It’s not just the flood of never-ending inventory. That’s a huge and growing problem, sure, as the chickens of last year’s short-termism overordering finally come home to their retailer roost. Being stuck with too many goods isn’t necessarily fatal to the global and domestic manufacturing sectors.

The scale of the burden is one key worry, though equally so is demand. When the orders were placed during last year, companies appear to have fully bought into (literally) the permanent plateau of fiscal prosperity brought about by repeated war-scale government interventions. They never questioned the current nor future state of the American consumer, laser-focused instead on supply problems exclusively.

I wrote all the way back last September, just as Euro$ #5 was turning up the deflationary probabilities worldwide:

How’s it going for consumer demand now that we’ve reached “at some point?” Well, not good. Seriously, not good.

Tapped out customers when inventories levels and flows are at historic highs. That’s not inflationary, rather the opposite – as we see in more and more places by the week. |

|

| We’ll get advance inventory estimates tomorrow morning for the month of May. They’re already expected to be stout, closer to recent ridiculous highs than even normal highs; and recent estimates have been revised yet higher after more complete data comes in.

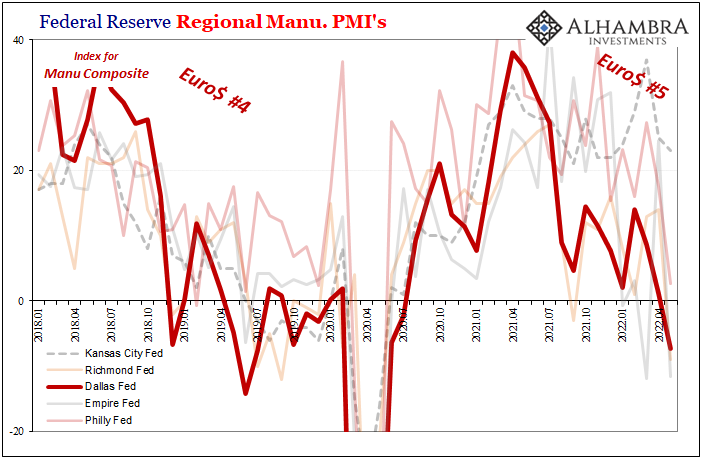

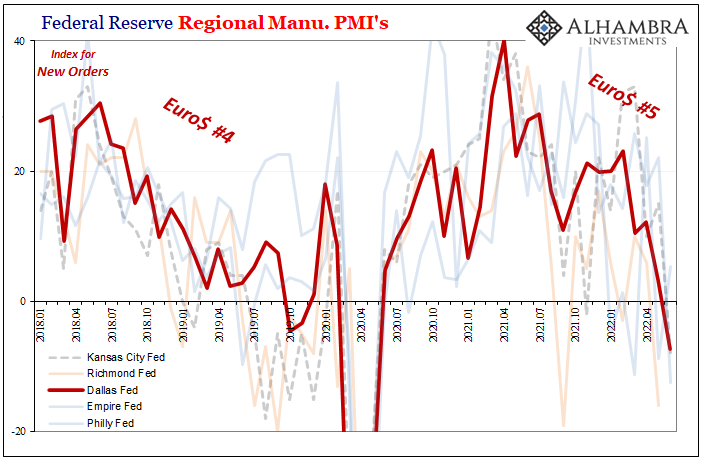

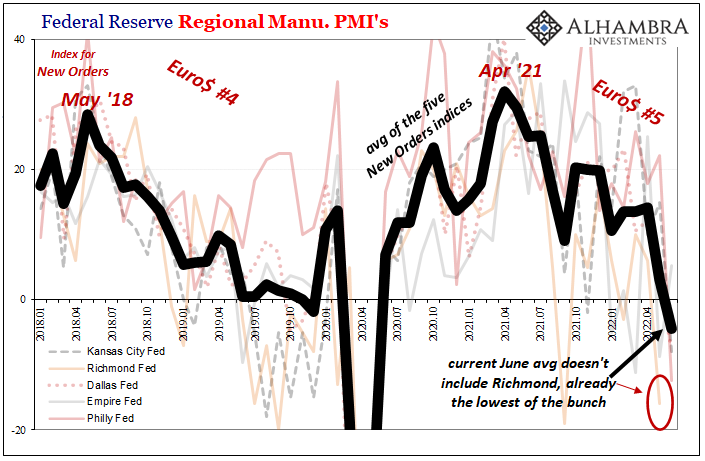

Demand trouble combined with excessive goods on hand, no wonder the manufacturing sector is really starting to fall apart. The latest today was the regional manufacturing survey out of the Fed’s Dallas folks. Their sector PMI was expected to rebound from -7.3 to around +1 or maybe zero. Instead, the overall figure dropped another 10 to end up at -17.7 for June 2022. |

|

| It’s not the level – though in this case, yeah, the level is alarming, too – as it is the pace of this downturn. And it’s one that shows no signs of letting up anytime soon.

On the contrary, the forward-looking numbers clearly indicate worse still to come. For this survey, that meant June New Orders falling 10.5 points to read -7.3; lowest in Texas since 2020 and it’s not close. While the Richmond survey results will be released tomorrow (to go with inventory updates), even without it (and Richmond’s is the lowest yet) our five-survey regional average spells big trouble ahead for much of US domestic manufacturers. If this last of the quintuple just stays near where it’s been, the average’s only going much lower than what you see below (subtract another three). Classic inventory cycle, only in 2022 this means more than it did the last few times like 2018-19 or 2014-15. While during those the eventual “manufacturing recession” led to serious and synchronized global downturns, the goods economy today hyped up on this massive fed-fueled consumer frenzy was about the only recovery-like condition in the entire global system. What happens when, not if, this lone bright fire turns from burning red-hot to ice cold? It’s a rhetorical question, not rhetorically priced into market and curve probabilities. |

Tags: currencies,demand,economy,Featured,Federal Reserve/Monetary Policy,Inventory,inventory cycle,manufacturing,Markets,newsletter