| Below is a non-exhaustive list of medium- and long-term implications from the Covid-19. We discuss the yuan, China’s competitiveness, its position in the global production chains, the impact on the Phase One trade deal, and rising financial stability risks. Globally, the virus will bring about a new wave of fiscal spending and revive the discussions about the limits of monetary policy. Lastly, we are concerned that the virus may provide further momentum for the rising anti-immigration nationalist.

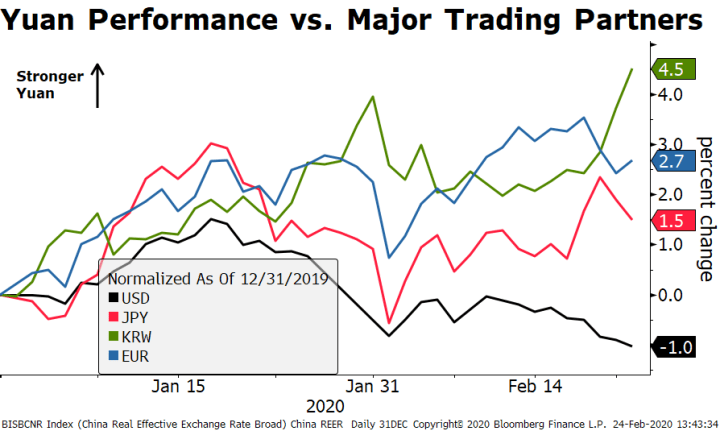

(1) The yuan is appreciating against most of its major trade partners, leaving China less competitive ahead of the presumed recovery. USD/CNY is rising, China’s other trade partners have seen their currencies depreciate by a lot more. The latest BIS REER print showed an 2.0% trade-weighted appreciation of the yuan in January, and February is likely to be even more. If sustained, this means a “V” shape recovery for China is either less likely or more expensive for the government to fabricate. So why is the PBOC not letting the yuan depreciate faster? First, the last thing they need now is concern about massive capital outflows, which will surely happen if the currency is perceived to be a central part of the adjustment and on a weakening trend. Second, it might provoke the US, giving Trump ammunition to rekindle the trade conflict if needed (more on this below). |

Yuan Performance vs. Major Trading Partners, 2020 |

| (2) Yet another argument to diversify global production chains away from China. Last year, it was the US-China trade war. Vietnam was the poster boy for the pickup in trade diversion, with abundant stories of factories relocating and a huge increase in inbound FDI. If, like us, multinational CEOs believe the US-China conflict is a secular phenomenon, then the virus outbreak is just another excuse to reconsider China’s role in global operations.

(3) China gets a pass on implementing Phase One trade deal. The virus provides a credible excuse for what everyone already knew: China was never going to fulfil its pledge to double imports from the US. Thankfully, the text of the deal included a face-saving paragraph (Article 7.6.2: Miscellaneous) stating that: “In the event that a natural disaster or other unforeseeable event outside the control of the Parties … the Parties shall consult with each other.” We believe this is enough for the import pledge side, but it’s less clear how the administration will think of China letting its currency depreciate (Article 5.1.4: General Provisions). In Trump’s eyes, is China still honouring the “currency-related commitments” and “refraining from competitive devaluations?” The answer, we believe, will be determined by a near-term electoral calculus – i.e. if antagonizing China is useful in the 2020 race. (4) Short-term growth support will come at the cost of higher long-term financial stability risks. In the simplest terms, we can view China’s policymaking as one giant intertemporal trade-off: the more they sacrifice growth in the present, the quicker they will unwind the toxic credit and capital dislocations in its financial system. The COVID-19 stimulus means that they will be forced to tip this trade-off towards the present just to track their ex-ante growth targets. The greater the stimulus now, the more painful the rebalancing will be later on. That said, we take some comfort from the way the PBOC conducted the interest rate cut last week. They reduced the 1-year LPR by 10 bp but cut the 5-year LPR by only 5 bp. The signal we take from this asymmetric move is that officials are focused in providing liquidity while also trying to minimize misallocation and the spillover of the credit expansion into the problematic sectors of the financial system. |

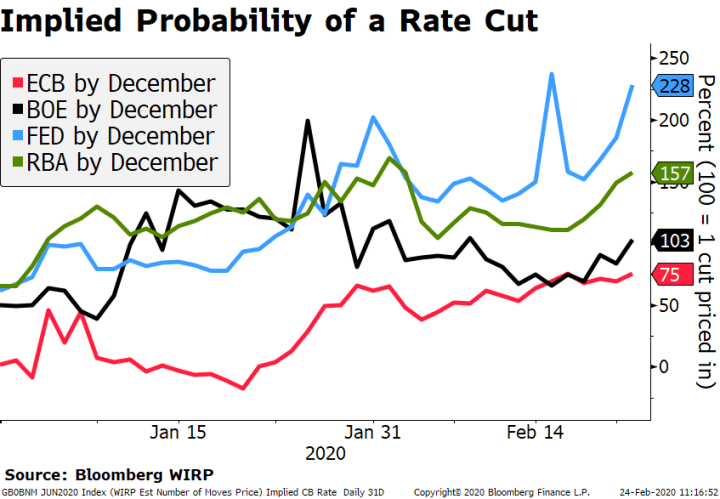

Implied Probability of a Rate Cut, 2020 |

(5) De-escalation or inflammation of the Hong Kong protests? The temporary end to the demonstrations in HK is probably the clearest silver lining of the virus for China. In retrospect, this new (and exogenous) factor preventing mass gatherings could very well prove the inflexion point in winding down the pro-democracy movement. On the other hand, we are seen protestors attack Beijing and Carrie Lam’s administration for their handling of the crisis, calling for the HK-China border to be closed. Three-quarters of HK residents approve of the closure, according to a recent poll. We don’t have a strong view on how this is going to play out.

(6) The virus will bring about a new wave a fiscal spending, but the impact on monetary policy outlook is less certain. The ideological pendulum was already swinging in this direction, now it’s gaining force. The list of governments promising huge countercyclical policies (especially in Asia) continues to increase. In Europe, several ECB members – most recently Villeroy (France) and Visco (Italy) – are arguing for governments to use fiscal policy to cushion the virus impact, highlighting the limits of what the ECB given the current accommodative stance. Still, markets couldn’t resist pricing in easing by the ECB, as well as by other major central banks.

(7) Anti-immigration groups could weaponize the virus for against globalization. The often alarmist media coverage of the virus spreading – e.g. “global pandemic” and “tipping point” – surely caused an impression on a lot of people around the world. Far-right nationalist parties could easily use this event as another argument to keep the borders closed, or to demand more robust infrastructure on tracking the movement of people (see HK section above). Italy would be a good place to look for this, given the electoral strength of the Lega. Perhaps this could even be a turning point (or an excuse) for many of those with a weak or undecided conviction about the immigration debate to settle on the side of closed borders.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,developed markets,Emerging Markets,newsletter