There’s no sign of inflation, markets are unsettled, and now new economic data keeps confirming that dark side. Forget each month, every day there is something else suggesting a slowdown. That much had been evident across much of the global economy, but this is now different. The US has apparently been infected, too, not that that is any surprise.

That’s how these things go. Global synchronized growth, decoupling, globally synchronized downturn. Every time. What’s amazing is just how quickly US decoupling in 2018 has disappeared. It’s like they’re not even trying anymore, so shocked at how quickly and fervently markets have turned (despite their brave public face, inversion[s] almost surely has everything to do with it).

The Wall Street Journal reports today what has been plainly obvious for more than a week if not longer. Even Jay Powell sees it, which means “it” isn’t something small if the US central bank is thinking about shifting. A Fed “pause” has been priced by markets for months now, only now they are trading as if that isn’t even the full extent.

| Eurodollar futures, for example, the curve continues to be inverted in the same key space right at the end of the 2-year window where real economy meets the Federal Reserve’s very limited influence. Futures prices have been bid (meaning an overall expectation for lower money rates, LIBOR, in the future) but the inversion continues and has even deepened.

The market is saying forget about a pause, there is as likely rate cuts in the intermediate future. Again, without any sense of wage inflation (also amazing just how fast the LABOR SHORTAGE!!! disappeared, too, from the front pages) there is just nothing on Powell’s side while a great deal of evidence continues to stack up against him. Today, it was US trade figures. It doesn’t take any calculations to see that “something” is different about 2018, indeed the last six months or so. |

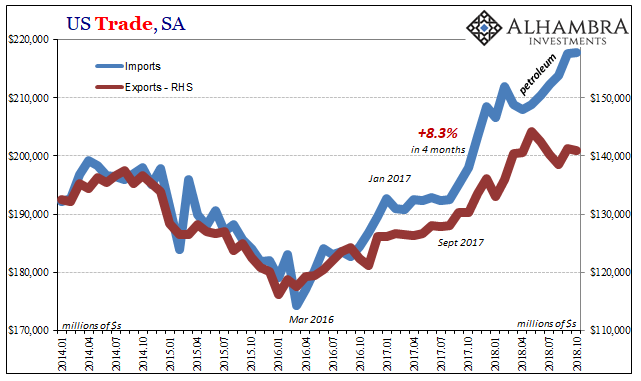

US Trade, SA 2014-2018 |

| The export sector is stumbling, not crashing or collapsing, but no longer providing economic momentum as it had been since last year’s hurricanes. According to the Census Bureau, the mild slump dragged into its fifth month in October 2018. Exports are down 2% during that period and it doesn’t appear is if that’s going to change anytime soon.

Imports continued to be sheltered to some extent by oil prices. But even here, the transition is noticeable. |

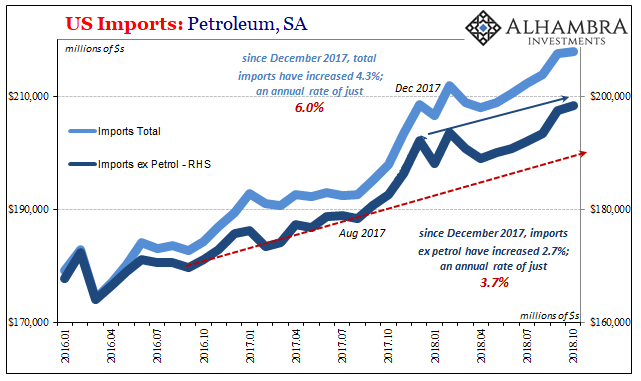

US Imports: Petroleum, SA 2016-2018 |

| Excluding petroleum, US imports are up just 2.7% for an annual rate of less than 4% during 2018. That’s consistent with worldwide downturn not growth, and simply confirms the US economy isn’t booming like it has been described.

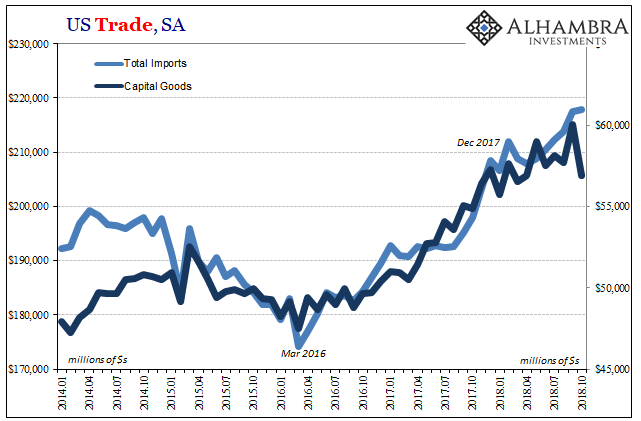

Importantly, it has been the capital goods sector contributing the most to the slowdown. Given the state of global money and finance, this isn’t surprising, either. Higher liquidity preferences especially in the skeptical manufacturing and industrial sectors leave those firms vulnerable and exposed to any economic reverse. Uncertainty about tariffs doesn’t help. In October, the Census Bureau suggests capital goods imports declined by the most in almost four years. That leaves imports in this category practically unchanged for now ten months of 2018 in the books. A key element that throughout Reflation #3 contributed some actual growth, capital goods imports have to be one factor leading the Fed toward its contemplated pause. |

US Trade, SA 2014-2018 |

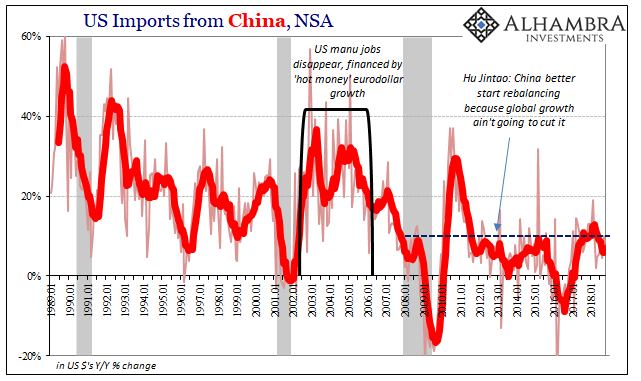

| As has become usual, this is an economic reality the Chinese more than anyone have to be constantly aware. US imports from China have not been affected by tariffs and trade restrictions, at least not in this series from the Census Bureau. The lackluster level of growth has been pretty consistent for far longer these than trade wars.

In October, imports from China increased by just 8.4%, less than 10% for six out of the last seven months. US demand for Chinese-produced and assembled goods has never come back from the 2012 slowdown, one key reason why the Chinese economy has likewise never come back during those same years. The big difference is that officials in China know it while their American counterparts especially at the central bank level have been blissfully going on about globally synchronized growth. Or, they had been. Jay Powell isn’t quite to Yi Gang’s degree of concern and desperation, of course, but it appears as if the central banks’ disparate economic views might now be finally converging. Like recent data across even the US economy, not in the good way. |

US Imports from China, NSA 1989-2018 |

Tags: Bonds,China,currencies,economy,EuroDollar,eurodollar futures,exports,Federal Reserve/Monetary Policy,global trade,imports,inversion,jay powell,Markets,newsletter