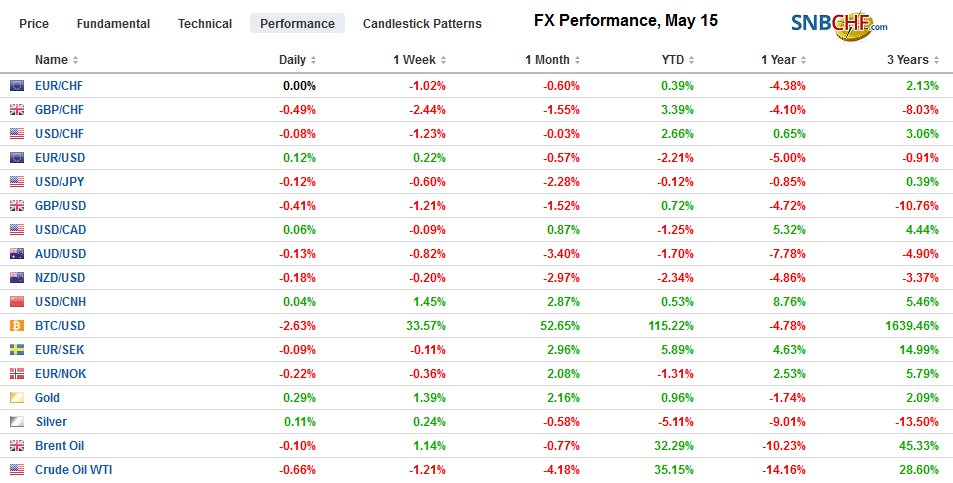

Swiss FrancThe Euro has fallen by 0.28% at 1.1273 |

EUR/CHF and USD/CHF, May 15(see more posts on EUR/CHF, USD/CHF, ) Source: merkets.ft.com - Click to enlarge |

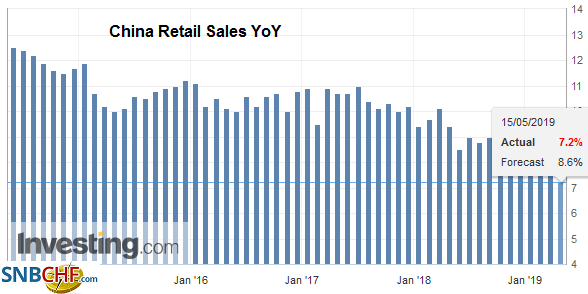

FX RatesOverview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week. Indonesia, which reported a record trade deficit on the back of collapsing exports (-13.1% year-over-year in April, nearly twice the decline expected after a 10% fall in March) kept the pressure on its equity market. At the same time, though, an unexpected rise in South Korean unemployment (4.1% vs. 3.8%) heightened speculation of a near-term rate cut, while the equity market rose for the second consecutive session. European and US equities have not followed suit. The Dow Jones Stoxx 600 has been unable to hold on to the initial gains after yesterday’s 1% rise, the most since early April, while US shares are trading with a softer profile. Bond yields are mostly softer. The US benchmark 10-year yield is slipping through 2.40%, while the German benchmark yield is its lowest since 2016 (negative 11 bp). Italy, where League leader and Deputy PM Salvini, probably campaigning for the European Parliament elections said he would be willing to break the EU fiscal rules to cut the unemployment rate in half, has seen its bond and stock underperform. Italy’s bank index has fallen over 12% this month. The dollar is mixed, but it seems that its role is more like a fulcrum than a key mover. The dollar-bloc currencies and the Scandis on the weaker side of the teeter-totter and the yen, Swiss franc are on the other side, with the euro and sterling firm but little changed. Unchanged unemployment at 14.7%, despite calls for deterioration, failed to lend the Turkish lira much support as the government re-imposed a 0.1% foreign exchange fee on some transactions to discourage speculation (rather than raise funds). |

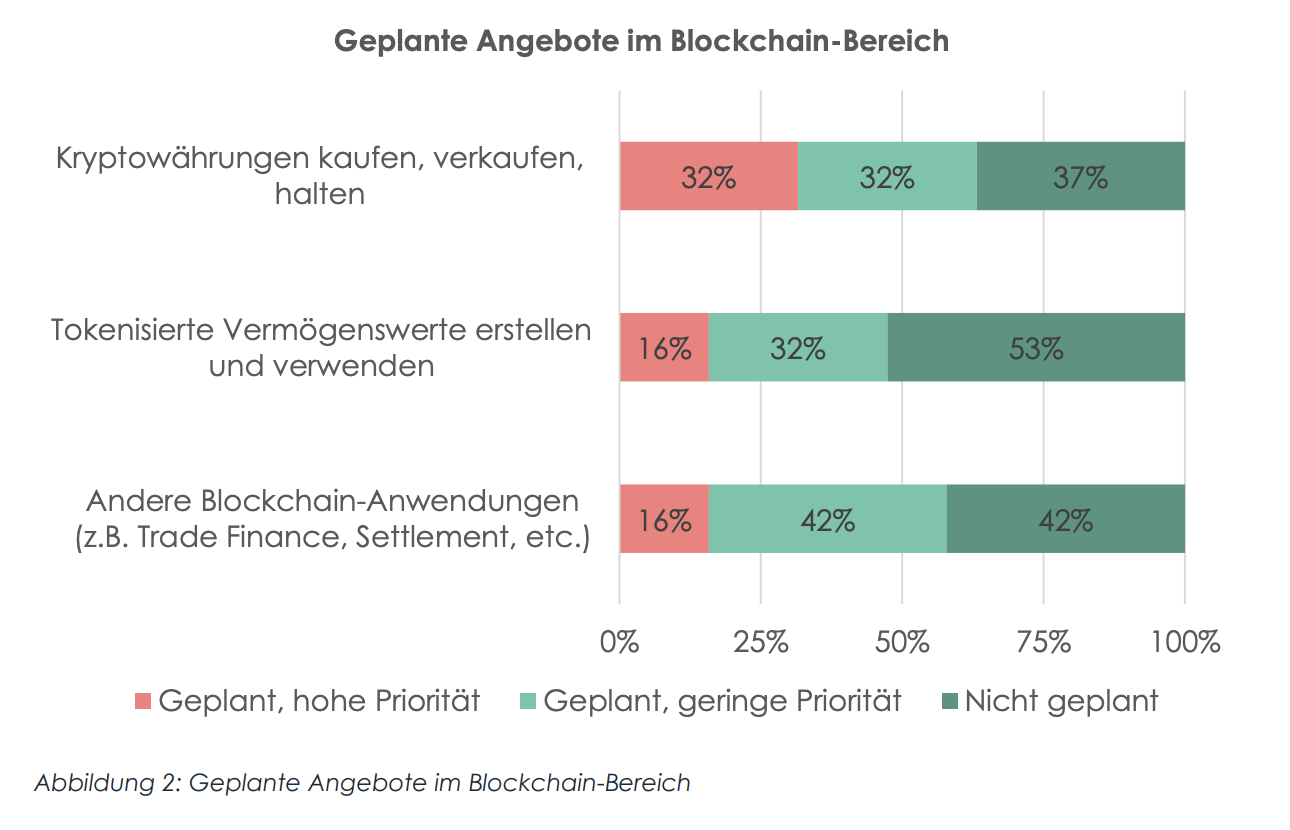

FX Performance, May 15 |

Asia PacificMany observers are suspect of Chinese economic data. Yet there seems to be an asymmetry. There is greater disbelief expressed toward strong data than weak data. That means that most are willing to accept at face value today’s disappointing data. Industrial output fell to 5.4% from 8.5% in March and well below expectations. |

China Industrial Production YoY, April 2019(see more posts on China Industrial Production, ) Source: investing.com - Click to enlarge |

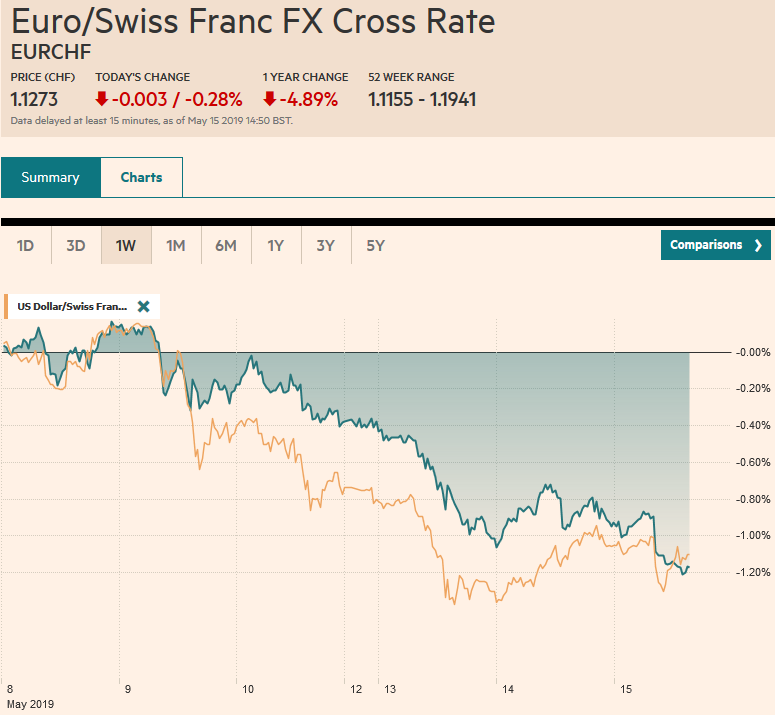

| Retail sales slowed to 7.2% from 8.7%. Fixed asset investment slowed to 6.1% form 6.3%. On the other hand, unemployment fell to 5.0% from 5.2%, and investment in property edged to 11.9% from 11.8%. The slowdown does not appear to be the result of the trade shock, and the latest escalation is not yet in effect. We think China has the will and the resources to make good on what we have called its “Draghi moment”–willing to do whatever it takes to bolster the economy in the face of US pressure and the 70th anniversary of the Communist Revolution. |

China Retail Sales YoY, April 2019(see more posts on China Retail Sales, ) Source: investing.com - Click to enlarge |

Japan reported mixed data. Construction orders jumped 66% in March. This follows a small decline in February after a nearly 20% rise in January. Orders rose by the most in Q1 since Q2 14. On the other hand, preliminary machine tool orders for April slumped by a third (-33.4%). It is the sixth consecutive year-over-year decline. Separately, we note that although the Japanese yield curve through 10-year is negative, the equity market is paying a rich yield. The yield of the Topix is near 2.5%, according to Bloomberg. This is not only greater than the S&P 500 dividend yield (just below 2%), but it is also above the US 10-year yield. The dividend yield of the Nikkei is near 2.2%.

Australian wage growth in Q1 matched the 0.5% increase in Q4 18, but disappointed expectations slightly. The weight on the Australian dollar is coming from its role as proxy for China and growing speculation of a rate cut. Actually, with today’s moves, it appears the market is discounting not one but two cuts this year and is leaning toward pricing in a third. A strong employment report tomorrow could see the speculation tempered, but unlikely to be reversed.

The dollar remains within Monday’s trading range against the yen. It has not been above JPY110.10 for a week. There is a $480 mln option struck at JPY110 that expires today, more the more interesting play is the $2 bln options struck in the JPY109.40-JPY109.50 range that will be cut today. Today’s low was recorded in the European session near JPY109.40. The Australian dollar’s bleeding continues, and it reached $0.6920 today, the lowest level since the flash crash on January 3. There is an option for almost A$530 mln struck at $0.6900 that expires today. The dollar was firm against the Chinese yuan, but the PBOC operations appear to be resisting the weakness rather than driving it.

EuropeUK Prime Minister May is going to shrug off backbencher concerns when she meets with them tomorrow. Reports suggest that she will press on and resubmit the Withdrawal Bill in the first week in June. The strategy apparently is counting on a poor showing in the EU Parliamentary elections and what is expected to be a strong showing for Farage’s Brexit Party and the “quick exit pledge.” While it appeared that Parliament had made more remote the possibility of leaving without an agreement, the risk of such an exit has perceived to have increased, and this is part of the explanation for sterling’s weakness. |

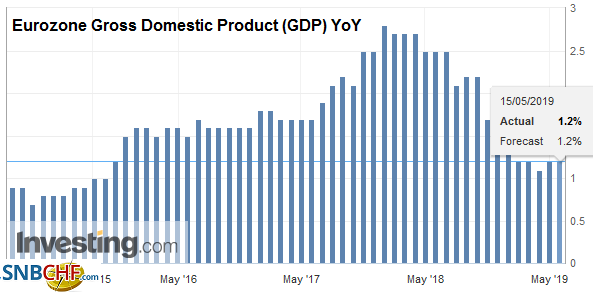

Eurozone Gross Domestic Product (GDP) YoY, Q1 2019(see more posts on Eurozone Gross Domestic Product, ) Source: investing.com - Click to enlarge |

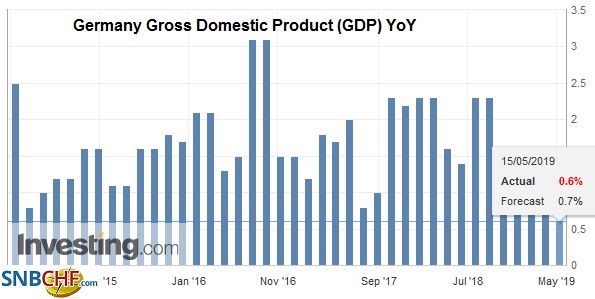

| German Q1 GDP was spot on with expectations, expanding 0.4%. Details are not available with the initial report, but the government highlighted the consumer, construction, and equipment investment, while recognizing trade was still a challenge. The German economy grew 1.4% in 2018 but is expected to slow to around 0.5% this year. |

Germany Gross Domestic Product (GDP) YoY, Q1 2019(see more posts on Germany Gross Domestic Product, ) Source: investing.com - Click to enlarge |

Pressure on Italy is mounting. The fissure lines in the government have been clear from the get-go, but they have been contained. However, circumstances are changing. The attempt to arrange a private bailout of a troubled bank has faltered, and it is possible that the unpleasant step to nationalize it may be necessary. An adviser of the League’s Salvini has had to step down due to corruption charges. The economy continues to struggle, and this translates into a larger budget deficit. Arguably, most importantly is that ahead of the EU Parliament elections, the League has seen its support wane a bit. Meanwhile, the doom loop, linking the banks to the sovereign, remains strong. The poor performance of Italian sovereign bonds (the 10-year yield is now with today’s move higher on the year, while the German Bund yield is off 35 bp this year) weighs on Italian banks.

After performing poorly yesterday, the euro briefly dipped below $1.12 for the first time in a week in early Europe. It bounced to the session highs just above $1.1215, perhaps in response to the German GDP report before pushing back. The topside appears blocked around $1.1265. The downside is appearing path of least resistance. The $1.1170 and $1.1185 area houses retracement objectives (50% and 61.8%) of the euro’s bounce since the 18-month low was set o April 26 a little above $1.1100. Sterling slipped briefly through $1.29 for the first time since April 26. There is a GBP554 mln option at $1.29 that expires today. The low from late April was near $1.2865.

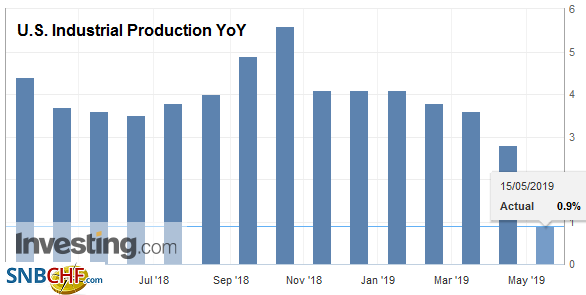

United StatesThe US reports April retail sales and industrial production figures. They will impact GDP estimates. Most observers see growth to be slowing after the unexpected surge of 3.2% in Q1 (subject to revisions). The inventory and trade contribution is not expected to be repeated, which accounted for half of the growth in the Jan-Mar period. Retail sales account for a little more than 40% of personal consumption expenditures, which typically drive 2/3 of the economy. Consumption was soft in Q1, and the April retail sales figures may be ambiguous. Investors already know that auto sales slowed to a 16.4 mln unit annualized pace in April, the lowest since August 2017 that as impacted by terrible storms. After a heady 1.6% surge in March, retail sales may have barely edged up, but excluding autos, sales likely rose around 0.7% after a 1.2% increase in March. However, the components that are used in GDP models, that excludes (actually picks them up from different time series) things like autos, gasoline, and building materials, is expected to rise 0.2% after March’s 1.0% gain. The median forecast in the Bloomberg survey calls for flat industrial production report. It fell by a cumulative of 0.3% in Q1. After contracting a cumulative 0.8% in Q1, manufacturing output is forecast to also be unchanged in April. |

U.S. Industrial Production YoY, April 2019(see more posts on U.S. Industrial Production, ) Source: investing.com - Click to enlarge |

Following last week’s monster’s jobs data that saw the Canadian economy add 106k jobs in April and 420k jobs over the past year, Canada reports April CPI today. A 0.4% rise that economists expect would lift nudge the year-over-year rate to 2.0%. This risks understating the case. A 0.4% rise would bring the three-month average to 0.6%, which matches the strongest pace since May 2011. The combination of these two reports solidify expectations that the Bank of Canada is steadfastly on hold. Since late March, the implied yield on the December Banker Acceptances futures has risen nearly 20 bp as the market has priced out the chance of a cut. Separately, Canada reported April existing home sales. They are likely to have continued their weak attempt to recover from the 9% slide in February.

The American Petroleum Institute estimated that US oil inventories rose 8.6 mln barrels last week. The EIA’s estimate is due later today and is projected to be a build closer to 1.2 mln barrels. The spike on Monday amid reports of drone harassment in the Gulf stopped near the 20-day moving average (~$63.35 basis the June WTI contract) returned to around $60.65. Meanwhile, the US pressure on Iran is increasing, and many fear that we are on the brink of hostilities. Separately, although China did not add a tariff to US oil, it is looking for alternatives, and reports suggest it is looking to swap US cargoes for supplies from other countries.

The US dollar remains mired in a CAD1.3400-CAD1.3500 trading range. It is performing better than the other dollar-bloc currencies, and it is essentially flat against the dollar over the past five sessions. The greenback remains firm against the Mexican peso. Here too it remains range-bound, within the ranges set last Friday (~MXN19.04-MXN19.28). The central bank meets tomorrow. A steady hand, keeping the overnight rate at a lofty 8.25% is widely anticipated. The Dollar Index is at four-day highs. Watch DXY’s 20-day moving average (~97.60). A move through this area, which also corresponds to a 50% retracement of the losses since April 26 could mark the end of the consolidative/corrective phase.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$CNY,Brexit,China Industrial Production,China Retail Sales,EUR/CHF,Eurozone Gross Domestic Product,FX Daily,Germany Gross Domestic Product,newsletter,U.S. Industrial Production,USD/CHF