Tag Archive: newsletter

Swiss investment management sector growing

As the Swiss financial centre adjusts to the loss of banking secrecy and possible fallout from Brexit, a report highlights increased investment management as the sector's cornerstone. The report, released on Thursday by the Swiss Bankers Association (SBA) and the Boston Consulting Group (BCG), outlines the emergence of investment management – the “management of investments for institutional and private clients” – as a key component of the Swiss...

Read More »

Read More »

Swiss Post Office Expands Hospital Drone Delivery System

The Swiss Post is expanding its drone delivery system, transporting laboratory samples between two hospitals in Zurich. Similar pilots have been conducted in Bern and Lugano. On Tuesday, the Swiss Post announced it is launching a one-year pilot project to use drones to send laboratory samples between the University Hospital of Zurich and the Irchel site of the University of Zurich, which are 2.5 kilometres apart.

Read More »

Read More »

Swiss complaint over US tariffs to be reviewed by WTO panel

A Swiss complaint to the World Trade Organization (WTO) against United States import tariffs on aluminium and steel will be decided by a WTO panel. On Tuesday, the WTO's Dispute Settlement Body (DSB) accepted to create separate panels to hear the complaints by Switzerland and India, after the two countries filed a second request for their cases to be heard.

Read More »

Read More »

A Global Dearth of Liquidity

Worldwide Liquidity Drought – Money Supply Growth Slows Everywhere

This is a brief update on money supply growth trends in the most important currency areas outside the US (namely the euro area, Japan and China) as announced in in our recent update on US money supply growth (see “Federal Punch Bowl Removal Agency” for the details).

Nobody likes a drought. This collage illustrates why.

The liquidity drought is not confined to the US – it...

Read More »

Read More »

Converging Views Only Starts With Fed ‘Pause’

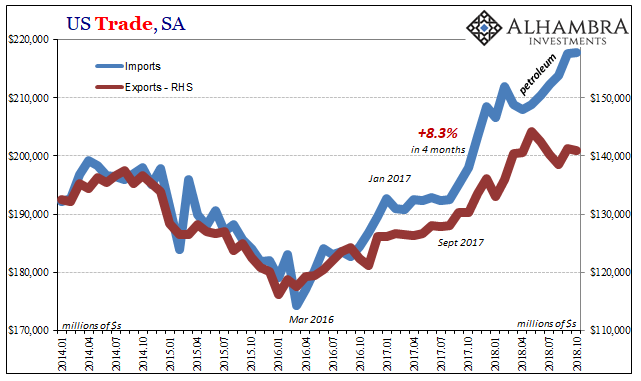

There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise.

Read More »

Read More »

FX Daily, December 07: A Couple More Events before Seeing the End of Difficult Week for Investors

Overview: Global equities have stabilized after US equities recovered yesterday, with the NASDAQ 100 staging its biggest reversal in eight months and the S&P500 recouped almost three percent to close 0.15% lower. Asia Pacific equities were mostly higher. Hong Kong shares, including the mainland shares that trade there, were the notable exception.

Read More »

Read More »

Amazon reduces online offer for Swiss customers

Shoppers in Switzerland will no longer be able to buy items from the US Amazon website due to recent changes to Swiss value-added tax law. Exceptions will be made for e-books and apps. “From 26 December 2018 customers shopping on Amazon.com and other non-EU Amazon websites will not be able to ship non-digital orders to any shipping address in the Swiss Customs Union,” Amazon said on Monday.

Read More »

Read More »

Unexpected?

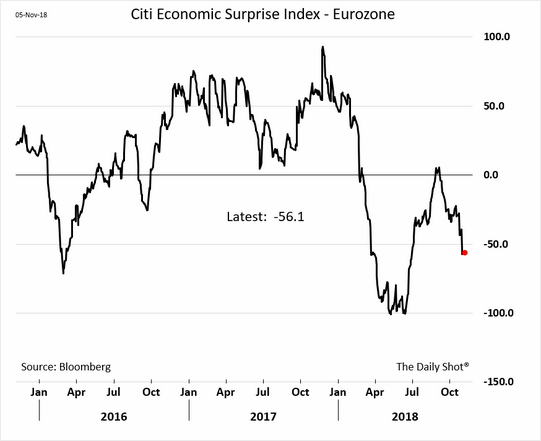

Now that the slowdown is being absorbed and even talked about openly, it will require a period of heavy CYA. This part is, or at least it has been at each of the past downturns, quite easy for its practitioners. It was all so “unexpected”, you see. Nobody could have seen it coming, therefore it just showed up out of nowhere unpredictably spoiling the heretofore unbreakable, incorruptible boom everyone was talking about just last week.

Read More »

Read More »

Why Buy Gold Now? Because Of The “I Don’t Knows”…

From 2000 through 2012, the price of gold increased every year, rising from around $280 an ounce to nearly $1,700. It was an unprecedented run. Then, in 2013, gold took a nose dive, losing over 27% of its value. It was widely reported that the Swiss National Bank, the former bastion of monetary conservatism, lost $10 billion that year just on its gold holdings.

Read More »

Read More »

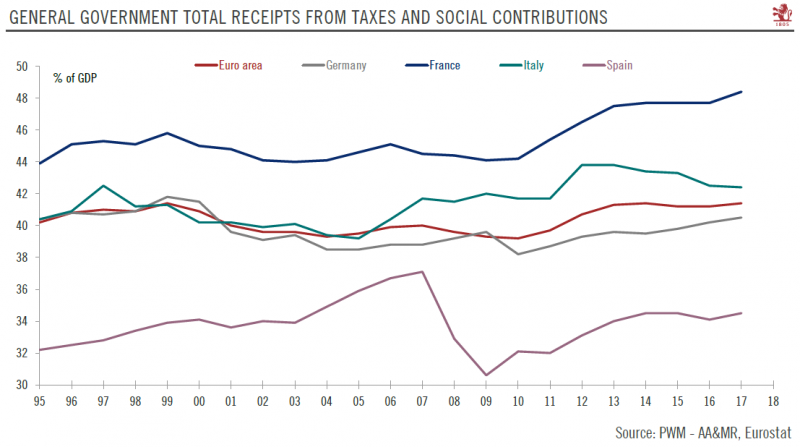

Yellow vest protests cast cloud over Macron’s reform plans

Recent protests could have a negative impact on French growth, tax revenue and president Macron’s reform plans for his country and for Europe. French protests began on November 17 over hikes in fuel taxes, but have progressively broadened out into an expression of general anger with the French government about the cost of living and high taxes.

Read More »

Read More »

FX Daily, December 06: New Spanner in US-China Relations Weighs on Risk Appetites

Overview: The global capital markets were fragile amid trade uncertainty and economic slowdown fears. News that Canada arrested the CFO of Huawei on behalf of the US, ostensibly for violating the embargo against Iran triggered an almost immediate risk-off wave that has extended the equity markets losses, sending core bond yields lower, with the US 10-year slipping below 2.9%, and underpinning the dollar against most currencies, with the notable...

Read More »

Read More »

Interessante Dividenden

Auch im nächsten Jahr (2019) gibt es wieder steuerfreie (sprich aus den Kapitalreserven stammende) Dividenden. Wir zeigen einige Schätzungen.

Read More »

Read More »

Swiss Starbucks Customers Vulnerable due to Insecure WiFi

An investigation by Swiss Public Television, SRF, has found that data isn’t sufficiently protected when customers use WiFi at cafes in Switzerland of the global coffee chain. Free WiFi access at Starbucks - one of the great perks offered by the company – was investigated by the SRF consumer programme “Kassensturzexternal link”.

Read More »

Read More »

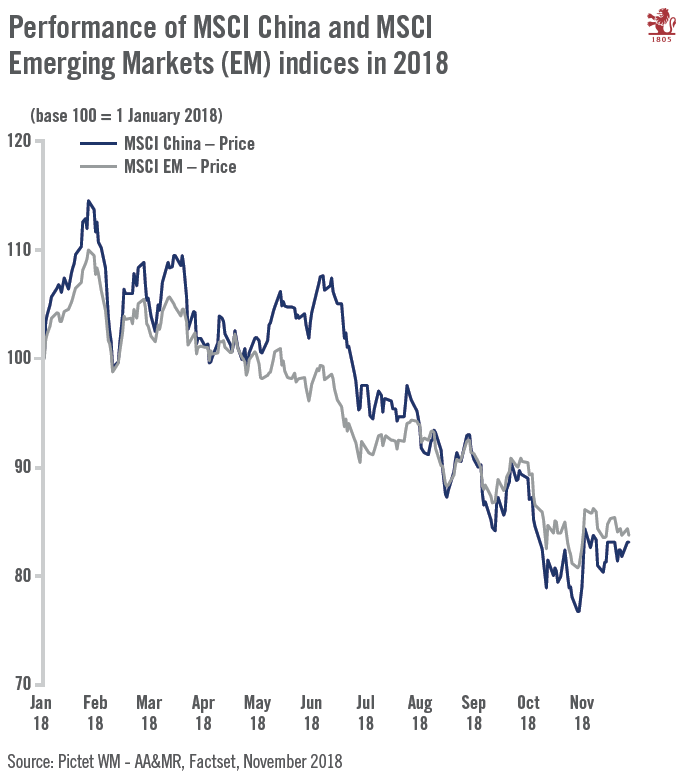

House View, December 2018

We remain neutral on global equities overall, seeing relatively limited potential for developed market stocks in particular as earnings growth declines. We favour companies with pricing power as well as measurable growth drivers and low leverage.

Read More »

Read More »

FX Daily, December 05: US Market Closure may be a Firebreak

The 3%+ drop in the S&P 500 yesterday kept global equities under pressure today, though losses in Asia and Europe were milder. In Asia, only Hong Kong and Taiwan benchmarks lost more than 1%. In Europe, the Dow Jones Stoxx 600 is off about 0.8% in late morning turnover.

Read More »

Read More »

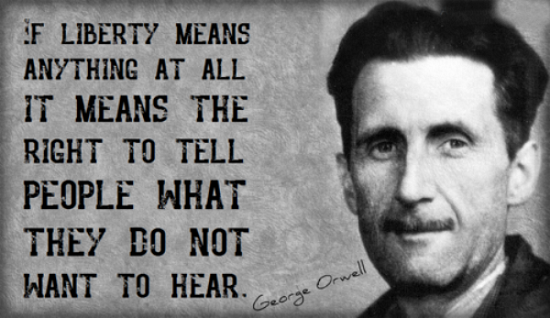

The View from the Trenches of the Alternative Media

What's scarce in a world awash in free content and nearly infinite entertainment content? After 3,701 posts (from May 2005 to the present), here are my observations of the Alternative Media from the muddy trenches. It's increasingly difficult to make a living creating content outside the corporate matrix.

Read More »

Read More »

No Relief for Swiss Renters as Mortgage Rates Barely Move

Every three months the rate of interest used to set Swiss rents is reviewed. If it goes down some renters have the right to request a decrease in rent. This time it remained at 1.50%. The last time it dropped was 2 June 2017 when it fell to 1.5%, its lowest level since 2008.

Read More »

Read More »

The Dollar and Its Rivals

I was in graduate school, studying American foreign policy when I stumbled on Riccardo Parboni's "The Dollar and Its Rivals." This thin volume showed how the foreign exchange market was the arena in which capitalist rivalries were expressed. More than any single book, it set me on a more than 30-year path.

Read More »

Read More »

FX Daily, December 04: Stock Rally Arrested, but Bond and Oil Advance Continues, leaving Dollar in a Lurch

Overview: Equity markets are unable to build on yesterday's advance, but bonds and oil are extending gains. The dollar remains on the defensive and is off again all the major currencies. The lack of a joint statement over the weekend by the US and China and seemingly different interpretations of what was agreed leaves investors in a lurch.

Read More »

Read More »

GBP/CHF Forecast: Brexit Uncertainty Ahead Causing Movement for GBP/CHF

In today’s GBP/CHF forecast we look at why the Pound has been coming under a huge amount of pressure recently against the Swiss Franc. Those that have been following the currency markets will be aware that the pressure on GBP is largely owing to the uncertainty caused by the ongoing Brexit talks.

Read More »

Read More »