Before the Great “Recession” ended the business cycle as we once knew it, there was a widely accepted concept known as stall speed. In the US, if GDP growth decelerated down to around 2% it suggested the system had reached a danger zone of sorts. In a such a weakened state, one good push, or shock, could send the economy plunging into recession.

| Any economy which might slow down into a weakened state for whatever reasons becomes susceptible. What might be a minor, trivial inconvenience at 4% and 5% growth can be the straw which breaks the camel’s back at 2%. A burden too much to overcome even though it may not seem like much of a burden all its own.

You might call it a pre-recessionary state. There’s non-linearity to consider, too. The scale of the shock which creates the recession out of 2% growth might only need to be some multiple less at 1%. Since growth has averaged only 2% or so the last decade, obviously stall speed, if there is one, can’t be today what it used to be. Growth isn’t what it used to be for that matter. Still, there’s likely to be a danger zone somewhere even if we have a hard time figuring just where it might be. When we survey recent US economic data, unlike Europe it doesn’t shout out “recession.” In one sense, recession is a hyped-up downturn; more than merely decelerating or even contracting, passing through a business cycle peak means added urgency particularly on the business side. |

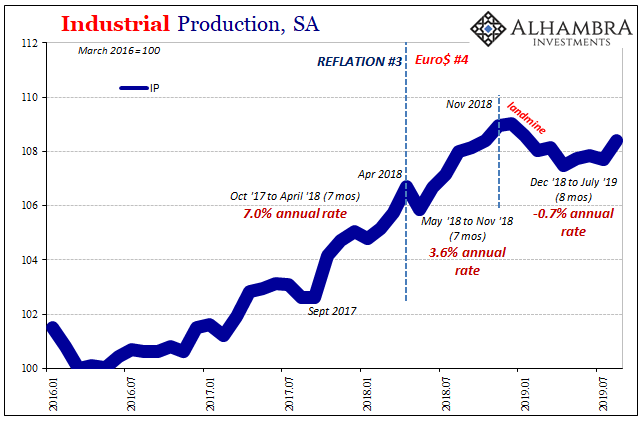

Industrial Production, SA 2016-2019 |

| Not merely content to make minor adjustments, the shock convinces too many firms to begin making major ones; really cutting back on investment and conducting mass layoffs. From there, in that pre-recession condition, the urgency spreads, it becomes self-reinforcing (layoffs lead to less spending and therefore more layoffs), and before you know it things get really bad.

Taking US Industrial Production, for example, again it doesn’t scream “recession.” It isn’t in any way good, either. What it says is that in all probability the US economy is no longer on even a small growth path. It does indicate a downturn, a sort of limbo perhaps lingering between growth and recession. |

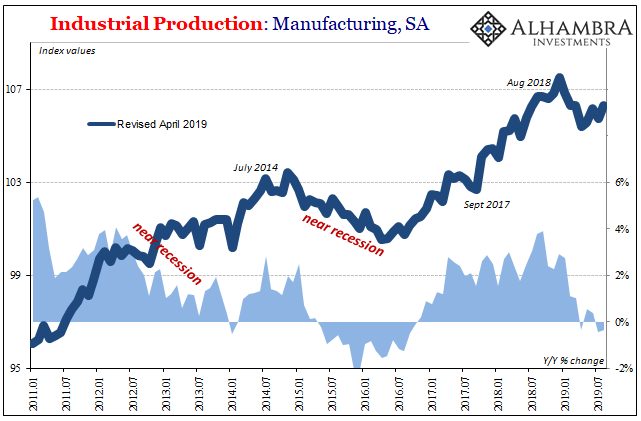

Industrial Production: Manufacturing, SA 2011-2019 |

| That does seem to qualify as this pre-recessionary condition. Circumstances may be ripe for that negative urgency to develop. And in this state, it might not take as much to push the economy over the edge.

That’s what our focus is on in these economic accounts as well as bond markets and the global dollar shortage; what might be one shock too many or too much? The downside risks are clear, but until something happens in that way they remain only risks. And they can pile up. While Industrial Production remains only slightly negative, that combined with other accounts do suggest serious vulnerabilities. |

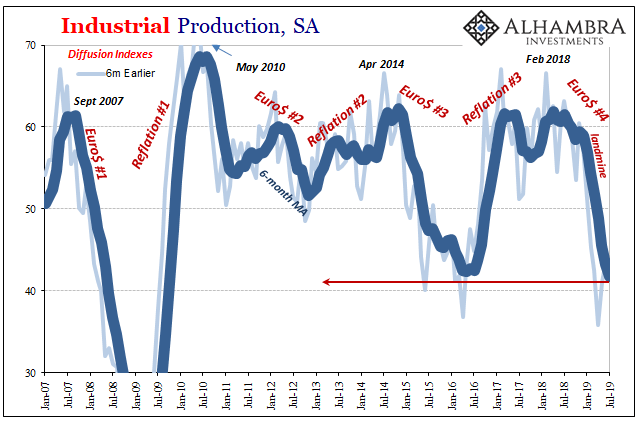

Industrial Production, SA 2007-2019 |

| The employment estimates, for example, along with some of the forward-looking sentiment indicators show substantial pessimism is building up – some of which has already been acted upon (lowest employment growth since QE2).

Whether it is certain PMI’s or labor market data, the IP estimates also supply some of those, too. The diffusion indices in this series are a bit different than they are in others like the ISM Manufacturing PMI. The latter measures changes in perceptions about order growth; the former, the Fed’s IP diffusion calculations, tell us about the broadness of whichever trend. In its current case, 2019, the diffusion numbers are saying that the weakness showing up in IP at only a mild negative pace thus far is however unusually widespread; more widespread than at any point since 2009. In other words, not a big contraction yet, one that is to this point shallow but at the same time very widely shared. Maybe that’s the best definition of the pre-recession condition. A whole lot of US industrial firms are reporting substantial if not overwhelming weakness. And, thus far, they’ve been pretty patient about it. |

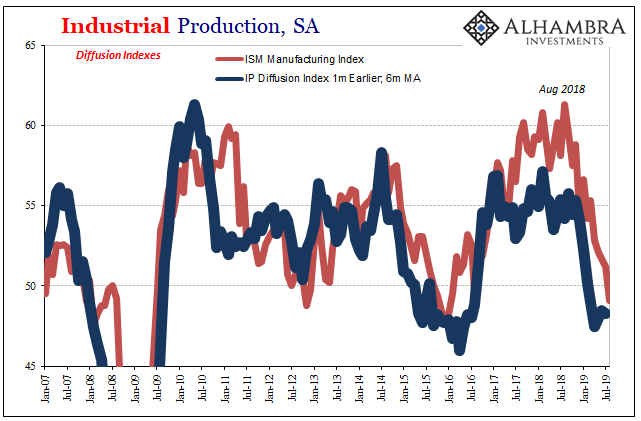

Industrial Production, SA 2007-2019 |

What is it that could get them to change, to become a lot less patient transforming into overly aggressive? And it works both ways; not just perhaps towards a full-scale recession, maybe instead toward growth and recovery. To ditch the caution and embrace their animal spirits (obviously, it won’t be QE).

With everything going wrong, however, the chances are balancing out wrong. They are much more to the downside than any upside, a fact being put to the test more and more as 2019 drags on and unleashes 2008-type craziness at least in isolated instances. The funding environment, the global slowdown, the lack of answers from Economists and central bankers, there’s a lot (more) to be concerned about a not a lot pointing in the right direction.

Already in a pre-recessionary state, what might be the last straw? That’s where we are right now. Not at recession, attempting still to understand and more so appreciate its risks.

Full story here Are you the author? Previous post See more for Next post

Tags: Business Cycle,currencies,economy,Federal Reserve/Monetary Policy,industrial production,manufacturing,Markets,newsletter,recession