Tag Archive: Argentina

Dollar Retreat Extended, but Turn Around Tuesday may have Already Begun

Overview: Last week's dollar losses have been

extended today. The yen is leading the move, encouraged by talk of a buying by

a large US real money fund. The Dollar Index is off about 0.35% after sliding

1.8% last week. It is below the 200-day moving average for the first time since

late August. As was the case last week, the Canadian dollar is the laggard. Emerging

market currencies are also mostly higher. The Chinese yuan's 0.67% rise is the

most...

Read More »

Read More »

JPY150 Pierced but Market is Not Done

Overview: News that Israel's ground assault

on Gaza is being delayed while hostage negotiations continue saw gold and oil ease,

but tensions continue to run high. Gold peaked near $1997 before the weekend

and pulled back to about $1964 today before steadying. December WTI peaked in

front of $90 a barrel at the end of last week, and fell to about $86.85 today,

but has also steadied. The dollar is firmer against the G10 currencies, with

the Scandis...

Read More »

Read More »

Greenback Remains Firm, with Yen and Aussie Falling to New 2023 Lows

Overview: The dollar and US rates remain firm. The

greenback rose to new highs for the year against the Japanese yen and

Australian dollar before steadying. Outside of the Swedish krona, which is off

nearly 0.5%, the G10 currencies are nursing small losses late in the European

morning, mostly less than 0.1%. Most emerging market currencies are also lower. The Chinese

yuan gapped lower for the second consecutive session and is also approaching

this...

Read More »

Read More »

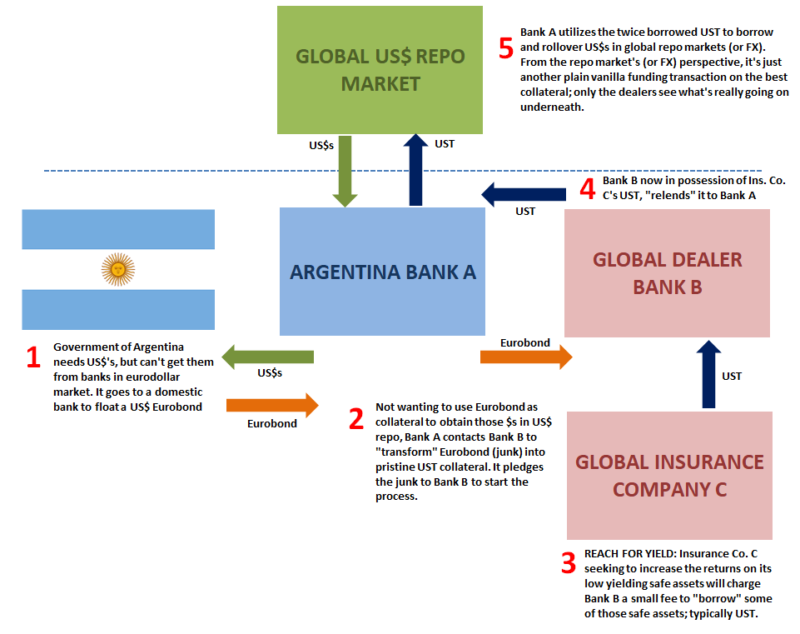

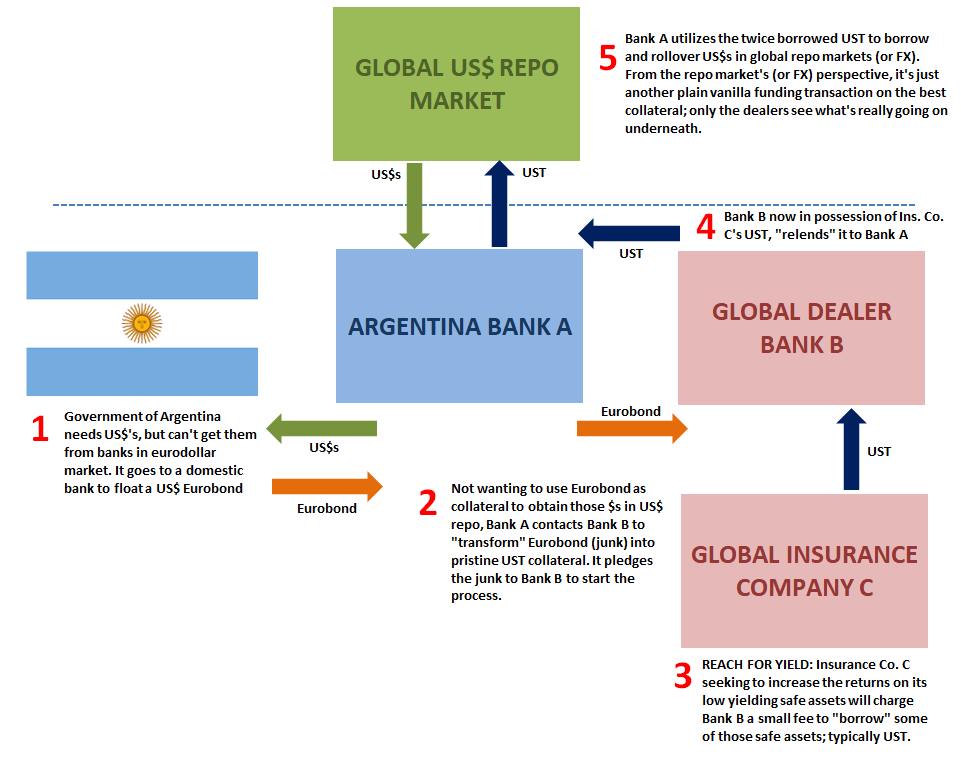

Eurobonds Behind Euro$ #5’s Collateral Case

The bond market is allegedly populated by the “smart” set, whereas those trading equities derided as the “dumb” money (not without some truth). I often wonder if it’s either/or. The fixed income system just went through this scarcely three years ago, yet all signs and evidence point to another repeat.

Read More »

Read More »

An International Puppet Show

It’s actually pretty easy to see why the IMF is in a hurry to secure more resources. I’m not talking about potential bailout candidates banging down the doors; that’s already happened. The fund itself is doing two contradictory things simultaneously: telling the world, repeatedly, that it has a highly encouraging $1 trillion in bailout capacity at the same time it goes begging to vastly increase that amount.

Read More »

Read More »

FX Daily, April 21: Oil Drilled Below Zero, Equity Rally Stalls, Greenback Advances

Overview: Oil's wild ride has been joined by two other developments that are keeping investors off-balance. First, reports suggest that North Korea's Kim Jong-Un maybe in critical condition after surgery. He apparently was absent from last week's events celebrating his grandfather.

Read More »

Read More »

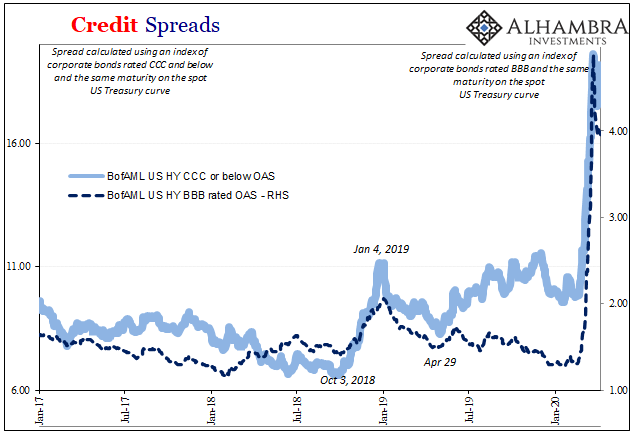

Fragile, Not Fortified

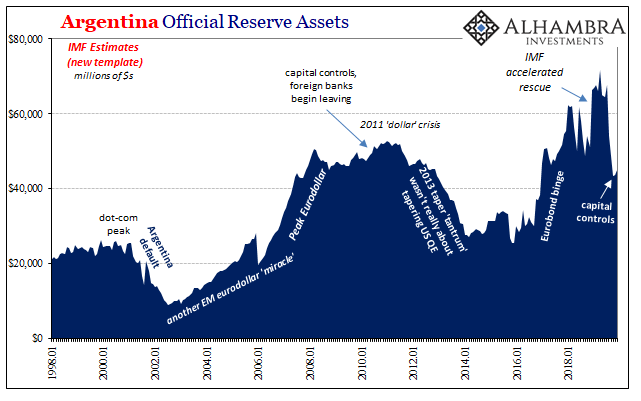

On Sunday, Argentina’s government announced it was postponing payment on any domestically-issued debt instruments denominated in foreign currencies. That means dollars, just not Eurobonds. At least not yet. In response, ratings agencies such as Fitch declared the maneuver a distressed debt exchange.In other words, technically a default.

Read More »

Read More »

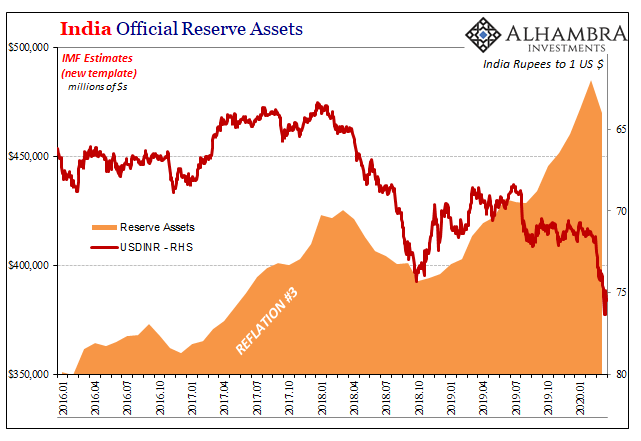

(No) Dollars And (No) Sense: Eighty Argentinas

India like many emerging market countries around the world holds an enormous stockpile of foreign exchange reserves. According to the latest weekly calculation published by the Reserve Bank of India (RBI), the country’s central bank, that total was a bit less than half a trillion. While it sounds impressive, when the month began the balance was much closer to that mark.

Read More »

Read More »

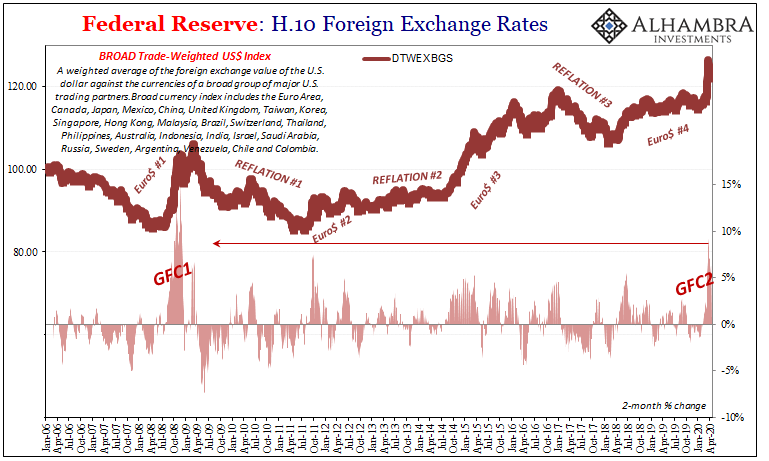

Time Again For Triple Digit Dollar

Being a member of the institutional “elite” means never having to say you’re sorry; or even admit that you have no idea what you are doing. For Christine Lagarde, Mario Draghi’s retirement from the European Central Bank could not have come at a more opportune moment. Fresh off the Argentina debacle, she failed herself upward to an even better gig.

Read More »

Read More »

FX Daily, December 3: US Brandishes Tariff Weapon and Weakens Animal Spirits

Asia Pacific equities mostly declined in sympathy with yesterday's large sell-off in the US and Europe. China and Taiwan were the notable exceptions, while Australia's 2.2% decline, following the central bank meeting that resulted in what many are seeing as a hawkish hold, led the move lower. Europe's Dow Jones Stoxx 600 fell 1.6% yesterday, the largest loss in two months, and is extending the losses for a third session today.

Read More »

Read More »

FX Daily, August 13: Investors Remain on Edge

Overview: The confrontation in Hong Kong and the fallout from the Argentine primary over the weekend join concerns the conflict between the two largest economies and slower growth to force the animal spirits into hibernation. Global equities remain under pressure. Japan's Topix joined several other markets in the region to have given up its year-to-date gain.

Read More »

Read More »

FX Daily, August 12: Yen Remains Bid, While Macri’s Loss in Argentina Weighs on Struggling Mexican Peso

Overview: China again tried to temper the downside pressure on the yuan, and this appears to be helping the risk-taking attitude. Many centers in Asia were closed today, including Japan and India, though most of the other equity markets advanced modestly, including China, Korea, and Australia. Europe's Dow Jones Stoxx 600 opened firmer but is staddling little changed levels unable to stain any upside momentum.

Read More »

Read More »

FX Daily, April 25: Equities Waiver, the Dollar Does Not

Overview: After closing at record highs on Tuesday, the S&P 500 slipped yesterday, and the Dow Jones Stoxx 600 snapped an eight-session advance. Asia followed suit, with the Shanghai Composite posting its biggest loss (~2.4%) in over a month. It is off about 4.6% this week, which if sustained tomorrow, would be the largest loss in six months.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX ended mixed in Friday, capping off an up and down week. RUB and TRY initially firmed on their respective rate hikes but gave back some of those gains heading into the weekend. Trade tensions are likely to remain high, as press reports suggest President Trump is pushing ahead with tariffs on $200 bln of Chinese imports even as high-level talks are planned.

Read More »

Read More »

Emerging Markets: What has Changed

Philippine central bank signaled another big hike. Poland central bank appears to be moving its forward guidance out further. Russia officials are sending confusing signals regarding monetary policy. Russia officials stand ready to support the ruble debt market if new US sanctions negatively impact it. South Africa’s African National Congress pledged to undertake land reform responsibly.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM FX came under greater pressure last week as the situation in Turkey deteriorated. With no weekend developments as of this writing, we expect Turkish assets to remain under pressure this week. Five worst EM currencies YTD are TRY (-41%), ARS (-36%), RUB (-15%), BRL (-14.5%), and ZAR (-12%). All five have serious baggage that warrants continued underperformance.

Read More »

Read More »

Emerging Markets: What Changed

US-China trade tensions are rising. Pakistan devalued the rupee for a third time since December. Bulgaria will seek to join the eurozone banking union and ERM-2 simultaneously. The National Bank of Hungary appears to have tilted more hawkish. Newly elected Egyptian President El-Sisi shuffled his cabinet. Argentina has a new central bank chief after Federico Sturzenegger resigned.

Read More »

Read More »

Emerging Markets: What Changed

The Reserve Bank of India hiked rates for the first time since 2014. Malaysia’s central bank governor resigned. Czech central bank tilted more hawkish. Russia central bank tilted more dovish. Argentina got a $50 bln standby program from the IMF.

Read More »

Read More »

Emerging Markets: What Changed

Bank Indonesia started a tightening cycle with a 25 bp hike to 4.5%. Jailed Malaysia opposition leader Anwar Ibrahim was released by new Prime Minister Mahathir. Malaysia scrapped the controversial 6% goods and services tax (GST). Violent protests shook Israel as the relocated US embassy opened in Jerusalem.

Read More »

Read More »