Oil prices have spiked after the weekend attack on Saudi oil facilities. Will it impact the Fed tomorrow? No. We compare the current (but still unfolding) situation to past oil shocks from the 1970s and discuss the policy responses taken.

RECENT DEVELOPMENTS

The weekend bombing of Saudi oil facilities continues to reverberate. The drone strike removed about 5% of global supplies from the market, leading Brent oil to spike to $72 per barrel Monday before falling back today to $65. Saudi Aramco reportedly lost about 5.7 mln bbl/day of output from the initial strike.

The timeline for restoring output has been all over the place. Initial reports suggested about half that loss would be restored by Monday, but subsequent reports suggested the recovery would be much slower than anticipated and could take months. Now, it is being reported today that output will be fully restored in 2-3 weeks. In the meantime, Saudi Arabia is starting up idled offshore oil fields and tapping into its oil stockpiles to maintain some supply to global markets.

Houthi rebels in Yemen claimed responsibility for the attacks and promised more. However, US intelligence released satellite photos that suggest the strikes came from the north and northwest. This would be consistent with attacks launched from Iran or Iraq, while Yemen lies to the south of Saudi Arabia. Both Iran and Iraq have denied any involvement, however.

President Trump authorized the release of oil from the Strategic Petroleum Reserve. That has helped calm markets a bit, and that is what the SPR is supposed to do in times of stress. Indeed, the SPR was created in 1975, after the first oil shock (see A Brief History Lesson below). The SPR can hold up to 727 mln barrels but currently contains about 645 mln barrels. However, the maximum withdrawal capacity is about 4 mln bbl/day, which meets only a portion of the daily US demand of around 20 mln bbl/day.

Meanwhile, the FOMC meets Wednesday. New Dot Plots and staff forecasts will be presented, though they are unlikely to deviate much from June. The US economy remains resilient and yet markets firmly believe the Fed will cut rates again by 25 bp. Markets are starting to waver a bit, however, with WIRP on Friday showing 3% odds of no cut. This is the first time the odds have been below 100% since early August.

The hawks and doves can find justification for their respective stances. The hawks will point out that price pressures are rising, the labor market is near full employment, and US equity markets are near record highs. The doves can point to growing headwinds from the US-China trade war and the risks from an inverted US yield curve, as well as falling inflation expectations and a core PCE deflator that’s still below the 2% target.

This current oil spike can be seen as a sort of Rorschach test. The Fed has been given a dual mandate to maintain full employment and price stability, and the policy response will be colored by one’s worldview. The hawks will see inflationary impulses. The doves will see a supply side shock that hurts economic growth.

The two major oil shocks of the 1970s provide two very different perspectives on the policy response (see A Brief History Lesson below). For now, we are confident that is this current shock is still too young to have any policy implications for the Fed tomorrow. It is something they will be watching, but not something that merits a policy response yet.

| A BRIEF HISTORY LESSON

On October 6, 1973, Egypt and Syria launched a coordinated attack on Israel during Yom Kippur, the holiest day of the Jewish religion. They hoped to win back land that they lost to Israel in the Six-Day War in 1967. Taking Israel by surprise, Egyptian forces quickly retook a large portion of the Sinai Peninsula, while Syrian forces had more trouble retaking the Golan Heights. Iraq joined in the fighting while Jordan aided Syria. The Israeli Defense Forces quickly mobilized and within days had turned back most of the invading forces. Starting on October 12, the US supplied Israel with emergency airlifts after the USSR sent arms to Syria and Egypt, which was followed by emergency military aid to the tune of $2.2 bln. This led OPEC to announce an oil embargo on October 19, 1973. The embargo targeted nations perceived as supporting Israel during the Yom Kippur War. The initial targeted nations were Canada, Japan, the Netherlands, the UK, and the US. The embargo was later extended to Portugal, Rhodesia, and South Africa. And so, the first oil shock began. The embargo was followed by gradual cuts in OPEC production which led to global oil output falling 25% by year-end from September levels. |

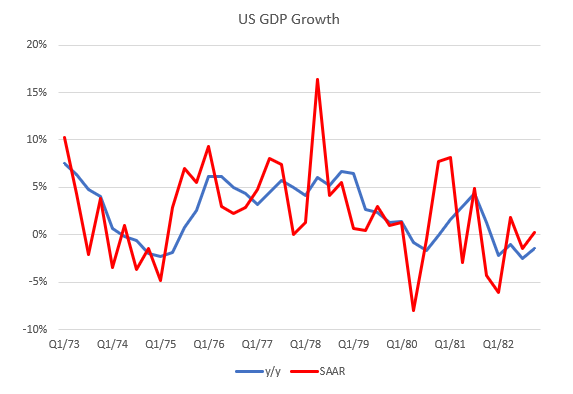

U.S. GDP Growth, Q1 1973-Q1 1982(see more posts on U.S. Gross Domestic Product, ) |

| Oil prices spiked nearly 400% from $3 per barrel to $12 per barrel. On October 25, an Israel-Egypt cease-fire was secured by the UN. This basically left Syria exposed and it wound up losing even more territory in the Golan Heights to Israel. The embargo ended in March 1974, but the damage had been done. The US fell into recession, with GDP contracting -0.3% in both 1974 and 1975.

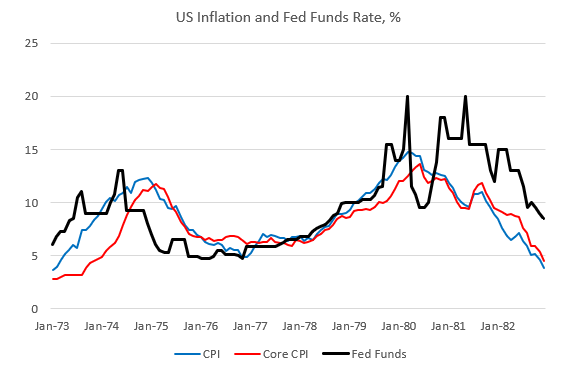

Meanwhile, CPI inflation spiked to 11% in 1974 and 9.1% in 1975. How did the Fed react? Then-Fed Chair Burns was skeptical that the Fed could do anything about so-called “cost-push” inflation. As such, Fed policy was much looser than what one might expect. |

US Inflation and Fed Funds Rate, 1973-1982 |

| The Iranian revolution began in October 1977 with a series of protests against the monarchy. The Shah ruled with an iron fist, repressing any political dissent with brutal methods refined by secret police force SAVAK. Yet civil disobedience and protests against the Shah intensified in 1978. As the demonstrations spread, the Shah cracked down further and declared martial law in September 1978.

In November, a strike by 37,000 workers at the nation’s oil refineries reduced output sharply from around 6 mln bbl/day to around 1.5 mln bbl/day. And so, the second oil shock began. Interestingly, global oil output only fell about 7% and yet the impact on oil prices was very strong. Oil prices spiked nearly 250% from $16 per barrel to nearly $40 per barrel. The Iranian revolution ended with the Shah fleeing the country for Egypt in January 1979. Ayatollah Khomeini returned from exile to lead the Islamic Republic of Iran. Oil production recovered only slowly and has never returned to pre-revolution levels. The US fell into recession, with GDP contracting -0.2% in 1980. Meanwhile, CPI inflation spiked to 11.3% in 1979, 13.5% in 1980, and 10.3% in 1981. How did the Fed react? Inflation was already high (7.6% in 1978) before the oil shock and yet the Fed under then-Chair William Miller was hesitant to tighten aggressively. It wasn’t until President Carter appointed Paul Volcker as Chair before the Fed got serious about tackling inflation. |

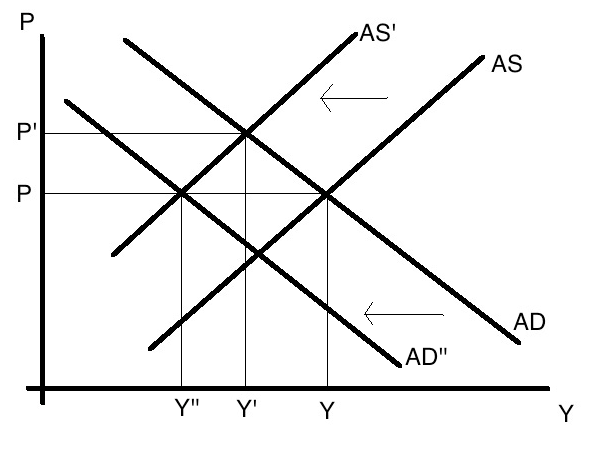

Theoretically speaking, an oil shock shifts the economy’s aggregate supply curve up and to the left. With no change to the aggregate demand curve, this results in a loss of output and a higher price level. A policy response from the Fed would impact the aggregate demand curve. Looser monetary policy would push the aggregate demand curve up and to the left, which would result in higher output but an even higher price level. Tighter policy would push the aggregate demand curve down and to the right, which would result in even lower output but a lower price level (shown above).

Bottom line: The Fed’s policy response to supply side shocks have varied. Fed Chairs Burns and Miller chose to put more emphasis on maintaining growth and kept policy loose, while Fed Chair Volcker put more emphasis on taming inflation and so kept policy tight. There is no right or wrong answer. Any response simply reflects the reaction function of policymakers at that time.

ECONOMIC OUTLOOK

The two oil shocks led to US recessions. However, those were caused by oil price spikes of 400% and 250%, respectively. Oil has risen less than 10% this week and so cannot be viewed yet as a comparable risk to the US economic outlook. Of course, it comes at a time when the US economy is already facing headwinds from the trade war and so this bears watching.

The impact of the weekend attacks will depend in large part on how long production is crimped. If the flow of oil is restored quickly, then oil prices should move lower without inflicting long-lasting damage to the economy. However, given the risks of further attacks and/or retaliation, oil prices are unlikely to fall back to pre-attack levels. There is clearly a need for a much higher risk premium to be priced into oil markets.

We believe the Chicago Fed National Activity Index remains the single best indicator to gauge US recession risks. The 3-month average was -0.14 in July, the best since January and still well above the recessionary threshold of -0.7. The August reading will be reported September 23. Note that a value of zero shows an economy growing at trend. Positive values represent above trend growth, while negative values represent below trend growth.

The US economy remains in solid shape. The Atlanta Fed’s GDPNow model is tracking 1.8% SAAR growth in Q3, down from 1.9% previously. This is slightly below trend (~2%) as well as the revised 2.0% SAAR in Q2. However, we expect an upward revision after today’s stronger than expected August IP report. Elsewhere, the NY Fed’s Nowcast model is tracking 1.6% SAAR growth in Q3. Its forecast for Q4 growth remains at 1.1% SAAR. We suspect both will be revised higher at its weekly update Friday

The 3-month to 10-year curve has continued to steepen and was at a multi-month low of -6 bp last Friday, signaling lower recession risk. That has since reversed due to the Saudi attack and stands at -17 bp currently. The NY Fed has a recession model the estimates the probability of a US recession 12 months ahead based on the shape of the US yield curve. It’s updated monthly and the latest reading for August just spiked to 37.93% from 31.5% in July. This is the highest since March 2008. However, if the steepening trend resumes, then the odds should fall in September.

INVESTMENT OUTLOOK

There are several implications to the attack. The first is that political risks in the region remain high and likely to feed into risk-off impulses. Yemen’s Houthi rebels claimed responsibility for the attack and promised more. Many fingers have been pointed at Iran, with Trump saying the US is “locked and loaded.” These developments suggest that oil prices may stay higher longer, unlikely to return to pre-attack levels.

The second is that if it is sustained, the rise in oil prices should keep upward pressure on interest rates and inflation. While central banks typically target some form of core inflation, bond markets typically focus on headline rates. If headline US inflation rises as a result of the oil spike, we believe US bond yields should move higher too.

The currencies of the oil producing nations are likely to outperform near-term. It’s worth noting that in the majors, CAD and NOK have the highest correlations with Brent oil. In EM, COP and RUB have the highest. Other than those examples, we believe the risk-off impulses will continue to favor USD, JPY, and CHF at the expense of growth-sensitive currencies such as the Antipodeans and EM.

Will these developments impact the Fed this week? In a word, no. The impact of the attacks is unknown still and so the Fed would be foolish to react to it. Given the Fed’s concern about low inflation, however, we suspect it would tend to err on the side of looseness in terms of a policy response to an extended oil shock, not tightness. Stay tuned.

We remain dollar bulls. If the Fed does hike this week, we think it would be the last in this mid-cycle correction. Markets are pricing in less than two hikes this year and one to two hikes next year. Whilst down from two to three hikes priced in for both at the start of September, we think the market is still overestimating the Fed’s capacity to ease.

Indeed, as we have yet to get confirmation that the US is facing imminent recession risk, we are sticking with our broad macro calls. These include a stronger dollar, higher equities, and a bearish steepening of bond yields. These calls were coming to fruition back in July but the renewed tariff threats led to a huge reset across all markets in August. As the US data have come in firmer than expected, markets have reset the other way so far in September.

Our calls hinge critically on our view that neither the trade war nor the oil spike will trigger a US recession. These calls will be tested time and again and we expect heightened volatility across all markets to continue in the coming months.

The dollar remains resilient. The Saudi attack will likely have two channels of impact on the dollar, both good. Safe haven flows from heightened political risk in the Middle East would tend to boost the dollar. Also, rising inflation risks should boost US rates, which would also be dollar-supportive.

We also continue to stress that as uncertain as the US outlook is, things elsewhere look even worse. The ECB just eased and is likely to ease further. The BOJ is likely to ease by year-end. So too are RBA and RBNZ as well as many EM central banks.

Taking all this into consideration, we believe DXY is still on track to test the recent highs near 99.099 and 99.370. Looking further out, the May 2017 high near 99.888 and the April 2017 high near 101.34 are the next major chart points.

The data remain key. If the outlook changes and the economy slows significantly or goes into recession, then the Fed will have no choice but to adjust its expected rate path significantly lower and we would have to revisit our bullish dollar call. For now, we think the rates markets are getting too negative once again.

EM will see mixed impact but overall are likely to remain under severe pressure. The ongoing trade tensions and now broad-based risk off sentiment should conspire to once again weaken EM. Yes, the oil exporters will benefit. However, the largest EM economies (China, India, Korea, Indonesia, Turkey, and Taiwan) are virtually all oil importers. Many are already suffering from the US-China trade war and higher oil prices will be yet another headwind.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,developed markets,Emerging Markets,newsletter,U.S. Gross Domestic Product