportedly spent $2.5 bln defending the lira this week, even though it weakened some 1.5% against the dollar. Indeed, the latest flow figures continue to show foreign investors pulling out of Turkish assets. |

Turkey Foreign Investment, 2015-2020 |

| ASIA Fitch moved the outlook on Japan’s A rating from stable to negative. The agency cited the worsening economic outlook as the main factor, noting “a renewed surge in cases is creating the possibility of further containment measures and risks to the economic outlook.” It added that the pandemic will “exacerbate the challenge of placing the debt ratio on a downward path over the medium term. This challenge is all the greater given Japan’s mixed record with debt consolidation over the past decade.” We disagree with the move, as our “DM Sovereign Rating Model For Q3 2020” shows Japan’s implied rating at A+/A1/A+. That is where S&P and Moody’s actual ratings are, while Fitch’s A is already too low. Australia reported Q2 CPI. Headline fell -0.3% y/y vs. -0.5% expected +2.2% in Q1, while trimmed mean slowed to 1.2% y/y vs. 1.4% expected and 1.8% in Q1. While the RBA has acknowledged an improved outlook, it acknowledges downside risks ahead and has pledged to keep policy loose for the foreseeable future. The bank has also shown little concern about the firmer AUD, which is making new highs for this move today and appears to be on track to test the January 2019 high near .7300. Hong Kong Q2 GDP came in weak. GDP contracted -9.0% y/y vs. –8.3% expected and -8.9% in Q1 and was the fourth straight drop. However, there is some good news in that GDP contracted only -0.1% q/q vs. -5.3% in Q1 and was the smallest q/q drop in the current recession. June retail sales will be reported Thursday. While some modest improvement is likely, the rising virus numbers in Hong Kong have led to some limited roll-backs of the reopening efforts. If tighter restrictions are eventually seen, the recovery will likely remain very weak and uneven. |

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Daily News,Featured,newsletter