Tag Archive: IMF

Euro Closed above $1.09 but Follow-Through Buying Limited

Overview: After

some intraday penetration, the euro finally settled above $1.09 yesterday. However,

follow-through buying has been limited and technical and option-related

resistance is seen in the $1.0940-50 area. The dollar is more broadly mixed

today, with the dollar-bloc and Norwegian krone leading the advancers. The

euro, yen, and sterling are nursing small losses near midday in Europe. The

recovery of US equity indices yesterday after gap...

Read More »

Read More »

Fed Day

Overview: Better US news from the likes of Google, Microsoft, and Texas Instruments has helped lift sentiment today and is encouraging a more risk-on mood ahead of the FOMC meeting. News that US President Biden and China’s Xi will talk tomorrow for the second time this year may be notable but does not appear to be impactful in the capital markets.

Read More »

Read More »

FX Daily, January 26: Federal Reserve and Bank of Canada Meet as Risk Appetites Stabilize

After a slow and mixed start in Asia, where Australia and India are on holiday, equity markets have turned higher. Europe's Stoxx 600 is up around 1.9% near midday in Europe, which if sustained would be the biggest gain of the year. US futures are snapping backing too, with the S&P 500 popping more than 1% and NASDAQ by 2%.

Read More »

Read More »

The Euro Remains Within Last Wednesday’s Range

Overview: A weak close in US equity trading yesterday and the widening of China's "cultural revolution" for a two-month investigation of the financial sector stopped a three-day advance in the MSCI Asia Pacific Index. China, South Korea, and Taiwan saw more than a 1% decline in their major indices.

Read More »

Read More »

Risk Appetites Didn’t Return from the Weekend

Overview: Investors' mood did not improve over the weekend, and the lack of risk appetites are rippling through the capital markets today. Equities have tumbled, yields have backed off, and the dollar is well bid. Hong Kong and Australia led the sell-off in the Asia Pacific region, off 3.3% and 2.1%, respectively.

Read More »

Read More »

Sophistry Dressed (as) Reallocation

Stop me if you’ve heard this before: About US$275 billion (about SDR 193 billion) of the new allocation will go to emerging markets and developing countries, including low-income countries.

Read More »

Read More »

The far-reaching impact of the US election

The 2020 election was a roller coaster experience for both sides and for all International observers who understood its massive economic and geopolitical implications for the rest of the West.

Read More »

Read More »

Shoe V arning

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood.

Read More »

Read More »

An International Puppet Show

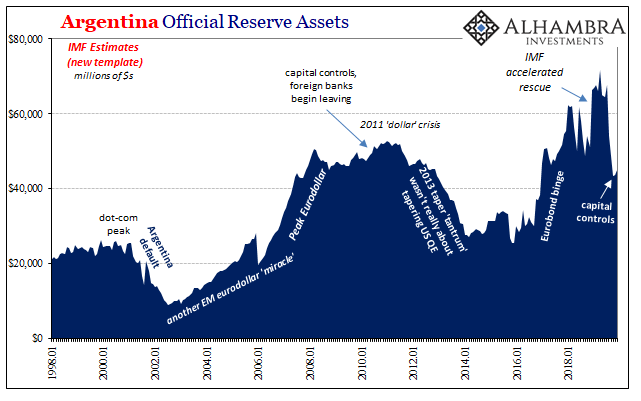

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

What to Expect from the World Bank and IMF

The spring meetings of the World Bank and IMF will be held virtually this week amid a profound economic crisis spurred by a novel coronavirus. Unlike previous such viruses, this went global in such a destructive way that many countries have responded the same way. Encouraging social distancing, closing non-essential businesses, and enforcing lockdowns.

Read More »

Read More »

(No) Dollars And (No) Sense: Eighty Argentinas

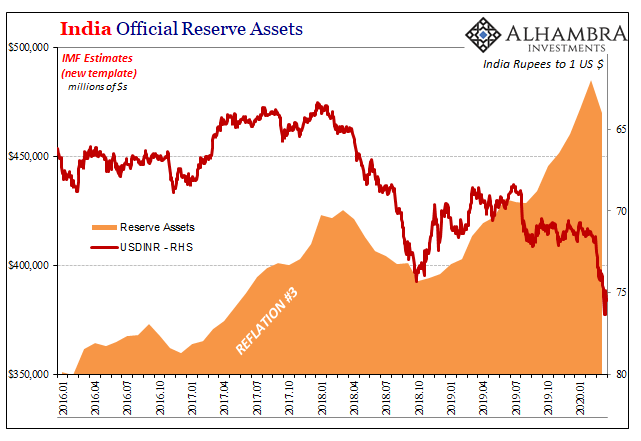

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark.

Read More »

Read More »

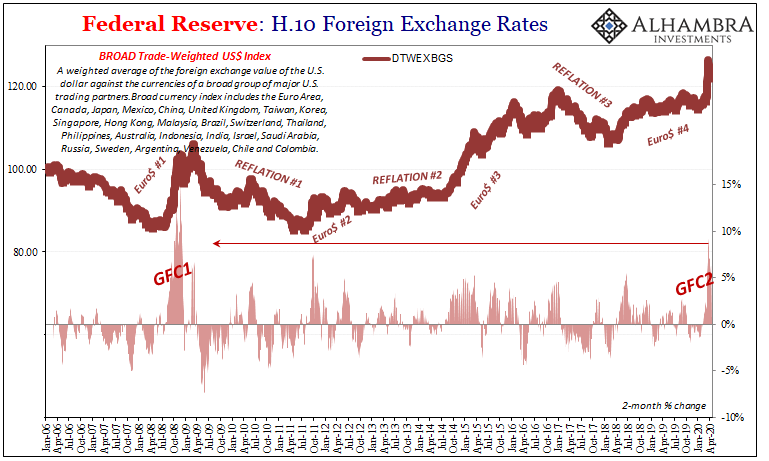

Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig.

Read More »

Read More »

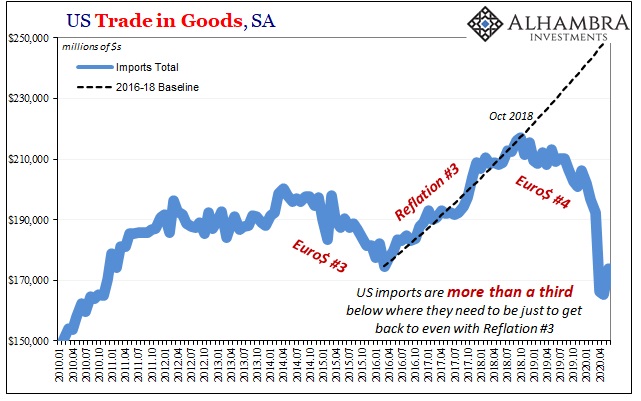

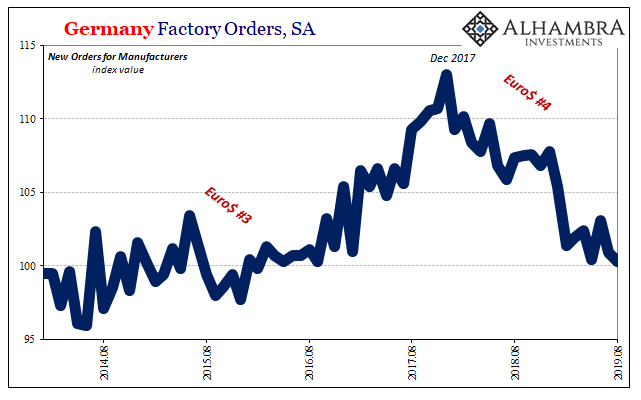

The Scientism of Trade Wars

One year ago, last October, the IMF published the update to its World Economic Outlook (WEO) for 2018. Like many, the organization began to talk more about trade wars and protectionism. It had become a topic of conversation more than concern. Couched as only downside risks, the IMF still didn’t think the fuss would amount to all that much.

Especially not with world’s economy roaring under globally synchronized growth. Even though there were...

Read More »

Read More »

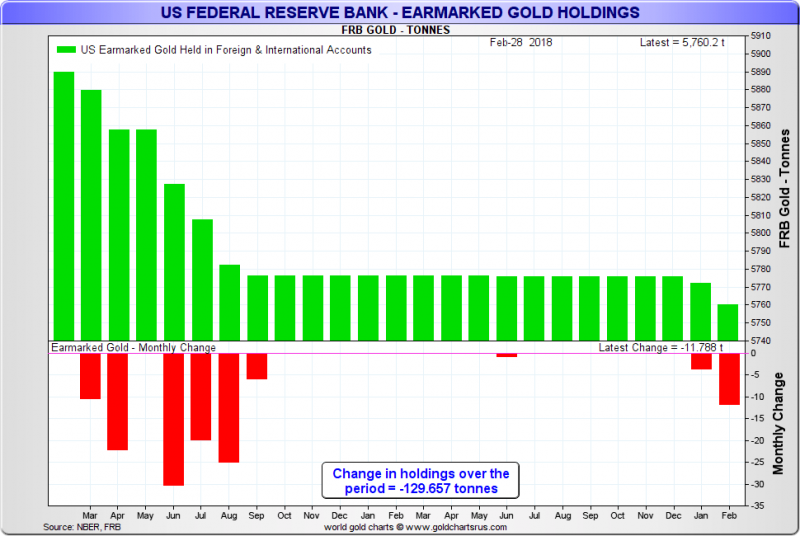

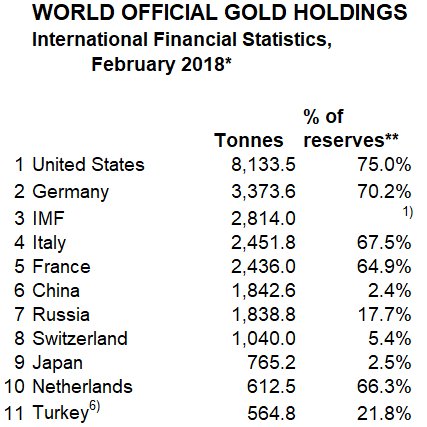

Turkey and Russia Highlight Gold’s Role as a Strategically Important Asset

On 17 April, Turkish news publication Ahval published a report stating that during 2017, Turkey withdrew 26.8 tonnes of gold that it had stored in the vaults of the New York Federal Reserve, and moved this gold under the custodianship of the Bank of England and the Bank for International Settlements (BIS). The source of the Ahval report was a Turkish language article from the popular Hürriyet newspaper in Turkey.

Read More »

Read More »

IMF forecasts 2.25 percent Swiss GDP growth in 2018 while pointing to risks

A boost to investment and net exports from the tailwind of strong external demand, together with faster expansion of household spending owing to rising employment, are forecast to lift GDP growth to around 2¼ percent in 2018, said the IMF in a statement referring to Switzerland issued on 26 March 2018.

Read More »

Read More »

FX Weekly Preview: A New Phase Begins

There were no celebrations; no horn or trumpets, nary a sound, but an important shift took place last week. The shift was signaled by two events. The first was the US strike on Syria, and the second was investors' willingness to look past Q1 economic data.

Read More »

Read More »

Greece and the Return of the Repressed

Don't expect a deal between Greece and its official creditors until late spring or early summer. Grexit is still not a particularly likely scenario. It was the European governments not Greece which put other taxpayers' skin in the game.

Read More »

Read More »

Greek Bonds may Soon be Included in ECB Purchases

The ECB accepts Greek bonds as collateral but does not include them in its asset purchases. A new staff-level agreement by the end of the year could change that. Finance ministers imply that Greece's debt is sustainable, but the IMF disagrees.

Read More »

Read More »

What the Greek Deal Does and Does Not Do

For investors, the most important thing about the successful review of Greece’s implementation of last year’s agreement is that it effectively removes it from the list of potential disruptive factors in the coming quarters. There will be no repeat of last year’s drama. Assuming Greece resolves a few outstanding issues in the next few days, …

Read More »

Read More »