Tag Archive: China Industrial Production

Industrial Production measures the change in the total inflation-adjusted value of output produced by manufacturers, mines, and utilities.

FX Daily, August 14: Consolidation Featured Ahead of the Weekend

The equity rally is stalling ahead of the weekend. Most markets in the Asia Pacific region eased, though China and Australia advanced. Japanese shares were mixed. The Nikkei, though advanced for the fourth consecutive session, while the Topis slipped.

Read More »

Read More »

FX Daily, June 15: Unwind Continues

Overview: The swing in the pendulum of market sentiment toward fear from greed began last week and has carried over into today's activity. Global equities are getting mauled. In the Asia Pacific region, no market was spared as the Nikkei's 3.5% drop, and South Korea's 4.7% fall led the way. In Europe, the Dow Jones Stoxx 600 is recovering from a more than two percent early loss, as it drops for the fifth time in the past six sessions.

Read More »

Read More »

FX Daily, May 15: Much Talk but Little Action

Overview: The S&P 500 staged an impressive recovery yesterday, a sell-off that took it to its lowest level since April 21, to close more than 1% higher on the day, helped set the tone in the Far East and Europe today. Gains in most Asia Pacific markets, but Hong Kong, Shanghai, and India, trimmed this week's losses. Australia's 1.4% rally today managed to turn ASX positive for the week, extending leg up for a third consecutive week.

Read More »

Read More »

China Enters 2020 Still (Intent On) Managing Its Decline

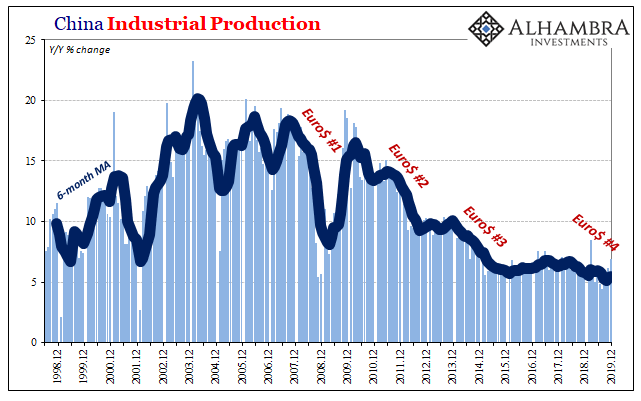

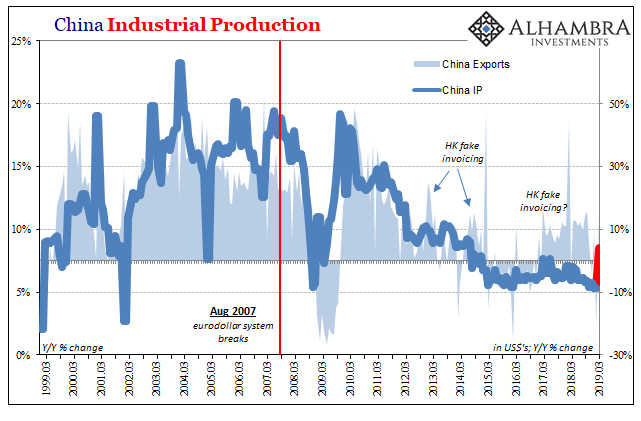

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it.

Read More »

Read More »

FX Daily, January 17: China and the UK Surprise in Opposite Directions

Overview: Helped by new record highs in the US, global stocks are moving higher today. Nearly all the markets in the Asia Pacific region advanced and the seventh consecutive weekly rally is the longest in a couple of years. Europe's Dow Jones Stoxx 600 is at new record highs and appears set to take a four-day streak into next week. US shares are trading firmly.

Read More »

Read More »

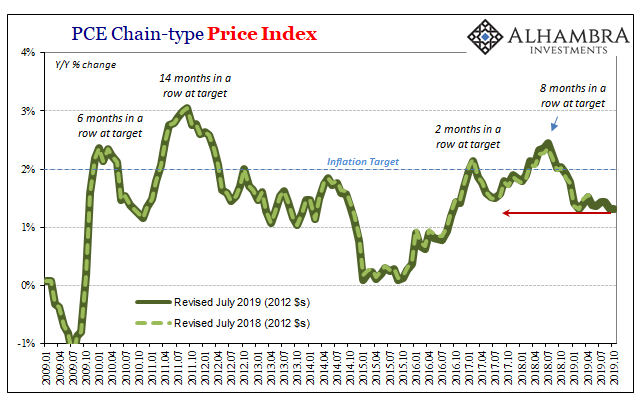

All Signs Of More Slack

The evidence continues to pile up for increasing slack in the US economy. While that doesn’t necessarily mean there is a recession looming, it sure doesn’t help in that regard. Besides, more slack after ten years of it is the real story. The Federal Reserve’s favorite inflation measure in October 2019 stood at 1.31%, matching February for the lowest in several years.

Read More »

Read More »

Exports: Currency Devaluation Won’t Grow the Economy

A visible weakness in economic activity in major world economies raises concern among various commentators that world economies have difficulties recovering despite very aggressive loose monetary policies. The yearly growth rate of US industrial production stood at minus 1.1 % in October, against minus 0.1% in September, and 4.1% in October last year.

Read More »

Read More »

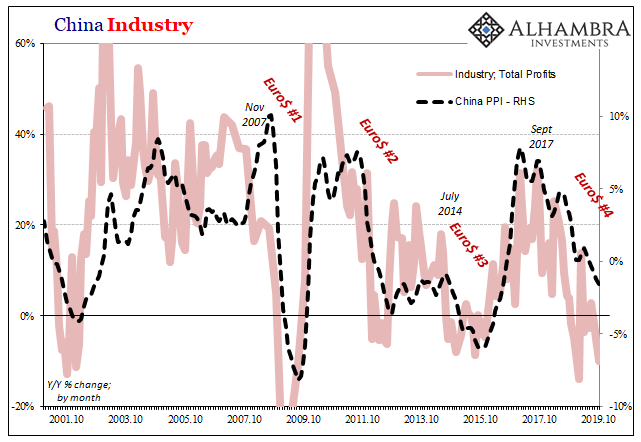

Nothing Good From A Chinese Industrial Recession

October 2017 continues to show up as the most crucial month across a wide range of global economic data. In the mainstream telling, it should have been a very good thing, a hugely positive inflection. That was the time of true inflation hysteria around the globe, though it was always presented as a rationally-determined base case rather than the unsupported madness it really was.

Read More »

Read More »

China’s Financial Stability: A Squeeze and a Strangle

I do get a big kick out of the way Communists over in China announce how they are dealing with their enormous problems especially as they may be getting worse. Each month, for example, the country’s National Bureau of Statistics (NBS) will publish figures on retail sales or industrial production at record lows but in the opening paragraphs the text will be full of praise for how the economy is being handled.

Read More »

Read More »

The Dollar-driven Cage Match: Xi vs Li in China With Nowhere Else To Go

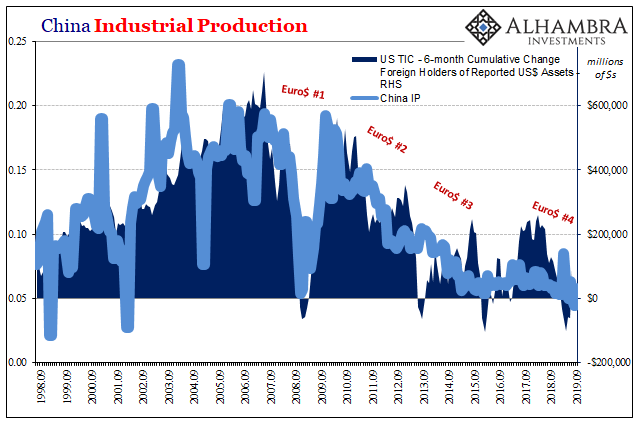

China’s growing troubles go way back long before trade wars ever showed up. It was Euro$ #2 that set this course in motion, and then Euro$ #3 which proved the country’s helplessness. It proved it not just to anyone willing to honestly evaluate the situation, it also established the danger to one key faction of Chinese officials.

Read More »

Read More »

FX Daily, October 18: Markets Becalmed Ahead of the Week

Overview: The global capital markets are ending the week on a subdued note as the UK Parliament decision on Saturday is awaited. The weaker Chinese Q3 GDP had little impact outside of China, where stocks fell over 1%. A brief suspension of hostilities by Turkey was sufficient for the US to lift its threatened sanctions.

Read More »

Read More »

FX Daily, September 16: Oil Surge Pared, Markets Remain on Edge

Overview: Oil prices surged in the initial reaction to the unprecedented drone attack on Saudi Arabia facilities. Saudi Arabia may be able to restore around half of the lost production in a few days. Saudi Arabia and other countries, including the US, prepared to tap strategic reserves, oil prices have seen the initial gains halved. Brent is trading near $65 after finishing last week near $60.

Read More »

Read More »

Dollar (In) Demand

The last time was bad, no getting around it. From the end of 2014 until the first months of 2016, the Chinese economy was in a perilous state. Dramatic weakness had emerged which had seemed impossible to reconcile with conventions about the country. Committed to growth over everything, and I mean everything, China was the one country the world thought it could count on for being immune to the widespread economic sickness.

Read More »

Read More »

FX Daily, July 15: Marking Time on Monday

Overview: The new record highs in US equities ahead of the weekend coupled with Chinese data that suggested the economy was gaining some traction as Q2 wound down is helping underpin risk appetites to start the week. Japanese markets were closed today, but equities were mostly firmer in the Asia Pacific regions, markets in China, Hong Kong, Taiwan, and India firmed.

Read More »

Read More »

FX Daily, June 14: Waning Risk Appetite Going into the Weekend

Overview: Worries about an escalation in the Gulf following US accusations that Iran was behind yesterday's two attacks and weaker growth impulses, while trade tensions remain high, are dampening risk appetites ahead of the weekend. Equities are lower. Nearly all the stock markets in the Asia Pacific region fell today with Japan and Australia being the notable exceptions.

Read More »

Read More »

FX Daily, May 15: Angst Continues

Overview: Disappointing Chinese April data spurred speculation that more stimulus will be forthcoming and bolsters hopes that a trade deal with the US by the end of next month helped Asian Pacific equities advance for the first time this week. Indonesia, which reported a record trade deficit on the back of collapsing exports (-13.1% year-over-year in April, nearly twice the decline expected after a 10% fall in March) kept the pressure on its...

Read More »

Read More »

China’s Blowout IP, Frugal Stimulus, and Sinking Capex

It had been 55 months, nearly five years since China’s vast and troubled industrial sector had seen growth better than 8%. Not since the first sparks of the rising dollar, Euro$ #3’s worst, had Industrial Production been better than that mark. What used to be a floor had seemingly become an unbreakable ceiling over this past half a decade. According to Chinese estimates, IP in March 2019 was 8.5% more than it was in March 2018. That was far more...

Read More »

Read More »

FX Daily, April 17: Veracity of Chinese Data Questioned, but Lifts Sentiment Nevertheless

The veracity of Chinese data will be questioned by economists, but today's upbeat reports round out a picture that began with stronger exports and a surge in lending. Chinese officials, we argue, had a "Draghi moment" and decided to do "whatever it takes" to strengthen the economy in the face of US tariffs and during the 70th anniversary of the Revolution.

Read More »

Read More »

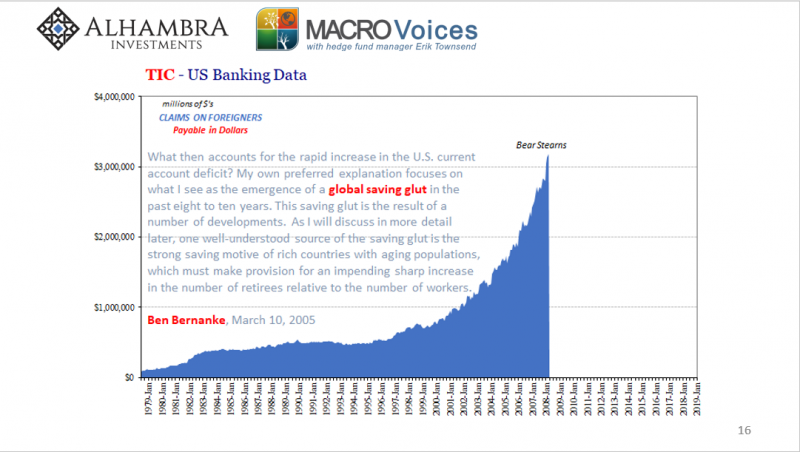

Why 2011

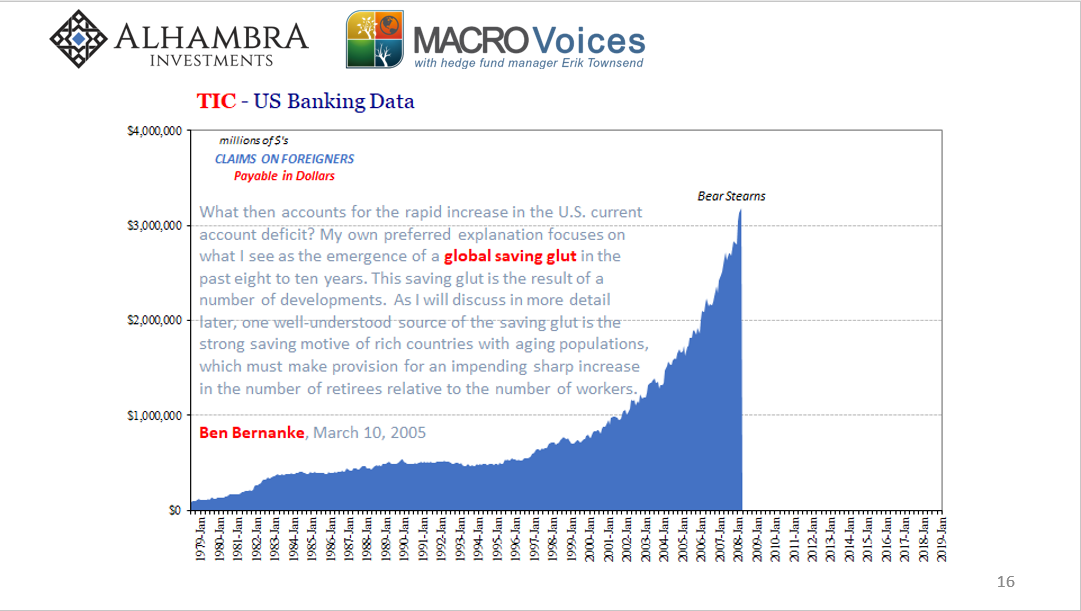

The eurodollar era saw not one but two credit bubbles. The first has been studied to death, though almost always getting it wrong. The Great Financial Crisis has been laid at the doorstep of subprime, a bunch of greedy Wall Street bankers insufficiently regulated to have not known any better. That was just a symptom of the first. The housing bubble itself was more than housing.

Read More »

Read More »

Slump, Downturn, Recession; All Add Up To Sideways

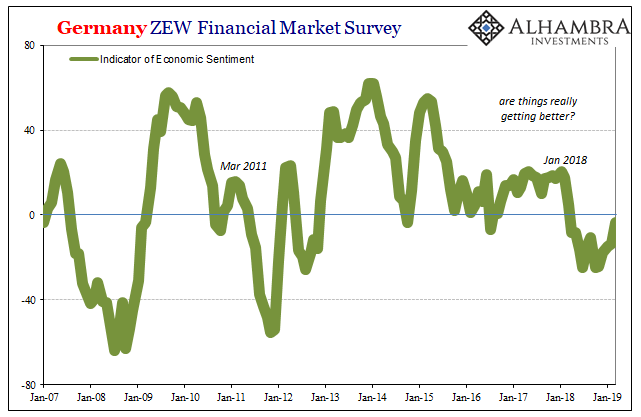

According to Germany’s Zentrum für Europäische Wirtschaftsforschung, or ZEW, the slump in the country’s economy has now reached its fourteenth month. The institute’s sentiment index has improved in the last two, but only slightly. As of the latest calculation released today, it stands at -3.6.

Read More »

Read More »