Summary

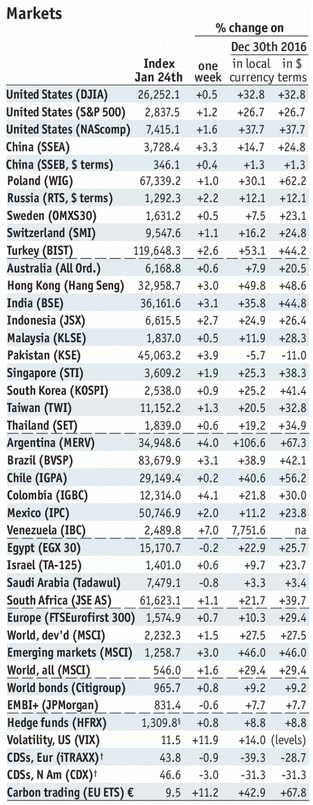

Stock MarketsIn the EM equity space as measured by MSCI, Brazil (+7.0%), Turkey (+5.3%), and Colombia (+5.1%) have outperformed this week, while Egypt (-1.3%), Poland (-0.2%), and Taiwan (-0.2%) have underperformed. To put this in better context, MSCI EM rose 3.0% this week while MSCI DM rose 1.4%. In the EM local currency bond space, Argentina (10-year yield -30 bp), Turkey (-24 bp), and Brazil (-23 bp) have outperformed this week, while Poland (10-year yield +19 bp), Indonesia (+7 bp), and Hungary (+6 bp) have underperformed. To put this in better context, the 10-year UST yield fell 1 bp to 2.65%. In the EM FX space, ZAR (+2.7% vs. USD), BRL (+2.0% vs. USD), and MYR (+1.8% vs. USD) have outperformed this week, while ARS (-2.7% vs. USD), PHP (-0.4% vs. USD), and HUF (-0.1% vs. EUR) have underperformed.

|

Stock Markets Emerging Markets, January 27 Source: economist.com - Click to enlarge |

KoreaKorea policymakers have asked state-owned banks and companies to limit the issuance of global bonds. Finance Ministry official said they are trying to pare issuance of foreign currency bonds that are considered “nonessential and not urgent.” The official said policymakers hope to minimize any unnecessary impact on the FX market. MalaysiaMalaysia’s central bank hiked rates for the first time in four years. Bank Negara hiked the overnight policy rate by 25 bp to 3.25%., citing a stronger domestic and global economy. The bank added that the hike would also “prevent the buildup of risks that could arise from interest rates being too low for a prolonged period of time.” PakistanPakistan’s central bank unexpectedly hiked rates for the first time in over four years. The bank hiked 25 bp to 6%. Governor Tariq Bajwa said, “We are pre-empting signs of economy overheating and trying to keep inflation under control.” Inflation was 4.57% y/y in December, the highest since May. However, it’s likely to head higher after the PKR devaluation last month. RussiaMoody’s raised its outlook on Russia’s Ba1 rating from stable to positive. The agency said the move was due to growing evidence of institutional strength and economic and fiscal resiliency. Our own sovereign ratings model has Russia’s implied rating at BBB-/Baa3/BBB-. As we noted before, S&P’s and Moody’s ratings of BB+ and Ba1, respectively, appear to have some upgrade potential now. Fitch’s investment grade BBB- rating now seems to be correct. ArgentinaArgentina’s central bank surprised markets with its second straight 75 bp rate cut. The move is questionable given that inflation picked up to 25% in December. It was also surprising given recent hawkish comments from central bank chief Sturzenegger. Indeed, President Macri felt obliged to later say that the bank has “absolute independence.” BrazilBrazilian appeals court unanimously upheld the graft sentence against former President Lula. All three judges denied Lula’s appeal and voted unanimously to increase his prison sentence from 9 ½ years to over 12. Lula can still appeal this ruling, but it seems that his path to the presidency is severely limited now. He is leading in the polls and so where his support eventually goes will be key.

|

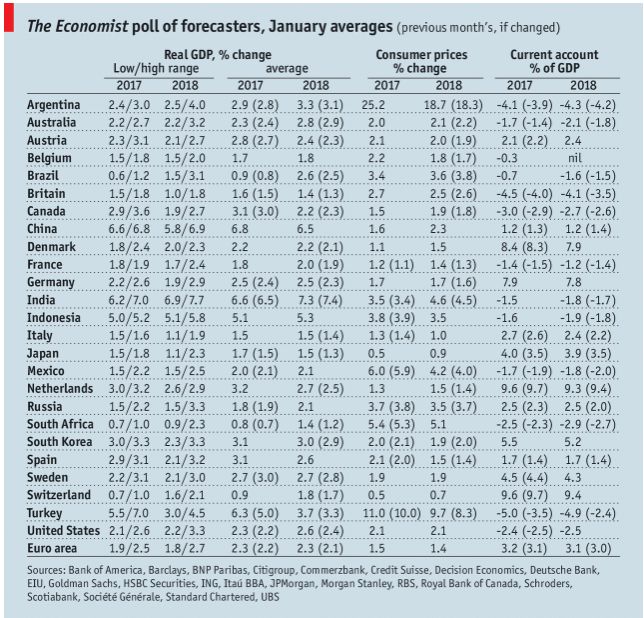

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2018 Source: economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Argentina,Brazil,Emerging Markets,Korea,Malaysia,newslettersent,Russia,win-thin