|

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount. Very reassuring. The IMF is becoming like the Federal Reserve. Before GFC1, it had a quarter of the resources available to it that it claims now. In 2009, all lines of expansion were pursued including an increase in quotas. |

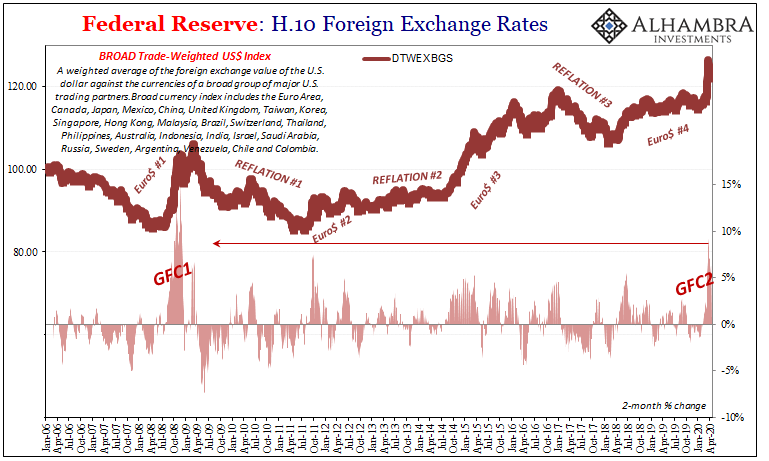

Federal Reserve: H.10 Foreign Exchange Rates, 2006-2020 |

| These efforts were only beginning.

So what I mean is, like the Fed, the more the IMF does the better it gets? When the US central bank’s balance sheet is expanding, that’s always a very bad sign. The private, global shadow money system (eurodollars) must be in some state of contraction, the Fed’s reactive response a clear sign of that negative case. As the IMF’s General Resources Account (GRA) has ballooned over the last decade, global currency problems have receded? No. If anything, they’ve grown much worse – as Argentina can attest. The IMF considers having to do more because the global eurodollar system has spent the last twelve years offering the world less. At times, much less. These now two GFC’s (Global Financial Crisis) that are really nothing more than a hidden eurodollar run. The latest one, largely in March 2020 to this point, certainly qualifies. You can even see the overwhelmingly negative consequences clearly on the dollar’s gross exchange values: |

It was an enormously violent and devastating amplification of the dollar shortage which had been in a slow(er) burn Euro$ #4 up until this year (thus, Argentina begging for aid all the way back in 2018). The dollar’s destructive rise hadn’t been so far so fast (a crisis measurement, for sure) since the belly of GFC1 in the Fall of ’08.

In the immediate aftermath of GFC2, despite overseas dollar swaps expanded by the Federal Reserve and now FIMA technically open to almost every other central bank and monetary authority around the planet (assuming they have and want to post UST securities for “liquidity” access), around 100 countries have begun the application process for emergency aid from the IMF anyway.

Very reassuring.

The organization has 183 members, meaning more than half are in some form of distress – and this is only beginning. The word unprecedented isn’t hyperbole in this instance.

Twenty-five have already been granted funds to cover what the IMF calculates is each one’s debt service requirements for the rest of 2020. Interest payments, in other words, in dollars mostly.

But where does the IMF get these funds to operate its complex menu of bailout programs?

The organization’s GRA consists of three parts: quotas, New Arrangements to Borrow (NAB), and finally Bilateral Borrowing Agreements (BBA). While the quotas are the main element, the latter two end up potentially providing the bulk of the resources should they ever get activated.

Take the NAB, for example. This is made up of standing agreements with 40 IMF members, and should 85% of all members consent this would trigger these further commitments.

According to the published figures from 2016 when the NAB was last updated and expanded (to SDR 182.4 billion), the IMF expects that in a global dollar crisis of this sort Chile will provide SDR 691 million, India SDR 4.44 billion, Mexico SDR 2.53 billion, Russia SDR 4.44 billion, Saudi Arabia SDR 5.65 billion, and Brazil, whose currency is currently plummeting again, SDR 4.44 billion. You get the point.

The BBA is even sketchier where, right off the top, the organization is counting on Algeria, freaking Algeria (no offense), to commit $5 billion in US$’s in a global emergency like this; Brazil another $10 billion; $43 billion from China; $10 billion from Mexico, whose external Eurobond debt was just downgraded; and another $10 billion from Russia.

How many of those countries listed in the two paragraphs above might have asked the IMF for help, rather than the other way around? Maybe none to this point, but how long before it isn’t that way?

And then there are the quotas. This first line of defense, they say. More than half the members are already seeking emergency aid and yet the whole list of them is going to sign right up to fund another issuance?

Again, you can begin to see why officials are in a rush to expand the lending capacities because the group’s lending capacities aren’t really what they seem. Cloaked in a dizzying array of acronyms and abbreviations – I’m not kidding, there are a dozen of them standing in for programs intended for potential borrowers and creditors alike – you also get the sense the IMF doesn’t really want to make it all that easy to track and understand what it actually might be doing.

Or is realistically capable of doing. Again, Argentina springs to mind, but hardly alone in its tale of dollar bailout woe.

An international puppet show meant to soothe emotions rather than to answer in effective money. To convince global dollar markets no need to take away any more, how everyone can trust the IMF (and the Fed) about no risks over keeping money in each country. Thus, the more the IMF claims it needs for its capabilities, the worse you know it probably is in the shadow eurodollar system. Just like the Fed’s domestic puppet show.

For all the Federal Reserve has done “money printing” and in its highly publicized international efforts, swaps and FIMA, along with these repeated assurances from the IMF, the dollar is normalizing downward if not screaming lower? Of course not, it is collectively barely less than its March 2020 high which, again, qualified as a crisis level global shortage event.

And we haven’t even seen what it will look like once the merchandise shutdown materializes in full. We only have a preview from the financial fallout in the starting applications of the unfortunate (so far) hundred.

Regardless of how the COVID-19 pandemic resolves itself, hopefully the most optimistic case (where the models are all ridiculously wrong, as it is turning out), there can be no global “V” where the global dollar system continues to be so ridiculously disarranged. The official sector has offered up everything it can think of, trying to find ever more, and only the financial media seems impressed.

Other than certain repo “gurus”, not even the Bond Kings are buying it any longer.

Maybe it’s all the acronyms. It sure isn’t the “dollars.”

Full story here Are you the author? Previous post See more for Next post

Tags: Argentina,Brazil,China,currencies,dollar,economy,EuroDollar,eurodollar system,Federal Reserve/Monetary Policy,GFC1,GFC2,global dollar shortage,IMF,India,Markets,newsletter