China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China. This was amended in December 2003 by the 6th Meeting of the Standing Committee of the Tenth National People’s Congress.

Already by then, the PBOC had begun using more of its monetary toolkit. It had experimented in 2002 with Open Market Operations, or OMO’s. The central bank would issue “bills” to Chinese banks, selling them in order to “soak up” excess liquidity under its definitions.

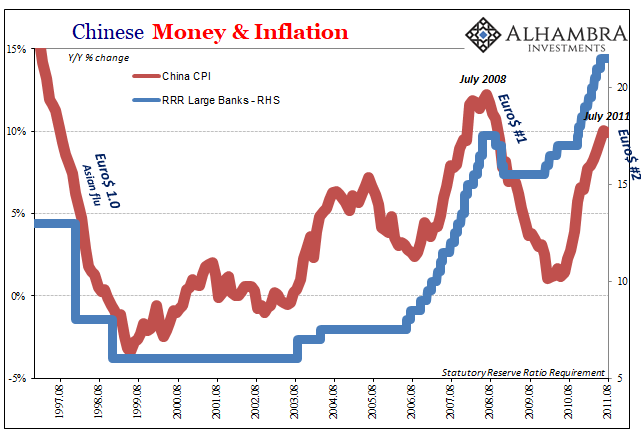

These were supplemented beginning in September 2003 by the first increase in the RRR, the reserve requirement ratio. This bank lever had been around since the eighties though rarely was it ever used. During China’s rough experience with the Asian flu in the late nineties, the RRR had been deeply reduced to help cushion the economic impact of massive eurodollar irregularities sweeping across its front.

This was an economic response in terms of a debt policy, not a monetary decision.

| The RRR told banks how much they needed to keep in liquid reserves (a ledger entry, satisfied via cash holdings or on account with the central bank). If it was reduced, theoretically banks would be able to increase lending because they would be increasingly freed from the reserve constraint. This would include lending in China’s nascent wholesale money markets.

By 2003, the winds of eurodollar influence were blowing heavily in China’s favor again. That meant an excess of monetary resources for the banking sector, only some of which was scooped up by the PBOC as a consequence of pegging CNY’s exchange value to the dollar. To head off harmful inflation, the central bank required the more flexible mandate which was finally sanctioned at the Tenth Congress. In those early years of it, authorities stuck to mostly OMO’s. There were only two RRR increases in the beginning, an experiment, too, of sorts. The Chinese central bank was new to this potential liquidity framework and the last thing they wanted was to do too much. As the middle 2000’s progressed, and “hot money” eurodollar inflows only intensified, a more aggressive campaign was called for. By the middle of 2006, RRR increases became as regular as OMO’s. |

Chinese Money & Inflation 1997-2011 |

| The thing is, these didn’t really work all that well individually or in combination(s). There were several reasons for the lack of control, including the bureaucratic structure of China’s official apparatus, government to central bank and back again.

But most of all, RRR and/or OMO’s are blunt instruments of indeterminate pathologies. Exactly how does a 50 bps increase in the RRR effect a Chinese bank’s proclivity to lend? No one really knows but a higher reserve requirement does sound a lot like tightening. As you can see above, China’s economy came to be plagued by high inflation anyway, especially damaging food price inflation. The country’s CPI suggested still the deflationary drag at the end of 2002, a decrease of 0.4% in the month of December 2002, but rising to a breakout +3.2% in December 2003. It had at first seemed like the OMO’s were working, with inflation rates falling in the middle of 2005 before another sharp surge which triggered the aggressive response relying more on the uncertain RRR mechanics. By early 2008, despite the RRR having been pushed as high as 17.5% (for large banks), consumer price inflation was rampant the CPI reaching 8.5%. Food prices were rising by more than 20% per year. |

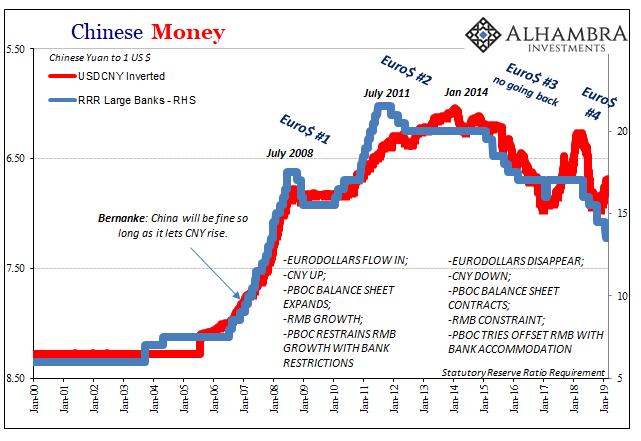

Chinese Money 2000-2019 |

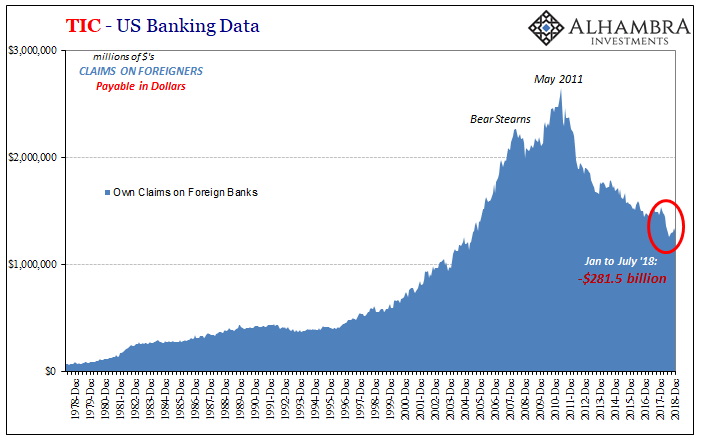

| The only thing that stopped the onslaught was Euro$ #2. The Global Financial Crisis of 2008, Euro$ #1, had been a temporary reprieve before the same massive money imbalances revisited China in its immediate aftermath. The RRR was pushed up to as much as 21.5% before the second global deflationary wave finally erased its momentum.

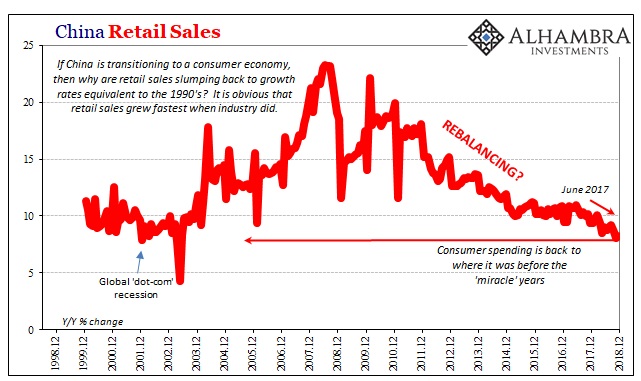

Since the middle of 2011, inflation is no longer a problem for the Chinese. Rather, monetary authorities now have nothing but the opposite concern. Their patchwork response has been to do the same things only in reverse; for eurodollar outflows the RRR is reduced. At times, the central bank even refrains from issuing central bank bills. As with the period before 2008, from 2011 to 2013 it didn’t go well. By the middle of 2014, the PBOC had added new capacities for more targeted bank liquidity, lending windows such as the MLF or SLF. Here’s the thing, though. Chinese monetary authorities after relying heavily on tools like the MLF in 2016 and 2017 are no longer as much interested in them. They increased the RMB part of the central bank balance sheet to no avail. This then left the RRR as China’s main monetary line of defense against deflationary forces in 2018 and going forward. Given its obviously poor performance as an inflation-fighting instrument, why would anyone be optimistic on its chances of succeeding now? You could try to make the case that it could possibly be more effective when used in reverse, but that’s just silly. China’s Communists aren’t silly they are authoritarian monsters, meaning they have to be pragmatic for their own survival especially where economic growth (the peasant to middle class pipeline) is concerned. China’s Premier Li Keqiang announced today that the national growth target for 2019 was reduced to a range between 6.0% and 6.5% real GDP expansion. This is lower still than 2018’s mandate for “about” 6.5%, which came in as expected at exactly 6.5%. What are the chances China’s GDP sees the top end of its newly set corridor? If the bottom, this would be the lowest growth since the eighties. Perhaps a significant sign, China’s Communist leadership appears to have given up entirely targeting both retail sales growth and fixed asset investment. |

China Retail Sales 1998-2018(see more posts on China Retail Sales, ) |

Li warned:

This is not a new theme except if you have been listening exclusively to the wishful thinking of Western Economists and central bankers. Since the 19th Communist Party Congress (the political apparatus, a separate entity from the National People’s Congress) held in October 2017, government officials have been consistent about this “tough struggle.” There never was globally synchronized growth at least not at a level that would meaningfully change the world’s economic circumstance. Behind everything is the same thing. Keynes was right. Inflation is one monetary evil, but its twin is far, far worse. At least with inflation things are moving, Chinese peasants are progressed up into the middle class even if it is more expensive when they get there. Deflation, however, is when everything stops; Dante’s Hell was freezing cold. It doesn’t have to be all at once like in the early thirties, this can be a prolonged affair dragging out across more years than anyone cares to remember. The frog isn’t being slowly boiled, it is being progressively frozen. It is now almost completely frigid, too cold to be able to leap out of the icy water. Stuck here without any other options, it must conserve its energy as best it can and hope that it can somehow survive. If given a choice, you pick the heat of high inflation over this every day of the week; until you realize it isn’t your choice. It never really was. |

TIC - US Banking Data 1978-2018 |

Tags: $CNY,China,China Retail Sales,currencies,dollar short,dollar shortage,economy,EuroDollar,Federal Reserve/Monetary Policy,Markets,newsletter,PBOC,RMB