The IMF identified US fiscal policy as a key to fueling demand, inflation, and the stronger greenback, which has heightened concern among several countries in the Asia Pacific region, including Japan, South Korea, China, and Indonesia. It appears that Japan intervened materially in late April and again in early May. Indonesia hiked rates to defend the rupiah. South Korea, and a few other countries in East Asia expressed concern about the pressure on their currencies.

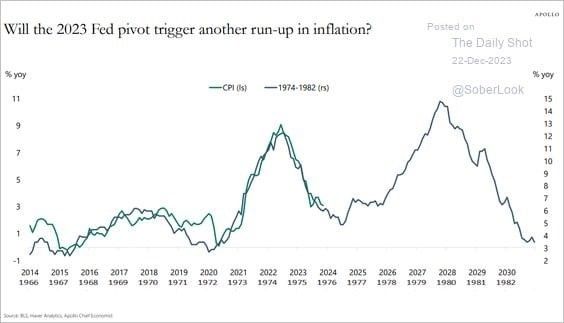

At the end of last year, it has looked like US inflation was moderating quickly and economy has looked poised to slow considerably. Throughout the most aggressive Fed tightening cycle in a generation, the market had periodically discounted a more dovish policy only to subsequently re-converge with the Federal Reserve. In December 2023, the median Fed forecast was for three cuts in 2024, and the market the Fed funds futures had implied more than six cuts would be delivered.

The continued employment gains and wage growth faster than inflation, coupled with expanding consumer credit, helped fuel strong US consumption. Price pressures proved stubborn, primarily as shelter costs have not moderated as many economists, both on Wall Street and at the Federal Reserve expected. Without shelter prices falling, it is difficult to be confident that inflation is on a sustainable path back to 2% target. By the March FOMC meeting, the additional confidence that Fed officials sought had not materialized and March’s data, delivered in April, shattered any remaining confidence in the narrative of a “bumpy path” toward the target. The debate in the market had transformed from hard landing vs. soft-landing to discussions of re-accelerating growth.

The market has pushed out the timing of the Fed’s first cut and has reduced the extent of interest rate cuts this year, the derivatives market is pricing in one quarter-point cut and about a 50% chance of a second cut. Given the still strong job growth in April and the risk of continued sticky inflation, the interest rate adjustment may continue. There may be scope for the two-year note yield to climb toward 5.25% (from slightly below 5%), and possibly more, in the coming weeks. The rate adjustment has sparked a sharp setback in equities, after a dramatic rally in the first quarter. This, coupled with geopolitical tensions, has fostered a risk-off environment, which is also supportive of the dollar.

The Bank of Japan’s rate hike in March failed to stem the yen’s sell-off. The yen appears to be more sensitive to US interest rates than Japanese. Moreover, even with the rate hike, Japan is still the low yielder, making in an attractive funding currency. Intensified verbal intervention seemed largely shrugged off and the dollar broke above the JPY152 area which had capped it in 2022 and 2023 on April 10 and took out JPY155 about two weeks later.

Japanese official verbal intervention intensified, but with the third consecutive US CPI above expectations, the dollar surged to almost JPY160.20 in late April. The Bank of Japan appears to have sold around $58 bln over two separate operations at the end of April and early May. Officially confirmation is unlikely until the end of May. Still, if there was the intervention, there are two notable features. First, officials intervened in thin markets. This allowed their size to overwhelm the market. Second, it appears Japan acted on its own. And even if Japan did not coordinate intervention with others, no other central bank appears to have intervened at the same time.

The weakness of the euro is unlikely to stand in the way of the European Central Bank delivering a June rate cut. The ECB explains that it does not target the exchange rate, but it is considered when in the forecasts growth and inflation. Although several high-frequency economic series suggest that the eurozone economy is off to a firmer start to the year, growth impulses still seem muted. And while, unemployment in the region remains near cyclical lows, despite the economic stagnation and rate hikes, the June European parliament election may see voters express their frustrations.

Using formal and informal mechanisms, Chinese officials have resisted the pressure on the yuan. As a low-yielder, and with low volatility, the offshore yuan, like the Japanese yen, is a popular funding currency. If Chinese officials were to step back and market forces were allowed a freer hand, the yuan’s decline would accelerate. Despite China’s mercantilist policies, it does not appear to be using the exchange rate to boost exports. The offshore yuan surged on the back of the yen's (likely intervention-induced) rally, and broader dollar pullback. Assuming it is reflected in the onshore yuan, it may help to create more space for monetary policy.

The weight on the yuan cannot be dismissed simply because China runs a trade surplus or that it has plenty of reserves to mount a serious defense. The key factor is not the market for goods but for capital. The bond market is not attractive, and investors do not have confidence in Chinese stocks. The PBOC’s continued gold purchases capture the imagination of many observers and journalists, but Chinese investors themselves also appear to be keen gold buyers as they seek alternatives to the property market and local equities under the capital control regime.

Although the Chinese economy appeared to expand by more than expected in Q1, the March data disappointed. It underscored the need for more stimulus if the 5% annual growth target is to be achieved. Meanwhile, China’s industry subsidies irk its trading partners from the US and Europe to some emerging market countries like Brazil. On her recent trip to China, Yellen warned that China will encounter resistance to it efforts to export the product of its excess capacity. Electric vehicles, batteries, and solar panels are the source of the current angst.

The US political cycle seemed to explain the Biden administration’s increase in tariffs on Chinese steel, which account for less than 2% of US steel consumption. Around the same time that Biden called for the increase in tariffs, he also reiterated his opposition to Nippon Steel’s bid for US Steel, ostensibly trying to bolster support in a key state for his re-election, Pennsylvania. Including Japan in his broad accusation of xenophobia, Biden seemed a bit exaggerated, or at least dated, as the number of foreign residents in Japan increased by around 10% last year to 3.4 mln. Japan's shrinking population is encouraging it to open in a significant way.

With the reassessment of the Federal Reserve's trajectory, emerging market currencies struggled. The JP Morgan Emerging Market Currency Index fell by about 0.75%. It was the fourth consecutive monthly decline and left it 4.2% lower on the year. The MSCI Emerging Market Currency Index eased by 0.55% and it is off about 2.5% below where it finished 2023. However, emerging market equities outperformed the high-income equity markets. The MSCI Emerging Markets Index rose by 0.25%, its third consecutive monthly advance. Through April, it is up a little more than 2% this year. The MSCI World Index of developed market equities fell nearly 3.9% in April, its biggest loss since last September. Still, it has risen by about 4.25% in the first four months of the year. The JP Morgan emerging market bond premium over Treasuries widened to about 300 bp from 287 bp at the end of March. It had finished 2023 near 319 bp.

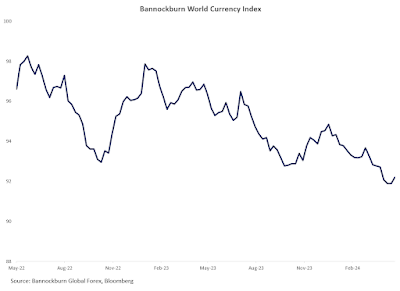

The US dollar's broad strength was reflected in Bannockburn's World Currency Index, which fell to new multi-year lows at the end of April. Its 1.1% decline was the fourth consecutive monthly loss and the largest in seven-month. The BWCI is a GDP-weighted basket of the currencies from the dozen largest economies, split evenly between high-income countries and emerging market economies. BWCI fell to new multiyear lows in early May and proceeded to recover (from 91.70 to 92.20) and looks poised to return to the April high near 93.00, and possibly the March high closer to 93.50. This is consistent with the consolidative phase for we anticipate for the dollar, which after a four-month rally, means a weaker dollar bias.

In April, the dollar rose against all the other members of BWCI but the Indian rupee, which was practically flat. After it, the Chinese yuan was the next best performer, losing about 0.25%. The Australian dollar was the strongest among the currencies of high-income countries, and it fell by about 0.75%. All the other currencies lost at least 1% against the dollar. The Japanese yen saw the biggest decline in April, falling by slightly more than 4%. Since the intervention it is risen by about 3.2%. While the yen's losses seem outsized, the Mexican peso and Brazilian real fell by a little less than 3.5% in April. Helped by an upgrade in Moody's outlook, which in part reflected progress on fiscal reforms, the Brazilian real rose by about 2.4% in early May. The peso rose a more modest 1%.

U.S. Dollar: The real broad trade-weighted dollar index rose 1.2% in April. It was the largest rise since last October. The greenback rose against all the G10 currencies. The gains were driven by a reconsideration of the trajectory of Fed policy in response to continued elevated inflation readings and robust demand. By the end of April, the market had pushed out the first cut to December. Recall that in December, seeing 2% annualized CPI, the Fed expressed growing confidence that inflation was on a sustainable path back to its target. The median Fed forecast was for three cuts in 2024. The market, which often exaggerates in both directions, had more than six cuts discounted in early January. At the end of April, the futures market had 28 bp of easing this year and is around 45 bp after the softer than expected April jobs report. The US economy appears to have lost some momentum at the start of Q2, and we expect this will also translate to a softer CPI and retail sales report (consumption) due in mid-May. This could fuel an extension of the Dollar Index's pullback seen in the second half of April. It settled near 105 after the jobs report. A break of the 104.25 area could target 102.80-103.00.

Euro: After contracting in the second half of 2023, the eurozone economy has begun to recover. The economy expanded by 0.3% in Q1 24, which is the strongest growth since Q3 22. However, the manufacturing sector remains challenged, and recovery seems fragile. The progress on inflation appears to be stalling. The headline rate has fallen from 8.5% in the beginning of last year to 2.4% in March. It remained there in April, and the base effect warns a higher reading over the next few months. However, the core rate has continued to fall, and this appears helping to boost confidence that the European Central Bank can deliver its first rate cut at its next meeting on June 6, which also marks the beginning of the European Parliament elections that run through June 9. At the end of last year, the derivatives market had 190 bp of cuts discounted for this year. It has been scaled back to about 60 bp, which is two cuts and about a 40% chance of a third. The divergence between the expected trajectory of the Federal Reserve and European Central Bank has weighed on the euro. The single currency fell to $1.06 in mid-April, a six-month low but recovered to poke above $1.08 after the US jobs data. A close above the March and April downtrend ($1.0810, falling to around $1.0725 at the end of May). The initial target is in the $1.0870-$1.0900 area and then $1.0935-50

(As of May 3, indicative closing prices, previous in parentheses)

Spot: $1.0760 ($1.0790) Median Bloomberg One-month forecast: $1.0830 ($1.0725) One-month forward: $1.0800 ($1.0775) One-month implied vol: 5.5% (5.0%)

Japanese Yen: The Bank of Japan hiked rates in March, but it did not do much for the Japanese yen. The US 10-year yield rose almost 50 bp in April, ostensibly offsetting in full the BOJ rate hike. Pressure mounted on the exchange rate. The dollar was already trading above JPY155 when the BOJ met in late April. Governor Ueda sounded somewhat dovish and the BOJ's core inflation forecast for this fiscal year and next remained at 1.9%. Ueda seems to show little direct concern about the yen's weakness. The market responded quickly and before the day was out took the greenback north of JPY158. Follow-though buying after the weekend (to almost JPY160.20) appears to have trigged the first material intervention since 2022. The market appeared to challenge Japanese officials and the BOJ appears to have intervened again a few hours after the FOMC meeting concluded, when the dollar was near JPY157.50. We think that what made the 2022 intervention successful was that it coincided with a near-term top in US Treasury yields. The 10-year US Treasury yield peaked in late October 2022 near 4.35% and fell over the next six months by 100 bp. The 10-year US yield peaked on April 25 near 4.75% and traded to 4.45% after the US jobs data and the dollar briefly traded below JPY152. Japan's Q1 GDP is due May 16. The economy likely contracted by 0.3%-0.4% quarter-over-quarter, with consumption, investment and net exports providing headwinds. Tokyo's April CPI fell more than expected (1.6% core rate from 2.4%) and this signal a pullback in the national core figures from 2.6% in March to, possibly, below 2%. We anticipate a consolidative phase (JPY151-JPY156?)

Spot: JPY153.00 (JPY151.35) Median Bloomberg One-month forecast: JPY152.45 (JPY149.15) One-month forward: JPY152.30 (JPY150.75) One-month implied vol: 9.5% (7.7%)

British Pound: Sterling fell for the fourth consecutive month in April, and its nearly 1% loss was more than the cumulative decline of the previous three months. Still, it was the second best performing G10 currency last month behind the Australian dollar. That speaks to the dollar's broad strength more than an idiosyncratic challenge problem with sterling. Sterling's decline came despite the rise in UK rates and a reassessment of the trajectory of Bank of England policy. At the end of March, the swaps market was pricing in almost 75 bp in cut this year. That has been reduced to almost 50 bp. The market is wavering on the timing of the first rat cut between August and September. There is slightly less than a 50% chance of June cut in the swaps market. The Bank of England meets on May 9 and Q1 GDP is due the following day. The market expects the economy expanded by 0.2% after a 0.3% contraction in Q4 23. The UK economy is not contracting as it was in H2 23, but growth is meager: the labor market is slowing, and over the four months through March, retail sales, excluding gasoline, were virtually flat in volume terms. The exchange rate will likely be sensitive to the employment and wage data on May 14 and CPI on May 22. Sterling recorded the low for the year on April 22 near $1.23. It reached its highest level since the March US CPI on April 9 after the US jobs report ($1.2635). The heavier US dollar we envisage could see sterling rise into the $1.2700-50 area.

Spot: $1.2545 ($1.2625) Median Bloomberg One-month forecast: $1.2520 ($1.2650) One-month forward: $1.2550 ($1.2630) One-month implied vol: 6.3% (5.6%)

Canadian Dollar: The Canadian dollar was no match for the greenback in April. It fell by about 1.5% last month, its largest decline in six months. It was also the first losing month in six for the S&P 500, illustrating the sensitivity of the Canadian dollar's exchange rate to the broader risk environment. The swaps market has downgraded the extent of Bank of Canada easing this year from about 75 bp at the end of March to about 50 bp at the end of April. After some soft data in early May, the market discounted nearly 65 bp of easing. The US two-year premium rose to almost 80 bp last month, the highest since early 2019 and pulled back to about 65 bp in early May. Still, the most important driver continues to be the broad direction of the US dollar. The 60-day rolling correlation of changes in the bilateral exchange rate and the Dollar Index is near 0.85, its highest in over a decade. At the April meeting, the Bank of Canada lifted this year growth forecast to 1.5% from 0.8%, encouraged by stronger than expected exports and strong immigration, which officials think may have boosted growth potential about 0.25% to 2.5%. Canada's first new major pipeline in a couple of decades (Trans Mountain pipeline) will become operational in early May. It will carry an additional 600k barrels of oil a day from Alberta to the Pacific coast for exporting to Asia. Bank of Canada Governor Macklem suggested that a June rate cut was possible, and the market is pricing in a 2/3 chances. It may require a few closes below CAD1.36 for the market to become more convinced a US dollar high is in place. The April high, near CAD1.3850 was the highest since last November.

Spot: CAD1.3685 (CAD 1.3540) Median Bloomberg One-month forecast: CAD1.3635 (CAD1.3490) One-month forward: CAD1.3680 (CAD1.3435) One-month implied vol: 4.9% (4.6%)

Australian Dollar: The market has nearly given up on rate cut by the Reserve Bank of Australia this year. Recall that as recently as early February, the futures market was discounting two quarter-point cuts and a nearly 70% of a third cut. Now the futures market points to an ever so slightly higher rate at the end of the year, which seems to be an exaggeration. The macroeconomic data have been mixed. Inflation slowed in Q1, though not as much as expected, and although, full-time employment rose by 126k, offset a little more than the losses last December, and the unemployment rate ticked up to 3.8%. The RBA meets on May 7 and the lack of urgency to cut rates will likely be expressed. The April jobs report is a week later. Separately, the rally in the metals like iron ore, copper, and gold may have helped lift sentiment toward the Australian dollar, which was the best performing currency among the G10 in April, but it still lost about 0.40% in April against the US dollar. After the US employment data, the Australian dollar traded to almost $0.6650. It has traded above there once since mid-January. A move above $0.6670 could signal a recover toward $0.6750-$0.6800.

Spot: $0.6610 ($0.6520) Median Bloomberg One-month forecast: $0.6605 ($0.6580) One-month forward: $0.6615 ($0.6525) One-month implied vol: 8.5% (7.5%)

Mexican Peso: The dollar fell to nine-year lows near MXN16.26 in the first part of April. A bout of profit-taking amid broadly stronger greenback as the trajectory of Fed policy was reassessed. It has recovered to nearly MXN17.17 through April 18 before surging above MXN18.21 on what is dubbed a "flash crash" on news of Israel's retaliatory strike on Iran. It subsequently traded to almost MXN16.90 before choppy consolidation. The shock, reflected in a jump in volatility, has shaken the market's confidence. The underlying fundamental considerations, such as the near-shoring meme, attractive carry, solid external balances continue to hold. Improvement in headline inflation appears to be stalling and the moderation in core prices is slowing. The central bank meets on May 9, and it is likely to standpat after cutting its overnight rate by 25 bp to 11.00% in March. With the June 2 election looming, and political violence running elevated, many participants may not be in a hurry to re-establish positions squeezed out of in the flash crash. Although the peso has fully recouped its flash crash losses, market sentiment seems smore fragile than previously.

Spot: MXN16.9750 (MXN16.56) Median Bloomberg One-Month forecast: MXN17.0450 (MXN16.74) One-month forward: MXN17.05 (MXN16.63) One-month implied vol: 10.4% (7.4%)

Chinese Yuan: China's trade policies continue to be broadly criticized, but it does not appear that officials are seeking export advantage through the exchange rate. The PBOC continues to resist pressure on the yuan to depreciate. The yuan slipped less than a quarter-of-one percent in April, and its year-to-date decline of around 1.8% is among the least in the emerging market world. China's stocks and bonds also fared well. The 10-year government bond yield fell to record lows near 2.22% in late April before recovering to almost 2.40%. At the low, the yield was less than half rate on the US 10-year Treasury. The mainland's CSI 300 rallied about 2.5% in April. It was the third consecutive monthly advance. However, mainland shares that trade in Hong Kong surged by more than 8%. It was nearly flat for the year at the end of Q1 24. We had thought there was potential for the dollar to return to its previous range of roughly CNY7.25-CNY7.30, but the greenback peaked slightly shy of the lower end of the range. There is speculation in some quarters that Beijing is planning of a large depreciation of the yuan. We are skeptical as officials have been emphasizing the desire for exchange rate stability. The offshore yuan has been allowed to trade beyond the onshore band, but it recovered smartly in early May (while mainland markets were closed for the labor holiday). In order for Beijing to boost the chances of reaching its 5% growth target, many suspect more government support is needed. With the yuan recovering off its lower band, and Chinese equities doing better, monetary policy may have more degrees of freedom. The Third Plenary session has been set for July and additional economic reforms may emerge.

Spot: CNY7.2410 (CNY7.225) Median Bloomberg One-month forecast: CNY7.2460 (CNY7.2065) One-month forward: CNY7.0965 (CNY7.1180) One-month implied vol 4.6% (4.8%)

Tags: Featured,macro,newsletter