Tag Archive: newsletter

Percentage of men in workforce declines in Switzerland

Recently published figures show a 7% decline in the percentage of men in Switzerland’s workforce between 1991 and 2018. The workforce figures, which include the unemployed, show a fall in male workforce participation from 81% to 74%, a 7% decline over 27 years.

Read More »

Read More »

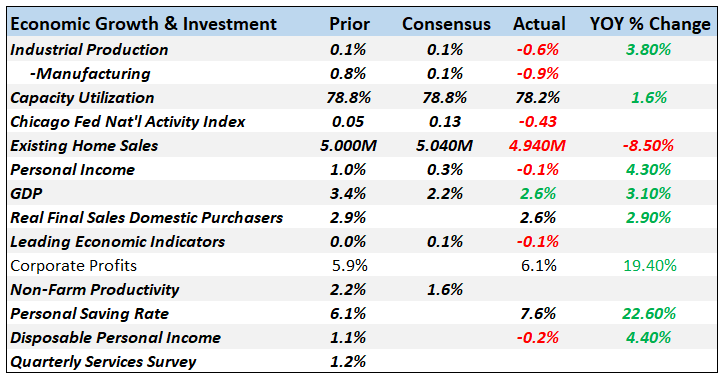

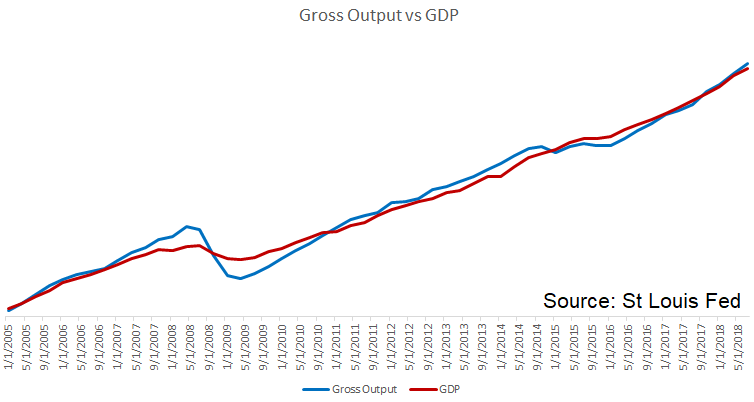

Monthly Macro Chart Review – March

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk.

Read More »

Read More »

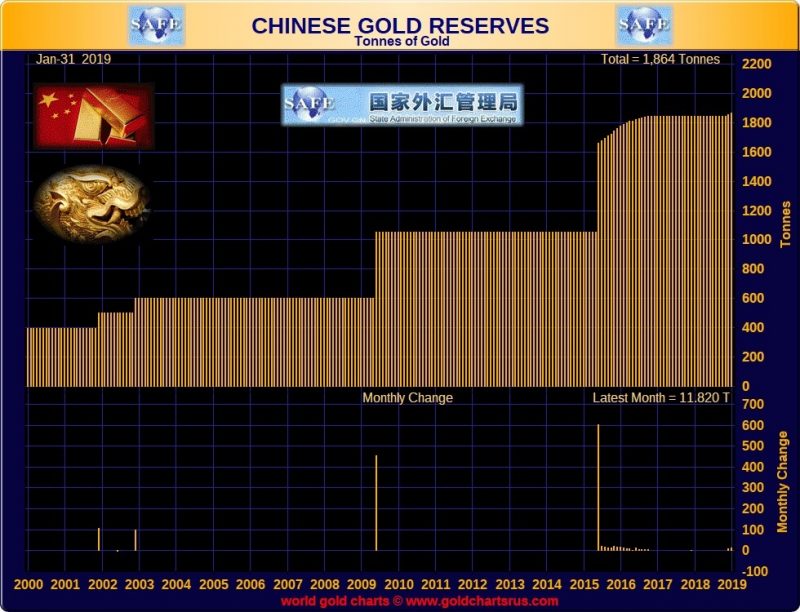

China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning.

The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces.

Read More »

Read More »

FX Daily, March 07: EMU Looks to ECB

The ECB meeting is today's highlight. A dovish signal is expected. The euro remains pinned near its lows ahead it. The global equity market rally in January and February is faltering this week. Asian equities were mixed, but the Nikkei eased for the third consecutive session.

Read More »

Read More »

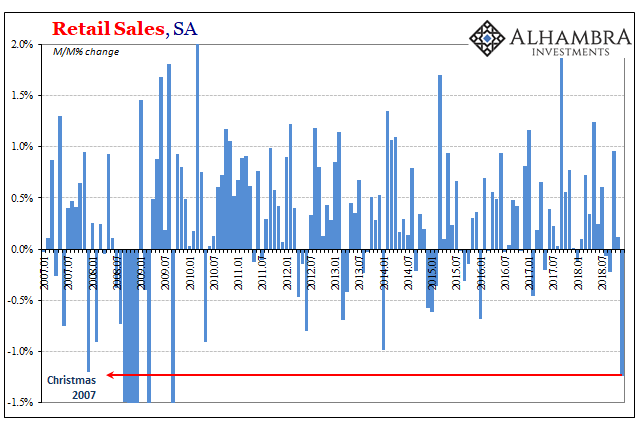

Labor Shortage America has been Canceled

The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage.

Read More »

Read More »

Swiss National Bank releases new 1000-franc note

The Swiss National Bank (SNB) will begin issuing the new 1000-franc note on 13 March 2019. Following the 50, 20, 10 and 200-franc notes, this is the fifth of six denominations in the new banknote series to be released. The current eighth-series banknotes remain legal tender until further notice.

Read More »

Read More »

FX Daily, March 6: The Dollar Index Extends Gains into the Sixth Consecutive Session

Overview: The capital markets are on edge. The week's big events lie ahead. The Bank of Canada meets today and the ECB tomorrow, followed by US (and Canada) employment data on Friday. The equity markets are mixed. While Japan and Korean equities eased, China's markets continue their tear.

Read More »

Read More »

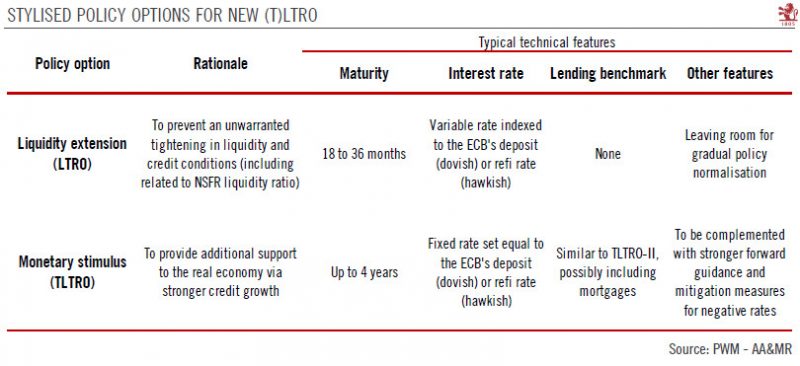

Thoughts about the ECB and Euro

Mario Draghi's term at the helm of the ECB is winding down. He will step down in October. It has not been an easy job. The light at the end of the tunnel in 2017 turned out to be another train in 2018. The eurozone enjoyed 0.7% quarterly growth every quarter in 2017. The ECB was able to outline an exit from its asset purchases. The debate began over sequencing and when the first rate hike could be delivered.

Read More »

Read More »

GBP/CHF exchange rates: A good start to the year, but what next for Brexit?

Since the start of the year GBP/CHF exchange rates have increased from 1.2377 to 1.3212 at the time of writing this report. To put this into monetary value, a client that converts £200,000 into CHF could now achieve an additional 16,700 Swiss Francs.

Read More »

Read More »

ECB: to LTRO, or not LTRO, what is the question?

The ECB’s decision on (T)LTRO will matter most to the euro area periphery banks who have been the biggest consumers of current TLTROs. Considering the weakness in most economic indicators the ECB should maintain an adequate degree of monetary accommodation.

Read More »

Read More »

China Has No Choice

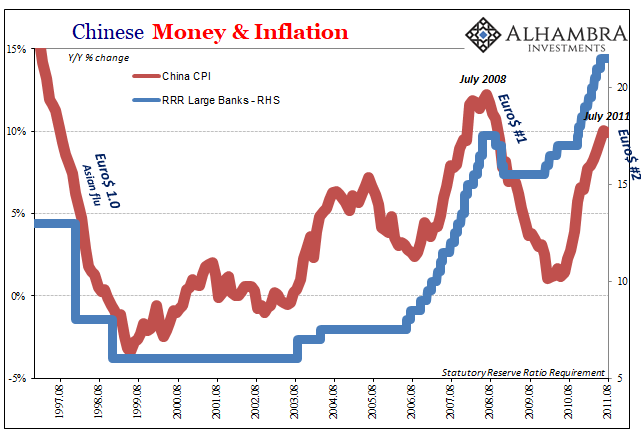

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China.

Read More »

Read More »

Bitcoin Bottom Building

Defending 3,800 and a Swing Trade Play. For one week, bulls have been defending the 3,800 USD value area with success. But on March 4th they had to give way to the constant pressure. Prices fell quickly to the 3,700 USD level. These extended times of range bound trading are typical for Bitcoin Bottom Building in sideways ranges.

Read More »

Read More »

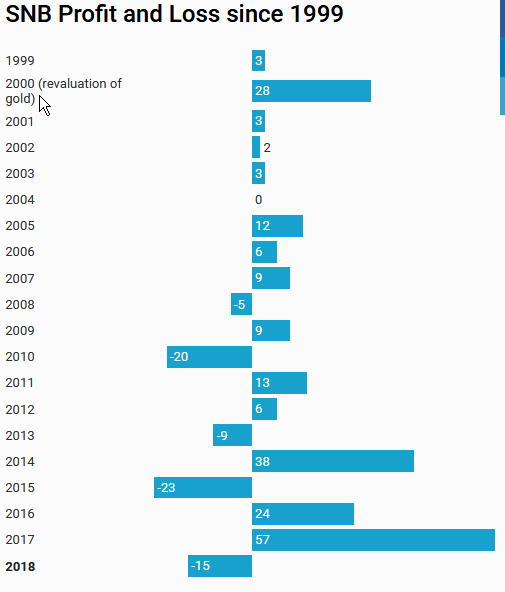

SNB loses 15 billion in 2018

The SNB earned 2 billion on negative interest rates (Swiss franc positions below), but lost nearly 17 billion CHF on FX investments, of which 5 bn on bonds and 12 bn on stocks. Gold was nearly unchanged.

Read More »

Read More »

FX Daily, March 05: Dollar Remains Firms as China Cuts Growth Target and Taxes, while EMU PMI Surprises on Upside

Overview: It is an eventful day, but the capital markets are taking it in stride. Equity markets are mixed. Asia may have been weighed down by China's shaving its growth target and announced around CNY2 trillion (~$300 bln) in tax cuts to support the economy, though Chinese stocks edged higher.

Read More »

Read More »

Swiss Consumer Price Index in February 2019: +0.6 percent YoY, -0.3 percent MoM

05.03.2019 - The consumer price index (CPI) increased by 0.4% in February 2019 compared with the previous month, reaching 101.7 points (December 2015 = 100). Inflation was 0.6% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).

Read More »

Read More »

Mit Negativzinsen die Wirtschaft ankurbeln? Nächste Irrlehre der SNB

Seit Jahrzehnten geistert die Illusion in den Köpfen der Oekonomen herum, man könne mit Zinssenkungen eine Wirtschaft ankurbeln. Den Vogel schiesst der vermeintliche „Starökonom“ von der Harvard University, Kenneth Rogoff, ab. Er prophezeit, dass künftige Wirtschaftskrisen mit Negativzinsen von bis zu minus 6 Prozent bekämpft würden.

Read More »

Read More »

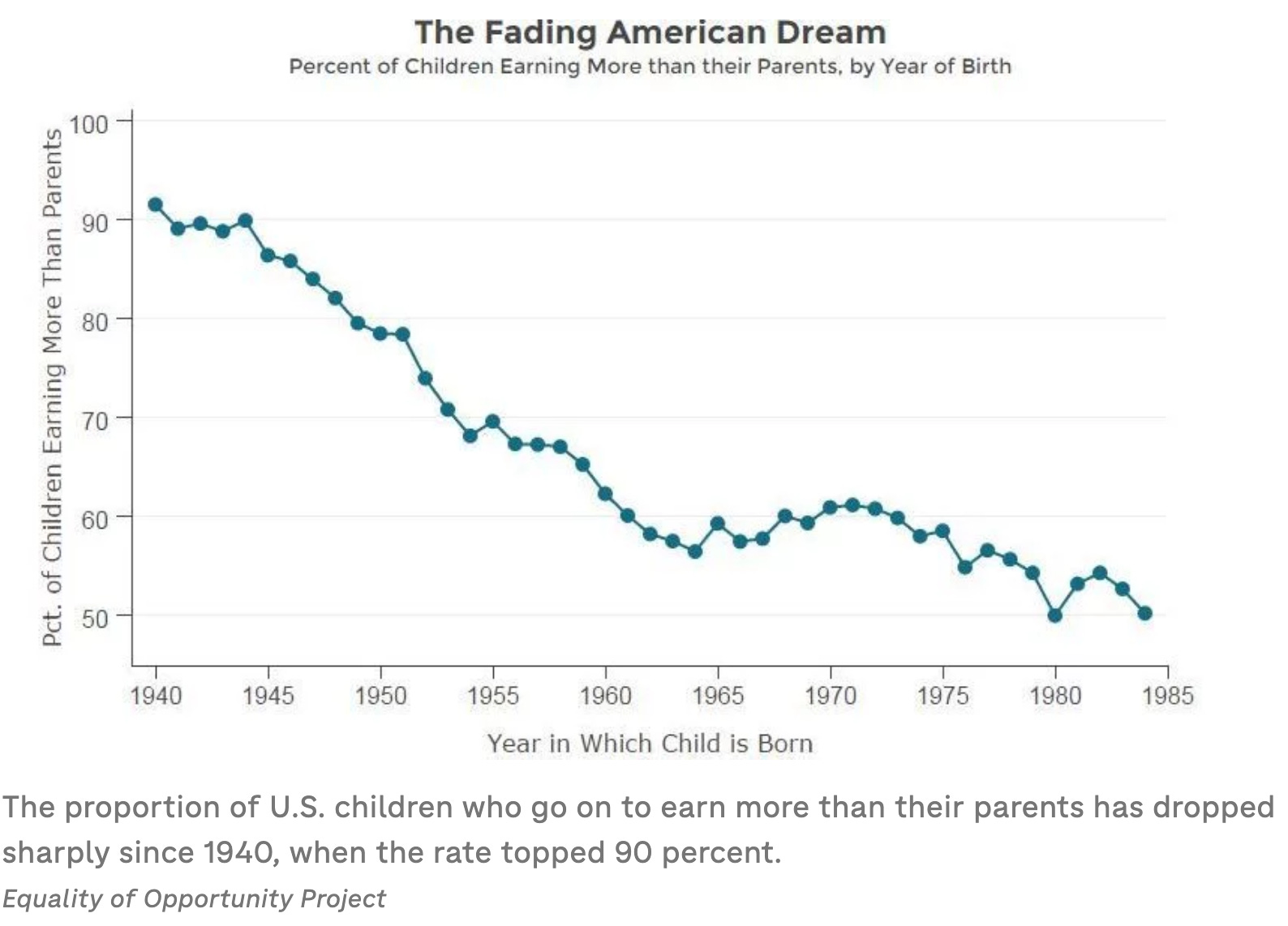

The Fed’s “Wealth Effect” Has Enriched the Haves at the Expense of the Young

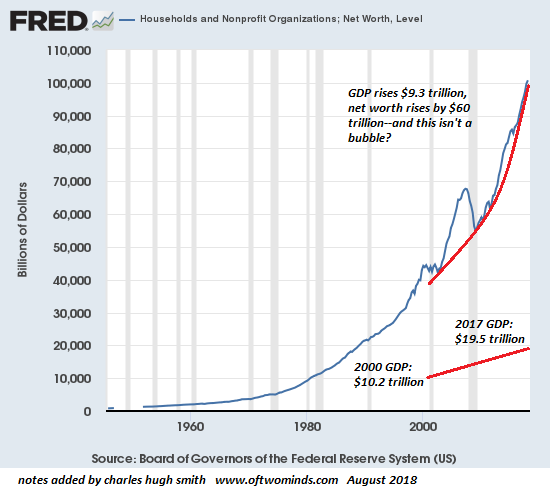

The Fed is the mortal enemy of the young generations, and thus of the nation itself. The wealth effect" generated by rising stock and housing prices has long been a core goal of the Federal Reserve and other central banks. As Lance Roberts noted in his recent commentary So, The Fed Doesn't Target The Market, Eh?

Read More »

Read More »

FX Weekly Preview: Dovish Hold by the ECB and Uptick in US Wages will Underscore Divergence

The important events take place in the second half of the week ahead: the ECB meeting and the US employment report. A dovish hold by the ECB is the most likely outcome. US jobs growth is bound to slow from the heady 304k gain in January, but there won't be anything in it that lends credence to ideas that the world's largest economy is on the precipice of a recession.

Read More »

Read More »

Brexit looms over Geneva motor show

The Geneva International Motor Show opens this week amid growing concerns about the impact of Brexit on car manufacturers in the UK and across Europe. Experts expect that a no-deal Brexit could lead to sudden tariffs that could disrupt the auto industry supply chain. With three weeks left until UK’s planned exit from the EU, some car manufacturers see the annual Geneva motor show as an opportunity to warn against a no-deal separation while...

Read More »

Read More »