Summary

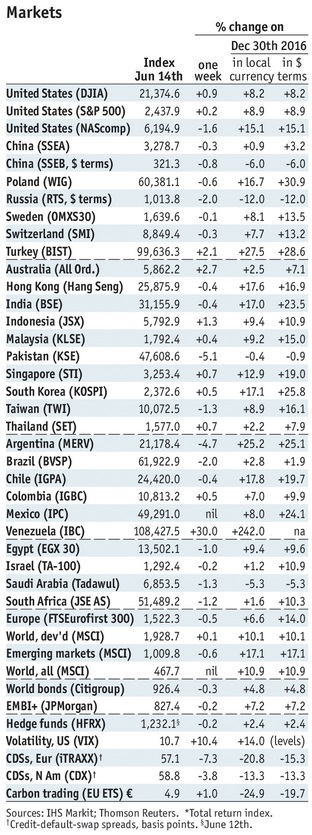

Stock MarketsIn the EM equity space as measured by MSCI, Hungary (+1.3%), Indonesia (+1.2%), and Mexico (+0.9%) have outperformed this week, while Russia (-4.1%), South Africa (-3.2%), and Egypt (-3.0%) have underperformed. To put this in better context, MSCI EM fell -1.5% this week while MSCI DM fell -0.2%. In the EM local currency bond space, Brazil (10-year yield -22 bp), Mexico (-19 bp), and Thailand (-12 bp) have outperformed this week, while Argentina (10-year yield +25 bp), Russia (+17 bp), and Colombia (+13 bp) have underperformed. To put this in better context, the 10-year UST yield fell 4 bp to 2.16%. In the EM FX space, MXN (+1.0% vs. USD), TRY (+0.7% vs. USD), and BRL (+0.3% vs. USD) have outperformed this week, while COP (-1.2% vs. USD), RUB (-1.1% vs. USD), and KRW (-1.0% vs. USD) have underperformed. |

Stock Markets Emerging Markets, June 14 Source: economist.com - Click to enlarge |

PhilippinesPhilippines central bank forecast a current account deficit this year, the first one in fifteen years. The bank also forecast a deficit in the overall balance of payments, but sees little change in foreign reserves. Deputy Governor Guinigundo said that protectionist policies in the US may hurt exports and outsourcing, while strong growth in the domestic economy will boost imports. KuwaitKuwait refrained from matching the Fed’s 25 bp hike. Typically, pegged currencies require moves in lockstep with the Fed. Saudi Arabia, UAE, Bahrain, and Qatar all matched the Fed this week. Central bank Governor Al-Hashel said the decision reflected “limited economic growth and the continued increase of interest rates on the US dollar and all the challenges that entails.” RussiaThe US Senate voted overwhelmingly to step up sanctions against Iran and Russia. The bill was passed by a veto-proof 98-2. It includes new sanctions against Russia over its continued involvement in Ukraine and Syria, as well as its alleged meddling in the 2016 US election. Russian central bank Governor Nabiullina downplayed the economic impact of these sanctions. South AfricaMoody’s downgraded South Africa by a notch to Baa3 with negative outlook. This was expected (but disappointing). Moody’s is being much more generous than the other two agencies, both at BB+. We think Moody’s will eventually follow suit with another cut to Ba1 but by then, S&P may already have moved it to BB. That is where our own ratings model puts South Africa. South Africa plans to require that all local mines be 30% black-owned. This would hold regardless of whether the mines have previously sold shares or assets to black investors that then divested. The required level is currently 26%. The new rules will also require that companies 1% of annual revenue to communities. BrazilBrazil press reported that President Temer ordered the country’s intelligence service to spy on Supreme Court Judge Edson Fachin. Fachin oversees the ongoing “Carwash” corruption investigation. Temer denied the report, but the head of the country’s Supreme Court, Carmen Lucia Rocha, called the allegations serious. The news came just after the top electoral court upheld the results of the 2014 presidential election. Petrobras announced cuts in fuel prices. Gasoline prices will be lowered by an average 2.3%, while diesel fuel reductions will average 5.8%. Petrobras said it will start reviewing fuel prices at intervals of less than 30 days given high volatility in oil and FX markets. The last fuel price review was on May 25. |

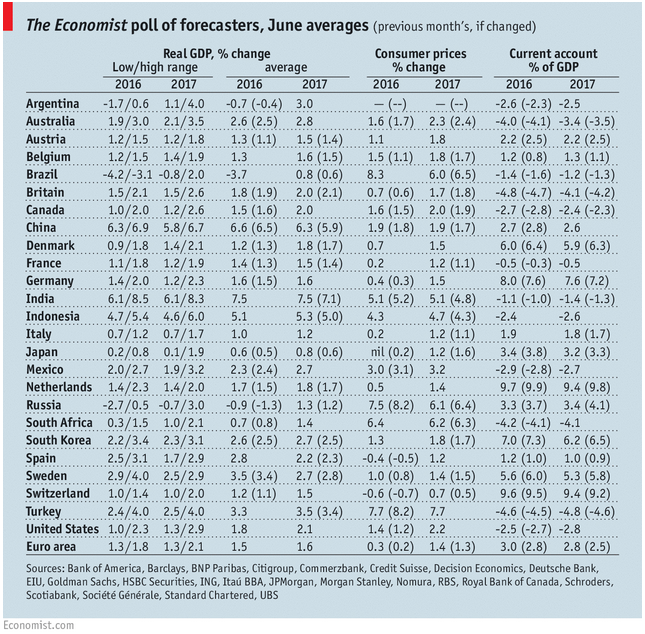

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, June 2017 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent