In early September 2023 we reported on the Producer Price Index, the PPI. This price statistic takes a back seat to the Consumer Price Index in media reporting and the policy-setting agenda. Back then we explained what it was and what it was telling us about the economy.

The timing of that episode reflected our concern that the sharp drop in the PPI to that point in time might not be a sign of things to come. The PPI had been dropping since mid-2022. Regular listeners will recall our regular discussions and doubts about the Fed’s battle against inflation.

So how does the PPI look six months later?

Since the last episode on PPI, the decline has stopped and the Producer Price Index has leveled off instead of continuing its decline. Since the report for December 2023, the next three reports registered increases in PPI.

The latest monthly report showed an increase of two percent, which is actually less than consensus forecasts! However,

- On a year-over-year basis, compared with the level twelve months ago, this month saw the largest gain since April of 2023, indicating that pressures in consumer price inflation is building up in the pipeline or structure of the economy, which stretches from the forests, mines, farms, and wells of the economy to the shelves of Walmart.

- Close to our end of the pipeline, the prices of wholesale goods dropped 0.1 percent after rising 1.2 percent in February. But this decrease in the latest report is due to the 1.6 percent drop in wholesale energy prices. The drop in wholesale energy prices was offset by a big 0.8 percent increase in wholesale foods. If you don’t consider food and energy prices, the overall PPI was up 0.1 percent for the month.

- Producer services rose 0.3 percent, and the adjusted figure is even higher for the third straight monthly gain.

- Just for your information, the price of copper has been up 6 percent since the beginning of the month, and crude oil is up 2 percent.

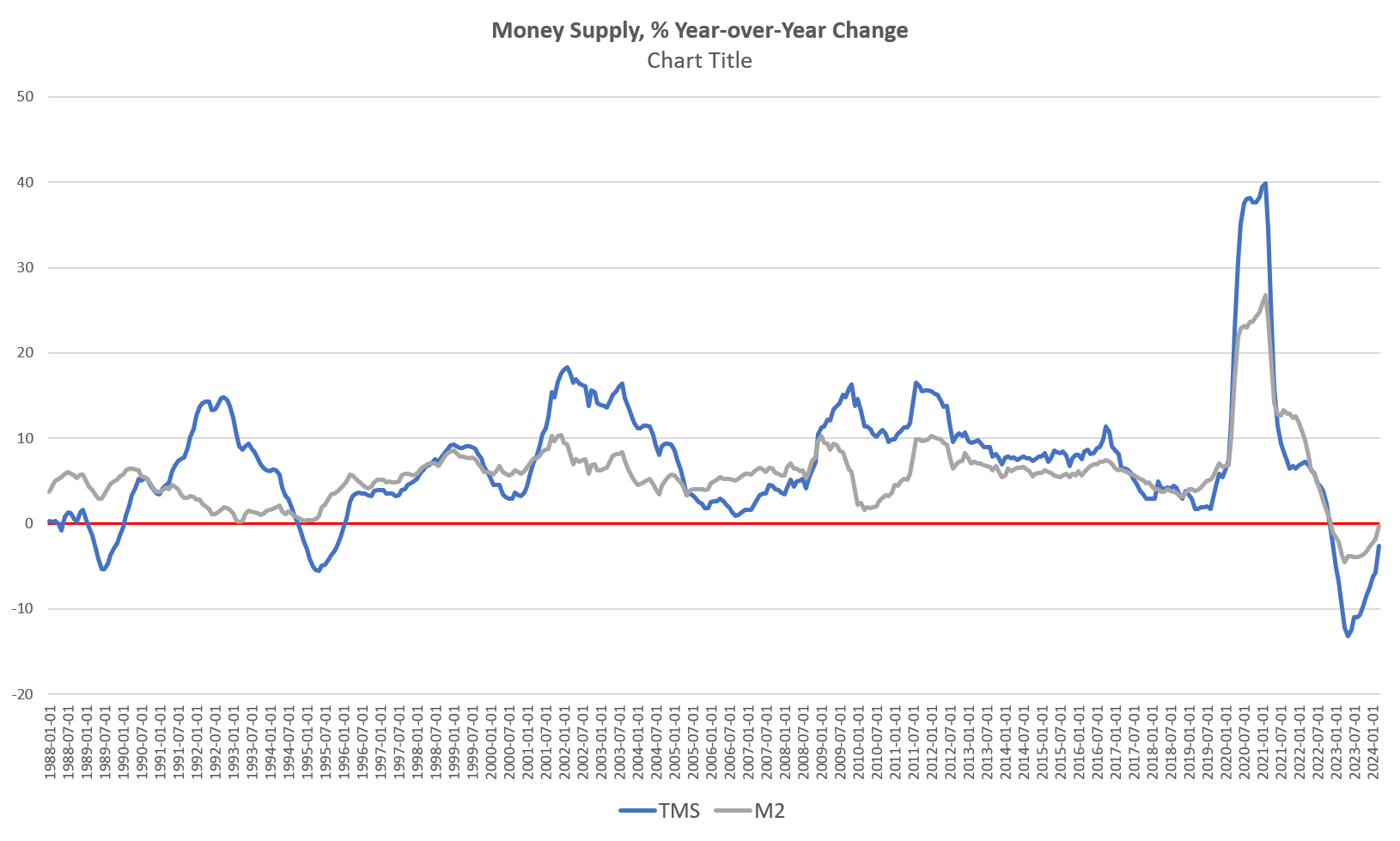

The producer goods pipeline that was driving the decrease in Consumer Price Index inflation down from 9 percent to over 3 percent has clearly stabilized and is less likely to contribute to the Fed’s meeting its 2 percent target. With categories like wage rates and prices of services continuing to rise, how will it reach its target short of throwing the economy into a crisis?

The producer price pipeline is wide and deep, with each stage for each consumer price having multiple stages with an array of its own pipelines and warehouse inventories of inputs. That pipeline might be stacked with gestating price increases for consumers, although nothing guarantees retailers and wholesalers that they will get their money back or make a profit on those past purchases.

If commodity food inflation spreads throughout the entire category and if energy prices continue to strengthen, the Fed’s immaculate disinflation to get back to its target without wrecking the economy and stock market is in serious doubt, especially with interest rates already heading higher and the price of gold at an all-time record high.

Note: The views expressed on Mises.org are not necessarily those of the Mises Institute.

Full story here Are you the author? Previous post See more for Next postTags: Featured,newsletter