Tag Archive: China Retail Sales

Retail sales are an aggregated measure of the sales of retail goods over a stated time period, typically based on a data sampling that is extrapolated to model an entire country. Measuring consumer demand for finished goods, retail sales help gauge the pulse of an economy and its projected path toward expansion or contraction. As a leading macroeconomic indicator, healthy retail sales figures typically elicit positive movements in equity markets.

FX Daily, August 14: Consolidation Featured Ahead of the Weekend

The equity rally is stalling ahead of the weekend. Most markets in the Asia Pacific region eased, though China and Australia advanced. Japanese shares were mixed. The Nikkei, though advanced for the fourth consecutive session, while the Topis slipped.

Read More »

Read More »

FX Daily, June 15: Unwind Continues

Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today's activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei's 3.5% drop, and South Korea's 4.7% fall led the way. In Europe, the Dow Jones Stoxx 600 is recovering from a more than two percent early loss, as it drops for the fifth time in the past six sessions.

Read More »

Read More »

FX Daily, May 15: Much Talk but Little Action

Overview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week's losses. Australia's 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week.

Read More »

Read More »

China Enters 2020 Still (Intent On) Managing Its Decline

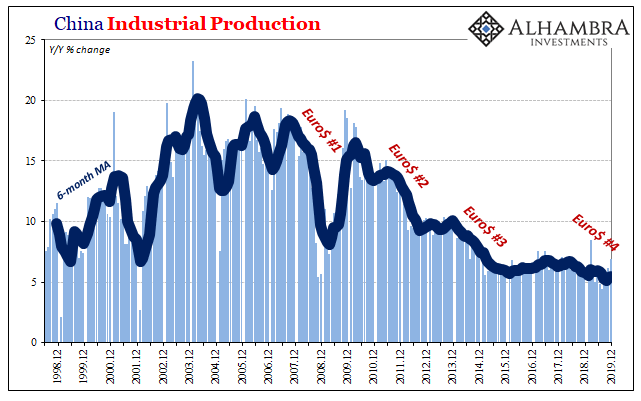

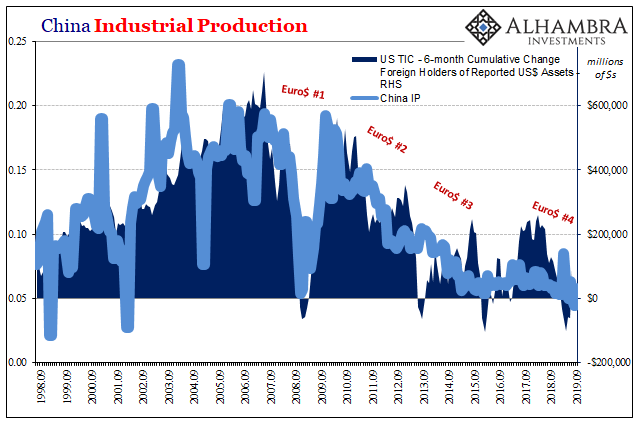

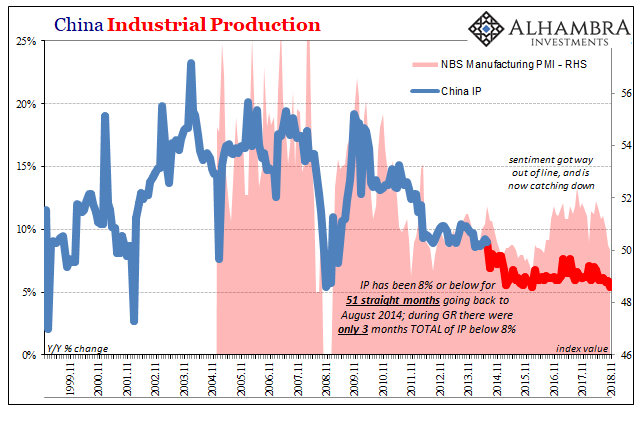

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it.

Read More »

Read More »

China Data: Something New, or Just The Latest Scheduled Acceleration?

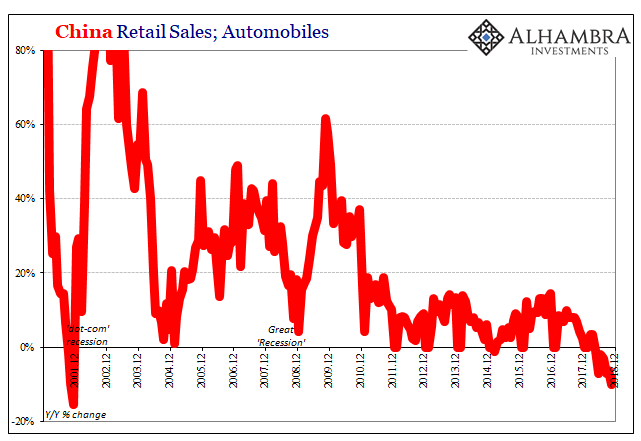

The Chinese government was serious about imposing pollution controls on its vast stock of automobiles. The largest market in the world for cars and trucks, the net result of China’s “miracle” years of eurodollar-financed modernization, for the Chinese people living in its huge cities the non-economic costs are, unlike the air, immediately clear each and every day.

Read More »

Read More »

China’s Financial Stability: A Squeeze and a Strangle

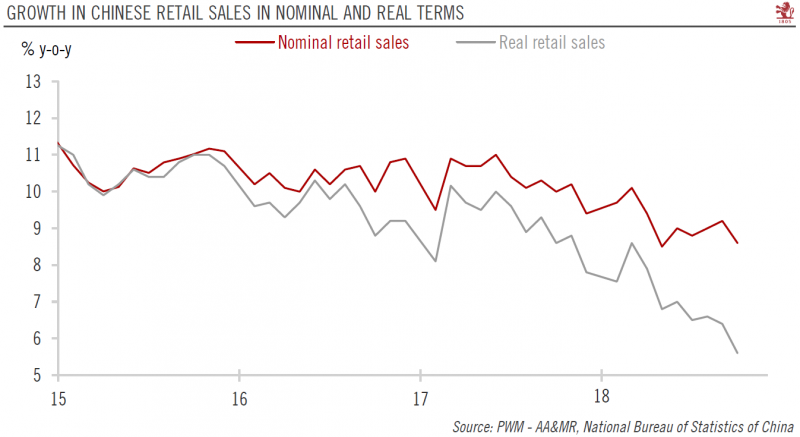

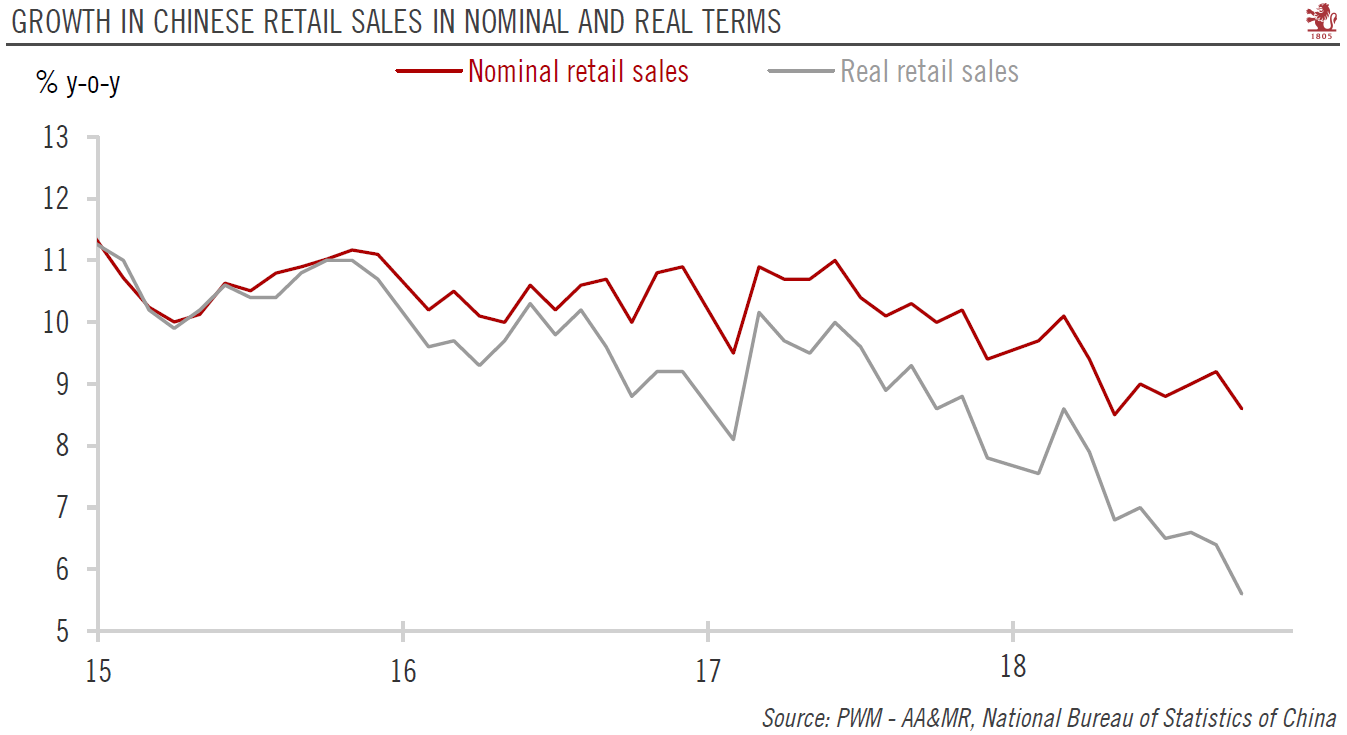

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled.

Read More »

Read More »

FX Daily, November 14: Unexpected German Growth Fails to Buoy the Euro

Overview: Rising trade anxiety and disappointing economic reports from the Asia Pacific region helped unpin the profit-taking mood in equities, while bond yields continued to pullback. The MSCI Asia Pacific Index and the Dow Jones Stoxx 600 are in the red for the fourth time in the last five sessions. Germany reported a surprise 0.1% expansion in Q3, but it has done little for the DAX or the euro.

Read More »

Read More »

The Dollar-driven Cage Match: Xi vs Li in China With Nowhere Else To Go

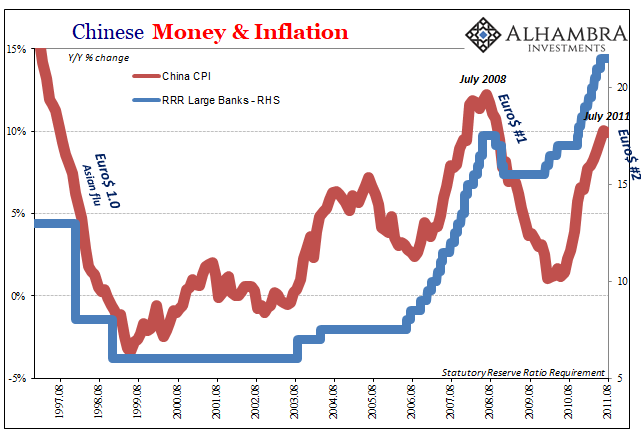

China’s growing troubles go way back long before trade wars ever showed up. It was Euro$ #2 that set this course in motion, and then Euro$ #3 which proved the country’s helplessness. It proved it not just to anyone willing to honestly evaluate the situation, it also established the danger to one key faction of Chinese officials.

Read More »

Read More »

FX Daily, October 18: Markets Becalmed Ahead of the Week

Overview: The global capital markets are ending the week on a subdued note as the UK Parliament decision on Saturday is awaited. The weaker Chinese Q3 GDP had little impact outside of China, where stocks fell over 1%. A brief suspension of hostilities by Turkey was sufficient for the US to lift its threatened sanctions.

Read More »

Read More »

FX Daily, September 16: Oil Surge Pared, Markets Remain on Edge

Overview: Oil prices surged in the initial reaction to the unprecedented drone attack on Saudi Arabia facilities. Saudi Arabia may be able to restore around half of the lost production in a few days. Saudi Arabia and other countries, including the US, prepared to tap strategic reserves, oil prices have seen the initial gains halved. Brent is trading near $65 after finishing last week near $60.

Read More »

Read More »

FX Daily, July 15: Marking Time on Monday

Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed today, but equities were mostly firmer in the Asia Pacific regions, markets in China, Hong Kong, Taiwan, and India firmed.

Read More »

Read More »

Dimmed Hopes In China Cars, Too

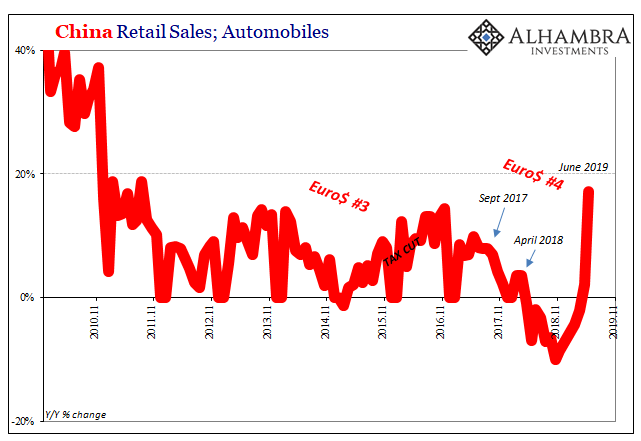

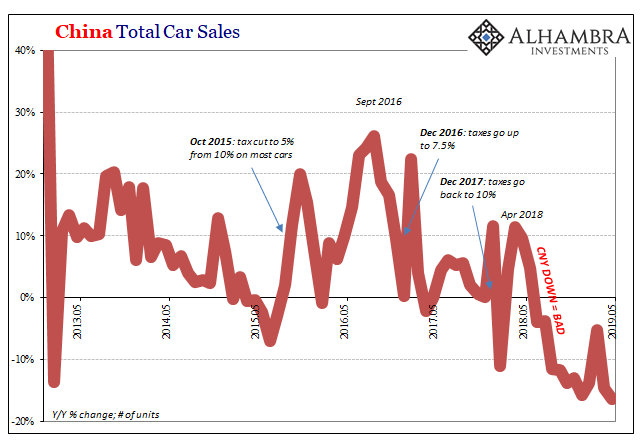

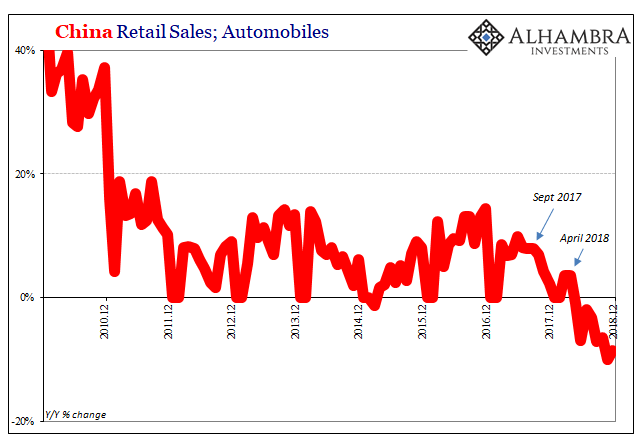

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each.

Read More »

Read More »

FX Daily, June 14: Waning Risk Appetite Going into the Weekend

Overview: Worries about an escalation in the Gulf following US accusations that Iran was behind yesterday's two attacks and weaker growth impulses, while trade tensions remain high, are dampening risk appetites ahead of the weekend. Equities are lower. Nearly all the stock markets in the Asia Pacific region fell today with Japan and Australia being the notable exceptions.

Read More »

Read More »

FX Daily, May 15: Angst Continues

Overview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week. Indonesia, which reported a record trade deficit on the back of collapsing exports (-13.1% year-over-year in April, nearly twice the decline expected after a 10% fall in March) kept the pressure on its...

Read More »

Read More »

Coloring One Green Shoot

China’s Passenger Car Association reported last week that retail sales of various vehicles totaled 1.78 million units in March 2019. The total was 12% less than the number of automobiles sold in March 2018. This matches the government’s data, both sets very clear as to when Chinese economic struggles accelerated: May 2018.

Read More »

Read More »

China Has No Choice

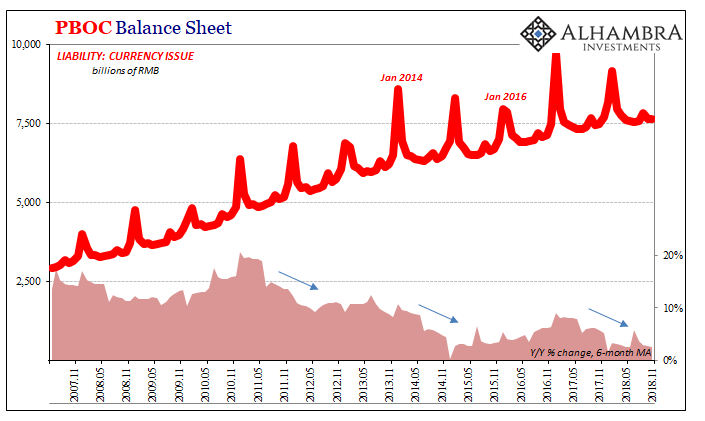

China’s central bank was given more independence to conduct monetary policies in late 2003. It had been operating under Order No. 46 of the President of the People’s Republic of China issued in March 1995, which led the 3rd Session of the Eighth National People’s Congress (China’s de facto legislature) to create and adopt the Law of the People’s Republic of China on the People’s Bank of China.

Read More »

Read More »

Something Different About This One

In Japan, they call it “powerful monetary easing.” In practice, it is anything but. QQE with all its added letters is so authoritative that it is knocked sideways by the smallest of economic and financial breezes. If it truly worked the way it was supposed to, the Bank of Japan or any central bank would only need it for the shortest of timeframes.

Read More »

Read More »

China’s Eurodollar Story Reaches Its Final Chapters

Imagine yourself as a rural Chinese farmer. Even the term “farmer” makes it sound better than it really is. This is a life out of the 19th century, subsistence at best the daily struggle just to survive. Flourishing is a dream.

Read More »

Read More »

The Relevant Word Is ‘Decline’

The English language headline for China’s National Bureau of Statistics’ press release on November 2018’s Big 3 was, National Economy Maintained Stable and Sound Momentum of Development in November. For those who, as noted yesterday, are wishing China’s economy bad news so as to lead to the supposed good news of a coordinated “stimulus” response this was itself a bad news/good news situation.

Read More »

Read More »

China hard data for October reveals mixed picture

Disappointing consumption numbers point to growth deceleration in early 2019, but government measures beginning to be felt.Hard data out of China for October was mixed. On the positive side, growth in infrastructure picked up, suggesting the government’s fiscal policy easing is taking effect in the real economy. Industrial production numbers stopped declining, and the mining sector has a particularly strong performance.

Read More »

Read More »