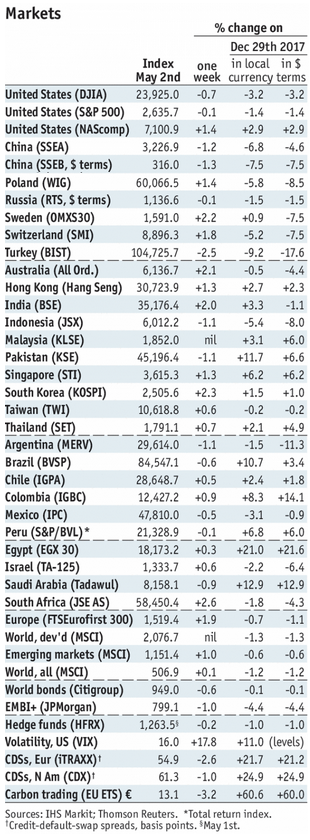

Stock MarketsEM FX ended Friday on a week note and capped of another generally negative week. Worst performers last week were ARS, BRL, and TRY while the best were ZAR, RUB, and KRW. We remain negative on EM FX and look for losses to continue. US retail sales data Tuesday pose further downside risks to EM FX. |

Stock Markets Emerging Markets, May 08 |

IndiaIndia reports April WPI and CPI Monday. The former is expected to rise 2.9% y/y vs. 2.5% in March, while the latter is expected to rise 4.4% y/y vs. 4.3% in March. If so, inflation would remain in the upper half of the 2-6% target range. Next RBI policy meeting is June 6, and no change is expected then. TurkeyTurkey reports April current account data Monday, and the deficit is expected at -$4.1 bln. If so, the 12-month total would rise to -$54.3 bln. This would be the highest since April 2014 and highlights the rising external vulnerabilities. March IP will be reported Wednesday, which is expected to rise 8.0% y/y vs. 9.9% in February. ChinaChina reports April retail sales and IP Tuesday. The former is expected to rise 10.0% y/y vs. 10.1% in March, while the latter is expected to rise 6.4% y/y vs. 6.0% in March. For now, the mainland economic outlook remains solid. IndonesiaIndonesia reports April trade Tuesday. Bank Indonesia then meets Thursday and is expected to keep rates steady at 4.25%. However, the market is split. Of the 13 analysts polled by Bloomberg, 7 see steady rates and 6 see a 25 bp hike. CPI rose 3.4% y/y in April, which is in the bottom half of the 3-5% target range. While this argues for steady rates, we believe that the weak rupiah may lead to a hawkish surprise. Czech RepublicCzech Republic reports Q1 GDP Tuesday, which is expected to grow 4.8% y/y vs. 5.5% in Q4. Despite robust growth, price pressures remain low. As a result, the central bank has pushed out the timing of the next rate hike until Q4. Next policy meeting is June 27, no change is expected then. IsraelIsrael reports April CPI Tuesday, which is expected to rise 0.4% y/y vs. 0.2% in March. If so, inflation would be the highest since December, though still well below the 1-3% target range. Next Bank of Israel policy meeting is May 28, no change is expected then. Israel reports Q1 GDP Wednesday, which is expected to grow 3.8% SAAR vs. 4.1% in Q4. ArgentinaArgentina reports April CPI Tuesday. Inflation was 25.4% y/y in March, which is well above the 12-17% target range. The central bank was wrong to cut rates in January, which is one of the major reasons it was forced to reverse course and hike rates in recent weeks to the current 40%. The plunging peso warns of a further spike in inflation, and so the bank will likely need to hike rates again. ColombiaColombia reports Q1 GDP Tuesday, which is expected to grow 2.2% y/y vs. 1.6% in Q4. Overall, the economy remains sluggish and so the central bank should continue its easing cycle. It just cut rates 25 bp to 4.25% in April. It has been cutting rates every other meeting recently, and so we see no change at the next meeting on June 29. ThailandBank of Thailand meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 1.1% y/y in April, the first reading in the 1-4% target range since February 2017. Still, price pressures are low and should allow BOT to remain on hold this year. South AfricaSouth Africa reports March retail sales Wednesday, which are expected to rise 4.4% y/y vs. 4.9% in February. CPI rose only 3.8% y/y in March, but is expected to rise to 4.6% in April. This would put it near the middle of the 3-6% target range. The economy is picking up, but low price pressures should allow SARB to continue its easing cycle. Next policy meeting is May 24, and much will depend on how the rand is trading then. PolandNational Bank of Poland meets Wednesday and is expected to keep rates steady at 1.5%. CPI rose 1.6% y/y in April, moving back into the 1.5-3.5% target range after two months below it. Low price pressures have led the central bank to take an increasingly dovish stance, with forward-guidance showing steady rates through much of 2019. BrazilBrazil COPOM meets Wednesday and is expected to keep cut rates 25 bp to 6.25%. IPCA inflation rose 2.8% y/y in April, near the cycle low and the bottom of the 2.5-6.5% target range. The central bank has signaled that this will likely end the easing cycle, but many (including us) believe that it has cut too much already in light of growing political risk. MalaysiaMalaysia Q1 GDP and current account data Thursday. GDP is expected to grow 5.6% y/y vs. 5.9% in Q4. CPI rose only 1.3% y/y in March. While Bank Negara does not have an explicit inflation target, low price pressures should allow it to remain on hold this year. We think politics will dominate economics with regards to the country’s near-term outlook, as the repercussions of the shock opposition election victory are still being felt. MexicoBanco de Mexico meets Thursday and is expected to keep rates steady at 7.5%. CPI rose 4.6% y/y in April, the lowest since December 2016 but still above the 2-4% target range. If the peso remains under pressure this week, then we see a growing chance of a hawkish surprise. ChileChile reports Q1 GDP Friday, which is expected to grow 4.0% y/y vs. 3.3% in Q4. The economy is picking up, helped by higher copper prices. CPI rose only 1.9% y/y in April, just below the 2-4% target range. The central bank has signaled an end to the easing cycle, but low inflation gives it leeway to cut rates again if the economy were to slow. |

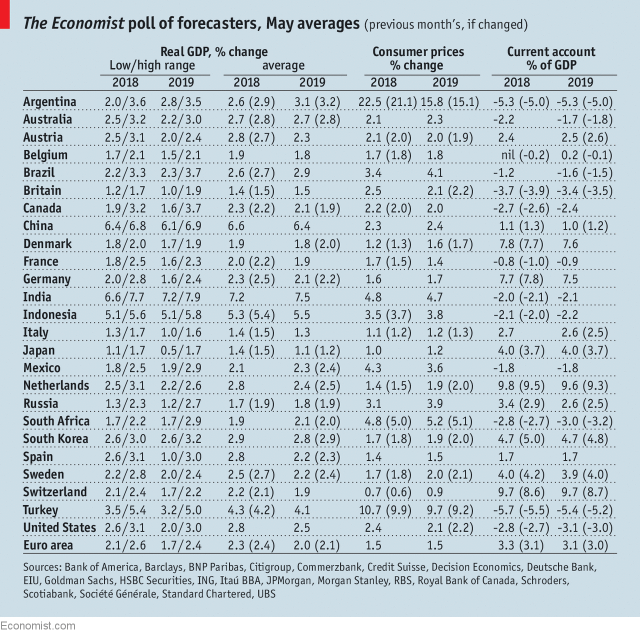

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, May 2018 Source: economist.com - Click to enlarge |

Tags: Argentina,Brazil,Chile,China,Colombia,Czech Republic,Emerging Markets,India,Indonesia,Israel,Malaysia,Mexico,newslettersent,Poland,South Africa,Thailand,Turkey,win-thin