Tag Archive: manufacturing

Weekly Market Pulse: A Most Unusual Economy

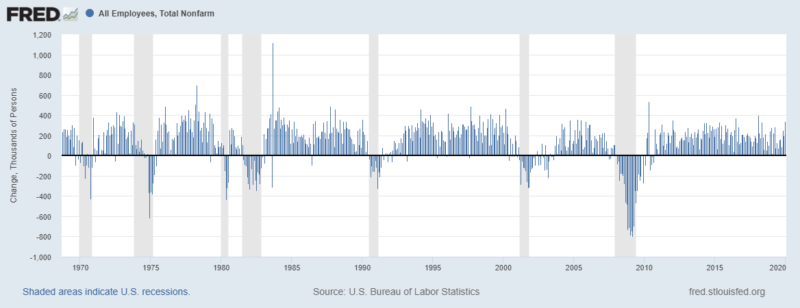

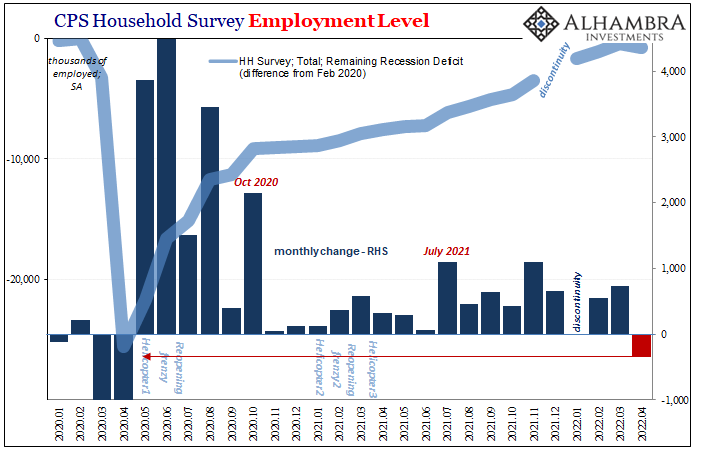

The employment report released last Friday was better than expected but the response by bulls and bears alike was exactly as expected. Both found things in the report to support their preconceived notions about the state of the economy.

Read More »

Read More »

Demand Down, Supply Down, Ugly Up

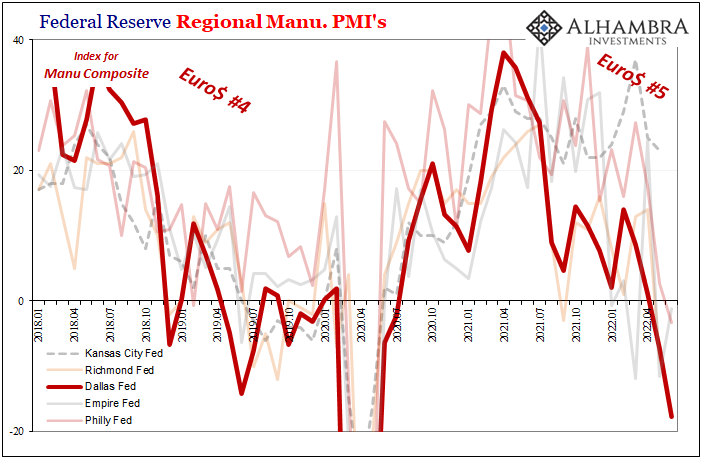

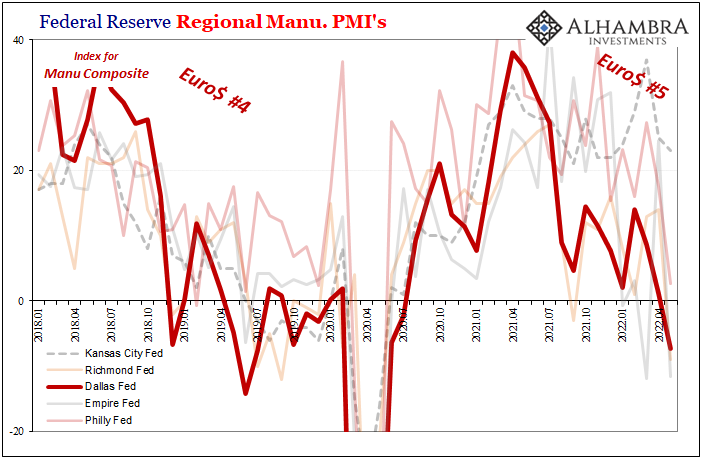

Well, that was a mess. The Richmond Fed’s Manufacturing Survey was at first released before being taken back. Initially reported as a plunge in the headline number, it was quickly scrapped once the statisticians remembered they had just discontinued their average workweek component – but had kept a zero in its place when tallying the overall PMI.

Read More »

Read More »

It’s Inventory PLUS Demand

It’s not just the flood of never-ending inventory. That’s a huge and growing problem, sure, as the chickens of last year’s short-termism overordering finally come home to their retailer roost. Being stuck with too many goods isn’t necessarily fatal to the global and domestic manufacturing sectors.

Read More »

Read More »

ADP Front-Runs BLS and President Phillips

It’s gotten to the point that pretty much everyone is now aware of the risks. Public surveys, market behavior, on and on, hardly anyone outside politics thinks the economy is in a good place. Gasoline, sentiment, whatever, Euro$ #5 in total is much more than what’s shaping up inside the American boundary. Globally synchronized of which the US is proving to be a close part.

Read More »

Read More »

President Phillips Emerges To Reassure On Growing Slowdown

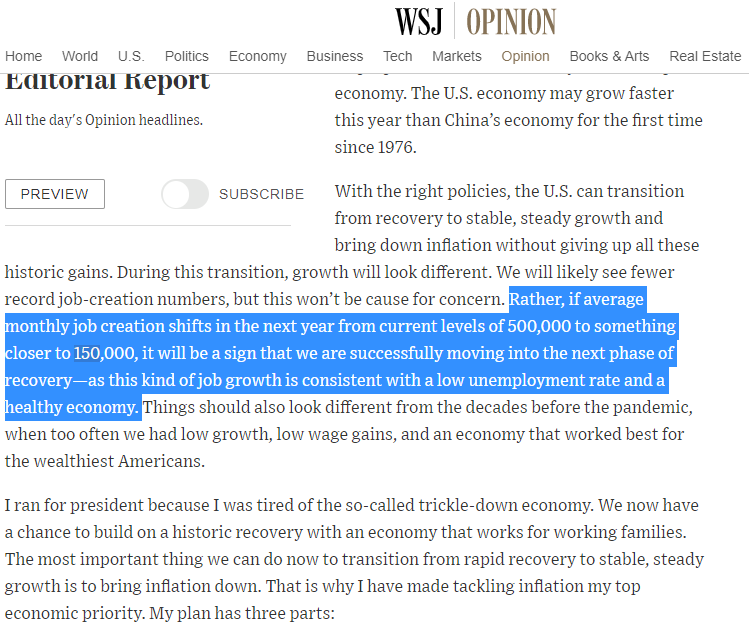

Just the other day, President Biden took to the pages of the Wall Street Journal to reassure Americans the government is doing something about the greatest economic challenge they face. Biden says this is inflation when that’s neither the actual affliction nor our greatest threat.

Read More »

Read More »

Another Month Closer To Global Recession

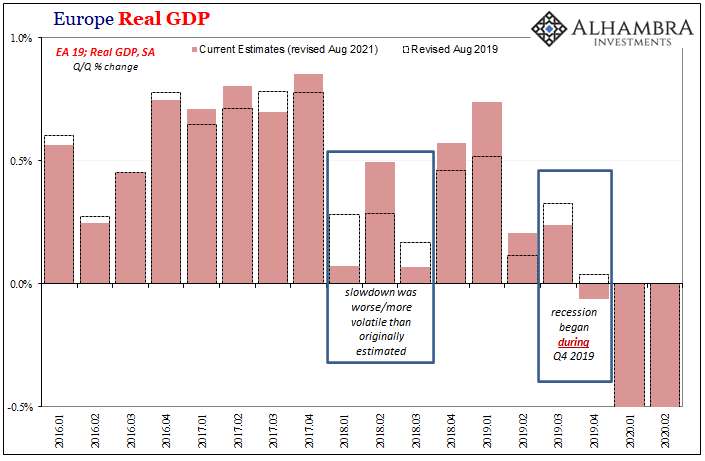

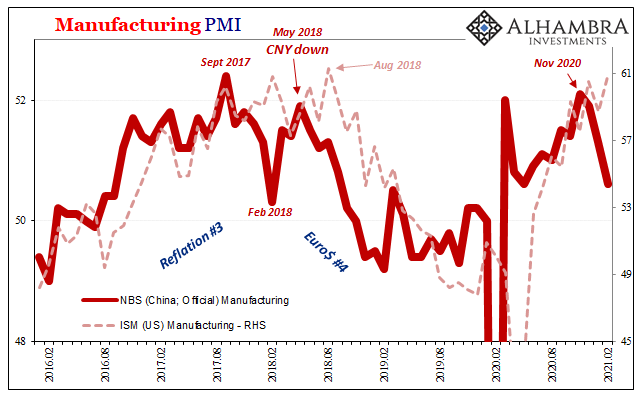

We always have to keep in mind that the major economic accounts perform poorly during inflections. Europe in early 2018, for example, was supposed to have been just booming only to have run right into the brick wall that was Euro$ #4.

Read More »

Read More »

Worry Walls Don’t Explain Repeated Falls

Someone once said that the stock market is always climbing a wall of worry. Maybe that had been true in some long-ago day, but whether or not it might nowadays is beside the point. The nugget of truth which makes the prosaism memorable is the wall rather than the climber. There’s always something going on somewhere to get worked up over.

Read More »

Read More »

Far Longer And Deeper Than Just The Past Few Months

Hurricane Ida swept up the Gulf of Mexico and slammed into the Louisiana coastline on August 29. The storm would continue to wreak havoc even as it weakened the further inland it traversed. By September 1 and 2, the system was still causing damage and disruption into the Northeast of the United States.

Read More »

Read More »

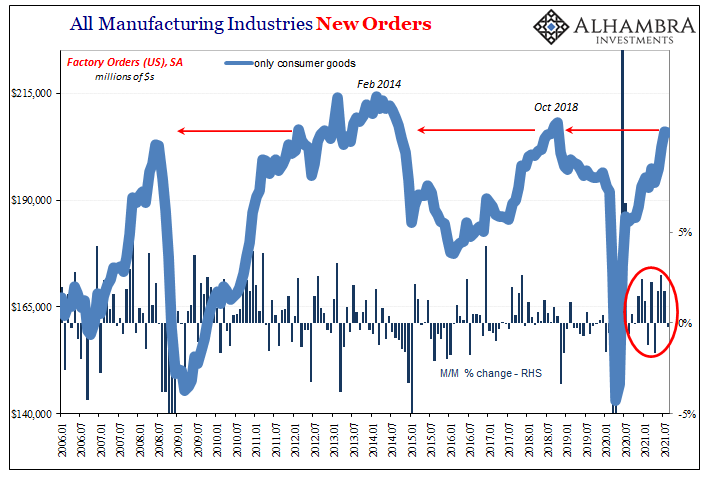

Surprise: It Isn’t Consumers Keeping American Factories Busy

US factories are humming along, constrained only by supply issues which might occasionally limit production. That’s the story, anyway. There’s too much business because of them, manufacturers taking in only more orders by the day leaving them struggling to catch up.But what kind of stuff is it that is being ordered from our nation’s factories?

Read More »

Read More »

More About Less New Orders

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”).

Read More »

Read More »

All Eyes On Inventory

You’ve heard of the virtuous circle in the economy. Risk taking leads to spending/investment/hiring, which then leads to more spending/investment/hiring. Recovery, in other words. In the old days of the 20th century, quite a lot of the circle was rounded out by the inventory cycle. Both recession and recovery would depend upon how much additional product floated up and down the supply chain.

Read More »

Read More »

ISM’s Nasty Little Surprise Isn’t Actually A Surprise

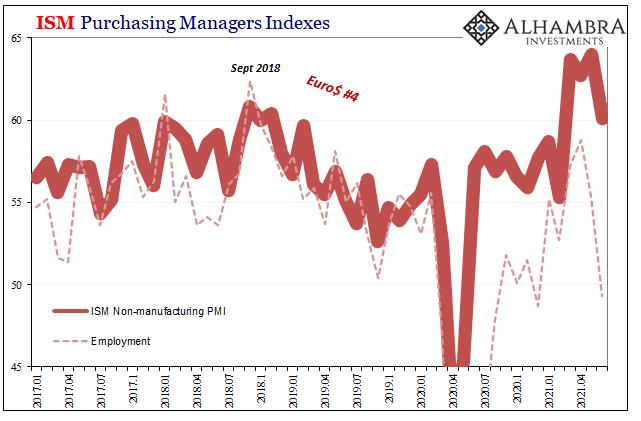

Completing the monthly cycle, the ISM released its estimates for non-manufacturing in the US during the month of June 2021. The headline index dropped nearly four points, more than expected. From 64.0 in May, at 60.1 while still quite high it’s the implication of being the lowest in four months which got so much attention.

Read More »

Read More »

Another Round of Transitory: US Retail Sales & (revised) IP

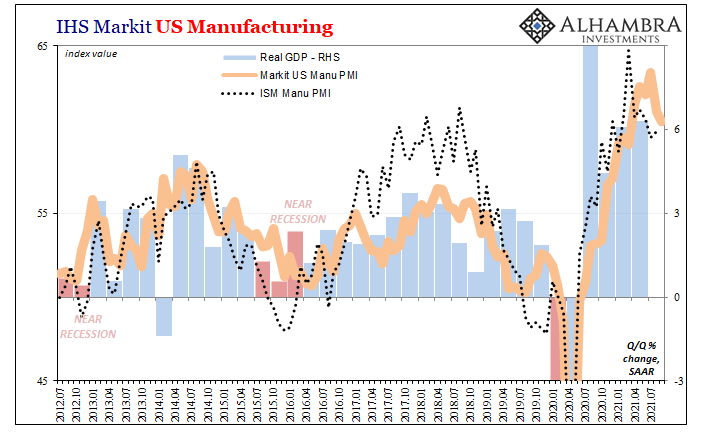

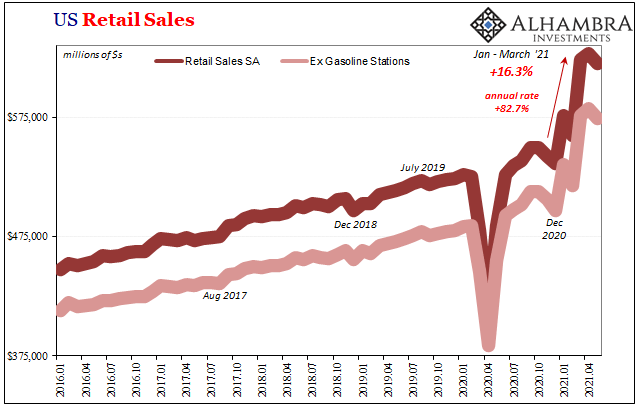

Same stuff, different month. We can basically reprint both what was described yesterday about supply curves not keeping up with exaggerated demand as well as the past two months of commentary on Retail Sales plus Industrial Production each for the US. Quite on the nose, US demand for goods, anyway, is eroding if still artificially very high.

Read More »

Read More »

There’s Two Sides To Synchronize

The offside of “synchronized” is pretty obvious when you consider all possibilities. In economic terms, synchronized growth would mean if the bulk of the economy starts moving forward, we’d expect the rest to follow with only a slight lag. That’s the upside of harmonized systems, the period everyone hopes and cheers for.

Read More »

Read More »

What Did Hamper Growth ‘In A Few Months’

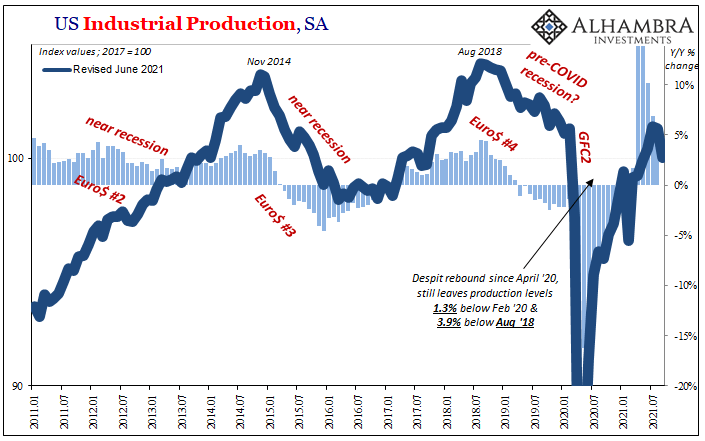

Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign.

Read More »

Read More »

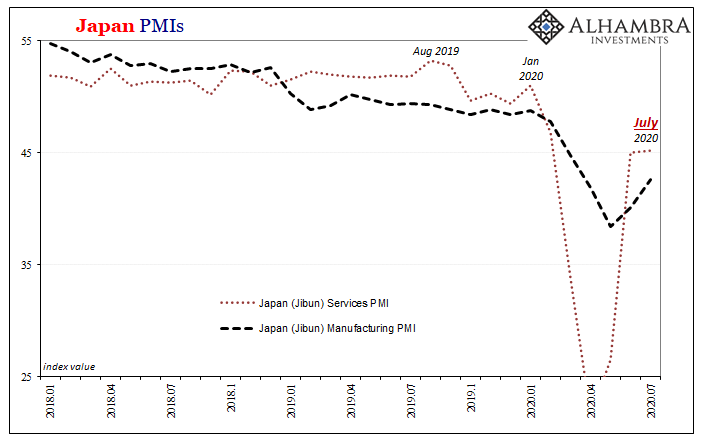

A Japanese Stall?

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

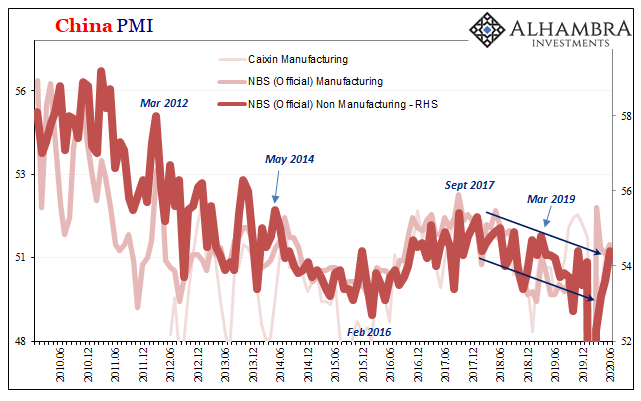

What The PMIs Aren’t Really Saying, In China As Elsewhere

China’s PMI’s continue to impress despite the fact they continue to be wholly unimpressive. As with most economic numbers in today’s stock-focused obsessiveness, everything is judged solely by how much it “surprises.” Surprises who? Doesn’t matter; some faceless group of analysts and Economists whose short-term modeling has somehow become the very standard of performance.

Read More »

Read More »

FX Daily, May 15: Much Talk but Little Action

Overview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week's losses. Australia's 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week.

Read More »

Read More »

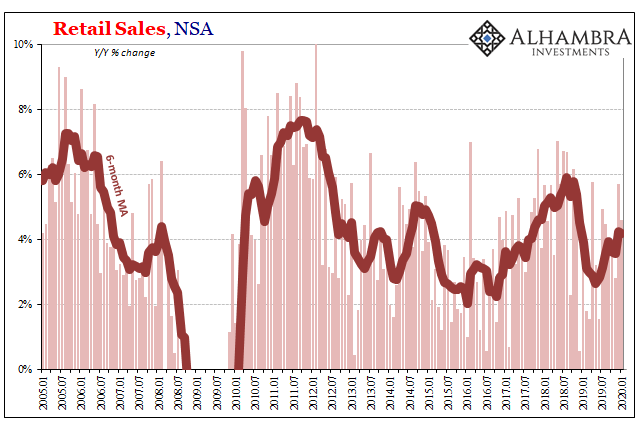

US Sales and Production Remain Virus-Free, But Still Aren’t Headwind-Free

The lull in US consumer spending on goods has reached a fifth month. The annual comparisons aren’t good, yet they somewhat mask the more recent problems appearing in the figures. According to the Census Bureau, total retail sales in January rose 4.58% year-over-year (unadjusted). Not a good number, but better, seemingly, than early on in 2019 when the series was putting out 3s and 2s.

Read More »

Read More »

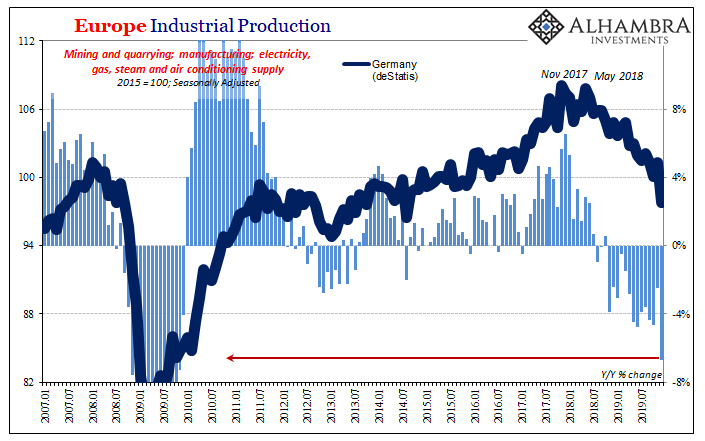

Two Years And Now It’s Getting Serious

We knew German Industrial Production for December 2019 was going to be ugly given what deStatis had reported for factory orders yesterday. In all likelihood, Germany’s industrial economy ended last year sinking and maybe too quickly. What was actually reported, however, exceeded every pessimistic guess and expectation – by a lot.

Read More »

Read More »