Summary

Stock MarketsIn the EM equity space as measured by MSCI, Turkey (+5.9%), Brazil (+3.1%), and Chile (+2.7%) have outperformed this week, while Indonesia (-2.0%), Russia (-1.4%), and Colombia (-1.2%) have underperformed. To put this in better context, MSCI EM rose 1.7% this week while MSCI DM rose 0.3%. In the EM local currency bond space, Brazil (10-year yield -48 bp), the Philippines (-39 bp), and Colombia (-18 bp) have outperformed this week, while Turkey (10-year yield +17 bp), China (+16 bp), and Hungary (+6 bp) have underperformed. To put this in better context, the 10-year UST yield fell 1 bp this week to 2.42%. In the EM FX space, ZAR (+2.0% vs. USD), KRW (+1.5% vs. USD), and TWD (+1.3% vs. USD) have outperformed this week, while TRY (-3.2% vs. USD), EGP (-2.9% vs. USD), and MXN (-2.1% vs. USD) have underperformed. |

Stock Markets Emerging Markets - January 11 Source: Economist.com - Click to enlarge |

ChinaChina’s government has asked banks to balance their yuan inflows and outflows. The move comes amidst growing concerns about capital outflows from China. Banks have been asked to show at the end of every month that the amount of yuan outflows matches their yuan inflows. Any banks that have difficulty balancing these flows will have to temporarily halt outbound flows. IndonesiaIndonesia partially lifted a ban on exports of nickel ore and bauxite. Mining companies that are building processing plants locally will be allowed to export. After the ban went into effect in 2014, other producers like the Philippines filled the void left by Indonesia. Czech RepublicCzech President Zeman picked two new central bankers as the end of the koruna cap looms. Zeman will name Oldrich Dedek and Marek Mora to the seven-member policy board, replacing Lubomir Lizal and Pavel Rezabek as their terms end. Current forward guidance is for an end to the cap around mid-2017 and is unlikely to be extended. After these additions, five central bankers will be appointees of President Zeman, who has been critical of the cap. TurkeyTurkish central bank is taking limited measures to support the lira. First, it cut FX reserve requirements by 50 bp, which will reportedly boost FX liquidity by $1.5 bln. Then, it tightened liquidity by not offering any bank funding at 8% via the 1-week repo auction. Local banks were instead expected to borrow at 10% via the late liquidity window. Lastly, it cut the interbank borrowing limit to TRY11 bln, which will force banks to go even more to the late liquidity window for funding. The central bank’s next policy meeting is January 24, where a rate hike is needed to help support the lira and to arrest building price pressures. Turkey’s parliament voted 338-134 to discuss proposed constitutional changes that would increase the power of the presidency. Parliament will now begin discussing all 18 of the proposed changes, with each one needing at least 330 votes in favor before the entire package is voted on. A public referendum would have to be held if the final package gets 330 votes but falls short of 367. BrazilBrazil central bank accelerated the pace of easing. It cut the SELIC rate by a larger than expected 75 bp after two 25 bp cuts in Q4. The bank noted that it had established a “new rhythm of easing” and that the decision was unanimous. With such a dovish signal, another 75 bp cut seems likely at the next COPOM meeting February 22. |

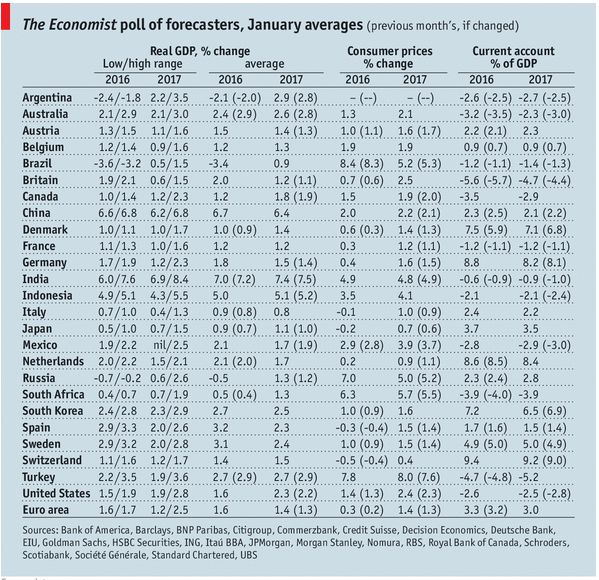

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2017 Source: Economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent