Tag Archive: imports

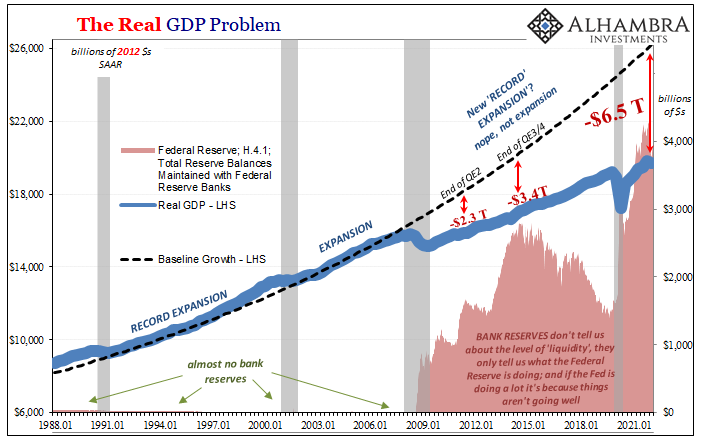

Macro: GDP Q3 — Inflationary BOOM!

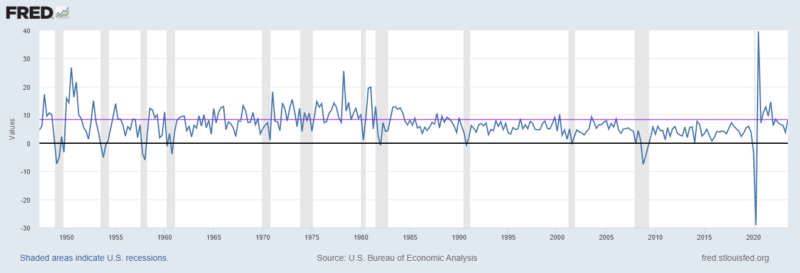

Outside of the pandemic defined as 2020 and 2021, this past quarter was the 5th best quarter for nominal GDP in the last 25 years.

Read More »

Read More »

Weekly Market Pulse: Look Up In The Sky! It’s A UFO! Or Not!

As I sit here writing this Sunday afternoon, the US has just shot down a third UFO in the last 3 days in addition to the Chinese “weather” balloon last week. I have no insight into what these things might be but I do wonder if we haven’t declared war on the National Weather Service. The federal government has become so sprawling that it could easily be the case that NORAD has no idea what the NWS has up in the air.

Read More »

Read More »

Curve Inversion 101: US CPI Politics Up Front, China PPI Down(ing) The Back

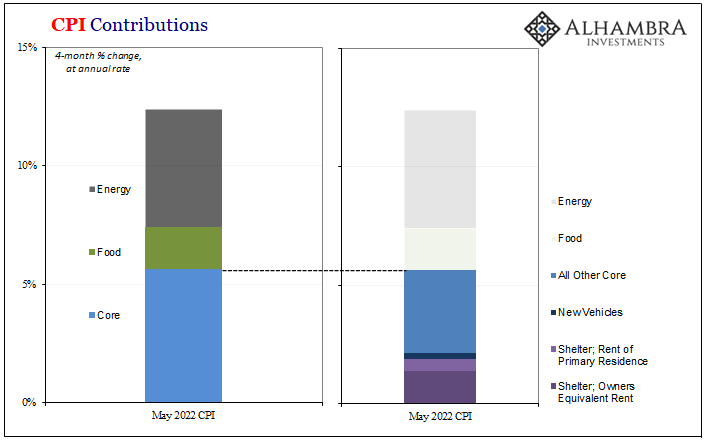

While the world fixated on the US CPI, it was other “inflation” data from across the Pacific that is telling the real economic story. Having conflated the former with a red-hot economy, the fact American consumer prices aren’t tied to the actual economic situation has been lost in the shuffle of the FOMC’s hawkishness, with markets obliged to price wrong-way Jay.

Read More »

Read More »

“Inflation” Not Inflation, Through The Eyes of Inventory

It isn’t just semantics, nor some trivial, egotistical use of quotation marks. There is an actual and vast difference between inflation and “inflation.” And in the final results, that difference isn’t strictly or even mainly about consumer prices.Who cares, most people wonder. After all, what does it really matter why prices are going up so far?

Read More »

Read More »

T-bills Targeted Target

Yesterday’s market “volatility” spilled (way) over into this morning’s trading. It ended up being a very striking example, perhaps the clearest and most alarming yet, of a scramble for collateral. The 4-week T-bill, well, the chart speaks for itself:During past scrambles, such as those last year, they didn’t look like this. They would hit, stick around for an hour, maybe a bit longer, and then clear up as collateral books get balanced in repo like...

Read More »

Read More »

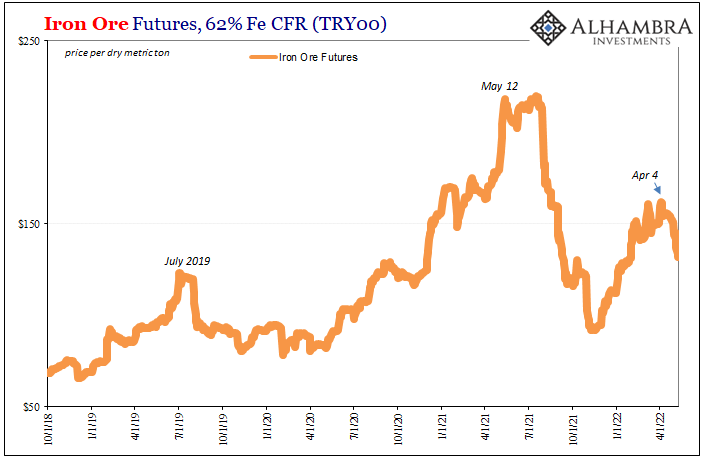

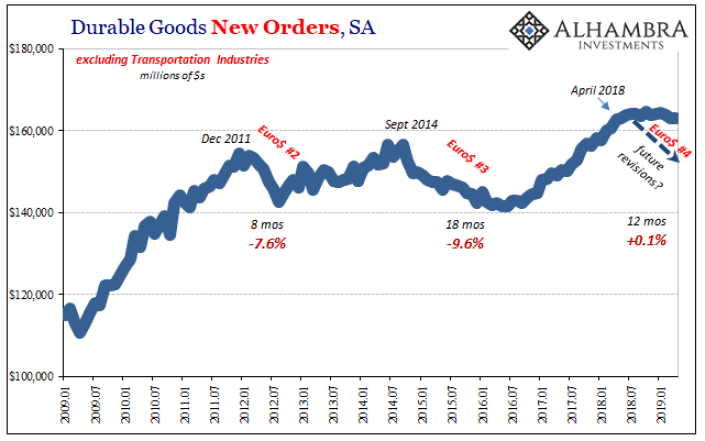

Industrial Synchronized Demand

Are the industrial commodities starting to get a whiff of demand side rejection? Short run trends suggest that this could be the case. From copper to iron and the highest (formerly) of the high flyers, aluminum, this particular group has been exhibiting a rather synchronized setback going back to the end of March, start of April.

Read More »

Read More »

Is It Recession?

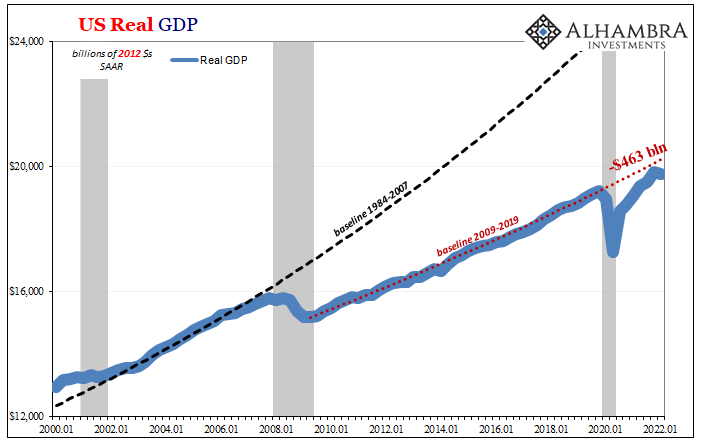

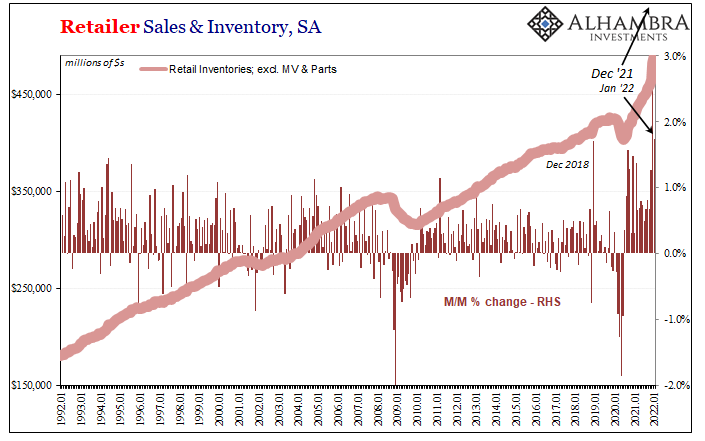

According to today’s advance estimate for first quarter 2022 US real GDP, the third highest (inflation-adjusted) inventory build on record subtracted nearly a point off the quarter-over-quarter annual rate. Yes, you read that right; deducted from growth, as in lowered it. This might seem counterintuitive since by GDP accounting inventory adds to output.

Read More »

Read More »

China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

Briefing Even More Inventory

Retail sales stumbled in December, contributing some to the explosion in inventory across the US supply chain – but not all. Inventories were going to spike even if sales had been better. In fact, retail inventories rose at such a record pace beyond anything seen before, had sales been far improved the monthly increase in inventories still would’ve unlike anything in the data series.

Read More »

Read More »

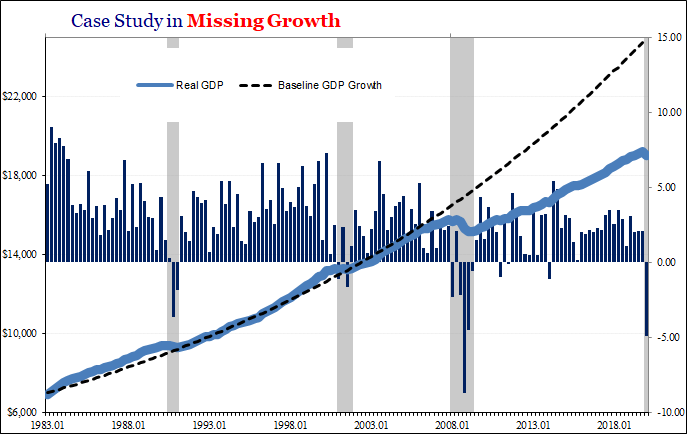

The Enormously Important Reasons To Revisit The Revisions Already Several Times Revisited

Extraordinary times call for extraordinary commitment. I never set out nor imagined that a quarter century after embarking on what I thought would be a career managing portfolios, researching markets, and picking investments, I’d instead have to spend a good amount of my time in the future taking apart how raw economic data is collected, tabulated, and then disseminated.

Read More »

Read More »

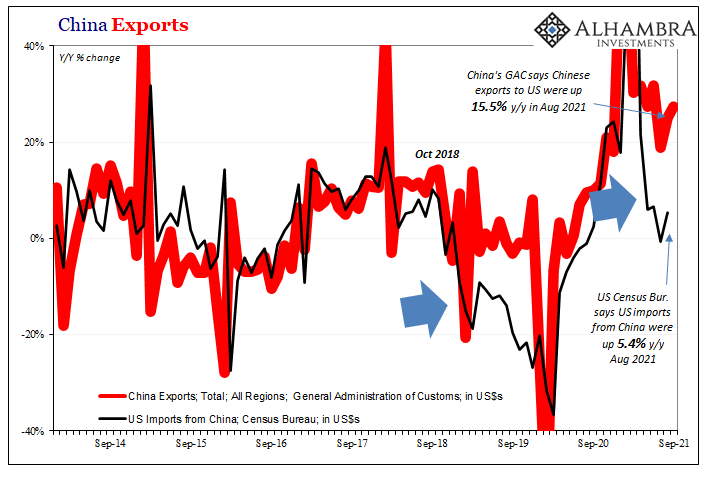

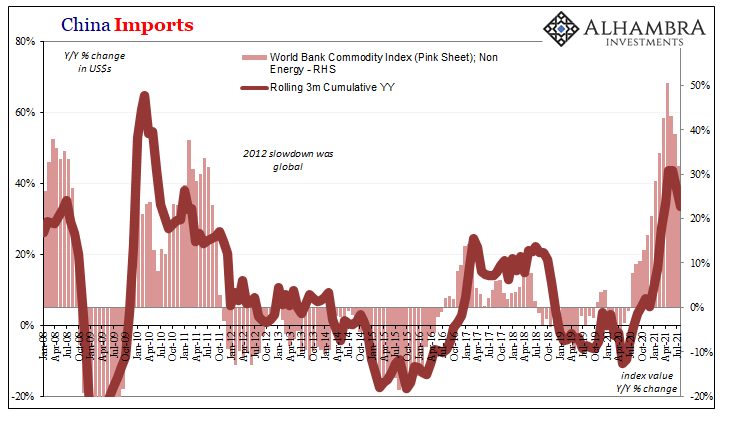

Inflating Chinese Trade

There was never really any answer given by the Chinese Communists for why their own export data diverged so much from other import estimates gathered by its largest trading partners. Ostensibly different sides of the same thing, it’s not like anyone asked Xi Jinping to weigh in; they report what numbers they have and consider them authoritative.

Read More »

Read More »

What’s Real Behind Commodities

Inflation is sustained monetary debasement – money printing, if you prefer – that wrecks consumer prices. It is the other of the evil monetary diseases, the one which is far more visible therefore visceral to the consumers pounded by spiraling costs of bare living. Yet, it is the lesser evil by comparison to deflation which insidiously destroys the labor market from the inside out.

Read More »

Read More »

A Real Example Of Price Imbalance

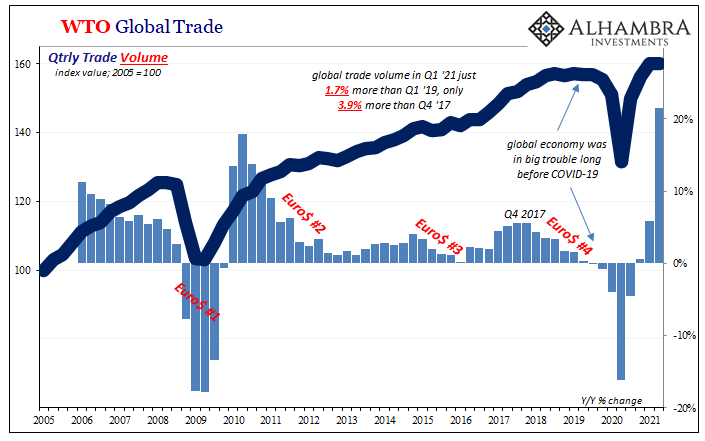

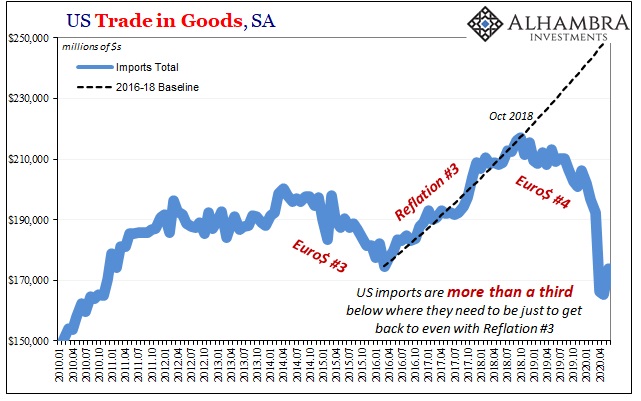

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim.

Read More »

Read More »

Real Dollar ‘Privilege’ On Display (again)

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime...

Read More »

Read More »

Shoe V arning

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood.

Read More »

Read More »

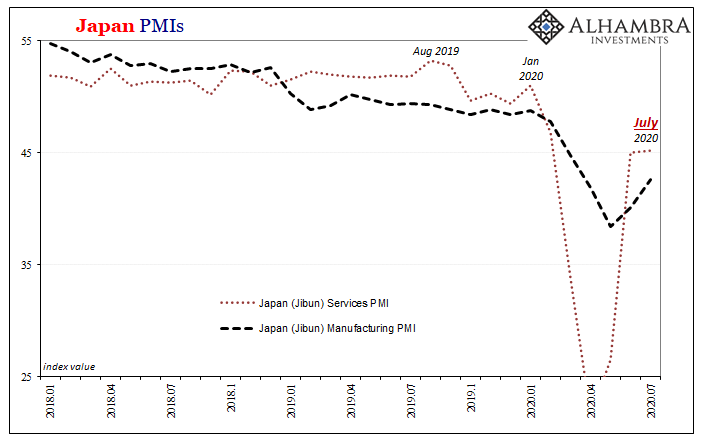

A Japanese Stall?

In sharp contrast to the sentimental deference towards central bank stimulus exhibited by Germany’s ZEW, for example, similar Japanese surveys are starting to describe potential trouble developing. Like Germany, Japan is a bellwether country and a pretty reliable indicator of global economy performance.

Read More »

Read More »

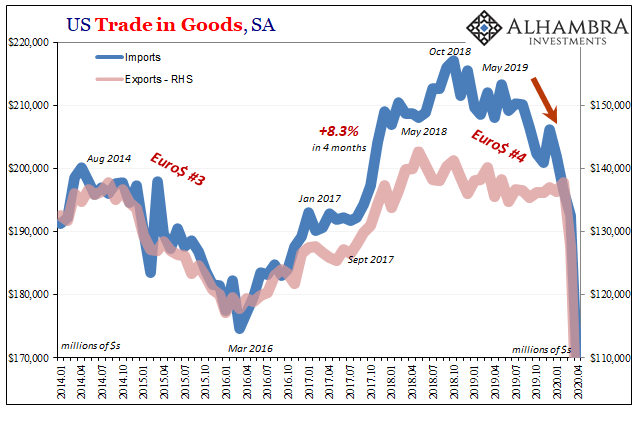

Second Wave Global Trade

Unlike some sentiment indicators, the ISM Non-manufacturing, in particular, actual trade in goods continued to contract in May 2020. Both exports and imports fell further, though the rate of descent has improved. In fact, that’s all the other, more subdued PMI’s like Markit’s have been suggesting.

Read More »

Read More »

Someone’s Giving Us The (Trade) Business

The NBER has made its formal declaration. Surprising no one, as usual this group of mainstream academic Economists wishes to tell us what we already know. At least this time their determination of recession is noticeably closer to the beginning of the actual event. The Great “Recession”, you might recall, wasn’t even classified as an “official” contraction until December 2008 – a full year after the NBER figured the thing had begun.

Read More »

Read More »

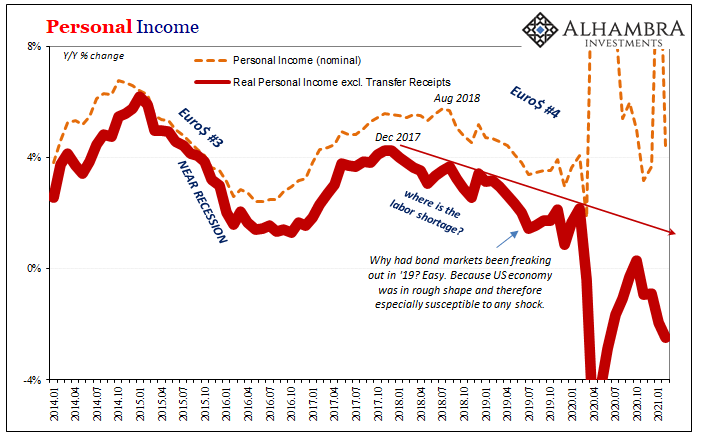

GDP + GFC = Fragile

March 15 was when it all began to come down. Not the stock market; that had been in freefall already, beset by the rolling destruction of fire sale liquidations emanating out of the repo market (collateral side first). No matter what the Federal Reserve did or announced, there was no stopping the runaway devastation.

Read More »

Read More »

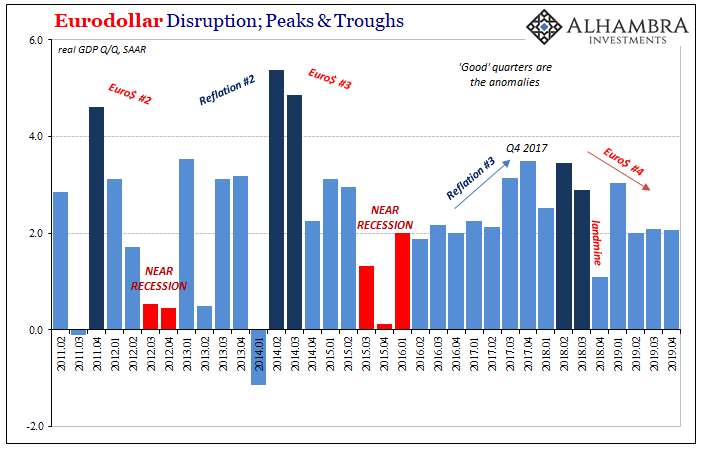

Three Straight Quarters of 2 percent, And Yet Each One Very Different

Headline GDP growth during the fourth quarter of 2019 was 2.05849% (continuously compounded annual rate), slightly lower than the (revised) 2.08169% during Q3. For the year, the Bureau of Economic Analysis (BEA) puts total real output at $19.07 trillion, or annual growth of 2.33% and down from 2.93% in 2018. Last year was weaker than 2017, the second lowest out of the six since 2013.

Read More »

Read More »