Summary

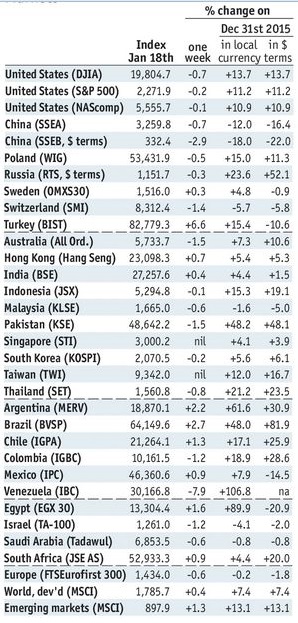

Stock MarketsIn the EM equity space as measured by MSCI, Mexico (+5.1%), Russia (+4.5%), and Poland (+4.0%) have outperformed this week, while UAE (-1.5%), Hungary (-0.1%), and South Africa (flat) have underperformed. To put this in better context, MSCI EM rose 2.2% this week while MSCI DM rose 1.1%. In the EM local currency bond space, Colombia (10-year yield -17 bp), the Philippines (-16 bp), and Peru (-10 bp) have outperformed this week, while Poland (10-year yield +18 bp), South Africa (+13 bp), and Korea (+7 bp) have underperformed. To put this in better context, the 10-year UST yield rose 3 bp this week to 2.50%. In the EM FX space, MXN (+2.7% vs. USD), CLP (+1.1% vs. USD), and ZAR (+0.9% vs. USD) have outperformed this week, while TRY (-2.7% vs. USD), HUF (-0.7% vs. EUR), and COP (-0.4% vs. USD) have underperformed. |

Stock Markets Emerging Markets January 30 Source: economist.com - Click to enlarge |

ChinaPress reports suggest that China’s central bank has ordered banks to limit new loans in Q1. The PBOC reportedly emphasized its concern about mortgage lending. Reports also suggest that it may make some lenders pay more for deposit insurance. If reports are true, then we would expect the economy to slow as we move through 2017. For now, China is not one of the major market drivers but this news would clearly be negative for risk and EM. NigeriaFitch revised the outlook on Nigeria’s B+ rating from stable to negative. The agency said it was concerned that a lack of foreign exchange will hurt the economy. Fitch forecast GDP growth of 1.5% this year vs. an estimated -1.5% last year. RussiaRussia announced details of the FX purchase plan. Officials said the FX purchases were aimed at reducing the impact of oil price fluctuations on the economy and the budget. The central bank will buy FX when oil is above $40/bbl, and will sell FX when it’s below $40. The Finance Ministry added that excess oil revenue will not to be used for additional budgetary spending. BrazilBrazil’s central bank confirmed it will simplify the reserve requirement system for banks. The first phase will focus on unifying the rates, while the second phase will aim to gradually reduce the rates. The bank said that it doesn’t want to lower reserve requirements in the first phase in order to avoid interfering with the ongoing easing through SELIC rate cuts. ChileS&P cut the outlook on Chile’s AA- rating from stable to negative. We fully agree with this. From the most recent EM Sovereign Rating Model update: “Chile’s implied rating remained steady at A-/A3/A-. The fall in copper prices has taken a toll, however, and actual ratings of AA-/Aa3/A+ are still facing some downgrade risks.” MexicoMexican Finance Minister Meade announced another hike in fuel prices will take place on February 4. Meade said this hike won’t be as large as the January hike. Still, higher inflation should keep the central bank in tightening mode. We think it hikes 50 bp on February 9 and another 50 bp on March 30. What happens at the May 18 meeting will depend largely on the peso. Mexican President Pena Nieto canceled a planned meeting with President Trump as tensions flare. This round was sparked by the issue of Mexico paying for the controversial border wall. Trump tweeted that “If Mexico is unwilling to pay for the badly needed wall, then it would be better to cancel the upcoming meeting.” |

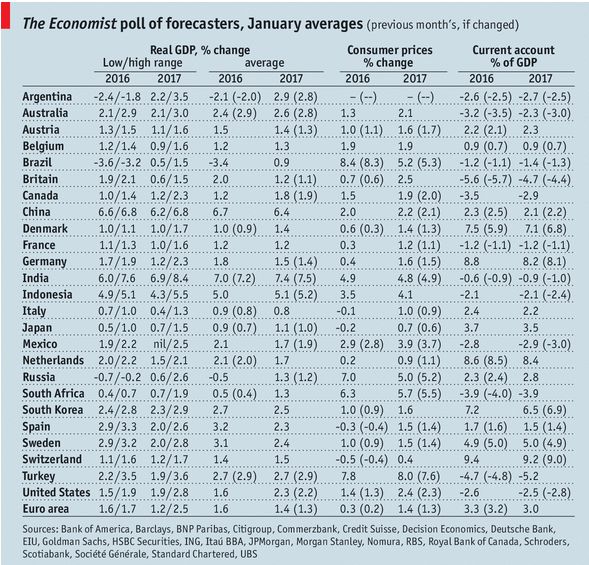

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, January 2017 Source: Economist.com - Click to enlarge |

Full story here Are you the author? Previous post See more for Next post

Tags: Emerging Markets,newslettersent