Tag Archive: OIL

Greenback Returns Better Bid

Overview: After the making marginal new highs in

early North America yesterday, the dollar pulled back, arguable dragged lower

by the softness of US rates, helped by the sharp drop in oil prices and healthy

reception to the US three-year note auction. However, the greenback has

returned better bid today as the market continues to search for direction

post-FOMC and US jobs report. The euro and sterling are the weakest of the G10 currencies

through...

Read More »

Read More »

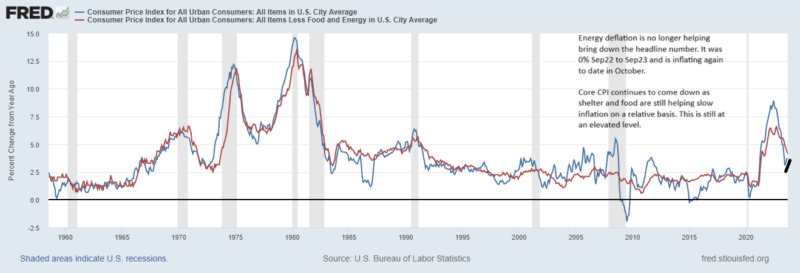

Macro: Sep CPI stuck at 3.7% YOY

The most anticipated release of the week came in … “Unchanged” or sticky stuck from the August at 3.7% yoy. But it’s worth mentioning as we will discuss below that this is up from June CPI which was 3.09% yoy. Core CPI which excludes food and energy because of their volatility sits at 4.13% yoy down from 4.39% last month.

Let’s look under the hood a bit because headlines will mention “sticky” CPI and there are some reasons that CPI will indeed...

Read More »

Read More »

The Dollar and Oil Steady After Yesterday’s Advance

Overview: Bonds and stocks are mostly heavier today

and the dollar has turned mixed. Oil prices are consolidating after soaring to

new highs since late last year on the longer than expected extension of Saudi

Arabia's extra cut of one million barrels a day. Since July, it has been

extending it by one month at a time. Yesterday, it extended it through Q4. Russia,

who had previously indicated intentions on reducing its exports by 500k

barrels,...

Read More »

Read More »

Dollar Comes Back Bid

Overview: The US dollar is recovering today

after it was sold following the jobs report before the weekend. It is enjoying

a firmer bias against nearly all the G10 currencies. The dollar-bloc is faring

best, while the Scandis are off close to 0.5%. Most emerging market currencies

are also softer, with only a few Asian currencies edging higher today,

including the South Korean won, Indian rupee, and Taiwanese dollar. With a

stronger dollar and...

Read More »

Read More »

PBOC Surprise Rate Cut and a Strong UK Labor Market Report Ahead of US CPI

Overview: A surprise cut in China's seven-day repo

and a stronger than expected UK employment report are session's highlights

ahead of the US CPI. The base effect alone suggests a sharp fall in the

year-over-year rate, while the median forecast in Bloomberg's survey has been

shaved to a 0.1% month-over-month gain. The dollar is under pressure and is

weaker against nearly all the G10 currencies. It is mixed against the emerging

market currencies....

Read More »

Read More »

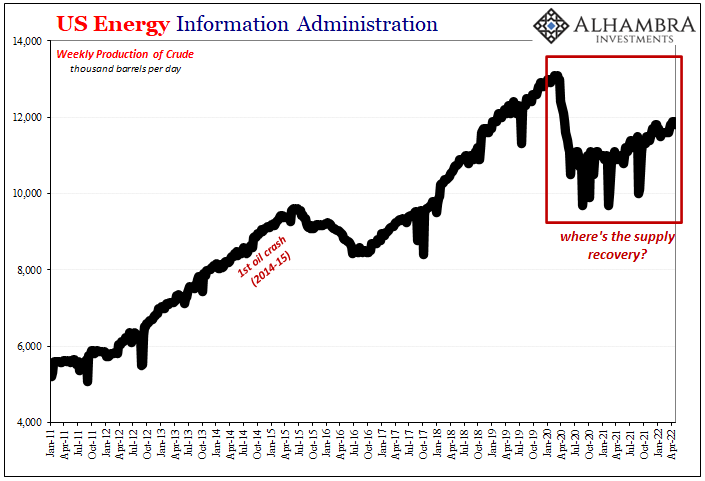

OPEC+ Surprises while Manufacturing Remains Challenged

Overview: News of OPEC+ unexpected output cuts saw May WTI gap

sharply higher and helped lift bond yields. May WTI settled near three-week

highs before the weekend near $75.65 and opened today near $80. It reached

almost $81.70 before stabilizing and is straddling the $80 area before the

North American session. The high for the year was set in the second half of

January around $83. Benchmark 10-year yields are up 2-5 bp points. The 10-year

US...

Read More »

Read More »

US Dollar Comes Back Better Bid

Overview: Although the US January CPI was in line with

expectations, the year-over-year rate was a little firmer than expected. Still, the measure that Fed Chair Powell has underscored, core services, excluding shelter, moderated with a 0.3% month-over-month gain. US rates shot up and this lent

the dollar support, while weighing on equities and risk sentiment. The US

two-year note yield rose to almost 4.64% yesterday, the highest in three months....

Read More »

Read More »

A Day of Surprises

(I

am on a business trip and did not intend to post any analysis today. However,

there have been a number of unexpected developments that warrant some

commentary. Thanks for bearing with me.) Japanese press reports that the BOJ Deputy

Governor Amamiya turned down the opportunity to become the next BOJ governor. Instead,

next week, former BOJ board member Kazuo Ueda will be nominated. The market

reacted dramatically, taking the yen sharply higher...

Read More »

Read More »

Euro Pokes Above $1.09. Will it be Sustained?

Overview: The Lunar New Year holiday has shut many centers in Asia until the middle of the week, though China's mainland is on holiday all week. The signaling of a downshift in the pace of Fed tightening by some notable hawks helped lift risk appetites ahead of the weekend and saw the

S&P 500 snap a four-day decline.

Read More »

Read More »

Chinese Stocks Extend Rally Even Though Covid Infections Appear to be Spreading

Overview:

The easing of vaccination, quarantine, and some travel protocols

related to Covid in China (and Hong Kong) continues to draw funds back into Chinese

stocks, wherever they trade. The Hang Seng rose 2.3% today to close the week

with a nearly 6.6% advance. The index of mainland companies that trade there

rose 2.5% on the day for a7.3% weekly gain. The CSI 300 of mainland shares rose

1% today and almost 3.3% for the week. Japan’s 1% gain...

Read More »

Read More »

Attention turns to US Jobs while the Yen’s Surge Continues

Overview: There have been significant moves in the capital markets this week

and participants are turning cautious ahead of the US employment report. After the

US equity market rally stalled yesterday, nearly all the Asia Pacific bourses fell

today. The strength of the yen (~3.8% this week) has weighed on Japanese equities

(Nikkei -1.8% this week) and spurred the BOJ to buy ETFs today for the first

time in five months. Europe’s Stoxx 600 is...

Read More »

Read More »

Calm Markets with Japan on Holiday Today and the US Tomorrow

Overview: The capital markets are quiet today with

Japan on holiday and the US on holiday tomorrow. Asia Pacific equities were

mostly firmer after yesterday’s rally on Wall Street. Europe’s Stoxx 600 is

about 0.25% higher and at its best level in three months. US futures are steady to

slightly higher. Benchmark 10-year yields are little changed. The dollar is narrowly

mixed against the major currencies, with Scandis leading the way. Sweden is...

Read More »

Read More »

Poor Chinese and Japanese Data Are Not Deterring Euphoria

Overview: Recent developments have spurred a euphoria

that is exciting the animal spirits. Greater confidence that US inflation has

peaked, and new initiatives from China, and yesterday’s Biden-Xi meeting are all

feeding this narrative. The dollar, which

slumped last week, is sliding anew today. Strategically, we anticipated the

turn, but tactically, we thought last week’s move had stretched the near-term

technical condition. The dollar is...

Read More »

Read More »

Currency and Bond Markets Challenge the Bank of Japan

Asia Pacific equities were mixed as the China, Hong Kong, Taiwan, and South Korean markets, among the large markets were unable to gain in the wake of a solid performance in the US. Europe is also struggling to maintain the upside momentum that has lifted the Stoxx 600 for the past four sessions.

Read More »

Read More »

Surging Energy Prices Pushing Europe Closer to Recession

The poor eurozone PMI underscores likely recession and weighs on the single currency, which was sold to a new 20-year low. Rather than a "Turn Around Tuesday" a broadly consolidative session is unfolding. Asian and European equities are weaker, while US futures are positive but little changed. Benchmark 10-year bond yields are mostly firmer and the premium offered by Europe's periphery is edging higher. The US 10-year is little changed near...

Read More »

Read More »

US Dollar Soft while Consolidating Yesterday’s Drop

Overview: The US dollar is consolidating yesterday’s losses but is still trading with a heavier bias against the major currencies and most emerging market currencies. The US 10-year yield is soft below 2.77%, while European yields are mostly 2-4 bp higher.

Read More »

Read More »

Update The Conflict of Interest Rate(s)

What changed? For over a month, the Treasury market had the Fed and its rate hiking figured out. Rising recession risks had been confirmed by almost every piece of incoming data, including, importantly, labor data.

Read More »

Read More »

Moderating Labor Market is what the Fed Wants

Overview: For the large rally in US stocks yesterday and the sell-off in the dollar, US rates were surprisingly little changed. This set the tone for today's action, ahead of the US employment data. Asia Pacific equities moved higher and Europe’s Stoxx 600 has edged up to extend yesterday’s rise. The 10-year US Treasury yield is little changed, hovering around 2.91%. European benchmark yields are 1-3 bp higher.

Read More »

Read More »

‘Unconscionably Excessive’ Denial

What would “unconscionably excessive” even look, legally speaking? More to the issue, who gets to decide what constitutes “excessive?”

Read More »

Read More »

Is It Being Demanded?

Shipping container rates have been dropping since early March – right around the time when we had just experienced our “collateral days” and then stood by to witness chaotic financial fireworks, inversions, the whole thing.

Read More »

Read More »