Summary

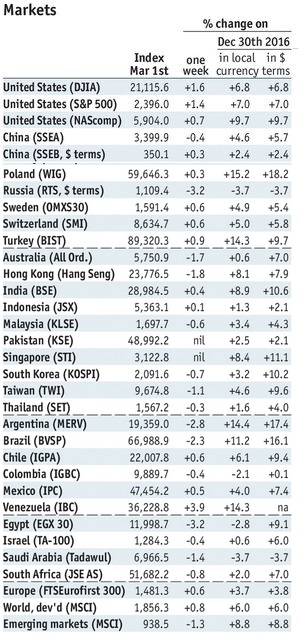

Stock MarketsIn the EM equity space as measured by MSCI, Turkey (+1.5%), Czech Republic (+1.4%), and Mexico (+1.2%) have outperformed this week, while Colombia (-3.4%), Brazil (-2.1%), and UAE (-2.1%) have underperformed. To put this in better context, MSCI EM fell -1.4% this week while MSCI DM rose 0.3%. In the EM local currency bond space, India (10-year yield -11 bp), Poland (-9 bp), and Indonesia (-3 bp) have outperformed this week, while Turkey (10-year yield +44 bp), Colombia (+18 bp), and Malaysia (+14 bp) have underperformed. To put this in better context, the 10-year UST yield rose 18bp to 2.50%. In the EM FX space, MXN (+1.6% vs. USD), PLN (+0.4% vs. EUR), and ARS (+0.2% vs. USD) have outperformed this week, while COP (-3.1% vs. USD), TRY (-3.0% vs. USD), and KRW (-2.2% vs. USD) have underperformed. |

Stock Markets Emerging Markets, March 01 Source: economist.com - Click to enlarge |

KoreaA Korean special prosecutor indicted Samsung chief Jay Y. Lee on bribery charges. He is accused of exchanging bribes for government favors, which were uncovered during the investigation of President Park. Lee allegedly directed tens of millions of dollars to a confidante of President Park in return for government support of a 2015 merger that benefited his interests. These developments could fundamentally change the role of the chaebol in the Korean economy. Korean press is reporting that China has told its travel agents to halt sales of holiday packages to South Korea. If confirmed, the move would likely be in retaliation for Korea agreeing to deploy a US missile defense system. Spokesman for China’s Foreign Ministry said he wasn’t aware of any such measures while an official at the Korea Tourism Organization (KTO) said China has issued the ban. KTO estimates that nearly half of the foreign visitors to Korea last year were from China. BulgariaBulgaria’s interim government said it may apply to join the eurozone within a month. Prime Minister Gerdzhikov said recently that there were no obstacles for the country to start the euro adoption. He heads an interim government as Bulgaria prepares for March 27 elections. A nation must be part of ERM-2 for at least two years and meet the convergence criteria in order to adopt the euro. Bulgaria has no official target date to join the euro zone but it does meet the requirements. South AfricaSouth Africa’s main labor union Cosatu accepted a government-proposed minimum wage of about ZAR3500 per month. Cosatu called it a “step forward for the country” since it fell short of the minimum ZAR4500 per month that it favored. Businesses that aren’t able to afford the minimum wage will be able to apply for an exemption. NaftaNew Commerce Secretary Ross appears to be taking a less confrontational stance with regards to Nafta. He noted that the peso could recover “quite a lot” with a sensible Nafta deal. We cannot get optimistic on Mexico until the framework for NAFTA talks becomes clearer. The economic officials in the cabinet (Ross, Mnuchin) seem to be more market-friendly than Trump but we are skeptical that Mexico can come out this whole thing unscathed. MexicoPress reports suggest Mexico may request a swap line from the Fed. This caused some knee-jerk buying, which later reversed when the report was denied by Banxico Governor Carstens. We’ve written about the ASEAN swap lines in the past, pointing out that they are simply credit lines that allow a central bank to borrow dollars as needed for intervention. However, these swaps eventually have to be repaid and so there is really no net impact. PeruPeru’s central bank cut reserve requirements again. This is just the latest of several cuts over the past several years. Other backdoor easing may be seen in the coming months, in lieu of an outright policy rate cut. A statement said that the move is meant to maintain stability in credit conditions locally amid a credit slowdown and higher global interest rates. |

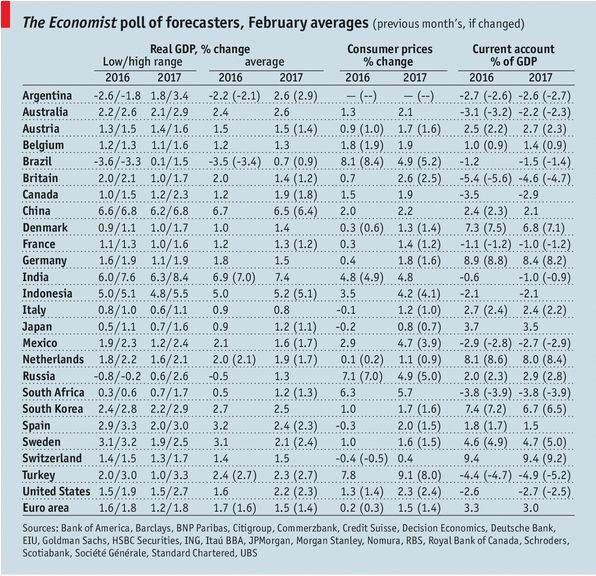

GDP, Consumer Inflation and Current Accounts The Economist poll of forecasters, February 2017 Source: Economist.com - Click to enlarge |

Tags: Emerging Markets,newslettersent,win-thin