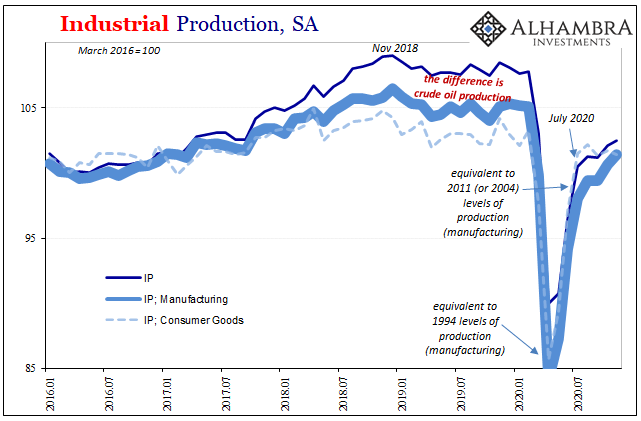

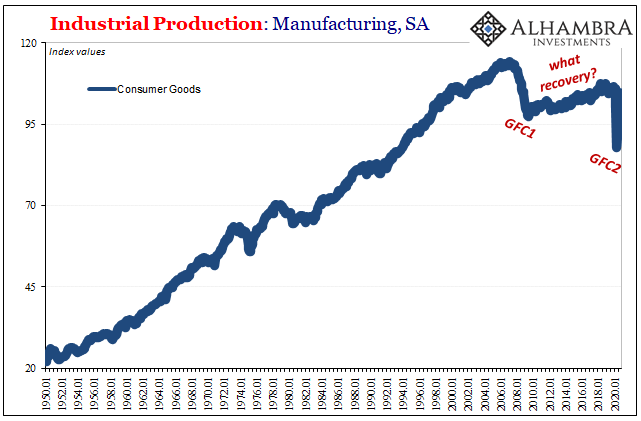

| Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign.

Summer slowdown extends in Industrial Production. According to the Federal Reserve, the outfit which has kept tabs on this economic sector for more than a century, the economic rebound from 2020’s big collapse bent the wrong way around July and hasn’t yet been able to curve its way back in the good direction. |

US Industrial Production, SA 2011-2020 |

| Over the four months since, through November, IP has come back by just a little over 2%.

While a 6.7% annual rate sounds fantastic – given where things stood even before COVID – it isn’t near enough to make up for the almost 17% drop March and April. Because of the clear and sustained slowdown, IP in November 2020 remained a very recession-like 5.5% below where it had been in November 2019. And, lest we forget, US industrial output in November 2019 was already a touch (-0.4%) less than it had been in November 2018. Landmines and their (ongoing) aftermath. |

Industrial Production, SA 2016-2020 |

Industrial Production: Manufacturing, SA 1950-2020 |

|

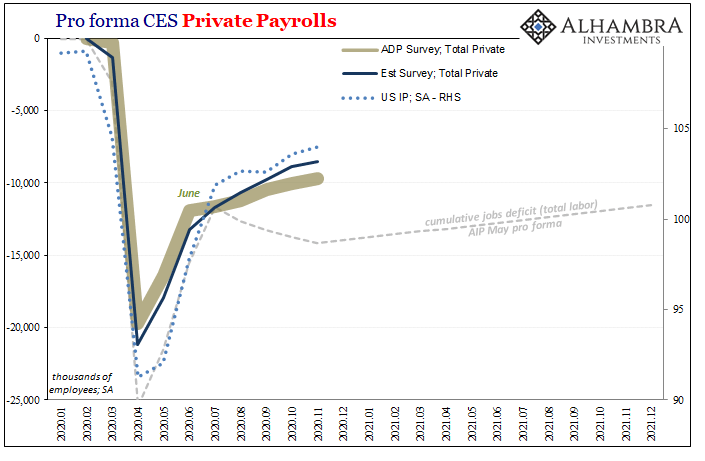

| The implications, at least, are very simple and straightforward: as we’ve been saying since summer, the production side of the economy never bought the “V.” Largely because of this, this segment (which includes services; so much of the service sector is dedicated to managing, transporting, and selling what industry makes or extracts) hasn’t been hiring and rehiring near enough to create a recovery. Negative spillovers abounded.

Like the labor market, output isn’t even halfway. And that should boggle the mind given what would have happened if there had been a “V.” Economic activity beginning with industry should’ve not only rebounded to where it was prior in February (or November 2018, if we’re truly keeping score), it would’ve surged way above for at least a few months to make up for those when production was largely closed down. In the immediate aftermath, during the reopening frenzy, that scenario had been somewhat plausible, at least for officials hoping to make the message reasonably saleable to the general public as a way to float as much optimism as humanly possible. |

Pro forma CES Private Payrolls, 2020-2021 |

| Overall economy activity, including the labor market, came back really quickly in the initial stage (gigantic positives).

That all stopped, though, and for reasons that no one seems to want to venture an explanation. The “V” died and we’re left otherwise to believe that a resurgent COVID bug did the deed. Nope. This thing turned, again, back in July for IP and in June for a lot of data including employment figures (and markets which sniffed it out in real-time). As gigantic as those positives had been, they actually weren’t near enough to convince economic actors (employers, consumers) to take on the risks a true recovery demands. Neither was QE and all those government stipends pretending to be “stimulus.” Of the latter, such aid was legitimate and legitimately necessary given the situation. It wasn’t, however, going to be sufficient to bring about the “V”-shaped recovery. |

Pro forma CES Private Payrolls, 2020-2021 |

Already the economy was put in a horrible position by GFC2; on top of what had been, at minimum, a manufacturing and industrial recession prior to this year which had been ongoing for a very long time (Euro$ #4). I wrote the following on March 26, the title all-too-accurate as it has turned out, if you’ll permit me the extent of the reminder:

Add US industry to the already-lengthy list populated by a broad survey of wide-ranging data showing you that, yes, definitely more slowly, way too slowly, such that sadly fewer of displaced workers really will have their livelihoods restored. Vaccines won’t fix this. Nor is inflation coming out of it.

|

Pro forma CES Private Payrolls, 2020-2021 |

Full story here Are you the author? Previous post See more for Next post

Tags: consumer goods,currencies,economy,employment,Euro$ #4,Featured,Federal Reserve/Monetary Policy,GFC1,GFC2,global dollar shortage,industrial production,industry,manufacturing,Markets,newsletter,recession