Summary

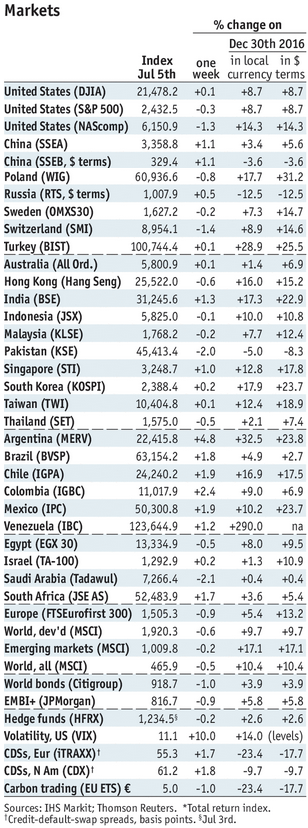

Stock MarketsIn the EM equity space as measured by MSCI, Chile (+1.9%), Hungary (+1.8%), and India (+1.7%) have outperformed this week, while Qatar (-1.4%), Hong Kong (-1.3%), and Russia (-1.1%) have underperformed. To put this in better context, MSCI EM fell -0.8% this week while MSCI DM fell -0.4%. In the EM local currency bond space, Argentina (10-year yield -6 bp), India (-3 bp), and Taiwan (-3 bp) have outperformed this week, while Turkey (10-year yield +27 bp), Colombia (+25 bp), and Indonesia (+21 bp) have underperformed. To put this in better context, the 10-year UST yield rose 8 bp to 2.39%. In the EM FX space, EGP (+1.4% vs. USD), BRL (+0.5% vs. USD), and HUF (up 0.2% vs. EUR) have outperformed this week, while TRY (-2.9% vs. USD), RUB (-2.8% vs. USD), and ZAR (-2.6% vs. USD) have underperformed. |

Stock Markets Emerging Markets, July 05 Source: economist.com - Click to enlarge |

North KoreaThe US confirmed North Korea’s claims that it tested an intercontinental ballistic missile. The US and South Korea almost immediately announced a new joint military exercise. Although the US has indicated that all options are on the table, there does not appear to be support for military options by South Korea, Japan, Russia, or China. PakistanThe Pakistani rupee was devalued, prompting a new central bank governor to be named. Yet the move was confusing, as Finance Minister Dar said the rupee’s fall was due to “miscommunication.” It also prompted Dar to choose a new central bank governor to replace Acting Governor Riazuddin. Incoming Governor Bajwa is seen as being loyal to Dar, which could hurt central bank independence. VietnamVietnam’s central bank cut interest rates for the first time since March 2014. The refinancing rate, discount rate, and overnight lending rate will all be cut 25 bp effective July 10. This wasn’t very surprising given inflation fell to 2.5% in June. With growth coming in a bit sluggish of late, there’s a risk that policymakers will weaken the dong to stimulate exports. EgyptEgypt’s central bank surprised markets with a 200 bp hike to 18.75%. No change was expected. However, it appears that the central bank is working to limit any second-round effects after the government just raised electricity, fuel, and cooking gas prices significantly as part of the IMF program. More tightening may be needed in the coming months if inflation remains stubbornly high. South AfricaSouth Africa’s ruling ANC reportedly proposed that SARB be state-owned. While this would not necessarily translate into greater government control, it’s the second proposed change to the SARB in recent weeks, the other being a proposal to change the bank’s mandate. It’s simply astounding that officials are saying this kind of stuff when they know full well that all eyes are on them and investor confidence is fragile. BrazilPetrobras announced two separate cuts to fuel prices. The first one cut both diesel and gas prices by 0.5%, while the second one cut diesel by 0.2% and gas by 0.7%. This will continue to put downward pressure on inflation. Lower than expected IPCA inflation of 3% y/y for June has markets looking for a 100 bp cut from COPOM when it meets July 26. Inflation is now at the bottom of the 3-6% target range and seems likely to fall below it. |

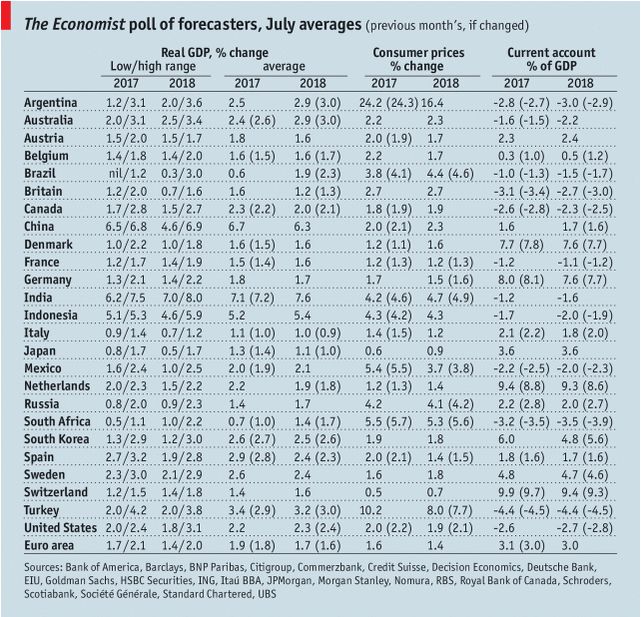

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, July 2017 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent,win-thin