|

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood. We’ve so far made through only one big test, there are likely more to follow. And if they do, when they do, the system greets them with a significantly weakened foundation. A lot of times confronted with major upheaval the push back from it uses up all the ammo; or the entire toolkit, depending upon your preferred metaphor. |

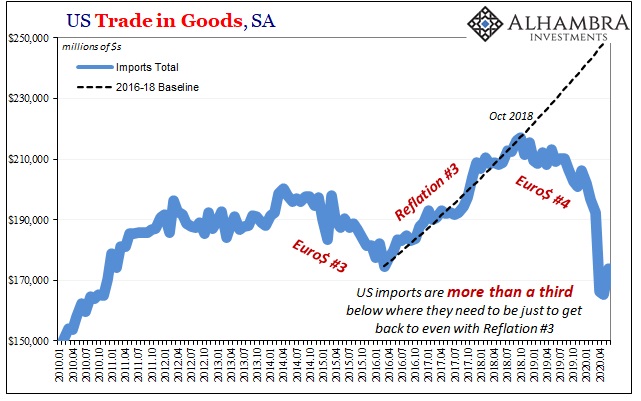

US Trade in Goods, Jan 2010 - Jul 2020 |

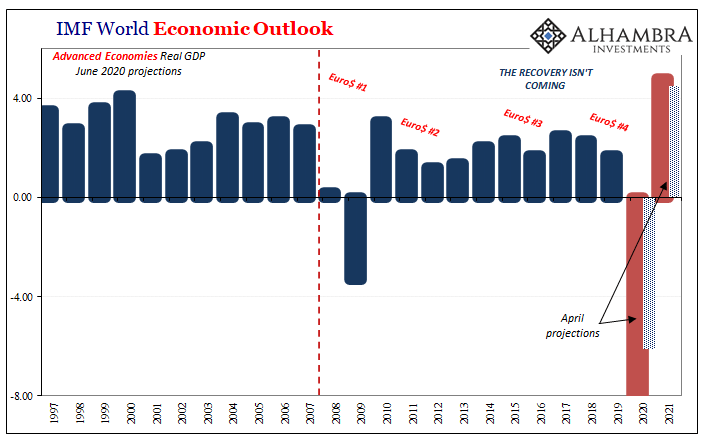

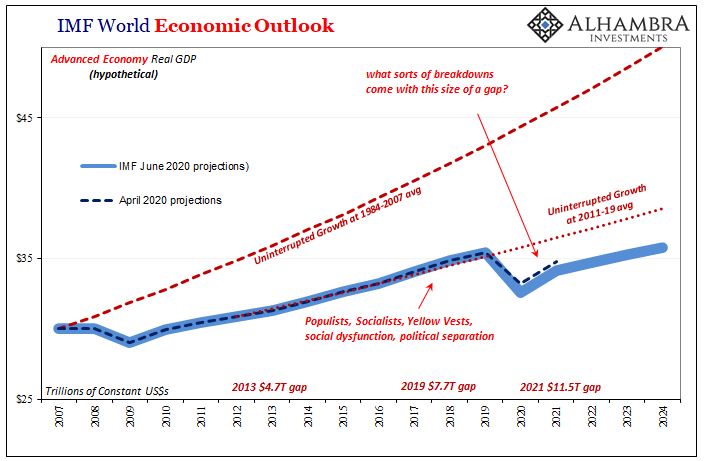

| This is something that the IMF, of all places, since they’d know about repeated problems, continues to warn about in ongoing, recurrent commentary. Not merely the usual hedging on a shaky “V”, truly trying to get people’s attention ahead of time. Was GFC2 that much of a disruption that it actually got the IMF to think ahead rationally for once?

It sure seems that way now.

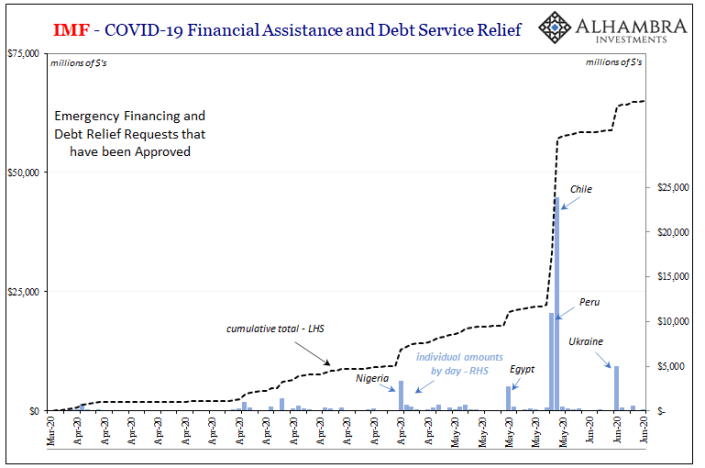

These unfortunate EM’s sapped of their strength by the last more than half decade of dollar subsistence then had to expend all their bullets just trying to get to this point. And that’s a problem because just two days ago the IMF had warned in a separate communication about:

|

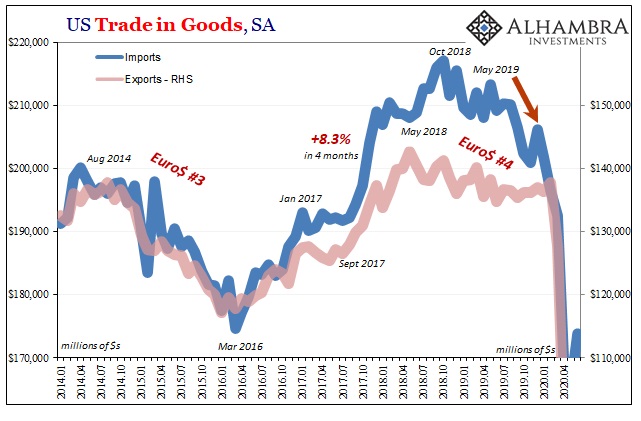

US Trade in Goods, Jan 2014 - Jul 2020 |

| The two often go together, an almost self-fulfilling prophecy. Eurodollars get tight, trade falls off, causing eurodollars to become tighter. And so on.

The interim we’re experiencing now is a wait-and-see over how much so much official sector countermeasures might have helped. But always with that wariness of more shoes. That’s what these GFC events tend to do to the system. Faced with obvious central bank failures, and the media’s obvious failure to be honest about them, conditions, as I describe in more detail here, become almost binary – money dealers in the eurodollar system don’t just pull a little off the table when confronting the next potentially scary development, they run for the exits taking everything with them. That was how Bear Stearns, a purported huge success, actually set the table for Lehman and AIG. |

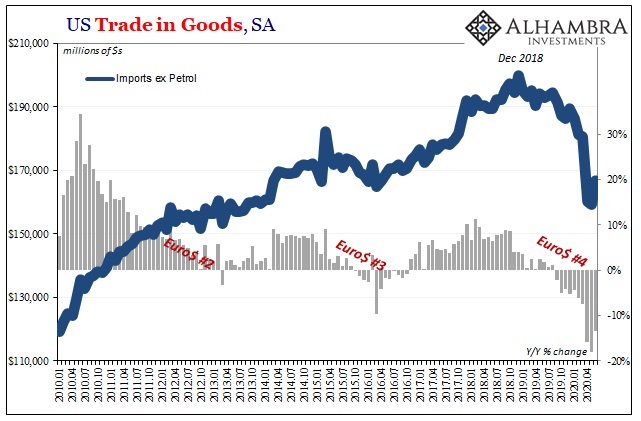

US Trade in Goods, Jan 2010 - Jul 2020 |

| To put that into the IMF’s context, even the realistic prospect for “a further decline in global trade” could become even more serious “capital flow reversals” at the drop of a hat. Governments and the IMF are trying to be proactive about negotiating and implementing funding cushions, but, as I keep pointing out, even if done well these are not the same thing as perfect substitutes for lost market funding.

It can get out of hand fairly quickly. Argentina in 2018 was actually one of the organization’s more thought out rescues and still it blew up while globally synchronized growth hadn’t yet turned into the globally synchronized downturn; the latter merely finished off what was left to finish off. While some domestic economies are faring better in terms of reopening since the April/May bottom, it’s coming along far more slowly in global trade. That’s why, I believe, the IMF is stepping up issuing these disclaimers: don’t blame us, we told you back in July and August about what sure seemed to be growing risks! As it pertains to US demand for trade, the Census Bureau reports today that like how PMI’s are truly situated the rebound just isn’t bouncing robustly off the trough. Rather, closer still to the bottom than anyone should be comfortable with. While these trade figures are for the month of June 2020, if sentiment estimates are anywhere near the ballpark we shouldn’t expect much further improvement to have taken place in July. |

IMF World Economic Outlook, 1997 - 2021 |

| Not only that, the above data once more reinforcing the “persistent, pre-existing external imbalances” which had left the whole global economy in bad shape before ever reaching GFC2 (thereby, in my view, contributing much to it; especially the repo collateral bottleneck).

Both imports into the US and exports out of the country were up in June from May, but, as you can see, again there’s a huge difference between a positive number and a rebound; let alone the V-people’s recovery. It’s still a huge mess, therefore a huge deficiency, therefore elevated potential before ever reaching the possibility of a “V.” The longer it goes like this, the greater, not less, chance it goes wrong again. |

IMF Emergency List Chart, Mar 2020 - Jun 2020 |

| Even the IMF knows and has repeatedly published this more than a few times recently. This is no trivial matter when these guys are still thinking footwear. |

IMF WEO Advanced pro forma, 2007 - 2024 |

Full story here Are you the author? Previous post See more for Next post

Tags: currencies,economy,exports,Featured,Federal Reserve/Monetary Policy,global dollar shortage,global trade,IMF,imports,Markets,newsletter