Tag Archive: newsletter

Swiss cantons forced to fish for multinationals with non-tax lures

Proposed changes to Switzerland’s tax rules could have a dramatic effect on which cantons remain attractive locations for multinational companies in future. As a result, factors such as the cost of premises or concentration of high tech facilities, will play a greater role, according to UBS bank.

Read More »

Read More »

SkyWork lands its last ever plane in Bern Airport

The last SkyWork flight landed in Bern Airport on Wednesday night, as ongoing financial difficulties forced the company to declare itself bankrupt. Some 11,000 passengers are affected. The company, founded in 1983, cited the failure of negotiations with a potential partner to pull the company from recurring funding shortfalls that intensified in October last year.

Read More »

Read More »

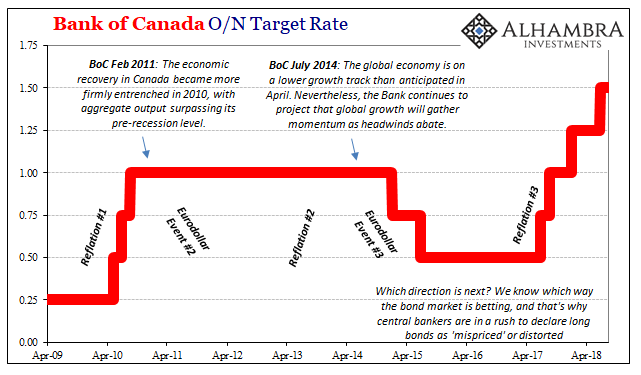

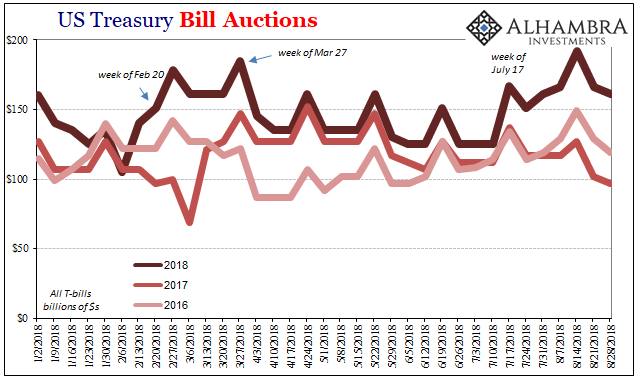

‘Mispriced’ Bonds Are Everywhere

The US yield curve isn’t the only one on the precipice. There are any number of them that are getting attention for all the wrong reasons. At least those rationalizations provided by mainstream Economists and the central bankers they parrot. As noted yesterday, the UST 2s10s is now the most requested data out of FRED. It’s not just that the UST curve is askew, it’s more important given how many of them are.

Read More »

Read More »

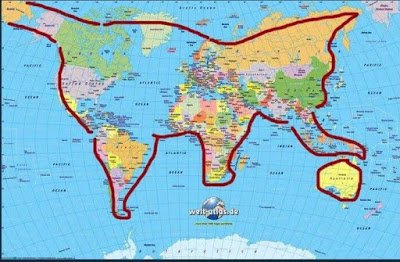

The Big Picture 18-24-Month Outlook: Some Preliminary Projections

The winding down of the North's summer provides a suitable time to consider not the near-term outlook, which many investors do on a daily basis, but to reflect on where we are heading down the road a bit. What will the next 18-24 months hold? Of course, we harbor no illusions of prescient vision and accept the hazards of the assignment and so should the reader.

Read More »

Read More »

Ongoing roadblocks stifle growth of Swiss banks

Swiss banks are withstanding the pressure of ongoing headwinds, but real progress continues to be stalled by political and economic roadblocks, the Swiss Bankers Association (SBA) said on Thursday. Releasing its annual Banking Barometer, which measures the performance of the sector in 2017, the SBA found that aggregate profits (profits minus losses) across Switzerland’s 253 banks rose by nearly a quarter to CHF9.8 billion ($10.1 billion).

Read More »

Read More »

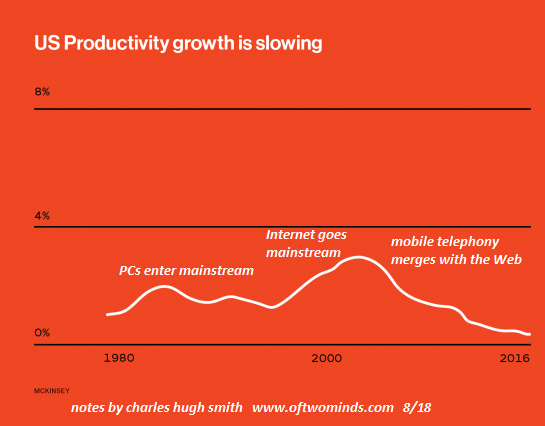

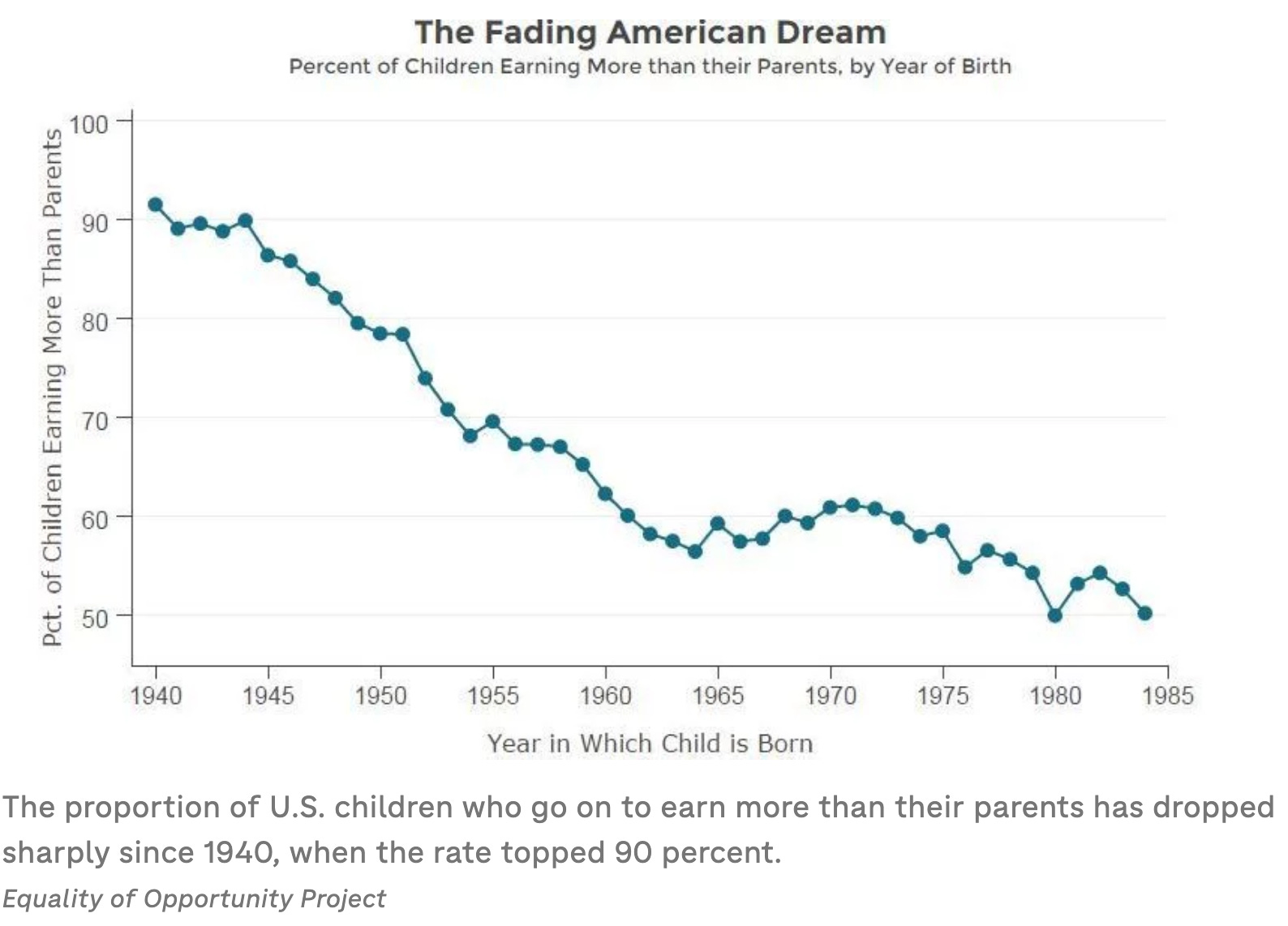

Why Is Productivity Dead in the Water?

As the accompanying chart shows, productivity in the U.S. has been declining since the early 2000s. This trend mystifies economists, as the tremendous investments in software, robotics, networks and mobile computing would be expected to boost productivity, as these tools enable every individual who knows how to use them to produce more value.

Read More »

Read More »

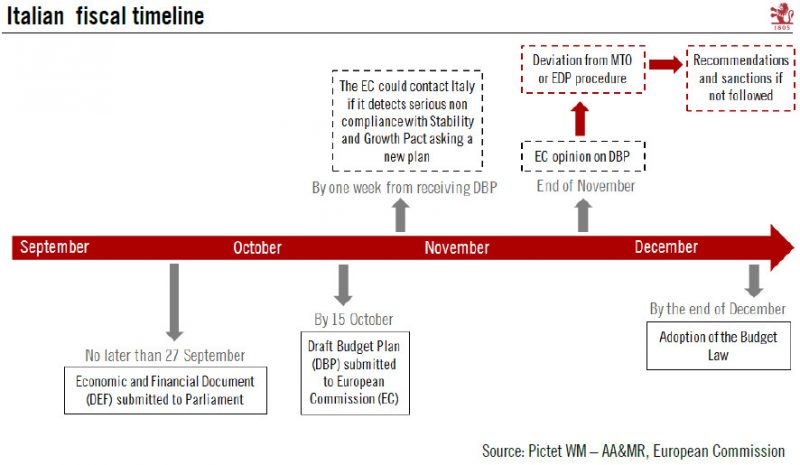

Italian 2019 draft budget: a bumpy road ahead

Tensions between Rome and Brussels could lead to significant market volatility before an agreement is found. September will be a key month for gauging the Italian government’s budgetary plans for 2019. The government has communicated neither a precise timeline for implementing the measures announced in its ‘contract for government’ nor a precise cost analysis for these measures.

Read More »

Read More »

Costs of owning a home in Switzerland set to rise for some

Currently, home owners in Switzerland must pay tax on fictional rent, calculated based on a home’s size and location. At the same time home owners get to deduct mortgage interest and home maintenance costs from their taxable income.

Read More »

Read More »

FX Daily, August 31: Month-End Adjustments and Tentative Stabilization in Emerging Markets Ease Demand for Dollars but Not Yen

The dramatic price action seen yesterday among several emerging market currencies is eased today, but here at month-end, demand for risk-assets is tentative at best. The macro backdrop, including the increase in US core inflation, expectations for continued hikes by the Federal Reserve, and unambiguous signals that trade tensions will increase in the coming weeks dampens the risk appetite.

Read More »

Read More »

FX Daily, August 30: Brexit Optimism Underpins Sterling

The US dollar is mostly firmer, while global equities are softer and bonds little changed. The Turkish lira and South African rand remain under pressures. However, there does not appear to be an overall theme in today's markets.

Disappointing data from Australia and New Zealand has seen the Antipodean currencies move lower. New Zealand's business confidence fell to a ten-year low, and this sent the Kiwi tumbling. Its nearly 0.9% fall...

Read More »

Read More »

A Fake Brexit and the “Noble Dream” – Claudio Grass Speaks With Godfrey Bloom

Introductory Remarks: The “Anti-Politician” Godfrey Bloom, by PT

Most of our readers will probably remember former UKIP chief whip and European Parliament representative Godfrey Bloom. As far as we know, he is the only politician who ever raised the issue of the workings of the fractionally reserved central bank-directed monetary system in the EU parliament. This system is of course central to the phenomenon of the recurring boom-bust sequences...

Read More »

Read More »

COMCO declines to investigate watchmakers over cartel claims

The Swiss Competition Commission (COMCO) has decided not to open a formal investigation into watchmakers including Swatch, LVMH and Richemont over the supply of spare parts for independent watch repair shops.

Read More »

Read More »

Swiss Job Numbers Up but too Few Qualified Workers

In the second quarter of 2018, the number of jobs in Switzerland rose to 5.048 million, a 2.1% increase on the second quarter of 2017. Regions rising the most were Lake Geneva (+3.0%), north west Switzerland (+3.0%), central Switzerland (+2.4%) and Zurich (+2.1%). Rises in job numbers in eastern Switzerland (+1.6%), Mittelland (+1.3%) and Ticino (0%) were lower.

Read More »

Read More »

FX Daily, August 29: Dollar Finds Support, but Downside Correction May Not be Over

The US dollar has steadied after pulling back in recent days, but the downside correction does not appear complete, and month-end flows are still a risk to picking a dollar-bottom. The Australian dollar is the weakest of the majors. The main drag is paradoxically Westpac, one of Australia's largest banks, raised the variable rate mortgage by 14 bp to 5.38%. Others are expected to follow.

Read More »

Read More »

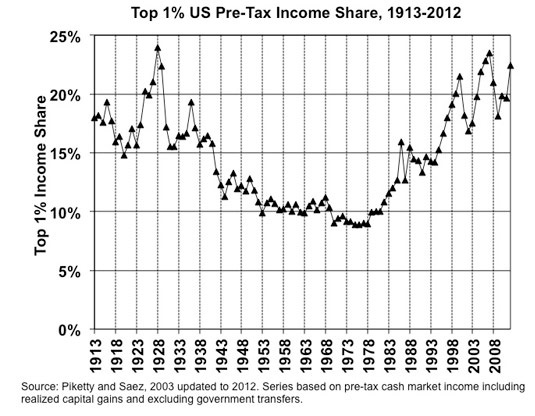

Here’s How We Ended Up with Predatory, Parasitic Elites

Combine financialization, neoliberalism and moral bankruptcy, and you end up with predatory, parasitic elites.

How did our financial and political elites become predatory parasites? Some will answer that elites have always been predatory parasites; as tempting as it may be to offer a blanket denunciation of elites, this overlooks the eras in which elites rose to meet existential crises.

Following in Ancient Rome's Footsteps: Moral Decay,...

Read More »

Read More »

Anticipating How Welcome This Second Deluge Will Be

Effective federal funds (EFF) was 1.92% again yesterday. That’s now eight in a row just 3 bps underneath the “technically adjusted” IOER. If indeed the FOMC has to make another one to this tortured tool we know already who will be blamed for it.

Read More »

Read More »

Günstig Land kaufen – Wie du profitabel kleine Grundstücke kaufst – mit Jack Bosch

Land kaufen - Dein kostenloses Immopreneur Starterpaket für Immobilieninvesotren: http://bit.ly/immobilienstarter

Im heutigen Interview habe ich Jack Bosch zu Gast. Wir sprechen darüber, wie du es schaffst mit einfach Methoden Land zu kaufen und so hohe Profite mitzunehmen.

Jack ist Experte für Land flipping und hat sich in den letzten Jahren ein starkes Immobilienportfolio in den USA aufgebaut. Zusätzlich ist er als Coach tätig und hilft...

Read More »

Read More »