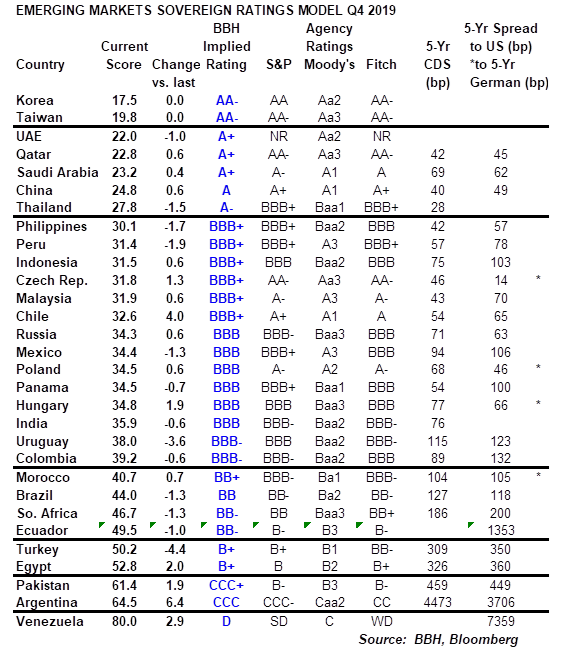

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance.

These scores translate into a BBH implied rating that is meant to reflect the accepted rating methodology used by the major agencies. We find that our model is very useful in predicting rating changes by the major agencies.

The total number of Emerging Market countries covered by our model now stands at 30, reflecting our decision to move Hong Kong, Israel, and Singapore to our DM universe as per MSCI Developed Market classifications.

EMERGING MARKETS RATINGS SUMMARYThere have been 16 EM rating actions since our last update in July. There were 6 positive actions and 10 negative actions. However, 7 of those actions were in Argentina alone. Netting those out, there were 4 positive and 5 negative actions in the rest of EM. So far in 2019, there have been 15 positive actions and 20 negative ones in total, resulting in a 43% share for positive actions. Positive actions made up 50% of the total moves in 2018, 40% in 2017, and 29% in 2016. Thus, it seems that the improving trend for EM ratings has stalled this year, due in large part to the knock-on effects of the US-China trade war. Let’s look at Argentina first. S&P downgraded it a notch to B- in mid-August. Two weeks later, S&P moved it to Selective Default (SD) but the next day moved it back up to CCC-. Fitch took a similar path, downgrading Argentina from B to CCC in mid-August and then following it up two weeks later with a move to Restricted Default (RD) and shortly thereafter back to CC. Moody’s took a more direct path, simply downgrading Argentina in one fell swoop at the end of August from B2 to Caa2. Since our last update, Fitch has been the most positive with 3 moves (excluding Argentina). It upgraded Russia a notch to BBB with stable outlook and moved the outlooks on both Ecuador and Turkey from negative to stable. On the other hand, Fitch downgraded Saudi Arabia a notch to A with stable outlook and downgraded Turkey a notch to BB- with stable outlook. Lastly, Fitch moved the outlook on South Africa from stable to negative. Moody’s made one positive move, upgrading Czech Republic by a notch to Aa3 with stable outlook. On the other hand, Moody’s moved the outlook on both India and South Africa from stable to negative. Since our last update, S&P has made no rating moves in EM outside of Argentina. |

Emerging Markets Sovereign Ratings Model Q4 2019 - Click to enlarge |

EMERGING MARKETS RATINGS OUTLOOK

Latin America

Argentina entered our EM model universe at an implied rating of B+/B1/B+ last year but has since plummeted in several stages to CCC/Caa2/CCC currently. This puts it pretty much at actual ratings of CCC-/Caa2/CC.

Brazil’s implied rating was steady at BB/Ba2/BB. Actual BB-/Ba2/BB- ratings are likely to be kept steady until the Bolsonaro government demonstrates its ability to enact significant fiscal reforms, of which pension reform is just the first step.

Chile’s implied rating fell a notch to BBB+/Baa1/BBB+, reversing last quarter’s improvement. The fall in copper prices has taken a toll and so too will the protracted popular unrest. Actual ratings of A+/A1/A are still facing greater downgrade risk. Ecuador’s implied rating rose a notch to BB-/Ba3/BB- and so actual ratings of B-/B3/B- are seeing greater upgrade potential.

Colombia’s implied rating was steady at BBB-/Baa3/BBB-. S&P’s downgrade to BBB- may not have been the last of the downgrades since Moody’s and Fitch’s ratings still appear too high at Baa2 and BBB, respectively.

Mexico’s implied rating remained steady at BBB/Baa2/BBB. Actual ratings of BBB+/A3/BBB are still facing downgrade risks, but much will depend on oil prices and the economy. Both have been weak this year and have weighed on the nation’s creditworthiness.

Peru’s implied rating was steady at BBB+/Baa1/BBB+. As a major copper exporter, the fall in prices fed through into weaker fundamentals. However, the outlook has improved and actual ratings of BBB+/A3/BBB+ appear to be largely on target. Moody’s A3 is the outlier, however.

Uruguay’s implied rating rose a notch to BBB-/Baa3/BBB-. This suggests that actual ratings of BBB/Baa2/BBB- are facing somewhat lower downgrade risk. Elsewhere, Panama’s implied rating was steady and pretty much right at actual ratings of BBB+/Baa1/BBB. Venezuela’s implied rating remained steady at D even as its score continues to worsen.

Asia

China’s implied rating was steady at A/A2/A. The slowdown from the trade war is taking a toll on the economy and we see some downgrade risks to actual ratings of A+/A1/A+. Elsewhere, Taiwan’s implied rating was steady at AA-/Aa3/AA- and keeps it right at its actual ratings. Korea’s implied rating was also steady at AA-/Aa3/AA- and keeps it close to its actual ratings of AA/Aa2/AA-.

India’s implied rating was steady at BBB/Baa2/BBB. This puts it close to actual ratings of BBB-/Baa2/BBB-. However, the economy is slowing sharply, and this is likely to push India’s credit metrics lower in the coming quarters. Elsewhere, Indonesia’s implied rating was steady at BBB+/Baa1/BBB+ and so actual ratings of BBB/Baa2/BBB are still enjoying some upgrade potential.

Malaysia’s implied rating was steady at BBB+/Baa1/BBB+. As such, modest downgrade risks to actual ratings of A-/A3/A- remain on the table. Thailand’s implied rating was steady at A-/A3/A- and there remains upgrade potential for actual ratings of BBB+/Baa1/BBB+.

The Philippines’ implied rating was steady at BBB+/Baa1/BBB+. There is still some modest upgrade potential to actual ratings of BBB+/Baa2/BBB. Pakistan’s implied rating fell a notch to CCC+/Caa1/CCC+, suggesting rising downgrade risks to actual ratings of B-/B3/B-.

EMEA

The Czech Republic’s implied rating was steady at BBB+/Baa1/BBB+, halting the deteriorating trend from last year. We still see strong downgrade risks to its AA-/Aa3/AA- actual ratings. Hungary’s implied rating fell a notch to BBB/Baa2/BBB, reversing last quarter’s improvement and suggesting no upgrade potential for actual ratings of BBB/Baa3/BBB. Poland’s implied rating was steady at BBB/Baa2/BBB after falling a notch last quarter. Our model suggests continued downgrade risks to actual ratings of A-/A2/A-.

Russia’s implied rating was steady at BBB/Baa2/BBB. The economy has weathered the negative impact of sanctions. As such, there is still upgrade potential for actual ratings of BBB-/Baa3/BBB-. Turkey’s implied rating rose a notch to B+/B1/B+, reversing last quarter’s drop. We still think Turkey faces strong downgrade risks to its B+/B1/BB- ratings.

South Africa’s implied rating was steady at BB-/Ba3/BB-. Moody’s and Fitch’s ratings of Baa3 and BB+, respectively, continue to see heightened downgrade risk. Loss of investment grade from Moody’s would lead to ejection from WGBI. Even S&P’s BB rating appears too high now.

Qatar’s implied rating was steady at A+/A1/A+. As such, Qatar still faces some downgrade risks to actual ratings of AA-/Aa3/AA-. The UAE’s implied rating was steady at A+/A1/A+, which still suggests downgrade risk to its lone Aa2 rating from Moody’s.

Saudi Arabia entered our EM model universe at A/A2/A last year and then improved a notch. Its implied rating was steady at A+/A1/A+ this quarter. This suggests upgrade potential for S&P’s A- and Fitch’s A ratings, while Moody’s A1 appears to be on target. Elsewhere, Egypt’s implied rating was steady at B+/B1/B+. Actual ratings of B/B2/B+ are still enjoying some upgrade potential. Morocco’s implied rating was steady at BB+/Ba1/BB+ and so actual ratings of BBB-/Ba1/BBB- remain subject to some downgrade risk.

CONCLUSIONS

The weighting of negative moves seen in EM in recent years continues as we move through 2019. Low commodity prices have had a negative impact on the commodity exporting countries in recent years, as has the global economic slowdown stemming from the US-China trade war. We continue to warn investors that EM fundamentals will still diverge across countries. The investment climate remains challenging, with fundamentals remaining the most important factor for global investors to consider.

Full story here Are you the author? Previous post See more for Next post

Tags: Articles,Emerging Markets,newsletter