Summary

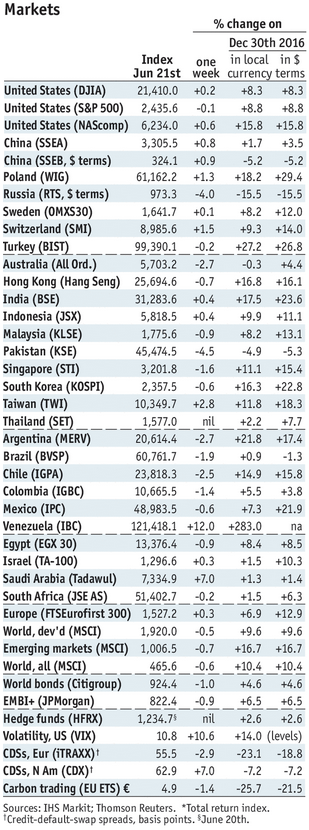

Stock MarketsIn the EM equity space as measured by MSCI, Taiwan (+2.7%), Indonesia (+2.1%), and China (+2.0%) have outperformed this week, while Colombia (-5.2%), Qatar (-2.6%), and Brazil (-2.5%) have underperformed. To put this in better context, MSCI EM rose 0.8% this week while MSCI DM fell -0.1%. In the EM local currency bond space, Russia (10-year yield -15 bp), Mexico (-7 bp), and Thailand (-6 bp) have outperformed this week, while Brazil (10-year yield +34 bp), Poland (+7 bp), and China (+5 bp) have underperformed. To put this in better context, the 10-year UST yield was flat at 2.15%. In the EM FX space, PEN (+0.4% vs. USD), CLP (+0.3% vs. USD), and EGP (flat vs. USD) have outperformed this week, while RUB (-3.3% vs. USD), COP (-1.4% vs. USD), and BRL (-1.4% vs. USD) have underperformed. |

Stock Markets Emerging Markets, June 21 Source: economist.com - Click to enlarge |

ChinaMSCI announced it will include 222 China Large Cap A-shares in its Emerging Markets Index. It will be a 2-step inclusion process and will likely represent an approximate 0.73% increase in China’s overall share in MSCI EM to 28.55%, slightly higher than the 0.5% that was previously flagged. Czech RepublicCzech central bank is pushing out rate hike expectations. Vice Governor Tomsik said there was no rush to hike since a stronger koruna is doing some of the tightening already. He noted that “If the koruna keeps its current pace of appreciation, it’s appropriate to discuss shifting the start of rate hikes from the third quarter to the fourth.” Governor Rusnok also made similar comments. HungaryHungary central bank eased again using unconventional measures. The bank lowered the cap on deposits in its 3-month facility to HUF300 bln for 3Q, down from HUF500 bln for 2Q. The central bank now forecasts meeting its 3% CPI target in early 2019, six months later than its previous forecast. It sees 2017 inflation at 2.4% vs. 2.6% previously, and sees 2018 inflation at 2.8% vs. 3.0% previously. Saudi ArabiaMSCI announced that it has launched a consultation on reclassification of Saudi Arabia from Standalone to Emerging Market status. The decision will be announced in June 2018, and we think it will be reclassified then if the Saudi authorities stick to their economic reforms. If implemented, MSCI estimates that Saudi Arabia would hold a 2.4% share in its EM index. South AfricaTop South African court ruled that the Zuma no confidence vote can be secret. However, the court added that the decision wiill be made by parliamentary speaker Mbete, a senior member of the ruling ANC. She has said in the past that the decision is not hers to make. This suggests that Zuma will survive the no confidence vote, as the vote will likely remain public and ANC members are unlikely to break ranks publicly. South African government official wants to change the mandate of the central bank. Public Protector Mkhwebane suggested removing the reference to “protect the value of the currency” and replace it with “promote balanced and sustainable economic growth in the Republic, while ensuring that the socio-economic wellbeing of the citizens are protected.” We don’t think that should be in any central bank’s mandate, and confirms our fears that Zuma is likely to tilt more populist ahead of the elections. BrazilBrazil Senate committee rejected the labor reform bill by a 10-9 vote. Finance Minister Meirelles downplayed it, saying this was part of the normal legislative process. We see it more negatively, as reports are already emerging that the government is considering a watered-down version. MexicoBanco de Mexico signaled an end to the tightening cycle. It hiked rates 25 bp, as expected, but noted that “the reference rate has reached a level that is consistent with the convergence of inflation to the 3% target.” Governor Carstens also noted that the pause could be maintained even in the face of further Fed tightening, though admitting that it will depend a lot on market conditions then. |

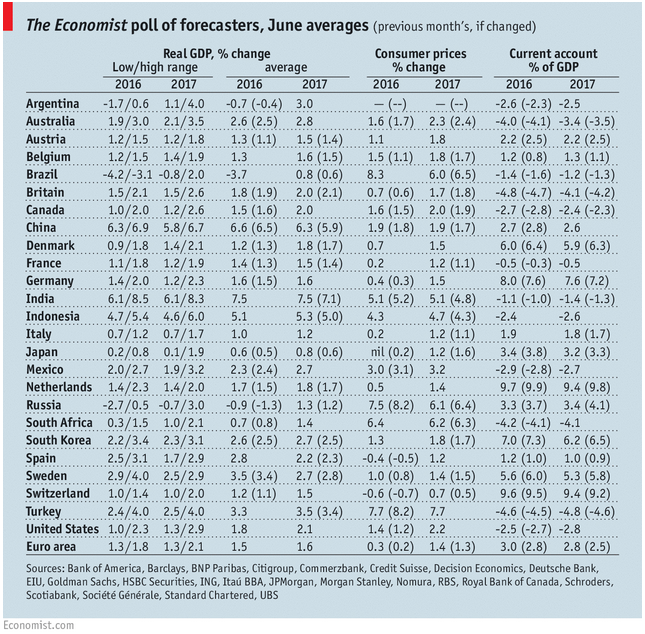

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2017 Source: economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent