Summary

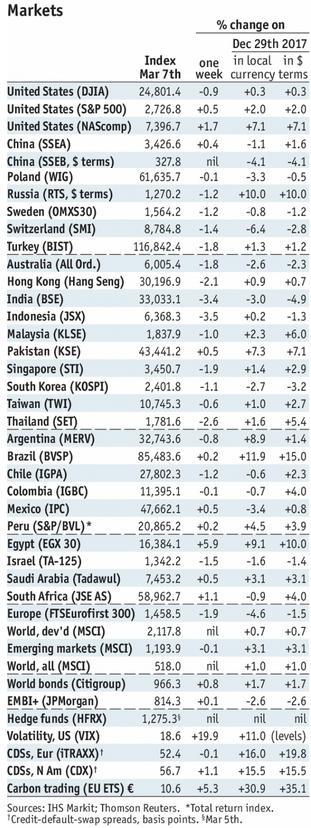

Stock MarketsIn the EM equity space, as measured by MSCI, Egypt (+10.6%), Mexico (+4.3%), and Hungary (+3.9%) have outperformed this week, while Qatar (-5.1%), India (-2.4%), and Indonesia (-2.2%) have underperformed. To put this in better context, MSCI EM rose 2.1% this week while MSCI DM rose 2.3%. In the EM local currency bond space, South Africa (10-year yield -13 bp), India (-7 bp), and Mexico (-6 bp) have outperformed this week, while Turkey (10-year yield +41 bp), Indonesia (+25 bp), and Hong Kong (+12 bp) have underperformed. To put this in better context, the 10-year UST yield rose 9 bp to 2.90%. In the EM FX space, MXN (+1.5% vs. USD), ZAR (+1.2% vs. USD), and KRW (+1.0% vs. USD) have outperformed this week, while CLP (-0.5% vs. USD), CZK (-0.3% vs. EUR), and PHP (-0.3% vs. USD) have underperformed. To put this in better context, MSCI EM FX rose 0.6% this week. |

Stock Markets Emerging Markets, March 07 Source: economist.com - Click to enlarge |

IndonesiaIndonesia will freeze prices for electricity, gasoline, and diesel fuel until next year. Furthermore, the Energy and Mineral Resources Ministry said subsidies for diesel fuel may be doubled, pending parliamentary approval. The announcements come ahead of provincial election campaigns already underway and the presidential election in 2019. Moody’s said that the moves signal a reversal of reforms and could hurt Indonesia’s credit rating. United StatesUS President Trump and North Korean President Kim Jong Un will hold a summit meeting this spring. It would be the first meeting between a sitting US president and their North Korean counterpart. This comes after North Korea floated the possibility of denuclearization, something it has always resisted. PolandNational Bank of Poland has tilted even more dovish. Governor Glapinski said the bank could keep rates steady until at least H2 2019 or even 2020. Previously, forward guidance saw steady rates until end-2018. The bank also issued new quarterly projections, which sees a lower path for inflation this year and next compared with the November outlook. TurkeyMoody’s downgraded Turkey a notch to Ba2 with a stable outlook. The agency cited deteriorating fundamentals, rising political risks, and weak policymaking efforts as factors behind the move. Our own sovereign rating model showed Turkey’s implied rating falling a notch to B/B2/B after remaining steady last quarter after two straight quarters of decline. As such, we see further downgrades by the agencies to actual ratings of BB/Ba2/BB+. Saudi ArabiaSaudi Arabian Energy Minister hinted that the Aramco IPO could be delayed until 2019. He added that the IPO would be “anchored” by a listing on the local Tadawul exchange and that any international listing would be announced later, if at all. Until recently, Saudi officials said that the IPO was “on track, on time” for 2018. TanzaniaTanzania finally obtained a sovereign rating after years of discussion. Moody’s issued a B1 rating with negative outlook. Government officials weren’t happy with the low rating. Finance Ministry official called the rating “premature and unrealistic.” We agree, as our own sovereign rating model shows Tanzania’s implied rating at BBB-/Baa3/BBB-. Moody’s noted that the outlook was negative because of Tanzania’s “very low institutional strength” and “moderately effective monetary policy.” |

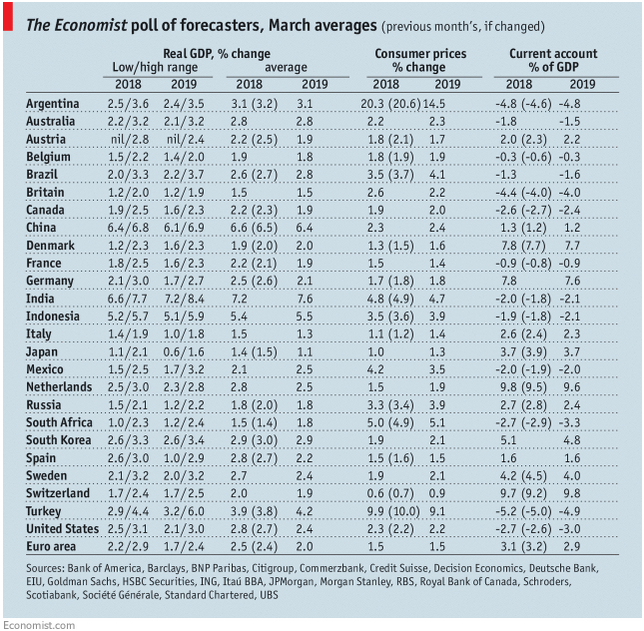

GDP, Consumer Inflation and Current Accounts Source: economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent,win-thin