Tag Archive: global dollar shortage

Angry April TIC Zeroed In On China’s CNY and Japan’s JPY

If the March gasoline/oil spike hit a weak global economy really hard and caused what more and more looks like a recessionary shock, a(n un)healthy part of it was the acceleration of Euro$ #5 concurrently rippling through the global reserve system.

Read More »

Read More »

Hong Kong Stocks Pivot Euro$ #5

The stock market hasn’t been moneyed; well, US equities, anyway. What do I mean by “moneyed?” Common perceptions (myth) link the Federal Reserve’s so-called money printing (bank reserves) with share prices.

Read More »

Read More »

CNY’s Drop Wasn’t ‘Devaluation’ in ’15 nor ’18, and It Isn’t ‘Devaluation’ Now

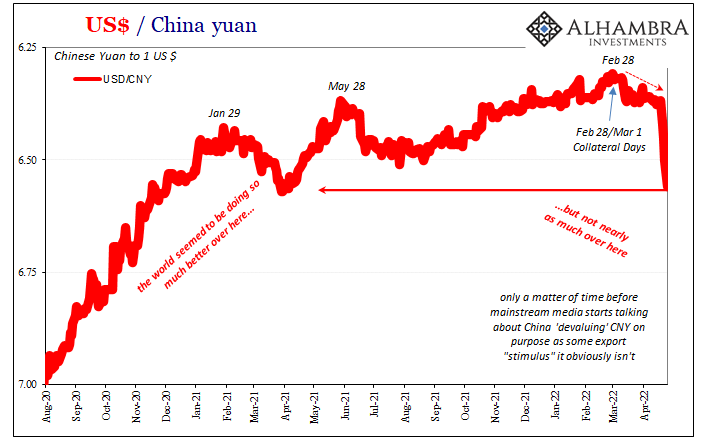

For one thing, that whole Bretton Woods 3 thing is really off to an interesting start. And by interesting, I mean predictably backward. According to its loud and leading proponent, China’s yuan was supposed to be ascending while the dollar sank, its first step toward what many still claim will end up in some biblical-like abyss.

Read More »

Read More »

China, Japan, And The Relative Pre-March Euro$ Calm In February

The month of February 2022, the calm before the latest storm. Russians went into Ukraine toward the month’s end, collateral shortage became scarcity, maybe a run right at February’s final day, and then serious escalations all throughout March – right down to pure US Treasury yield curve inversion.Given that setup, it was unsurprising to find Treasury’s February TIC data mostly unremarkable.

Read More »

Read More »

China More and More Beyond ‘Inflation’

If only the rest of the world could have such problems. Chinese consumer prices were flat from February 2022 to March, even though gasoline and energy costs predictably skyrocketed. According to China’s NBS, gas was up 7.2% month-over-month while diesel costs on average gained 7.8%.

Read More »

Read More »

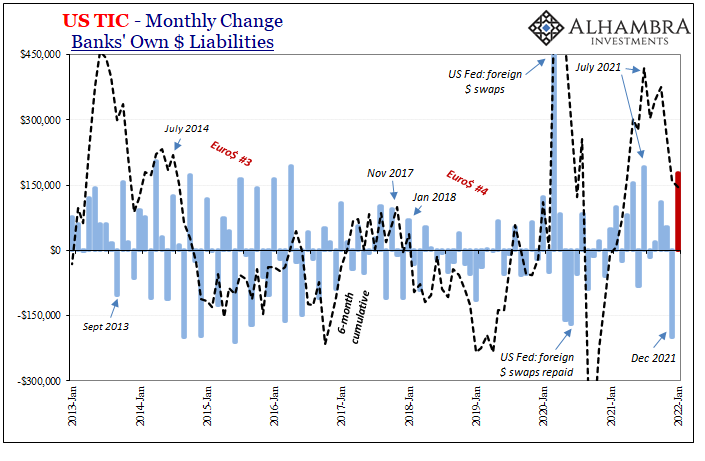

It Wouldn’t Be TIC Without So Much Other

With the Fed (sadly) taking center stage last week, and market rejections of its rate hikes at the forefront, lost in the drama was January 2022 TIC. Understandable, given all its misunderstood numbers are two months behind at their release. There were some interesting developments regardless, and a couple of longer run parts that deserve some attention.

Read More »

Read More »

Short Run TIPS, LT Flat, Basically Awful Real(ity)

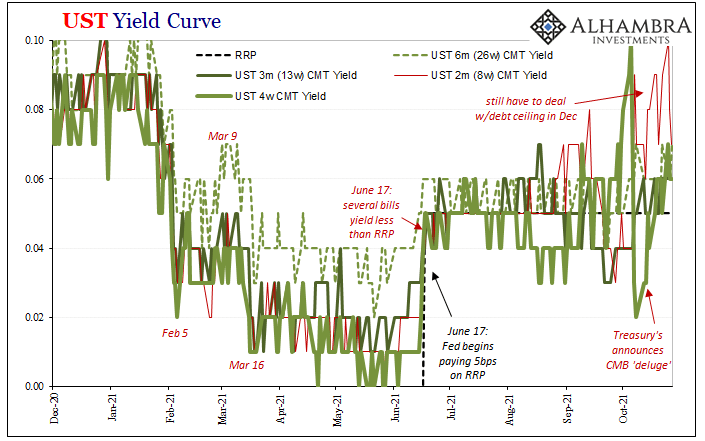

Over the past week and a half, Treasury has rolled out the CMB’s (cash management bills; like Treasury bills, special issues not otherwise part of the regular debt rotation) one after another: $60 billion 40-day on the 19th; $60 billion 27-day on the 20th; and $40 billion 48-day just yesterday.

Read More »

Read More »

Taper *Without* Tantrum

Whomever actually coined the term “taper”, using it in the context of Federal Reserve QE for the first time, it wasn’t actually Ben Bernanke. On May 22, 2013, the central bank’s Chairman sat in front of Congressman Kevin Brady and used the phrase “step down in our pace of purchases.” No good, at least from the perspective of a media-driven need for a snappy one-word summary.

Read More »

Read More »

A Real Example Of Price Imbalance

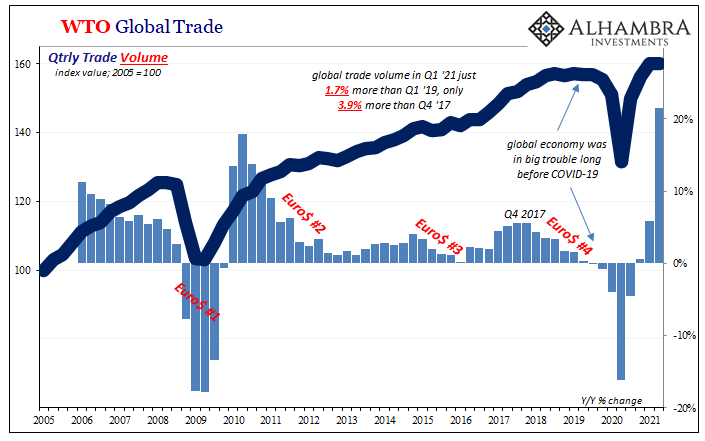

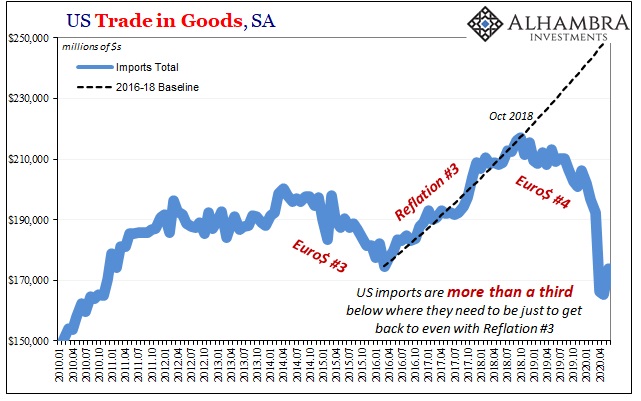

It’s not just the trade data from individual countries. Take the WTO’s estimates which are derived from exports and imports going into or out of nearly all of them. These figures show that for all that recovery glory being printed up out of Uncle Sam’s checkbook, the American West Coast might be the only place where we can find anything resembling Warren Buffett’s red-hot claim.

Read More »

Read More »

Real Dollar ‘Privilege’ On Display (again)

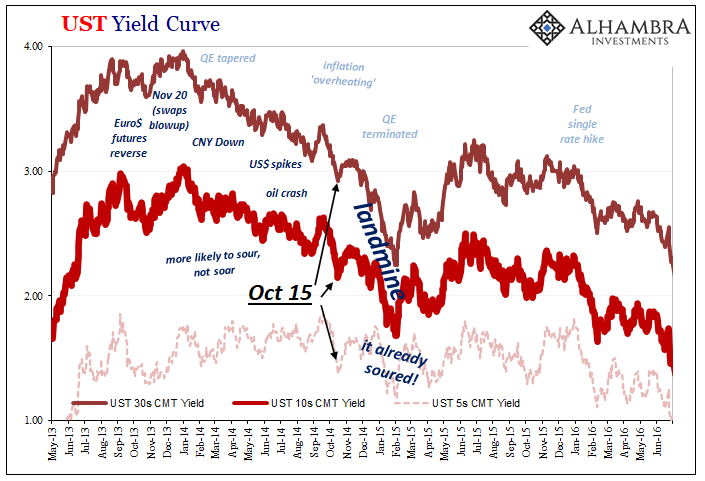

Twenty-fifteen was an important yet completely misunderstood year. The Fed was going to have to become hawkish, according to its models, yet oil prices crashed and the dollar continued to rise. Both of those things were described as “transitory” by Janet Yellen, and that they were helpful or positive (rising dollar means cleanest dirty shirt!), but domestically American policymakers’ clear lack of conviction and courage about that rate hike regime...

Read More »

Read More »

For The Dollar, Not How Much But How Long Therefore How Familiar

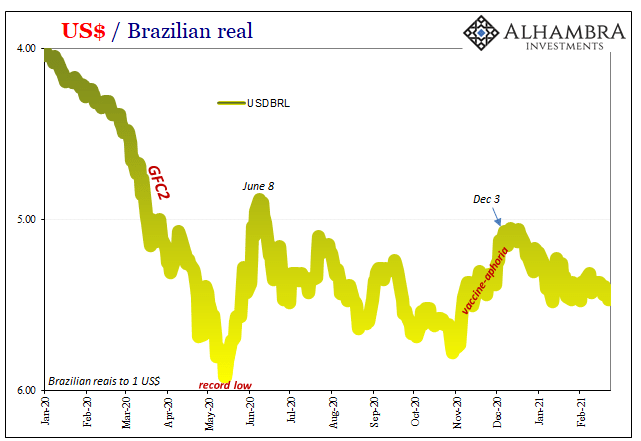

Brazil’s stock market was rocked yesterday by politics. The country’s “populist” President, Jair Bolsonaro, said he was going to name an army general who had served with Bolsomito (a nickname given to him by supporters) during that country’s prior military dictatorship as CEO of state-owned oil giant Petróleo Brasileiro SA. Gen. Joaquim Silva e Luna is being installed, allegedly, to facilitate more direct control of the company by the federal...

Read More »

Read More »

The Endangered Inflationary Species: Gazelles

Nevada is, by all accounts and accountants, in rough shape. Very rough shape. An economy overly dependent upon a single industry, tourism, in this case, is a disaster waiting to happen should anything happen to that industry. Pandemic restrictions, for instance.

Read More »

Read More »

What Did Hamper Growth ‘In A Few Months’

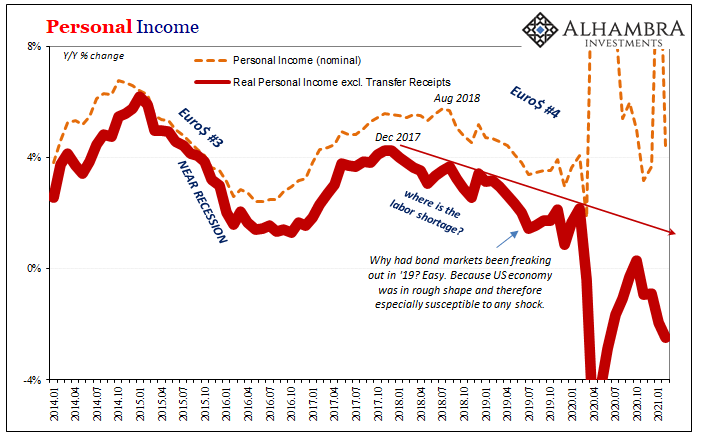

Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign.

Read More »

Read More »

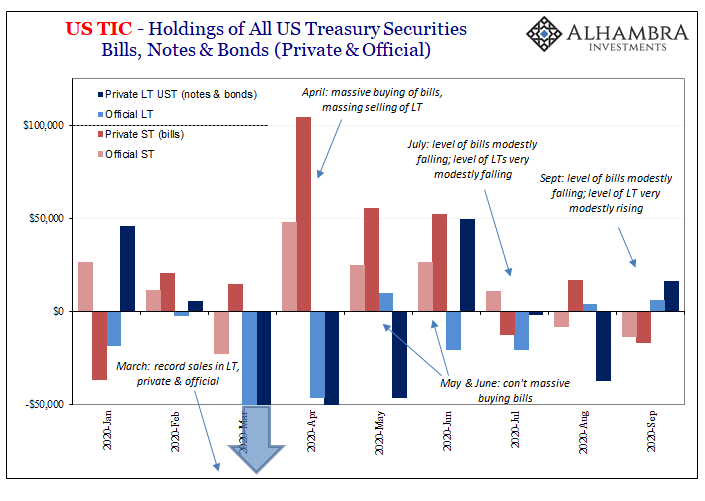

Just Who Is, And Who Is Not, Selling T-Bills

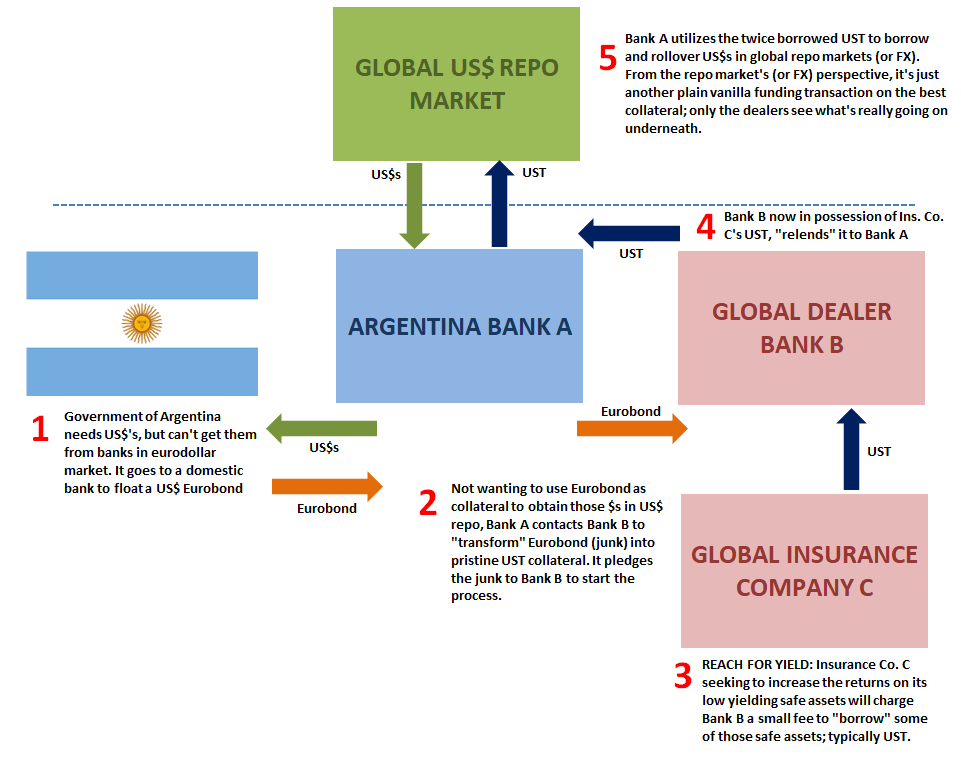

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral.

Read More »

Read More »

Treasury Auctions Are Anything But Sorry Because They’ve Never Been Sorry About Solly

Twenty years ago, in November 2000, the Treasury Department changed one aspect of the way the government would sell its own debt. Auctions of these and other kinds of securities had been ongoing for decades, back to the twenties, and they had been transformed many times along the way. In the middle of the 1970’s Great Inflation, for example, Treasury gradually phased out all other means for issuing securities, by 1977 relying exclusively on...

Read More »

Read More »

What’s Zambia Got To With It (everything)

As one of Africa’s largest copper producers, it seemed like a no-brainer. Financial firms across the Western world, pension funds from the US or banks in Europe, they lined up for a bit of additional yield. This was 2012, still global recovery on the horizon – at least that’s what “they” all kept saying.

Read More »

Read More »

Reopening Inertia, Asian Dollar Style (Still Waiting On The Crash)

Why are there still outstanding dollar swap balances? It is the middle of September, for cryin’ out loud, and the Federal Reserve reports $52.3 billion remains on its books as of yesterday.

Read More »

Read More »

Bottleneck In Japanese

Japan’s yen is backward, at least so far as its trading direction may be concerned. This is all the more confusing especially over the past few months when this rising yen has actually been aiding the dollar crash narrative while in reality moving the opposite way from how the dollar system would be behaving if it was really happening.

Read More »

Read More »

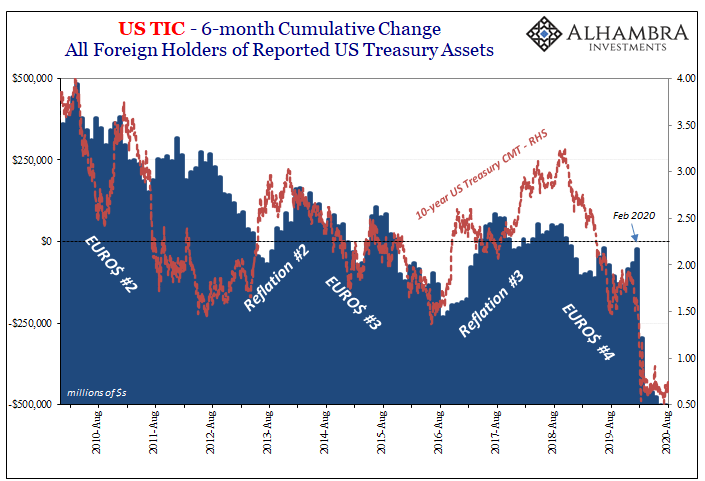

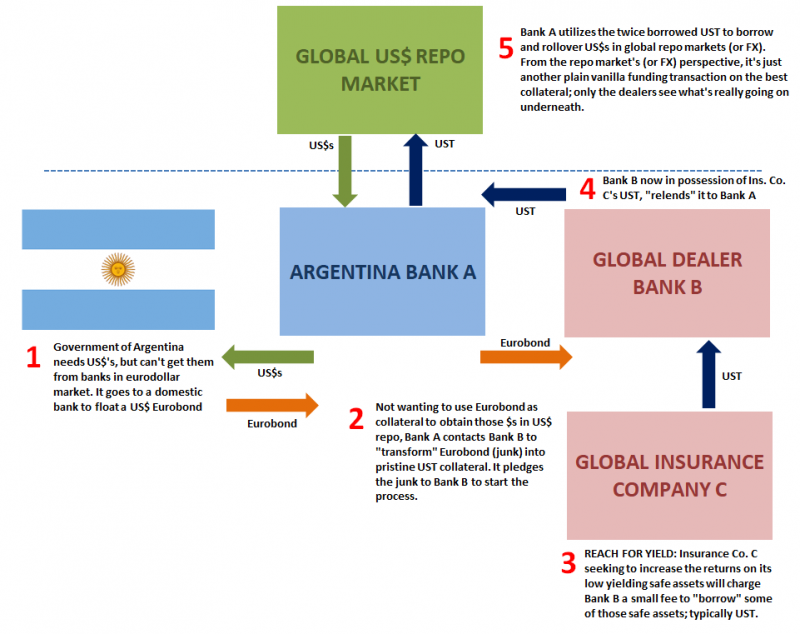

Part 2 of June TIC: The Dollar Why

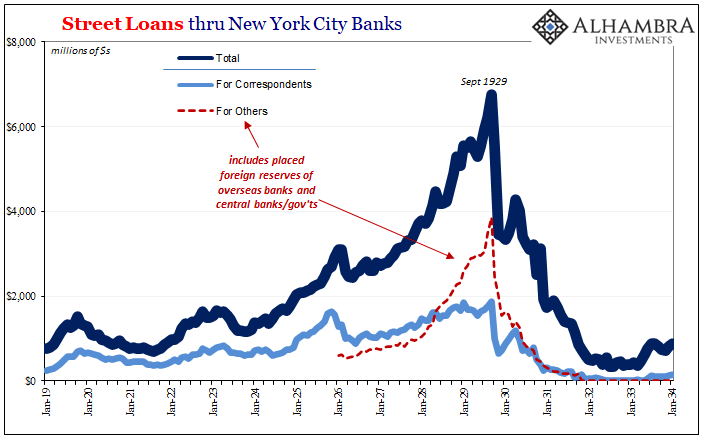

Before getting into the why of the dollar’s stubbornly high exchange value in the face of so much “money printing”, we need to first go back and undertake a decent enough review of the guts maybe even the central focus of the global (euro)dollar system.

Read More »

Read More »

Shoe V arning

It’s no wonder we’re obsessed with shoes these days. Even the V-people, as I’ll call them, keep one wary eye glued looking behind them. Survivor’s euphoria means a lot of potentially bad things, only beginning with a false sense of survivor-hood.

Read More »

Read More »