Summary

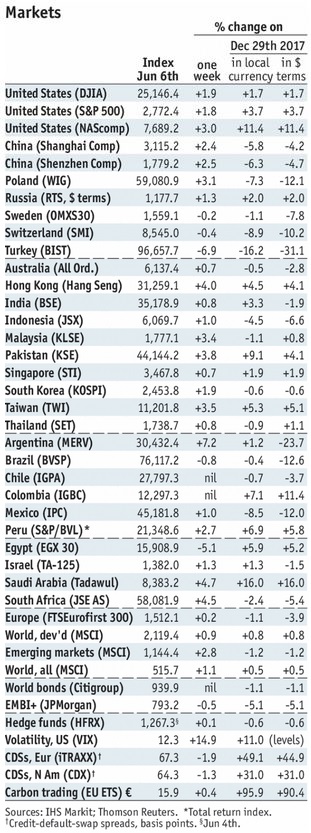

Stock MarketsIn the EM equity space as measured by MSCI, Qatar (+4.6), UAE (+3.5%), and Poland (+2.7%) have outperformed this week, while Brazil (-5.4%), Turkey (-2.6%), and Russia (-2.0%) have underperformed. To put this in better context, MSCI EM rose 0.5% this week while MSCI DM rose 1.2%. In the EM local currency bond space, Thailand (10-year yield -7 bp), Taiwan (-7 bp), and Colombia (-6 bp) have outperformed this week, while Brazil (10-year yield +69 bp), South Africa (+35 bp), and Indonesia (+31 bp) have underperformed. To put this in better context, the 10-year UST yield rose 7 bp to 2.93%.

|

Stock Markets Emerging Markets, June 6 Source: economist.com - Click to enlarge |

IndiaThe Reserve Bank of India hiked rates for the first time since 2014. However, it maintained a neutral stance, suggesting that the tightening cycle may be modest. Governor Patel said that the hike was not aimed at defending the rupee. Regardless of the motive, India has joined the list of EM countries that are tightening policy even as the Fed continues to hike rates. MalaysiaMalaysia’s central bank governor resigned. Questions have been raised as to the bank’s role in a deal linked to 1MDB. The new government accepted Governor Ibrahim’s offer to resign. In a note to central bank employees, he said he was “prepared to relinquish” his position to protect the bank’s image and reputation because of a land purchase from the government and the subsequent use of those proceeds. Czech RepublicCzech central bank tilted more hawkish. Governor Rusnok noted that wage data and the weak koruna support the case for an earlier rate hike. Deputy Governor Hampl said the bank needs to resume hiking rates to cool off the economy and will probably need to hike more than once this year. Next policy meeting is June 27, but that seems too soon in light of continued global uncertainty. We favor the August 2 meeting, but admit that a hawkish surprise this month is possible. RussiaRussia central bank tilted more dovish. First Deputy Governor Yudaeva said that “Of course, based on the inflation trend that we’re seeing at the moment, we see some room for reduction.” She added that “We’ll see whether that’s at the next meeting or later.” The next policy meeting is June 15. Market is currently split. Of the 20 analysts polled by Bloomberg, 14 see no cut and 6 see a 25 bp cut to 7.0%. ArgentinaArgentina got a $50 bln standby program from the IMF. It calls for narrower budget deficits in 2018 (-2.7% of GDP) and 2019 (-1.3%), which will entail austerity measures. Even before the deal, Argentine truckers were protesting and demanding lower fuel prices. Of note, the central bank was likely asked by the IMF to stop intervening in the FX markets and so the peso is likely to continue weakening. BrazilBrazil central bank signaled more aggressive FX intervention ahead. Central bank chief Goldfajn said the bank will offer $20 bln of new FX swaps next week, in addition to regular daily amount of $750 mln. He noted that interest rate decisions are made at every meeting, adding that COPOM will maintain its focus on inflation expectations and the risk balance. We believe it will start a tightening cycle then with a 50 bp hike to 7.0%. MexicoMexico trade tensions with US are rising. Mexico retaliated against the US steel tariffs with tariffs on several US products, including a 20% tariff on US pork imports. Furthermore, press reports suggest the US wants to split NAFTA talks into bilateral negotiations. Both Mexico and Canada have stressed that NAFTA is a multilateral deal and should remain one. As such, we believe both will reject this. PeruPeru has a new Finance Minister. Carlos Oliva was appointed by President Vizcarra after David Tuesta resigned to protest the government’s decision to water down a recent fuel tax increase in order to avert a nationwide transportation strike. Vizcarra pledged to increase revenue through more effective tax collection.

|

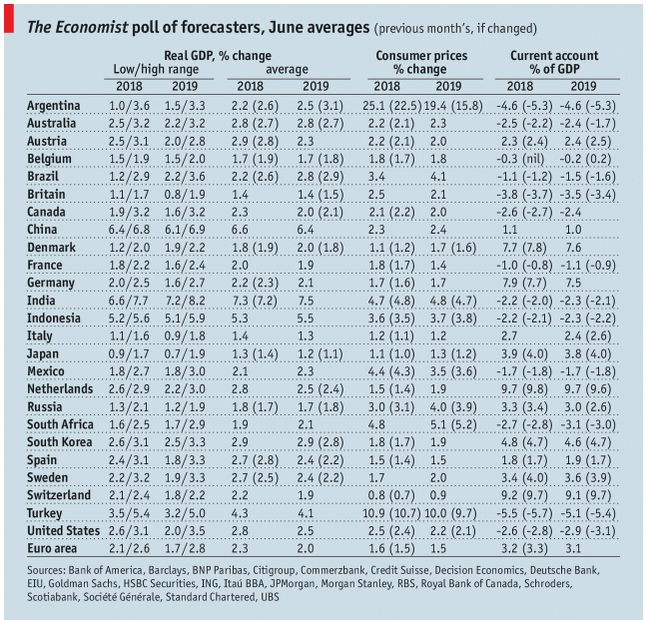

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2018 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Argentina,Brazil,Czech Republic,Emerging Markets,India,Malaysia,Mexico,newslettersent,Russia,win-thin