|

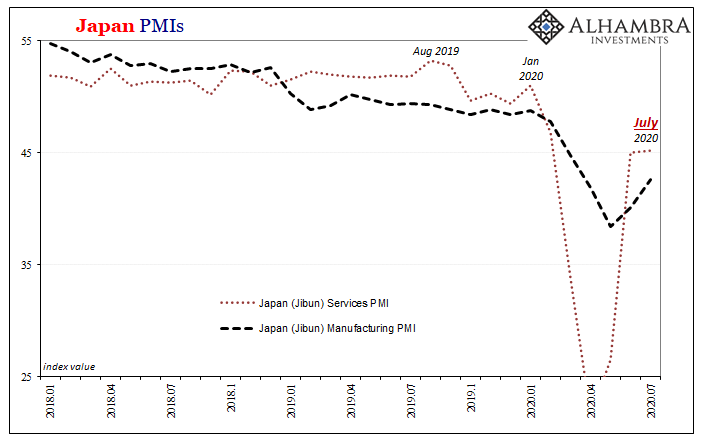

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance. Both of these places had solidly indicated the globally synchronized downturn long before it was recognized in any mainstream source (with central bankers last to figure it out). Historically, the ZEW German panel has been easily wowed by the ECB to the upside. The Japanese, on the other hand, don’t seem to care much what the Bank of Japan does or does not do. Thus, while German sentiment skyrockets way, way ahead of German data, the Jibun survey, for one, almost undershoots it. According to it, Japan’s slow recovery from the depths of April hit a snag…in July. The manufacturing PMI remained firmly below 50, just 42.6 in its flash estimate for this month improving a mere 2.5 points from June despite being near 40. |

Japan PMIs, 2018-2020 |

| More worrisome, the comeback in the service sector seems to have stalled out at similarly low level. Though the services PMI had dropped below 25.0 at the bottom in April, rising to 45.0 by June, it barely moved (45.2) from June to July even though it remains deep on the wrong side.

The second wave of the virus outbreak, and harsher re-imposed measures to contain it? Or, more worrisome, the second wave of economic damage being revealed as the limits to reopening are exposed? Neither possibility is cheery. Japan had, obviously, struggled with the pre-existing globally synchronized downturn, but that’s the point. It’s now July 2020 in terms of at least sentiment data and this leading economy doesn’t seem to be able to get it leading in the right direction with everything supposedly lined up in just the right way. Three months into reopening, and conditions seem to be still extremely depressed and not changing from it. The economic accounts and data while a month and two behind aren’t refuting that view. |

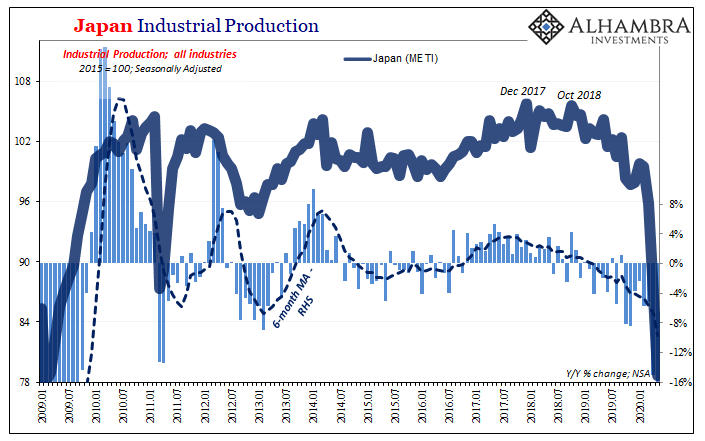

Japan Industrial Production, 2009-2020 |

| Japanese industry through May had yet to even find its bottom. The estimated level of total Industrial Production was about equal to the worst months of the Great “Recession.” And that was with a month or so of the economy being reopened.

Japan’s economic direction, of course, is not strictly Japanese – which is why the economic numbers from Japan are so worthwhile to understanding the direction to be taken by the global economy. If industry and Japan Inc. are hard-pressed by circumstances, you can bet that external demand for Japanese trade is a primary culprit. |

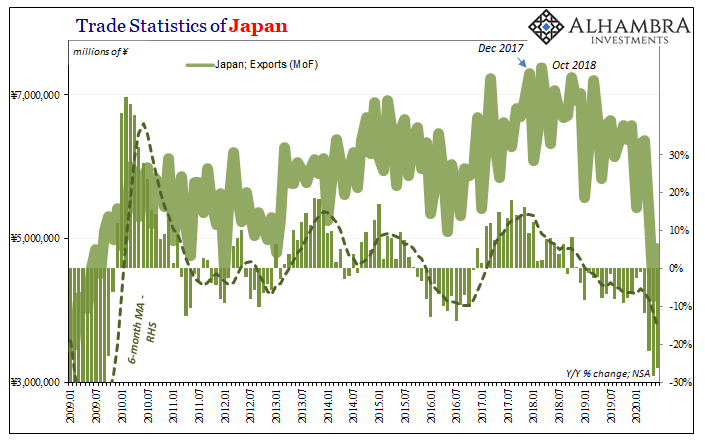

Trade Statistics of Japan, 2009-2020 |

| Exports from Japan (not seasonally-adjusted, in yen) fell by more than 26% year-over-year…in June. That was only slightly better than May’s -28.3% contraction. Japanese exports haven’t experienced a plus sign in 19 months, going all the way back to, once again, November 2018 (that whole global landmine).

In other words, the global economy had been weakened long before COVID-19 showed up, and now it seems there is, beginning as always in trade, a potential problem getting the economy back up and running again despite it being more and more reopened as we move along toward mid-summer. This export data at least here shows how importantly it’s the car business which continues to really weigh down everything; shipments of autos out from Japan down 49.9% year-over-year. Again, that’s June. Shipments of all types of goods to the UK fell 51%, while those to Germany were down 29.9%. Exports to the US dropped by nearly 47%. June. |

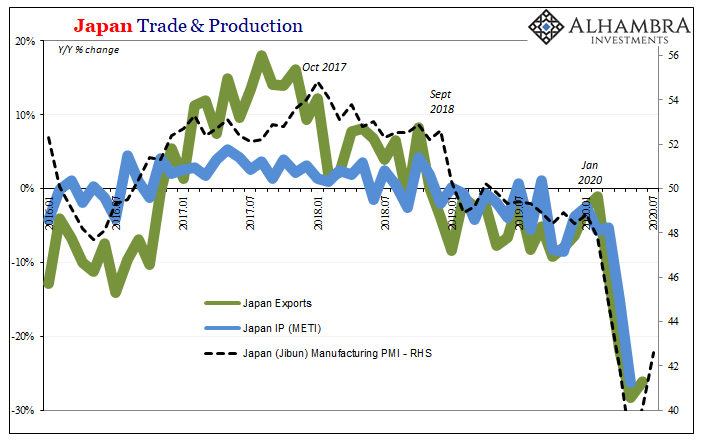

Japan Trade & Production, 2016-2020 |

| This adds more evidence to the lack of “V” in the real economy at least underlying the gobs of “stimulus” being applied in most jurisdictions. US retail sales, for example, sure have been closer in shape to what people picture of a “V” but only because of the America government’s short run payments.

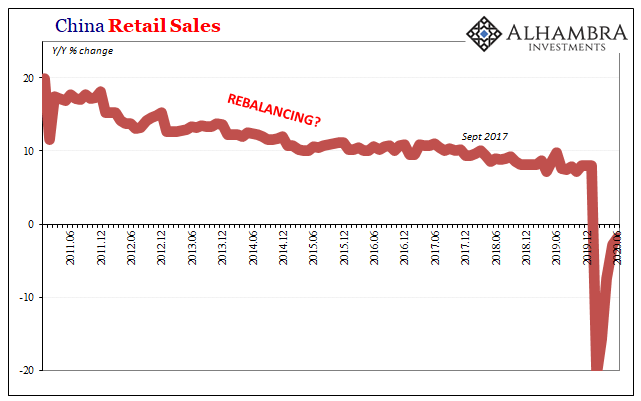

More like China’s retail sales, where there aren’t artificial boosts the economic picture of the reopening rebound is far less impressive. |

China Retail Sales, 2011-2020 |

And if that is truly the case (which has, and continues to be, our base case; so you can read this as confirmation bias if you like, though you’d also have to factor bond markets and money curves which do appear to agree with it), then that raises the risks of the second wave – which doesn’t necessarily mean an immediate double dip contraction, it could just be that the rebound stops rebounding for a while, falling well short and leaving the economy dangerously deficient after its initial shocks.

That’s what is initially being indicated here in the Japanese data, now nearly three months into its upside. They don’t even have the gigantic positives over there. If this thing really does begin to stall, in Japan first and then elsewhere, only then does the real stuff begin (the other shoe drops in broad second and third order effects).

Full story here Are you the author? Previous post See more for Next postTags: Bonds,China,currencies,economy,exports,Featured,Federal Reserve/Monetary Policy,Germany,global trade,imports,industrial production,Japan,manufacturing,Markets,newsletter,Retail sales,services