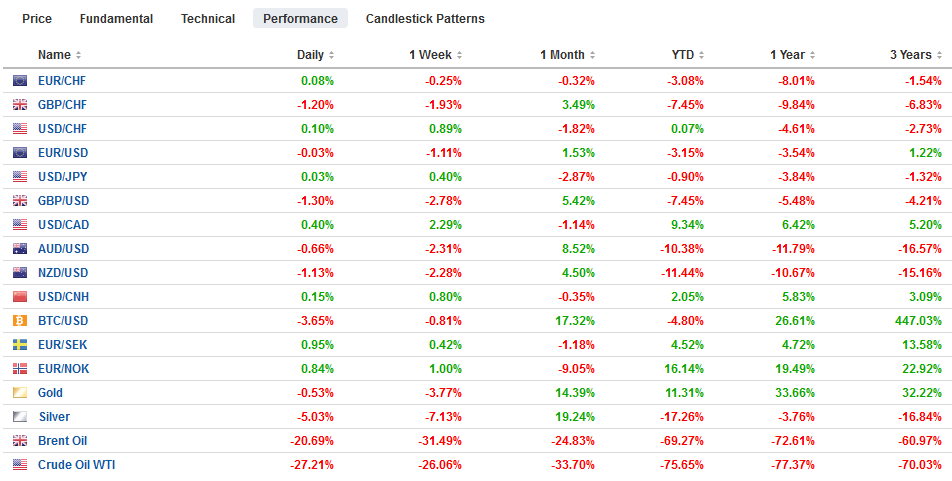

Swiss FrancThe Euro has risen by 0.05% to 1.0516 |

EUR/CHF and USD/CHF, April 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Oil’s wild ride has been joined by two other developments that are keeping investors off-balance. First, reports suggest that North Korea’s Kim Jong-Un maybe in critical condition after surgery. He apparently was absent from last week’s events celebrating his grandfather. The concern is about a potential power vacuum and the command and control of North Korea’s weapons. Second, in a tweet late yesterday, US President Trump said he would sign an executive order suspending immigration, ostensibly to fight the virus and protect jobs. No details were provided. Trump has also renewed his threat to stop imports of Saudi and Russian oil. These disruptions have seen global equities fall. Following yesterday’s 1.8% decline of the S&P 500, most of Asia Pacific’s major bourses (including Japan, Australia, Hong Kong, Taiwan, and India) fell 2% or more. Europe’s Dow Jones Stoxx 600’s three-day advance is ending, and the benchmark is off about 2% in late morning turnover. US shares are lower, with the S&P off by almost 1.0%. Bond markets are firm, with core yields off 3-4 bp, which puts the US 10-year near 57 bp. Italian bonds are under-performing. The dollar is well bid against nearly all the major and emerging market currencies. The yen is also benefiting from the risk-off. The dollar-bloc and Norwegian krone are the weakest of the majors, while the Russian rouble, South African rand, and Hungarian forint are leading the EM complex lower. Gold is heavy, near two-week lows (~$1670), and oil remains on the defensive. The May WTI jumped in early Asia above $2 but is back below zero, while the June contract has collapsed to nearly $11 from $20 yesterday and is around $16.50 as this is written. |

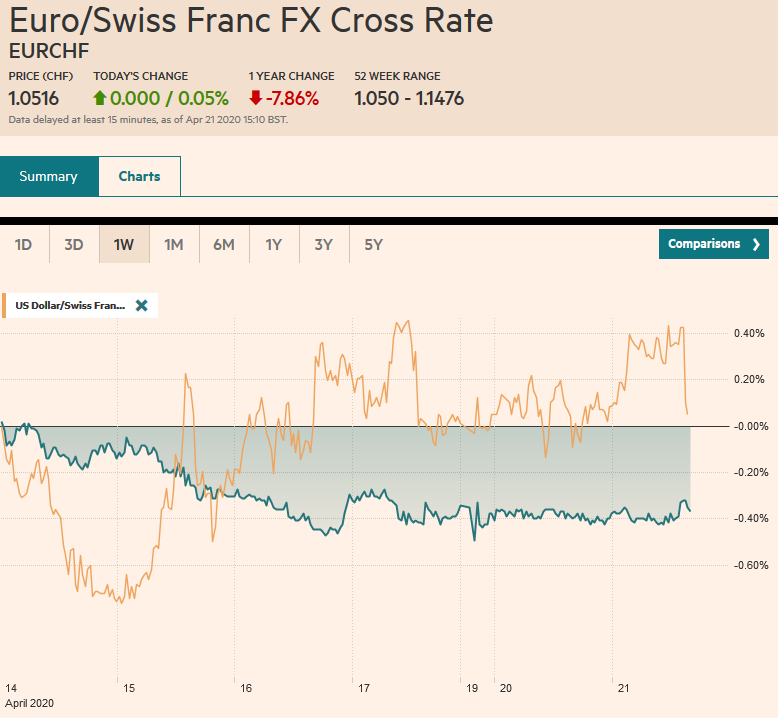

FX Performance, April 21 |

Asia Pacific

Fitch downgraded Hong Kong’s credit to AA- yesterday from AA, noting that it has been hit with two shocks–the demonstrations and now the virus. It warns that growth may contract 5% this year after falling 1.2% last year. Nevertheless, the relatively wide interest rate differential over the US has sent the Hong Kong dollar to the strong part of the band for the first time in nearly four years. The LIBOR spread was its widest in 20 years. The key spot level is HKD7.75. The Hong Kong Monetary Authority intervened, selling HKD for the first time in four years.

South Korea reported exports fell 27% in the first 20-days of April compared with a year ago. Exports to China were off 17%, while shipments to the US fell 18%, and to Japan, down 20%. In terms of products, semiconductor shipments were off 15%, and autos, nearly 30% lower. The data was poor but likely overstated. The period had two fewer working days than a year ago. Adjusted for this, exports were off about 17% on an average daily basis.

The dollar is trading at three-day lows against the Japanese yen near JPY107.25. There are a couple of option expirations today that may slow the dollar’s descent. There is a $730 option at JPY107.05 and another for $645 mln at JPY106.80. The greenback dipped a little below JPY107 last week but has not been below JPY106.80 since mid-March. The Australian dollar failed to resurface above $0.6400 yesterday and has been sold below $0.6300 today. Last week’s low was set near $0.6265, and a break signals a test on $0.6200 and possibly $0.6100 in the near-term. The US dollar is trading near two-week highs against the Chinese yuan, near CNY7.09.

Europe

German Chancellor Merkel showed the first sign that the European Council (heads of state) could take new measures on top of the compromise struck by Eurogroup (finance ministers). Without committing, Merkel seemed a bit more sympathetic to increasing the EU budget and a possible EU bond. A joint bond where each member is individually and collectively responsible is difficult to fathom. Still, a bond where the obligation is limited to a country’s share of the EU budget seems more politically realistic. However, the EU does not have the power to tax, so how it would service the debt would need to be worked out, especially if it is not to count toward the debt of the members. It is also noteworthy that Merkel may be trying to position it as an EU rather than an EMU issue.

Germany’s April ZEW survey appears to have captured the moment. The current assessment is dismal. At -91.5, it is the worst in a decade (from -43.1 in March). However, the expectations component defied expectations. It surged from -49.5 in March to 28.2 in April. This is the strongest reading in five years. Small shops are re-opening in Germany this week, and there is hope that an economic recovery begins in earnest in Q3.

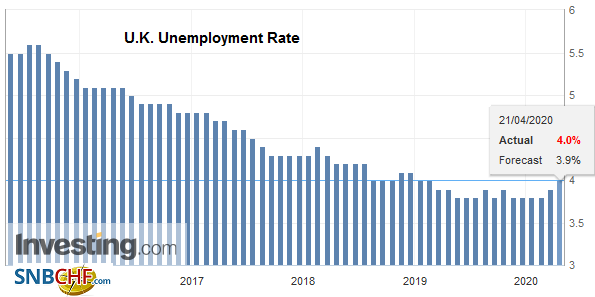

| The UK’s employment figures were better than expected. The claimant count in March edged up to 3.5% from a revised 3.4% in February. Jobless claims rose by a mild 12.2k after a 5.9k increase in February. It had originally reported a 17.3k rise in February. On the other hand, earnings data, which is lagged by another month, disappointed. Average weekly earnings slowed to 2.8% from 3.1% (three-month, year-over-year). The ILO employment rate ticked up to 4.0% from 3.9%. The UK reports March CPI tomorrow. Price pressures are expected to have continued to moderate. |

U.K. Unemployment Rate, February 2020(see more posts on U.K. Unemployment Rate, ) Source: investing.com - Click to enlarge |

The euro is softer, but it held above last week’s low (~$1.0810) in early European turnover. It seems unlikely to be able to overcome resistance in the $1.0860-$1.0880 area today. A break of $1.08 would spur a test on the $1.0770 area seen earlier this month. Sterling, on the other hand, has broken down to nearly two-week lows around $1.2350. Yesterday, it had briefly poked above $1.2500. The 20-day moving average is found near $1.2380, and sterling has not closed below it since late March. Chart support is seen in the $1.2180-$1.2200 area.

America

The collapse of the May WTI contract was epic. Perhaps lost on many, unlikely many financial futures that are cash-settled, the oil futures contract calls for physical settlement. Some participants had waited for the last day of trading to roll their position from May to June. When they went to sell their May contract, no one wanted to take delivery in Cushing, which is running out of unencumbered storage. The market imploded, and the May contract at one pointed traded lower than minus $40 a barrel. Participants are likely to make one of two mistakes. The first is to exaggerate the negative price of the May contract. It applies to a small and nearly inconsequential part of the oil market. It is due to oil specific considerations, and extrapolations to other markets may not be particularly helpful. The second mistake is not to appreciate the implications. A significant imbalance of supply and demand will last a while. Looking at the futures strip, light sweet crude is below $35 a barrel through October 2021. The collapse in the June contract warns that despite expectations of sharp drops in output (OPEC+ agreement and market-forced) will not be sufficient to alleviate the storage shortage.

It is hard to imagine a repeat of yesterday’s action as the June contract nears expiry, even if a negative price is seen again. Speculators will be more nimble in rolling to the next contract earlier. Others, caught off-guard by the developments, will be better prepared next time to take advantage of low if not negative oil prices. The pace of accumulation of inventories may slow as US production is pinched. Recall that the OPEC+ output cut agreement does not take effect until May 1. Saudi Arabia had already ramped up production this month and cut prices to Asia next month. US oil rig count has fallen by more than a third in the past five weeks. Low oil prices dampen headline inflation measures, just as some observers begin fretting about the inflation implications of either the federal government or the Federal Reserve policies A reduction of US shale output may boost the price of some of the byproducts, like gas. If oil prices remain low for an extended period, as the futures market implies, it risks weakening the shift to non-carbon fuels and materials.

The US Senate is expected to vote today on another emergency stimulus bill for around $500 bln. Most of the funds will be earmarked for the Payroll Protection Progam that turns business loans into grants if employment is maintained through September (begs the question of what happens in Q4). The House Democrats were looking for $100 bln for hospitals, but the compromise seems to be around $75 bln. They were also looking for aid to the state governments. Still, it appears the White House wants it separately, and instead, a compromise for funds to the Economic Injury Disaster Loan program, which includes grants, has been offered. It might pass the Senate without objection, which would allow the Senators not to return to Washington. The House may vote on the bill Wednesday. It is unlikely to be unanimous, which means the Representative would have to return to vote.

Three creditor groups rejected Argentina’s proposal to delay interest rate payments until 2023 and principal payments until 2026 on about $83 bln of foreign debt, which covers past restructured bonds as well as the more recent issues. Unless a compromise can be found, Argentina is headed for its ninth default. Even before the crisis hit, Argentina’s debt seemed unsustainable. The dollar has risen for 14 consecutive weeks. Through yesterday, the Argentine peso is off about 9.25% against the dollar year-to-date. In comparison, the Mexican peso is off about 21%, and the Brazilian real has depreciated almost 24%. The costs of insuring (five year CDS) against Mexico and Brazilian sovereign default are trading a little below 300 bp. In early March both were near 100 bp.

The combination of weaker equities and the continued drop in oil prices is weighing on the Canadian dollar. The US dollar is near CAD1.4260, its highest since April 6, and is near the (50%) retracement of the decline since reaching almost CAD1.4670 on March 19. The next target is near CAD1.4360, but the intraday technicals suggest scope for a pullback, and the upper Bollinger Band (two standard deviations above the 20-day moving average) is found near CAD1.4270. Initial support is seen around CAD1.4200. The greenback is bid against the Mexican peso, but it is below last week’s high (~MXN24.43). A move above the MXN24.50 area risks a return toward the spike high seen to the record set earlier this month near MXN25.78.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,Argentina,Currency Movement,EUR/CHF,Hong Kong,newsletter,OIL,South Korea,U.K. Unemployment Rate,USD/CHF