EM assets for the most part fared well last week, and positive sentiment should carry over into this week. China reported January foreign reserves over the weekend, and they fell less than expected to $3.231 bln. China markets are closed this week for the New Year holiday. While there should be little risk of negative headlines from the mainland, markets should watch how CNH trades in the offshore markets that are open.

Oil prices should also be regarded as an important factor behind general market sentiment. Overall, we think the current bounce could be extended, but we still believe the medium-term bear market for EM remains intact.

Divergences within EM should continue to be seen. Brazil is closed for the first half of the week for Carnival. When markets reopen, investors will have to grapple with deteriorating fundamentals and a dysfunctional political backdrop. Ukraine is facing heightened political risk after the Economy Minister abruptly resigned. On the other hand, Argentina is making progress in dealing quickly with the debt holdouts, reaching agreements with two of the six largest remaining groups.Czech Republic reported disappointing December industrial (0.7 vs 5.9% y/y consensus). It reported a small trade surplus rather than the expected deficit. It will report January CPI on Friday, and is expected to rise 0.5% y/y vs. 0.1% in December. Despite a firm economy, the central bank has tilted more dovish, saying that negative rates were “seriously” discussed at last week’s meeting. It also extended its forward guidance on maintaining current policies to H1 2017 from H2 2016 previously.

Hungary also reported a better December trade balance (HUF643 mln vs consensus of HUF340 mln). Central bank minutes will be released Wednesday. January CPI will be reported Thursday, and is expected to rise 1.2% y/y vs. 0.9% in December. Hungary reports Q4 GDP Friday, and is expected to rise 2.5% y/y vs. 2.4% in Q3. Despite rising inflation and a firm economy, the central bank retains a dovish tilt. The next policy meeting is February 23, no action is seen then. However, officials have raised the possibility of further easing if the outlook worsens.

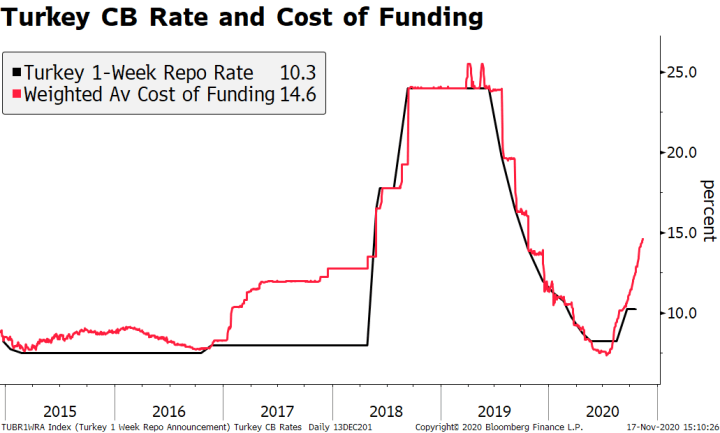

Turkey reports December IP Monday, rose a strong 4.5% year-over-year in December. The consensus expected to rise 3.6% y/y vs. 3.5% in November. It reports December current account data on Thursday, and is expected at -$5.0 bln. If so, the 12-month total would fall to -$32.8 bln, the lowest since August 2010. Despite weak exports, the external accounts continue to improve. However, offsetting this is the worsening inflation outlook and lack of central bank response. Next policy meeting is February 23. No hike then would be very harmful for investor sentiment.

Chile reports January CPI Monday, and is expected to rise 4.6% y/y vs. 4.4% in December. January trade will also be reported Monday, with exports expected at -14% y/y and imports at -12% y/y. The central bank meets Thursday and is expected to keep rates steady at 3.5%. With inflation moving further above the 2-4% target range, we think there is a slight chance of a hawkish surprise here.

India reports Q4 GDP Monday, and is expected to rise 7.1% y/y vs. 7.4% in Q3. It then reports January CPI and IP Friday. The former is expected at 5.3% y/y and the latter is expected at -0.4% y/y. The RBI kept rates steady last week, and basically challenged the government to deliver fiscal reforms before it would cut rates again.

South Africa reports Q4 unemployment Tuesday. It then reports December manufacturing production Thursday, and is expected at -1.5% y/y vs. -1.0% in November. The SARB continues to hike rates, but the economy is clearly struggling. It next meets March 17, and it will be a close call. If the rand remains firm, the SARB may stand pat then.

Mexico reports January CPI Tuesday, and is expected to rise 2.49% y/y vs. 2.13% in December. It reports December IP Thursday, expected flat y/y vs. 0.1% in November. Price pressures could be rising, but the economy is clearly facing headwinds. If the Fed stays on hold March 16, expect Banxico to do the same on March 18. The peso is a major factor for the central bank at this point, even though there hasn’t been much inflation pass-through yet.

The Philippines reports December exports Wednesday, and are expected to rise 1.2% y/y vs. -1.1% in November. The central bank meets Thursday and is expected to keep rates steady at 4.0%. However, with inflation remaining low at 1.3% y/y in January, we think the central bank could tilt more dovish if the economy continues to slow.

Malaysia reports December IP (1.1% y/y consensus) and manufacturing sales Thursday. Last week, December exports came in weaker than expected, contracting -17% y/y in USD terms. As such, we see downside risks to this week’s data. Political risk is likely to remain a concern, with risks of negative headlines relating to the ongoing 1MDB probes.

Russia reports December trade Thursday. Exports and imports are both expected at -31% y/y. Low oil prices continue to take a toll on the economy. However, the weak ruble has prevented the central bank from resuming its easing cycle. For now, the country’s fortunes will largely be determined by oil prices.

Peru’s central bank meets Thursday and is expected to hike rates 25 bp to 4.25%. January CPI came in higher than expected at 4.61% y/y, moving it further above the 1-3% target range. The bank has picked up its pace of tightening. After the first hike in September, it didn’t hike again until December. Since then, it hiked in January and now possibly in February, which would make it every month.

Poland reports Q4 GDP Friday, and is expected to rise 3.8% y/y vs. 3.5% in Q3. It also reports December trade and current account data on Friday. January CPI will be reported Friday too, and is expected to remain steady at -0.5% y/y. The next central bank policy meeting is March 11. By that time, the rest of the expiring MPC seats should be filled, and could mark a more dovish stance moving forward.

Tags: Emerging Markets